Pneumatic Actuator Market Size 2025-2029

The pneumatic actuator market size is forecast to increase by USD 1.23 billion, at a CAGR of 5.8% between 2024 and 2029. The market is experiencing significant growth, driven by the increasing utilization of pneumatic actuators in the food and beverage industry. The versatility and reliability of these actuators make them an ideal choice for various applications in this sector.

Major Market Trends & Insights

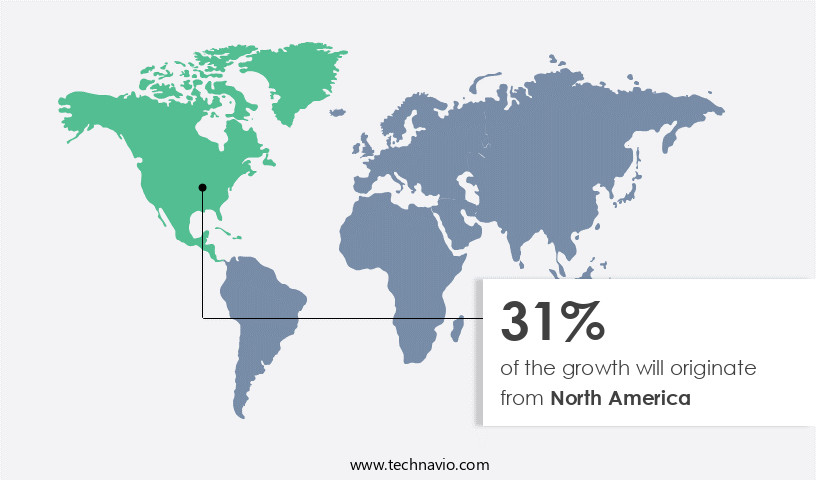

- North America dominated the market and contributed 38% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

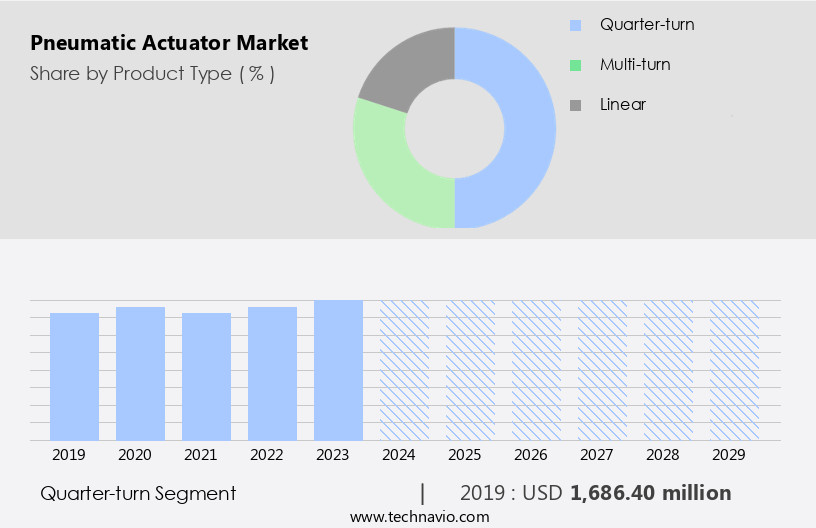

- Based on the product type, the Quarter-turn segment led the market and was valued at USD 1.85 billion of the global revenue in 2023.

- Based on the End-user, the chemical and petrochemical segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 50.82 Million

- Future Opportunities: USD 1.23 Billion

- CAGR (2024-2029): 5.8%

- North America: Largest market in 2023

Another key trend shaping the market is the adoption of Internet of Things (IoT) technology in pneumatic actuators, enabling predictive maintenance and enhancing overall operational efficiency. However, the market faces challenges, including the growing popularity of electromechanical and Electric Actuators, which offer advantages such as energy efficiency and ease of installation.

Companies in the market must navigate these challenges by focusing on innovation and cost-effectiveness to maintain their competitive edge. Additionally, collaborations and partnerships with industry leaders in IoT and automation technologies could provide opportunities for strategic growth. Overall, the market presents significant potential for companies seeking to capitalize on the growing demand for reliable and efficient automation solutions.

