Police And Military Simulation Training Market Size 2025-2029

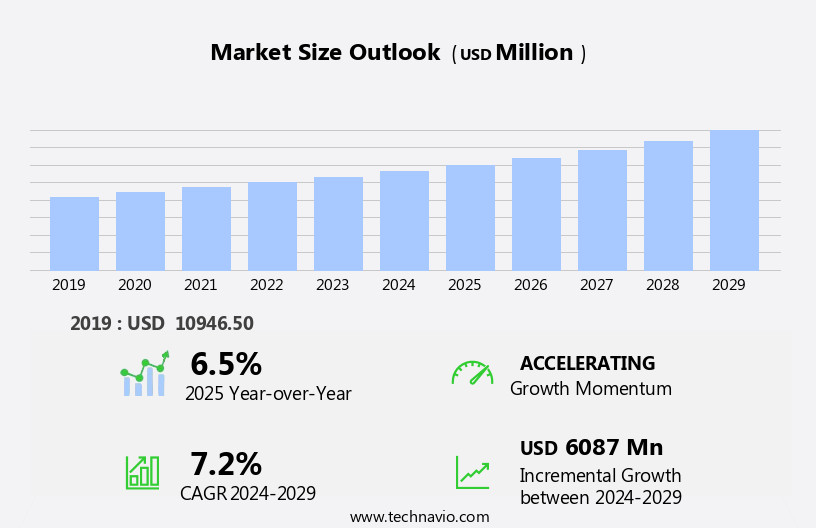

The police and military simulation training market size is forecast to increase by USD 6.09 billion, at a CAGR of 7.2% between 2024 and 2029.

- The market is driven by the increasing demand for cost-effective virtual training solutions. With high investments required for simulation systems, organizations are turning to virtual training to reduce costs and enhance training efficiency. However, the market faces challenges in the form of the high initial investment costs for implementing these simulation systems and the need for continuous updates to ensure the training remains relevant to the evolving threats and technologies. To capitalize on market opportunities, companies must focus on offering affordable and flexible virtual training solutions while investing in research and development to keep their offerings technologically advanced. Effective collaboration between simulation training providers and organizations can also help address the challenge of keeping training programs up-to-date, ensuring that they remain aligned with the latest threats and technologies. Military organizations are investing in advanced technologies to develop lightweight, durable, and multifunctional sensors for various applications, including health monitoring, location tracking, and threat detection. The use of wearable sensors in military operations offers numerous benefits, including improved operational efficiency, enhanced safety, and increased mission success rates.

- In summary, the market is characterized by a growing demand for cost-effective virtual training solutions, balanced against the challenges of high initial investment costs and the need for continuous updates. Companies seeking to succeed in this market must focus on affordability, flexibility, and technological innovation.

What will be the Size of the Police And Military Simulation Training Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the need for advanced, immersive experiences that prepare personnel for a diverse range of scenarios. Simulation software plays a crucial role in this dynamic industry, offering realistic environments for live-fire exercises, weapon systems simulation, urban warfare training, and air combat scenarios. Industry standards are constantly shifting, with augmented reality (AR) and virtual reality (VR) technologies increasingly integrated into training programs. These technologies enable more effective intelligence gathering, crowd control tactics, and mission planning, while providing valuable data logging capabilities for performance evaluation and feedback mechanisms. Cybersecurity training is another critical component of modern simulation training, as the threat landscape continues to evolve.

Self-paced learning and remote training enable personnel to access training materials at their own convenience, while critical incident response scenarios help prepare teams for high-pressure situations. Military budgets remain a significant factor in the market, with governments investing in accreditation and certification programs to ensure the highest standards of training. Scenario development is an ongoing process, with a focus on ethical considerations, de-escalation training, and situational awareness. Training curriculum development is a continuous process, with a focus on command and control, threat assessment, and communication skills. Mobile training units and tactical training enable personnel to access training on the go, while vehicle simulation and stress management training help prepare teams for the challenges of the field.

In summary, the market is characterized by ongoing dynamism, with a focus on providing effective, immersive training experiences that prepare personnel for a wide range of scenarios. The integration of VR, AR, data logging, cybersecurity training, self-paced learning, critical incident response, scenario development, military budgets, accreditation and certification, and other advanced technologies is a key driver of market growth.

