Potassium Feldspar Market Size 2024-2028

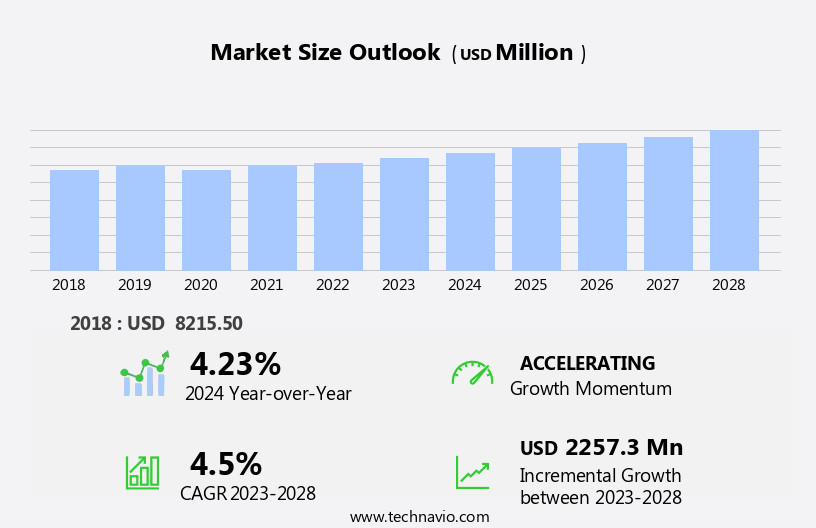

The potassium feldspar market size is forecast to increase by USD 2.26 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is witnessing significant growth due to several key factors. One of the primary drivers is the increasing investments in infrastructure development, particularly in construction, where potassium feldspar is extensively used as a fluxing agent.

- Another trend influencing the market is the expanding application of potassium feldspar in photovoltaic (PV) panels, which is expected to boost demand for this mineral. However, the market faces challenges from stringent environmental regulations related to feldspar in the mining industry, which require companies to adhere to strict standards for mining and processing potassium feldspar. These regulations increase operational costs and may hinder market growth.

- Overall, the market is expected to grow steadily, driven by these factors and the ongoing demand for potassium feldspar in various industries.

What will be the Size of the Potassium Feldspar Market During the Forecast Period?

- The market encompasses the global trade of potassium-rich aluminum silicates, specifically the minerals potassium feldspar, alkali feldspars, and microcline. These minerals are essential in various industries due to their unique properties, including their ability to act as fluxing agents and glass formers. Key industries utilizing potassium feldspar include the glass industry, ceramics, and automotive manufacturing sector. In the glass industry, potassium feldspar is used as a fluxing agent to lower the melting point of silica-based glass. In ceramics, it serves as a raw material for the production of ceramic tiles, kitchen appliances, and fiberglass. In the automotive sector, potassium feldspar is used In the production of welding rods and certain types of ceramic products.

- The market for potassium feldspar is driven by the increasing demand for glass and ceramics in various applications. The growth of the automotive industry and the expanding use of ceramics in building and construction also contribute to market expansion. Additionally, the electrical and electronics industry utilizes potassium feldspar as a filler and extender in various applications. The market is segmented into alkali feldspars, which include orthoclase and plagioclase feldspars, and microcline. The alkali feldspars segment dominates the market due to its wide range of applications. Overall, the market is expected to grow steadily due to the increasing demand for glass and ceramics in various industries.

How is this Potassium Feldspar Industry segmented and which is the largest segment?

The potassium feldspar industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Glass