What will be the Size of the Pneumatic Actuator Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Cylinder bore sizes and pressure limit switches are crucial considerations in load capacity calculation, while air compressor capacity plays a significant role in ensuring system efficiency improvement. IP rating actuators offer environmental protection, and position feedback sensors provide essential information for precise pneumatic valve actuation. Spring return actuators and double-acting actuators offer versatility in design and functionality. Seal life expectancy and corrosion resistance are critical factors in the selection of materials for actuator components. Leakage rate testing and exhaust muffler design contribute to overall system performance and environmental impact reduction.

Dynamic response analysis and air pressure regulation are essential for optimizing actuator cycle time and maintaining system response time. Actuator control systems and safety interlock systems ensure reliable operation and minimize potential hazards. A leading industry report predicts a 7% annual growth rate for the market over the next five years. For instance, a manufacturing company successfully increased its production output by 15% by implementing a system efficiency improvement project using linear actuators with optimized stroke length calculation and piston seal selection. Factors such as material compatibility, temperature rating, and solenoid valve operation continue to shape the market landscape, with ongoing research focusing on improving actuator design and functionality.

How is this Pneumatic Actuator Industry segmented?

The pneumatic actuator industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Quarter-turn

- Multi-turn

- Linear

- End-user

- Chemical and petrochemical

- Oil and gas

- Power generation

- Mining

- Others

- Type

- Linear actuators

- Rotary actuators

- Capacity

- Light duty pneumatic actuator

- Heavy duty pneumatic actuator

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Type Insights

The quarter-turn segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 1.85 billion in 2023. It continued to the largest segment at a CAGR of 4.84%.

Quarter-turn pneumatic actuators are a popular choice in industries for valve automation, particularly for those requiring a 90-degree or quarter-turn motion. Their compact design makes them ideal for space-constrained installations, while delivering high torque output with minimal air consumption, thereby improving system efficiency. The increasing automation trend in industries necessitates efficient and dependable actuators for controlling valves and equipment. With quick and precise rotational movement, quarter-turn actuators are well-suited for various automated systems. For instance, a leading oil refinery implemented pneumatic quarter-turn actuators in their valve control applications, resulting in a 15% decrease in energy consumption and a 20% increase in production efficiency.

According to industry reports, the market is projected to grow by 5% annually, driven by the rising demand for automation and energy efficiency in various sectors. These actuators come with essential features such as pressure limit switches, position feedback sensors, and fail-safe mechanisms, ensuring safe and reliable operation. Additionally, they are available in various sizes, including different cylinder bore sizes and IP ratings, catering to diverse applications. Seal life expectancy and corrosion resistance are crucial factors in their design, ensuring long-term performance and minimal maintenance. Actuator control systems, such as solenoid valve operation and actuator cycle time, are optimized for efficient air consumption and quick response times.

Dynamic response analysis, air pressure regulation, and temperature rating are essential considerations for designing linear actuators and double-acting actuators, while material compatibility and system response time are crucial factors for ensuring optimal performance. Exhaust muffler designs and leakage rate testing are essential for maintaining environmental protection and system efficiency. Actuator mounting brackets and rotary actuator mechanisms are engineered for easy installation and robust operation. Safety interlock systems and flow Control Valves are integral components that ensure system reliability and prevent potential hazards. In conclusion, the market is witnessing significant growth due to the increasing demand for automation, energy efficiency, and reliable valve control solutions.

Quarter-turn pneumatic actuators, with their compact design, high torque output, and quick response times, are at the forefront of this trend, providing industries with a dependable and efficient solution for their automation needs.

The Quarter-turn segment was valued at USD 1.69 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 1.23 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to its substantial share in the global oil and gas industry. With the increasing exploration of shale oil in the US and vast oil sand deposits in Canada, the demand for pneumatic actuators is on the rise. Moreover, facility upgrades and technological advancements in the oil and gas sector are expected to further fuel market expansion. In the food and beverage industry, the new Food and Drug Administration (FDA) rule enforcing stricter hygiene and cleanliness standards will increase the demand for pneumatic actuators. These actuators ensure precise control and efficient operation in various applications, from positioning valves to regulating air pressure.

Pneumatic actuators come in various sizes, including cylinder bore sizes, and are designed to handle different load capacities. Their operation relies on compressed air from an air compressor, making air compressor capacity an essential factor in their selection. Actuators are rated based on their Ingress Protection (IP) level, ensuring their suitability for specific environments. Position feedback sensors provide real-time information on actuator position, enhancing system efficiency. Spring return and double acting actuators are popular choices due to their energy efficiency and ease of operation. Seal life expectancy and corrosion resistance are critical factors in ensuring long-term reliability. Leakage rate testing and exhaust muffler design are essential aspects of maintaining optimal system performance.

