Game Engines Market Size 2024-2028

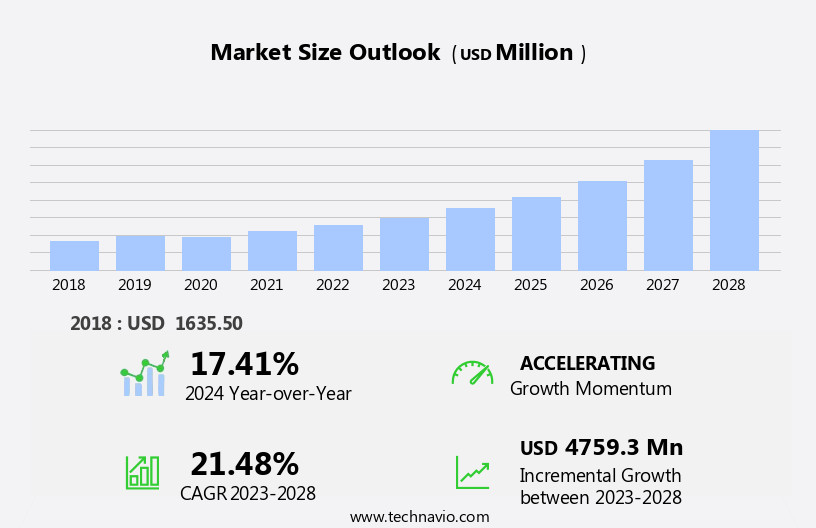

The game engines market size is forecast to increase by USD 4.76 billion at a CAGR of 21.48% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing popularity of eSports and the trend toward cross-platform gaming support. These factors are expanding the market's reach and increasing demand for advanced game engines that can deliver high-quality graphics, smooth performance, and seamless multiplayer experiences. However, the market faces challenges related to infrastructure, as the growing complexity of games and the need for real-time rendering and processing place significant demands on hardware and network capabilities. Addressing these challenges will require continued innovation and investment in technology and infrastructure to ensure that game engines can meet the evolving needs of developers and players alike.

- Overall, the market is poised for continued growth, with opportunities for companies that can provide solutions that address the infrastructure challenges and deliver advanced features to meet the demands of the gaming community.

What will be the Size of the Game Engines Market During the Forecast Period?

- The market is experiencing robust growth, driven by the increasing demand for immersive gaming experiences across various platforms. Game engines are essential software tools used by game developers to create 3D graphics, physics simulations, sound effects, animation, and artificial intelligence for video games. The market encompasses a diverse range of applications, including console, smartphone, and desktop games. Key trends shaping the market include the integration of advanced technologies such as AI, networking, streaming, and scripting to enhance gameplay and user experience. The integration of AI, for instance, is enabling the development of more intelligent non-player characters and dynamic game environments.

- Additionally, the market is witnessing a surge In the use of game engines for esports and multiplayer online battle arena (MOBA) games like League of Legends and Dota, further fueling market growth. Overall, the market is poised for continued expansion, offering significant opportunities for innovation and growth.

How is this Game Engines Industry segmented and which is the largest segment?

The game engines industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Genre

- Action and adventure

- Multiplayer online battle arena

- Simulation and sports

- Shooter

- Others

- Component

- Solution

- Services

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Genre Insights

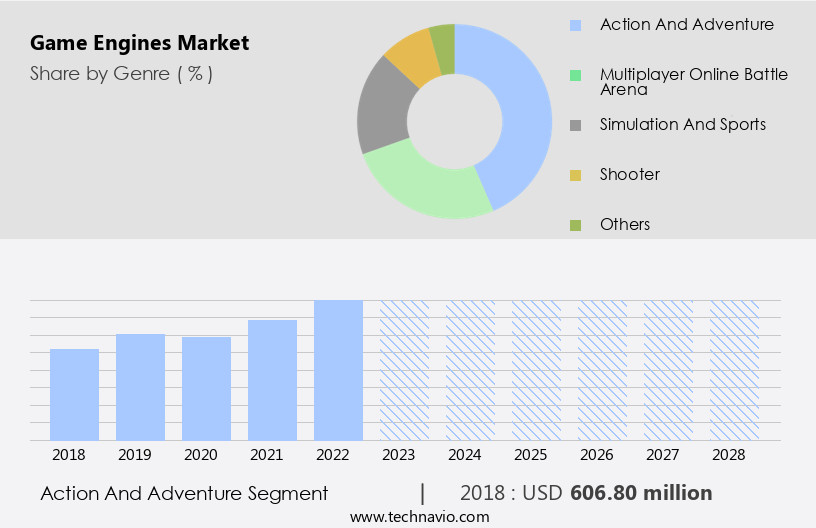

The action and adventure segment is estimated to witness significant growth during the forecast period.