- Ceramics

- Fillers

- Others

- Geography

- APAC

- China

- India

- Europe

- Germany

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By End-user Insights

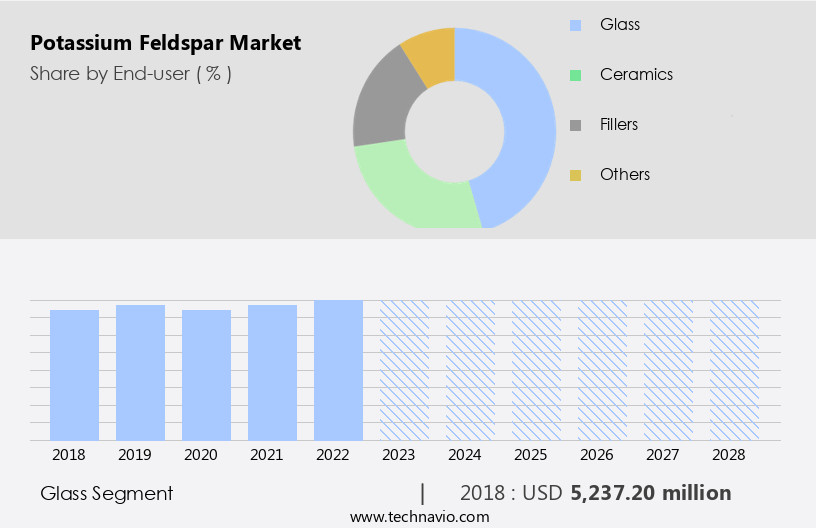

- The glass segment is estimated to witness significant growth during the forecast period.

Potassium feldspar is a significant raw material In the glass industry, serving as a fluxing agent that decreases glass viscosity. Alkali components in feldspar function as flux, lowering glass batch melting temperatures and reducing production costs. Feldspar's applications extend to various industries, including ceramics, floor tiles, kitchen and bathroom fixtures, and automotive sectors. The expanding construction industry and escalating demand for flat glass in automotive aftermarkets fuel the growth of the market. The versatility of potassium feldspar, with its use in ceramics as a functional filler, paints, and plastics, further bolsters its market potential.

Get a glance at the Potassium Feldspar Industry report of share of various segments Request Free Sample

The Glass segment was valued at USD 5.24 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

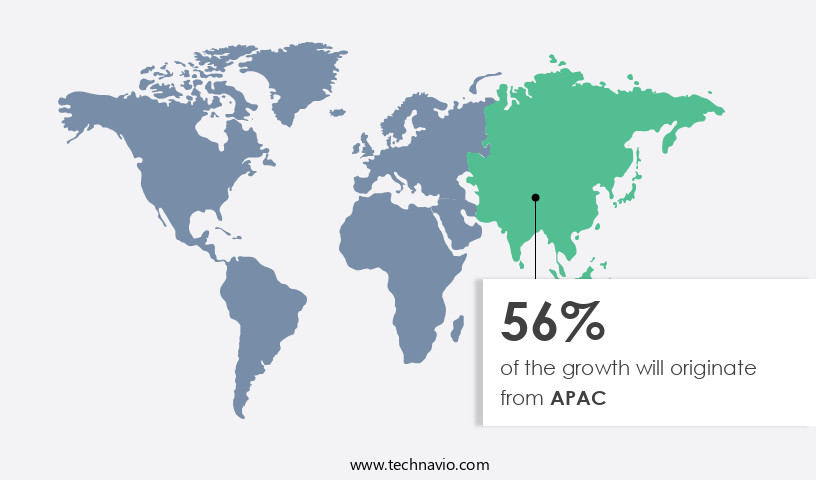

- APAC is estimated to contribute 56% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region, specifically China and Japan, significantly contributes to The market due to its abundant resources. Mining companies play a pivotal role In the extraction of feldspar, making APAC a leading producer. The ceramic and glass industries are major consumers of potassium feldspar, with China being a significant contributor. In the ceramic sector, potassium feldspar comprises approximately 30% of the raw materials. Huadian City in China holds a substantial potassium feldspar reserve, primarily utilized In the production of floor tiles and other ceramic products. The glass industry also relies on potassium feldspar as a fluxing agent, impacting glass viscosity during manufacturing.

Key applications include windows, doors, buildings, and various consumer goods such as medical devices, electrical and electronic appliances, and automobiles. The market growth is driven by increasing infrastructure revamping activities, particularly In the glass and ceramics industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Potassium Feldspar Industry?

Increasing investments in development of infrastructure is the key driver of the market.

- Potassium feldspar, a type of aluminum silicate mineral, is a crucial component in various industries, including ceramics, glassmaking, and construction. Feldspars, which include alkali feldspars like orthoclase, sanidine, and microline, and plagioclase feldspars like albite and anorthite, are abundant In the Earth's continental crust. Igneous rocks, such as magma, and metamorphic rocks contain significant amounts of these minerals. The ceramics industry is a major consumer of potassium feldspar. It is used as a fluxing agent In the production of ceramic products, such as floor tiles, kitchen and bathroom fixtures, and ceramic glasses. In the glass sector, potassium feldspar is used as a functional filler and extender, reducing the viscosity of glass and improving its workability.