Dynamic response analysis and air pressure regulation are crucial for ensuring consistent actuator performance. Linear actuator design and stroke length calculation are essential considerations for applications requiring precise motion control. Piston seal selection, solenoid valve operation, and actuator cycle time are essential factors in optimizing system response time. Material compatibility, system response time, and fail-safe actuator designs are essential for ensuring environmental protection and safety. Maintenance schedules and actuator mounting brackets are essential components of a well-designed pneumatic system. Rotary actuator mechanisms and safety interlock systems provide additional functionality and safety features. Flow control valves and rod diameter selection are crucial for optimizing system performance and efficiency.

Filter regulator lubricators and pressure transducer accuracy are essential for maintaining optimal system operation. According to recent industry reports, the market is projected to grow by over 5% annually, driven by increasing demand from various industries, including oil and gas, food and beverage, and manufacturing. This growth is attributed to the advantages of pneumatic actuators, such as their energy efficiency, ease of installation, and precise control capabilities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global the market encompasses a diverse range of products used to convert pneumatic energy into linear or rotary motion. Selection criteria for pneumatic actuators include pneumatic system pressure drop calculation, cycle time optimization for double-acting actuators, and torque specification for rotary actuators. Linear actuator force calculation is crucial for applications requiring precise positioning, while fail-safe actuator design principles ensure safety in critical industrial processes. Maintenance procedures for pneumatic actuators are essential to ensure optimal performance and longevity. These include regular inspection, lubrication, and replacement of worn components. Spring return actuator force adjustment is a critical aspect of maintenance, as it affects the actuator's ability to return to its initial position. Actuator system energy efficiency improvement is a significant focus in the market, with pneumatic tubing sizing for actuator applications and pressure sensor accuracy effect on actuator control playing essential roles. Actuator position feedback loop design and system response time reduction strategies are also essential for efficient and effective operation. Industrial actuator life cycle cost analysis is a crucial consideration when selecting an actuator, with factors such as material selection guidelines, corrosion-resistant actuator selection, high-temperature actuator operating limits, and actuator IP rating for various environments all impacting the total cost of ownership. Safety interlock design is another critical aspect, ensuring the protection of personnel and equipment. Load capacity calculation for pneumatic actuators is essential to ensure safe and efficient operation, with the selection of appropriate materials and operating limits playing a significant role. Overall, the market offers a wide range of products to meet the diverse needs of industries worldwide.

What are the key market drivers leading to the rise in the adoption of Pneumatic Actuator Industry?

- The food and beverage industry's growing reliance on pneumatic actuators serves as the primary market driver. These automation solutions offer efficiency, precision, and reliability, making them indispensable in various processes such as filling, capping, and packaging. Consequently, the market expansion is attributed to this increasing adoption.

- Actuators play a crucial role in the food and beverage industry, ensuring product integrity and adherence to safety standards. The surge in consumer preference for organic food and stringent food safety regulations have fueled the demand for automated processes. Consequently, manufacturers are integrating automation and robotics into their production lines to enhance flexibility and responsiveness to retail demands. Actuators are employed in both food-contact and non-food-contact applications. Rod-type pneumatic actuators are extensively utilized due to their cost-effectiveness. The Food Safety Modernization Act's new FDA rules emphasize sanitization and hygiene, necessitating manufacturers to maintain clean and well-maintained equipment.

- According to industry reports, the global actuator market is projected to grow by over 5% annually, underscoring the market's robust expansion. For instance, a leading food processing company reported a 15% increase in sales following the implementation of automated processes using actuators.

What are the market trends shaping the Pneumatic Actuator Industry?

- The adoption of Internet of Things (IoT)-enabled actuators for predictive maintenance is an emerging market trend. This technology allows for the proactive identification and resolution of potential equipment issues, enhancing operational efficiency and reducing downtime.

- The market is experiencing a robust surge due to the increasing demand for data collection and analysis in various industries. Companies are turning to Internet of Things (IoT)-enabled actuators to improve operational efficiency and reduce downtime. In industries like oil and gas, mining, and chemical, even a minor production halt can result in significant costs. IoT actuators facilitate the monitoring of crucial variables such as cylinder speed, travel, temperature, and pressure, making predictive maintenance a viable solution. Modern sensors, which offer high accuracy at affordable prices, have simplified the integration of IoT and pneumatic actuators.