Get a glance at the market report of various segments Request Free Sample

The Action and adventure segment was valued at USD 606.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

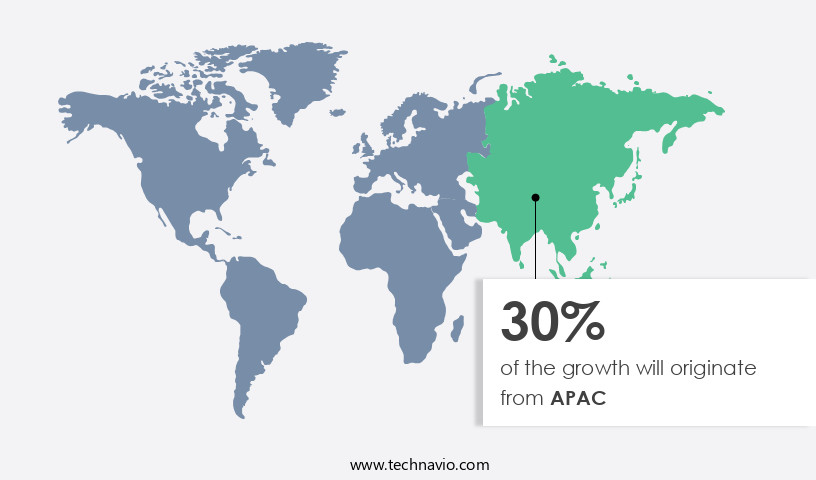

APAC is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market experienced significant growth in 2023, with APAC as the leading region due to the increasing demand for PC gaming and the expanding use of smartphones. China, South Korea, and Japan were the major contributors to the market's revenue. The popularity of online video games, particularly in Southeast Asia, and the expansion of broadband connectivity have encouraged game developers and enterprises to launch new games. Additionally, the rising penetration of broadband and the increasing use of mobile devices in countries like China, Thailand, Indonesia, and Vietnam have fueled the growth of online gaming, thereby increasing the demand for new games.

Game engines, such as Unity, Unreal Engine, and CryEngine, are essential tools for game developers, enabling the creation of high-quality 3D and 2D games for various platforms, including personal computers, gaming consoles, smartphones, desktops, and TVs. These engines provide features like physics engines, sound engines, animation engines, artificial intelligence, rendering engines, game architecture, game frameworks, programming languages, and networking. Companies like Unity Technologies, Chukong Tech, Crytek, Corona Labs, Garage Games, and Godot Engine are leading the market, offering multi-platform game development, cloud-based engines, and augmented reality (AR) and virtual reality (VR) solutions. The integration of blockchain technology, AI, and streaming services is expected to further drive the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Game Engines Industry?

- Increasing popularity of eSports is the key driver of the market.The market is experiencing significant growth due to the increasing popularity of eSports, particularly multiplayer games like League of Legends and Dota. ESports tournaments, such as 'The International,' are gaining traction among gamers worldwide, with professional gamers competing in front of large audiences, either in-person or online. These events are organized by various associations, including the International eSports Federation and the World Esports Association, leading to an increase In the frequency of tournaments and the number of participants. As game developers hold the intellectual property rights to the games used In these tournaments, the revenue growth of the market is expected to escalate.

- Game engines are essential components of game development software, which includes physics, sound, animation, and rendering engines, as well as game architecture and frameworks. They are used in game development for personal computers, gaming consoles, smartphones, desktops, and even TV games. Unity, for instance, is a widely-used 3D game engine, while Corona Labs offers a 2D game engine. Game development platforms like Unity Technologies and Chukong Tech provide game assets and development tools. Additionally, advancements in technologies like AI, AR, VR, cloud-based engines, and blockchain technology are expanding the market's scope. Game creators use programming languages like C++, C#, and Python for scripting, networking, streaming, memory management, and cloud games.

What are the market trends shaping the Game Engines market?

- Growing developments in cross-platform gaming support is the upcoming market trend.The gaming industry's expansion to various platforms, including gaming consoles, personal computers, and mobile devices, has fueled the demand for versatile game development tools. Cross-platform game engines are increasingly popular due to their ability to support online multiplayer games, enabling players on different hardware to compete together. The MOBA genre, including League of Legends and Dota, has spearheaded this trend. companies such as Unity Technologies, Crytek, Corona Labs, and Godot Engine are providing cross-platform compatibility solutions. The rise of mobile gaming and the increasing popularity of esports have further boosted the market. Game development software now includes advanced features like physics engines, sound engines, animation engines, artificial intelligence, rendering engines, game architecture, and game frameworks.