- It is also used In the paint sector as a filler and extender. The automotive sector utilizes potassium feldspar In the production of fiberglass, specialty glass, and welding rods. The building and construction industry uses it as a fluxing agent, and in infrastructure revamping activities, such as the production of enamel glazes, porcelain, and porcelain tiles. The glass industry, ceramics industry, and kitchen appliances industry are significant contributors to the global demand for potassium feldspar. The export activities of potassium feldspar are substantial, with major producers including nepheline syenite, quartz, and aluminum silicate. The global construction industry's growth, driven by emerging economies and government projects, is expected to fuel the demand for potassium feldspar in various industries during the forecast period.

What are the market trends shaping the Potassium Feldspar Industry?

Growing application of potassium feldspar in PV panels is the upcoming market trend.

- Potassium feldspar, a type of aluminum silicate mineral, is a crucial component in various industries. As one of the primary minerals In the feldspar group, it is rich in potassium minerals, including microline, sanidine, and orthoclase. These alkali feldspars are essential In the production of glass, ceramics, and other industrial applications. In the glass sector, potassium feldspar functions as a fluxing agent, reducing the viscosity of glass during manufacturing. This property is essential in producing high-quality glass products for various industries, such as windows, doors, buildings, and automobiles. Additionally, potassium feldspar is used as a functional filler and extender In the paint industry, enhancing paint performance and durability.

- The ceramics industry also relies on potassium feldspar for producing ceramic tiles, floor tiles, kitchen fixtures, bathroom fixtures, and various other ceramic products. In the automotive sector, it is used In the production of fiberglass, specialty glass, and welding rods. Furthermore, potassium feldspar is utilized In the construction sector as a fluxing agent and In the infrastructure revamping activities. The global demand for potassium feldspar has been growing due to the increasing adoption of renewable energy technologies, such as solar photovoltaic (PV) systems. The solar PV industry's expansion, driven by the need to reduce greenhouse gas emissions and dependence on non-renewable energy sources, has led to an increased demand for aluminum silicates, including potassium feldspar.

- In summary, potassium feldspar plays a vital role in various industries, including glass, ceramics, paint, and construction, due to its unique properties. The growing demand for renewable energy sources, particularly solar PV systems, is expected to further boost the market for potassium feldspar.

What challenges does the Potassium Feldspar Industry face during its growth?

Stringent environmental regulations In the mining industry is a key challenge affecting the industry growth.

- Potassium feldspar, a type of aluminum silicate mineral, is a crucial component in various industries, including ceramics, glassmaking, and construction. Feldspars, which include potassium feldspars like microline, sanidine, and orthoclase, as well as alkali feldspars and plagioclase feldspars, are abundant in Earth's continental crust and can be found in igneous, metamorphic, and sedimentary rocks. In the mining process, potassium feldspar is extracted using various methods, which may result in soil erosion and the removal of other minerals, impacting soil quality. The high carbon footprint of potassium feldspar mining is due to the use of heavy machinery, hydraulic equipment, explosives, and other harsh methods, contributing to the release of sulphur oxide into the atmosphere.

- Regulatory bodies worldwide have imposed regulations to minimize the environmental impact of mining, focusing on controlling pollution levels and ensuring sustainable practices. In industries, potassium feldspar is used as a fluxing agent in glassmaking, reducing the viscosity of glass and improving its workability. It is also used as a functional filler and extender In the paint sector, as well as In the ceramics industry for producing floor tiles, kitchen and bathroom fixtures, and ceramic glasses. Additionally, potassium feldspar is used In the automotive sector as a filler in fiberglass and specialty glass, and In the construction sector as a fluxing agent for enamel glazes and porcelain.

- In the glass industry, potassium feldspar is used In the production of windows, doors, and buildings, while In the ceramics industry, it is used In the manufacture of electrical and electronic devices, medical devices, and nepheline syenite, which is a source of albite, quartz, and aluminum silicate. In the paint industry, potassium feldspar is used as a ceramic flux and functional filler, while In the welding sector, it is used as a flux for welding rods. In the automotive manufacturing sector, potassium feldspar is used as a filler and extender in various applications.