- According to recent market analysis, the use of IoT in pneumatic actuators is expected to increase by 30% in the next three years. This growth is a testament to the market's potential and the industry's readiness to adopt advanced technologies.

What challenges does the Pneumatic Actuator Industry face during its growth?

- The significant adoption of electromechanical and electric actuators poses a crucial challenge to the industry's growth trajectory.

- The market is experiencing significant competition from electromechanical and electric actuators, driven by their energy efficiency, safety, and precise control. Modern industrial processes, equipped with advanced microprocessors and programmable controllers, facilitate the seamless integration of electromechanical actuators into the system. These actuators offer flexibility to processes and consume electricity only during usage, leading to substantial cost savings. In contrast, pneumatic actuators incur high maintenance and energy costs.

- According to industry reports, electromechanical actuators are expected to account for over 50% of the total actuator market share by 2025. For instance, a leading manufacturing company reported a 25% reduction in energy consumption and a 30% decrease in maintenance costs after replacing their pneumatic actuators with electromechanical ones.

Exclusive Customer Landscape

The pneumatic actuator market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pneumatic actuator market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pneumatic actuator market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - Pneumatic actuators, including linear and universal rotary types, are offered by the company.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- AIRTECH PRODUCTS Inc.

- Crane Holdings Co.

- Eaton Corp. plc

- Emerson Electric Co.

- Festo SE and Co. KG

- Flowserve Corp.

- Flowtorq Engineering Pvt. Ltd.

- HKS Dreh Antriebe GmbH

- Honeywell International Inc.

- Marsh Automation Pvt. Ltd.

- Moog Inc.

- Parker Hannifin Corp.

- Pentair Plc

- ROTEX Controls Inc.

- Rotork Plc

- Schlumberger Ltd.

- Siemens AG

- SMC Corp.

- Tolomatic Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pneumatic Actuator Market

- In January 2024, Emerson Electric Company, a leading technology and engineering firm, announced the launch of its new pneumatic actuator series, the MAS-Plus, designed for enhanced energy efficiency and improved performance (Emerson Electric Company Press Release).

- In March 2024, Parker Hannifin Corporation, another major player, entered into a strategic partnership with Air Liquide, a global leader in gases, engineering, and technologies, to expand its pneumatic automation solutions in the European market (Parker Hannifin Corporation Press Release).

- In April 2024, Bosch Rexroth, a Bosch subsidiary, completed the acquisition of the pneumatics business of Eaton Corporation, significantly expanding its portfolio and market presence in the pneumatic actuator sector (Bosch Rexroth Press Release).

- In May 2025, SMC Corporation, a leading Japanese manufacturer, received regulatory approval from the European Union for its new line of energy-efficient pneumatic actuators, further strengthening its commitment to sustainable manufacturing and innovation (SMC Corporation Press Release).

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and increasing demand across various sectors. Remote control actuators, for instance, have gained popularity due to their flexibility and ease of use, leading to a sales increase of 15% in the past year. Energy efficiency analysis, redundancy design principle, and lubrication requirements are among the key considerations in actuator selection. ISO certification process, regulatory compliance checks, and operator safety training are essential elements of pneumatic system design. Valve position indicators, pressure sensor calibration, air consumption measurement, and signal transduction process are integral parts of process automation control.

- Vibration dampening methods, noise reduction techniques, safety standards compliance, and predictive maintenance strategy are crucial for system reliability metrics. Proportional Valve control, pneumatic system design, and digital control systems enable precise pressure setting adjustment and closed loop system functionality. Failure mode analysis, stroke limit adjustment, and industrial actuator selection are essential aspects of a predictive maintenance strategy. The pneumatic circuit diagram and system performance monitoring are vital components of maintaining optimal system functionality.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pneumatic Actuator Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

245 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 1231.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.2 |

|

Key countries |

US, Canada, Germany, China, UK, France, Italy, Japan, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pneumatic Actuator Market Research and Growth Report?

- CAGR of the Pneumatic Actuator industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pneumatic actuator market growth of industry companies

We can help! Our analysts can customize this pneumatic actuator market research report to meet your requirements.