Polycystic Kidney Disease Drugs Market Size 2024-2028

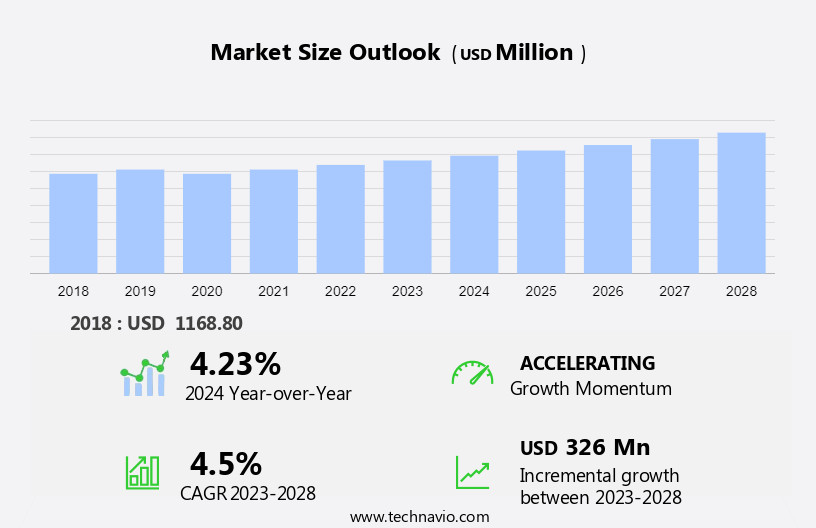

The polycystic kidney disease drugs market size is forecast to increase by USD 326 million at a CAGR of 4.5% between 2023 and 2028.

- The market is witnessing significant growth due to the high prevalence of chronic kidney diseases worldwide. The increasing research funding for PKD, driven by various organizations and governments, is another key growth factor. Pharmaceutical firms invest in research to develop novel treatments, leveraging advanced technologies like artificial intelligence and machine learning to understand PKD pathophysiology, high-output screening, computational modeling, genomics, and biomarker discovery. However, the market is faced with challenges such as the lack of approved drugs for PKD treatment. Despite the presence of several drugs in the pipeline, only a few have been approved for market use. This presents an opportunity for pharmaceutical companies to invest in research and development to address this unmet medical need and cater to the growing patient population.

What will be the Size of the Polycystic Kidney Disease Drugs Market During the Forecast Period?

- The market encompasses a range of interventions, including medication, surgery, and diagnostic tests, aimed at managing the symptoms and progression of this genetic disorder. PKD is characterized by the growth of numerous cysts In the kidneys, leading to high blood pressure, renal failure, and chronic kidney disease. Diagnostic tools such as ultrasound, CT scan, and MRI scan are essential for early detection and diagnosis. Medications, available in both oral and parenteral forms, are used to manage symptoms, reduce cyst growth, and prevent complications. Surgical interventions, including kidney transplants and nephrectomy, are employed when other treatments prove ineffective.

- The market is driven by the increasing prevalence of genetic abnormalities and the resulting healthcare expenditure. Pharmaceutical firms and research institutions are investing significantly In the development of new treatments, including those leveraging artificial intelligence and machine learning, to improve patient outcomes and reduce the burden of chronic kidney disease on healthcare systems. The market spans hospitals, specialty clinics, hospital pharmacies, and retail pharmacies.

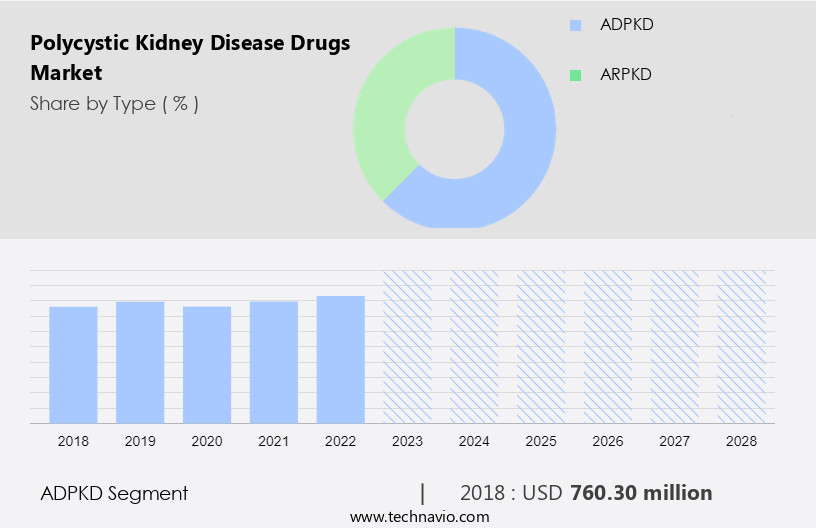

How is this Polycystic Kidney Disease Drugs Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- ADPKD