How is this Police And Military Simulation Training Industry segmented?

The police and military simulation training industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Flight

- Combat

- Maritime

- Application

- Air

- Naval

- Ground

- Type

- Live fire training

- Simulated scenario-based training

- Virtual reality training

- Decision-making training

- End-user

- Military forces

- Law enforcement agencies

- Emergency services

- Private security companies

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

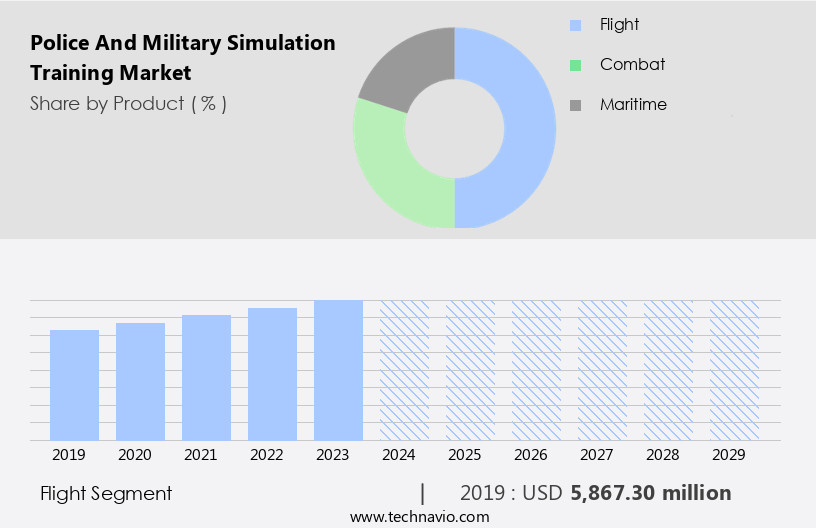

The flight segment is estimated to witness significant growth during the forecast period.

The defense industry invests significantly in simulation training to prepare military personnel for various operational scenarios. Simulation software plays a crucial role in creating immersive experiences, enabling live-fire exercises and weapon systems simulation for urban warfare and air combat training. Industry standards prioritize safety protocols, ensuring ethical considerations are met during counter-terrorism operations and crowd control tactics. Remote training and instructor-led sessions offer mission planning, performance evaluation, and feedback mechanisms for de-escalation training and critical incident response. Augmented reality (AR) and virtual reality (VR) technologies enhance training by providing situational awareness and interactive scenarios. Training curriculum development includes threat assessment, command and control, and tactical training.

Non-lethal weapons and cybersecurity training are essential components of modern military preparedness. Government funding supports mobile training units and self-paced learning, enabling access to training resources regardless of location. Mission planning and scenario development are critical aspects of military readiness. Realistic environments, communication skills, and vehicle simulation ensure effective training for various operational situations. Data logging and training effectiveness evaluations help improve performance and identify areas for improvement. Military budgets allocate resources for accreditation and certification of simulation training programs. The evolving market trends emphasize the importance of stress management, realistic environments, and instructor-led training for effective and efficient military preparedness.

The Flight segment was valued at USD 5.87 billion in 2019 and showed a gradual increase during the forecast period.