Exclusive Customer Landscape

The potassium feldspar market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the potassium feldspar market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, potassium feldspar market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

CERACLIQUE MINING India PVT LTD. - Potassium feldspar, available In the form of alumina and alkalis, serves as a crucial ingredient in various industries. This mineral, which the company provides in its purest form, plays a significant role In the production of high clarity glass, ceramics, sanitary ware, tableware, and paints. Its unique properties contribute to the desired characteristics of these end products, enhancing their durability, strength, and aesthetic appeal. By supplying high-quality potassium feldspar, the company supports the needs of manufacturers In these sectors, enabling them to produce top-tier products for consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CERACLIQUE MINING India PVT LTD.

- EK CO. AG

- Global Minechem Corp.

- GMCI

- iMinerals Inc.

- Kaolin EAD

- LB MINERALS Ltd.

- Micronized

- Minerali Industriali Srl

- Mudgee Dolomite and Lime Pty Ltd.

- Pacer Minerals LLC

- POLAT MADEN AS

- Prash Minerals Pvt. Ltd.

- Quartz Works GmbH

- SCR Sibelco NV

- Snow White Minerals Pvt. Ltd.

- Sun Minerals

- The QUARTZ Corp.

- TURKIYE SISE VE CAM FABRIKALARI A.S.

- United Mining Investment Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Potassium feldspar, a type of aluminum silicate mineral, is a crucial component of the earth's continental crust. It is one of the most common minerals found in igneous, metamorphic, and sedimentary rocks. The mineral's unique properties make it an essential ingredient in various industries, including ceramics, glass, and construction. Feldspars, a group of alkali and alkaline earth silicate minerals, consist of potassium feldspar, plagioclase feldspar, and other types. Potassium feldspar, specifically, is characterized by its reddish pink color and contains significant amounts of potassium. In the ceramics industry, potassium feldspar acts as a fluxing agent, reducing the viscosity of the glass during the manufacturing process.

It is used extensively In the production of ceramic tiles, floor tiles, kitchen fixtures, bathroom fixtures, and other ceramic products. The mineral's ability to improve the workability and strength of ceramic materials makes it an indispensable component in this sector. The glass sector also relies heavily on potassium feldspar. It is used as a filler and extender in glass production, contributing to the glass's durability and resistance to thermal shock. Potassium feldspar is also used In the production of specialty glasses, enamel glazes, and porcelain. The construction sector utilizes potassium feldspar as a fluxing agent In the manufacturing of cement and concrete.

It enhances the workability of the mixture and improves the final product's strength and durability. In the paint industry, potassium feldspar functions as a functional filler and extender. It improves the paint's rheology, making it easier to apply and increasing its coverage. Potassium feldspar is also used In the automotive sector as a filler and extender In the production of fiberglass, welding rods, and other automotive manufacturing processes. Potassium feldspar's versatility extends to the electronics industry, where it is used as a fluxing agent In the production of glass components for electronic appliances and medical devices. The mineral's ability to lower the melting point of glass and improve its flow properties makes it an essential ingredient in this sector.

The glassmaking sector also benefits from potassium feldspar's unique properties. It is used as a fluxing agent In the production of various types of glass, including windows, doors, and buildings. Potassium feldspar's ability to reduce the viscosity of the glass during manufacturing and improve its workability makes it an indispensable component in this sector. The demand for potassium feldspar is driven by the growing infrastructure revamping activities in various industries, including the glass industry, ceramics industry, and construction sector. The increasing production of kitchen appliances, automobiles, and other consumer goods also contributes to the rising demand for this mineral.

In conclusion, potassium feldspar is a versatile mineral with a wide range of applications in various industries, including ceramics, glass, construction, and electronics. Its unique properties, such as its ability to function as a fluxing agent, filler, and extender, make it an essential component In the manufacturing processes of these industries. The growing demand for consumer goods and infrastructure revamping activities is expected to drive the market for potassium feldspar In the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2257.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Germany, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Potassium Feldspar Market Research and Growth Report?

- CAGR of the Potassium Feldspar industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the potassium feldspar market growth of industry companies

We can help! Our analysts can customize this potassium feldspar market research report to meet your requirements.