- ARPKD

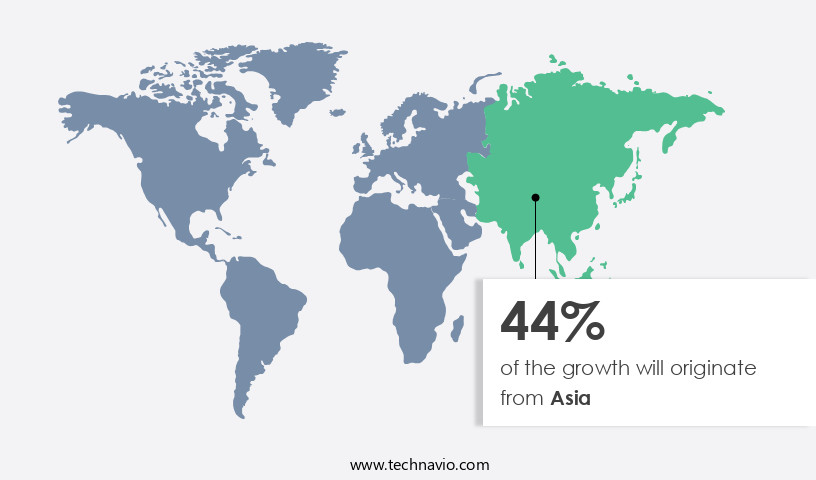

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Type Insights

- The ADPKD segment is estimated to witness significant growth during the forecast period.

Polycystic kidney disease (PKD), an autosomal dominant genetic disorder, is characterized by the growth of numerous cysts In the kidneys. Two primary gene mutations, PKD1 and PKD2, are responsible for the majority of cases. ADPKD, the most common form, affects approximately one in every 400 to 1,000 people worldwide. Diagnosis typically occurs between the ages of 30 and 50. This chronic condition can lead to high blood pressure, renal failure, and the need for dialysis or kidney transplant. Healthcare expenditure on genetic diseases, including PKD, is significant. Pharmaceutical firms invest in research to develop treatments that targets PKD pathophysiology.

Diagnostic tools like ultrasound, CT scan, and high-output screening aid in early detection. Treatment options include medication (oral and parenteral), surgery, and management in hospitals, specialty clinics, hospital pharmacies, and retail pharmacies. AI technologies, such as machine learning and computational modeling, are increasingly utilized in PKD research, including genomics and biomarker discovery.

Get a glance at the Polycystic Kidney Disease Drugs Industry report of share of various segments Request Free Sample

The ADPKD segment was valued at USD 760.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Asia is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Polycystic kidney disease (PKD) is a genetic condition leading to chronic kidney disease (CKD) and, in severe cases, renal failure. In North America, the high prevalence of PKD contributes significantly to the region's CKD cases, with the US accounting for a substantial percentage of these cases due to its large geriatric population. According to the Centers for Disease Control and Prevention (CDC), approximately 15% of the US geriatric population experiences kidney failure, and about 2-5% of these cases are attributed to PKD. The number of affected individuals is substantial given the large population base. PKD is characterized by the growth of numerous cysts In the kidneys, leading to kidney enlargement, high blood pressure, and eventually, kidney failure.

Treatment modalities include medication, surgery, ultrasound, CT scan, oral, and parenteral therapies. Hospitals, specialty clinics, hospital pharmacies, retail pharmacies, and biotech companies play crucial roles in the delivery of care. The market is driven by the increasing healthcare expenditure on genetic diseases and the growing need for effective treatments.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Polycystic Kidney Disease Drugs Industry?

The high prevalence of chronic kidney diseases is the key driver of the market.

- The global market for medications used in the treatment of polycystic kidney disease (PKD) is experiencing steady growth due to the increasing prevalence of chronic kidney diseases, including PKD. Chronic kidney diseases, such as PKD, are majorly driven by genetic abnormalities leading to the development of cysts In the kidneys. This condition can progress to renal failure, requiring costly treatments such as dialysis or kidney transplants. PKD can be diagnosed through various imaging techniques, including ultrasound and CT scan. Both oral and parenteral medications are used In the treatment of PKD, with some drugs targeting the PKD pathophysiology through drug development.

- Other emerging treatments include CFTR1 inhibitors, which are currently under investigation. The PKD medication market is served by various channels, including hospitals, specialty clinics, hospital pharmacies, and retail pharmacies. The market is dominated by pharmaceutical firms investing in research and production sites to increase production capacities and launch new products. Advanced technologies, such as artificial intelligence and machine learning, are being employed In the development of new treatments and diagnostics. Healthcare expenditure on genetic diseases, including PKD, is expected to increase significantly due to the rising prevalence and the need for expensive treatments. The market dynamics are influenced by factors such as the high burden of disease, increasing awareness, and the availability of new treatments.