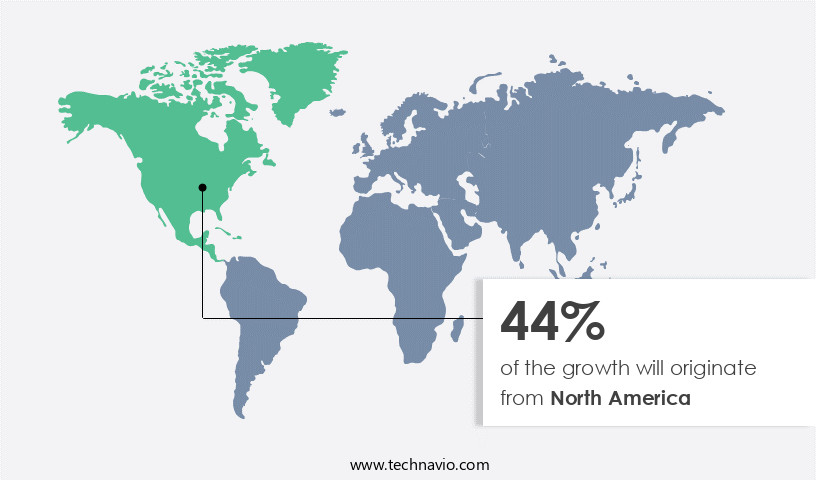

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The US defense spending, being the highest globally, is driving the growth of the market in the Americas. Major contributors to this market are Canada and the US, both investing substantially in modernizing their military equipment and simulation training solutions. Companies such as L3Harris Technologies Inc., Meggitt Plc, and Northrop Grumman Corp. Are key players offering immersive, instructor-led training for mission planning, performance evaluation, and feedback mechanisms. These solutions encompass weapon systems simulation, urban warfare and air combat training, as well as live-fire exercises and virtual reality experiences. Industry standards prioritize safety protocols, ethical considerations, and realistic environments, ensuring effective training for counter-terrorism operations, threat assessment, and critical incident response.

Additionally, remote training, augmented reality, and cybersecurity measures are increasingly integrated to enhance training effectiveness and flexibility. Government funding for non-lethal weapons and mobile training units further bolsters the market's development. Training curriculum development covers various aspects, including communication skills, stress management, and de-escalation tactics. Ultimately, these investments aim to prepare military and law enforcement personnel for mission readiness and situational awareness.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Police And Military Simulation Training Industry?

- Virtual training, which is cost-effective, serves as the primary growth catalyst for the market.

- The market is experiencing significant growth due to the cost-effectiveness and safety advantages of virtual training over real-time methods. In real-world training, expenses extend beyond the initial cost of resources, encompassing fuel for military platforms, procurement of training ammunition, and operational costs. Conversely, virtual training eliminates these additional expenses while minimizing risks to personnel and equipment. Command and control, threat assessment, tactical training, and stress management are integral components of these simulations, ensuring a comprehensive and effective training curriculum. Mobile training units and vehicle simulation enable on-the-go training, while interactive scenarios and communication skills development foster harmonious teamwork and collaboration.

- Ethical considerations are prioritized, maintaining the highest standards of professionalism and integrity. Realistic environments and immersive simulations provide trainees with a striking resemblance to real-life situations, enhancing their readiness for various missions. By focusing on these aspects, defense agencies emphasize the importance of simulation and synthetic training methodologies in their overall training strategies.

What are the market trends shaping the Police And Military Simulation Training Industry?

- The trend in education is shifting towards Self-Directed Learning through Science, Technology, Engineering, and Mathematics (STEM).

- Virtual reality (VR) simulation training is revolutionizing the way military and law enforcement agencies prepare for complex scenarios. STE, a leading simulation training solution, offers a comprehensive approach by integrating various platforms for combined-arms training. This system replicates intricate operating environments, enabling effective team building and critical incident response training. STE's immersive and harmonious design emphasizes cognitive, physical, and social elements, enhancing live training through augmented reality using cloud technologies and geospatial databases. The system provides a common objective picture to commanders, enabling mission operations among different military divisions. Data logging and self-paced learning are essential features of STE, ensuring training effectiveness and allowing trainees to learn at their own pace.

- Cybersecurity training is also integrated into the system, addressing the growing importance of securing digital networks. Scenario development is customizable, allowing organizations to create realistic and challenging situations tailored to their needs. Military budgets continue to prioritize simulation training due to its cost-effectiveness and the ability to minimize risks associated with live training. Accreditation and certification are also crucial aspects, with STE ensuring compliance with industry standards for maximum credibility. In conclusion, STE's VR simulation training solution offers a robust, effective, and flexible approach to meeting the evolving needs of military and law enforcement organizations.

What challenges does the Police And Military Simulation Training Industry face during its growth?

- The significant investment necessary for implementing simulation systems poses a substantial challenge to the industry's growth trajectory.

- The market has experienced significant cost reduction due to the adoption of Commercial Off-The-Shelf (COTS) technology and stringent Size, Weight, and Power (SWaP) requirements. Despite this, the market investment remains substantial, primarily due to the operational costs. Simulators are typically installed in training facilities, necessitating a dedicated space, advanced infrastructure, trained personnel, and maintenance staff, leading to additional expenses. Most training academies are situated in urban areas due to the necessity of network and communication technology, resulting in increased transportation costs for trainees, particularly military personnel. Simulation software plays a crucial role in this market, providing immersive experiences through weapon systems simulation, urban warfare simulation, air combat simulation, and intelligence gathering.