- Programming languages, rendering tools, and game development platforms are also essential components. The integration of cloud-based engines, blockchain technology, augmented reality, and virtual reality is revolutionizing the industry. Game creators require these tools to develop high-quality 3D and 2D games for consoles, smartphones, desktops, and even TVs. Memory management, networking, streaming, and scripting are crucial elements of game development. The market is dynamic, with companies continually updating their offerings to meet the evolving needs of game developers.

What challenges does the Game Engines Industry face during its growth?

- Infrastructural challenges are major issues impeding market growth is a key challenge affecting the industry growth.The market faces significant challenges due to the infrastructure requirements for supporting advanced online game engines. The need for high-speed and latency-free broadband services is crucial for an optimal gaming experience. However, this need is more pronounced in emerging economies where the adoption of advanced IT infrastructure is slow. The absence of high-speed Internet connections can result in frame rate loss and latency issues, negatively impacting user experience and sales of game engines. Furthermore, the delayed implementation of 5G technology in certain developing countries, such as India and Brazil, is hindering market growth. Game engines incorporate various components, including physics, sound, animation, AI, rendering, game architecture, and frameworks, which are built using programming languages like C++, C#, and Python.

Exclusive Customer Landscape

The game engines market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the game engines market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, game engines market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Amazon.com Inc. - The Open 3D Engine from the company is a versatile game development solution, enabling the creation of high-performance and visually stunning games across various genres and platforms. This engine empowers developers with a robust feature set, including real-time rendering, physics simulation, and advanced animation capabilities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- Appodeal Inc.

- Carnegie Mellon University

- Carsten Fuchs Software

- Crytek GmbH

- Degica Co. Ltd.

- Electronic Arts Inc.

- GameSalad Inc.

- GDevelop Ltd.

- Godot Engine

- Leadwerks Software

- LF Projects LLC

- Marmalade Game Studio Ltd.

- Microsoft Corp.

- Remedy Entertainment Plc

- Silicon Studio Corp.

- Torque Game Engine

- UNIGINE Holding S.a.r.l

- Unity Technologies Inc.

- YYG Property

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global game engine market is experiencing significant growth as the demand for advanced and immersive gaming experiences continues to rise. Game engines are essential tools for game developers, enabling the creation of high-quality games across various genres and platforms. These software solutions offer a range of features, including physics engines for realistic gameplay, animation engines for character movements, sound engines for immersive audio, and rendering engines for stunning graphics. Game engines have become an integral part of the gaming industry, powering popular titles across personal computers, gaming consoles, smartphones, desktops, and even virtual and augmented reality experiences. The market is characterized by intense competition among key players, with several companies offering robust solutions to cater to the diverse needs of game creators.

The game engine market is driven by several factors, including the increasing popularity of esports and multiplayer online games, the growing adoption of cloud-based engines, and the integration of artificial intelligence (AI) and other advanced technologies. The integration of AI in game engines is particularly noteworthy, as it enhances gameplay and creates more realistic and dynamic gaming experiences. Moreover, the market is witnessing the emergence of new players and the evolution of existing ones, with some offering specialized solutions for specific genres or platforms. For instance, some game engines are optimized for 3D graphics, while others focus on 2D games.

Some engines cater to mobile games, while others are designed for TV games or cloud games. The market for game engines is also witnessing the integration of blockchain technology, which is expected to revolutionize the gaming industry by enabling decentralized game development, ownership, and monetization. This trend is particularly noteworthy In the context of the growing popularity of NFTs (non-fungible tokens) and other digital assets In the gaming world. The market for game engines is expected to continue its growth trajectory, driven by the increasing demand for immersive gaming experiences and the continuous innovation in game engine technology.

As the market evolves, we can expect to see more advanced features, such as real-time rendering, improved memory management, and enhanced networking capabilities. In conclusion, the game engine market is a dynamic and innovative space, driven by the ever-evolving needs of game creators and the growing demand for immersive gaming experiences. With the integration of advanced technologies such as AI, blockchain, and cloud gaming, the market is poised for significant growth In the coming years. Game engines are essential tools for game developers, enabling them to create high-quality games across various genres and platforms. As the gaming industry continues to evolve, game engines will remain at the forefront of innovation, powering the next generation of gaming experiences.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.48% |

|

Market growth 2024-2028 |

USD 4759.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.41 |

|

Key countries |

US, China, South Korea, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Game Engines Market Research and Growth Report?

- CAGR of the Game Engines industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the game engines market growth of industry companies

We can help! Our analysts can customize this game engines market research report to meet your requirements.