What are the market trends shaping the Polycystic Kidney Disease Drugs Industry?

Increasing research funding is the upcoming market trend.

- Polycystic kidney disease (PKD) is a genetic condition characterized by the growth of numerous cysts In the kidneys. The disease is incurable, and current treatment options are limited to managing symptoms, such as high blood pressure and renal failure, through medication, surgery, or dialysis. The US market for PKD medications is witnessing significant growth due to the increasing prevalence of chronic kidney disease (CKD) and the unmet need for effective therapies. However, the market faces challenges, including the dominance of small- and mid-sized research organizations that lack sufficient funding to bring novel therapies to market. Advancements in technology, such as ultrasound and CT scans, have improved the diagnosis and monitoring of PKD.

- Oral and parenteral medications, including Empagliflozin, a drug used to treat type 2 diabetes that has shown promise in managing PKD, are currently available. However, there is a need for more effective treatments, leading to increased investment in research by organizations. The PKD pathophysiology is complex, and drug development requires a high-output screening process, computational modeling, genomics, and biomarker discovery. CFTR1 inhibitors are among the potential therapeutic targets. Hospital pharmacies and retail pharmacies play a crucial role In the distribution of PKD medications. The healthcare expenditure on genetic diseases is expected to increase, making it an attractive area for investment.

What challenges does the Polycystic Kidney Disease Drugs Industry face during its growth?

The lack of approved drugs is a key challenge affecting the industry's growth.

- The market is characterized by a limited number of approved medications for treating this genetic condition, which affects the kidneys and results In the formation of cysts. The market's dynamics are influenced by the complexities of PKD pathophysiology, including genetic abnormalities and high blood pressure, leading to renal failure and chronic kidney disease. The current treatment landscape is dominated by the off-label use of various medications, such as antibiotics, hypertension drugs, and Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), to manage symptoms like pain, hematuria, and frequent urination. Ultrasound and CT scans are commonly used for diagnosis, while hospitals and specialty clinics are the primary points of care.

- Oral and parenteral medications are the preferred routes of administration. The market's growth is also influenced by healthcare expenditure and the increasing prevalence of genetic diseases. Machine learning and computational modeling are being employed to improve high-output screening and biomarker discovery. Production sites and capacities are expanding to meet the growing demand for PKD treatments, with several product launches anticipated In the near future.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apotex Inc.

- AstraZeneca Plc

- Dr Reddys Laboratories Ltd.

- Galapagos NV

- Johnson and Johnson Services Inc.

- Merck and Co. Inc.

- Novartis AG

- Otsuka Holdings Co. Ltd.

- Palladio Biosciences Inc.

- Reata Pharmaceuticals Inc.

- Regulus Therapeutics Inc.

- Sanofi SA

- Teva Pharmaceutical Industries Ltd.

- Vertex Pharmaceuticals Inc.

- XORTX Therapeutics Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polycystic kidney disease (PKD) is a genetic disorder characterized by the growth of numerous cysts In the kidneys, leading to impaired renal function. This condition can result in various complications, including high blood pressure, renal failure, and the need for dialysis or transplant. The global market for PKD drugs is driven by the increasing prevalence of this chronic disease and the unmet medical need for effective treatment options. The PKD drug market is witnessing significant growth due to the increasing investment in research and development (R&D) in this area. The disease's complex pathophysiology, which involves genetic abnormalities and the formation of cysts, requires innovative approaches to drug discovery.

Moreover, advanced technologies such as artificial intelligence (AI) and machine learning are being employed to identify potential targets and develop new therapies. One promising area of research is the development of CFTR1 inhibitors, which have shown promise in preclinical studies. These drugs work by targeting the underlying genetic cause of PKD, making them a potential game-changer In the treatment of this condition. High-output screening and computational modeling are being used to identify potential CFTR1 inhibitors, with several companies actively involved in this research. Another approach to treating PKD is through the use of empagliflozin, a sodium-glucose cotransporter 2 (SGLT2) inhibitor.

Furthermore, while not specifically developed for PKD, empagliflozin has shown promise in reducing the progression of kidney damage in patients with this condition. Its mechanism of action, which involves increasing urinary excretion of sodium and water, may help reduce the pressure on the kidneys and slow down the growth of cysts. Despite the promising developments in PKD drug research, several challenges need to be addressed. The complex nature of the disease, which involves multiple genetic mutations and various complications, makes it difficult to develop effective and safe treatments. Additionally, the high healthcare expenditure associated with the management of PKD, which includes hospitalizations, dialysis, and transplantation, adds to the economic burden of this condition.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 326 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polycystic Kidney Disease Drugs Market Research and Growth Report?

- CAGR of the Polycystic Kidney Disease Drugs industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polycystic kidney disease drugs market growth of industry companies

We can help! Our analysts can customize this polycystic kidney disease drugs market research report to meet your requirements.