- Industry standards ensure that these simulations offer accurate and harmonious training experiences, emphasizing the importance of counter-terrorism operations and thematic scenarios. Augmented Reality (AR) technology further enhances the training experience by offering a more realistic and interactive environment. Overall, the market continues to evolve, offering innovative solutions that meet the ever-changing demands of the defense sector.

Exclusive Customer Landscape

The police and military simulation training market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the police and military simulation training market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, police and military simulation training market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arotech - The company specializes in providing advanced simulation training solutions for law enforcement and military sectors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arotech

- Ascent Flight Training Holdings

- BAE Systems Plc

- Bohemia Interactive Simulations ks

- CAE Inc.

- Cubic Corp.

- General Dynamics Mission Systems Inc.

- H SIM

- Indra Sistemas SA

- Israel Aerospace Industries Ltd.

- Kratos Defense and Security Solutions Inc.

- L3Harris Technologies Inc.

- Lockheed Martin Corp.

- Meggitt Plc

- Northrop Grumman Corp.

- Rheinmetall AG

- RTX Corp.

- Saab AB

- Virtra Inc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Police And Military Simulation Training Market

- In January 2024, Thales Group, a leading technology company, announced the launch of its new virtual reality (VR) police training solution, "VR-Police Academy," in collaboration with the French National Police (CNP). This innovative training program aims to enhance the effectiveness and safety of police training (Thales Group Press Release, 2024).

- In March 2024, Lockheed Martin Corporation and CAE Inc. Joined forces to create a strategic partnership, combining their expertise in military simulation and training. This collaboration is expected to expand their market reach and provide advanced training solutions to military and law enforcement organizations worldwide (Lockheed Martin Corporation Press Release, 2024).

- In May 2024, the U.S. Department of Defense (DoD) granted a contract worth USD120 million to Bohemia Interactive Simulations (BISim) for the development and delivery of advanced military simulation training systems. This contract represents a significant investment in the military simulation training market, demonstrating the importance of advanced training solutions for military readiness (DoD Contract Announcement, 2024).

- In February 2025, Elbit Systems Ltd., a global defense electronics company, unveiled its new "Virtual Reality Training Center" for military and law enforcement personnel. This state-of-the-art facility, located in Israel, features cutting-edge VR technology and immersive simulations, allowing trainees to experience realistic and effective training scenarios (Elbit Systems Ltd. Press Release, 2025).

Research Analyst Overview

- The market is characterized by the integration of advanced technologies and innovative training methods to enhance operational readiness and effectiveness. Game engines, such as Unreal Engine and Unity, serve as the foundation for creating realistic training environments, while scenario libraries offer a diverse range of tactics and strategies for troops to master. Artificial intelligence (AI) and machine learning (ML) are transforming training programs by providing adaptive and personalized learning experiences. Performance tracking and biometric monitoring enable trainers to assess trainees' progress and identify areas for improvement. Military doctrine and operational procedures are brought to life on the virtual battlefield, allowing for real-time data analysis and collaborative training.

- Haptic feedback and high-fidelity models further enhance the immersive experience, while motion capture and sensor technology ensure accurate replication of human behavior. Simulated combat scenarios, customized based on training data sets, enable interagency collaboration and knowledge transfer, fostering international security and conflict resolution. Decision support systems and data visualization tools provide valuable insights, enabling trainers to optimize training programs and improve skill development. In the realm of terrorism studies, AI and ML are employed for behavior analysis and scenario customization, allowing for effective preparation and response planning. Human-computer interaction (HCI) and cognitive science principles are integrated to create intuitive and effective training interfaces.

- Overall, the market is driven by the need for advanced, technology-driven training solutions that enable effective skill development and operational readiness in the face of complex and evolving security challenges.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Police And Military Simulation Training Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

245 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market growth 2025-2029 |

USD 6087 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Canada, China, Japan, India, UK, Germany, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Police And Military Simulation Training Market Research and Growth Report?

- CAGR of the Police And Military Simulation Training industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the police and military simulation training market growth of industry companies

We can help! Our analysts can customize this police and military simulation training market research report to meet your requirements.