Pouches Market Size 2024-2028

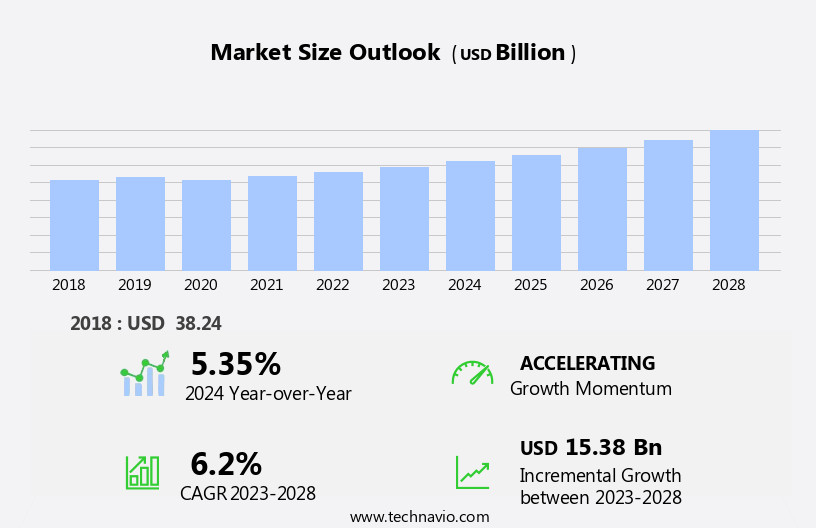

The pouches market size is forecast to increase by USD 15.38 billion, at a CAGR of 6.2% between 2023 and 2028.

- The market is witnessing significant growth, driven by the rising demand for extended shelf life in food and beverage products. companies are increasingly focusing on developing innovative pouch technologies to cater to this trend, ensuring consumer convenience and product freshness. Additionally, there is a growing emphasis on sustainable packaging solutions, with many initiatives being taken to reduce the use of plastic pouches. This shift towards eco-friendly alternatives is being fueled by increasing consumer awareness and government regulations. However, challenges persist in the form of high production costs for sustainable materials and the need for advanced technology to manufacture these pouches.

- Companies seeking to capitalize on market opportunities must invest in research and development to create cost-effective, sustainable pouch solutions, while also addressing the challenges of production complexity and cost. By doing so, they can effectively cater to the evolving consumer preferences and regulatory landscape, ensuring long-term success in the market.

What will be the Size of the Pouches Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in material science and packaging technology. Industrial-grade materials, such as barrier films, play a crucial role in ensuring product protection and extending shelf life. Supply chain management and inventory management are optimized through the use of automated packaging solutions, ultrasonic sealing, and printing techniques. Packaging design innovations include digital printing, heat sealing, and retort pouches, which cater to various sectors, from food and beverage to pharmaceuticals and cosmetics. Light barrier, resealable closures, and stand-up pouches are essential components, addressing the need for oxygen and aroma barrier, moisture protection, and ease of use.

Seal strength and sustainability initiatives are at the forefront of market dynamics, with compostable pouches and laminated pouches gaining popularity. Material science advances continue to shape the landscape, as does the integration of packaging machinery, packaging lines, and filling machines into streamlined production processes. Tamper-evident closures, child-resistant closures, and testing methods ensure product safety and quality control. The market's continuous unfolding is marked by the emergence of spouted pouches and vacuum pouches, catering to diverse consumer preferences and applications. Barrier properties remain a significant focus, with ongoing research and development in the areas of oxygen, aroma, moisture, and light barrier technologies.

Sustainability initiatives continue to shape market trends, as companies explore innovative solutions for reducing waste and minimizing environmental impact. In the realm of pharmaceutical and cosmetic grade materials, flexible packaging offers numerous advantages, from portability and convenience to extended shelf life and cost savings. Filling machines and sealing machines are integral components of the production process, ensuring efficient and reliable packaging solutions. The market's dynamism is reflected in its ability to adapt to evolving consumer demands and technological advancements. As market activities unfold, patterns continue to emerge, shaping the future of this versatile and ever-evolving industry.

How is this Pouches Industry segmented?

The pouches industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food and beverages

- Personal care and cosmetics

- Healthcare

- Others

- Type

- Stand-up

- Flat

- Spout

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By End-user Insights

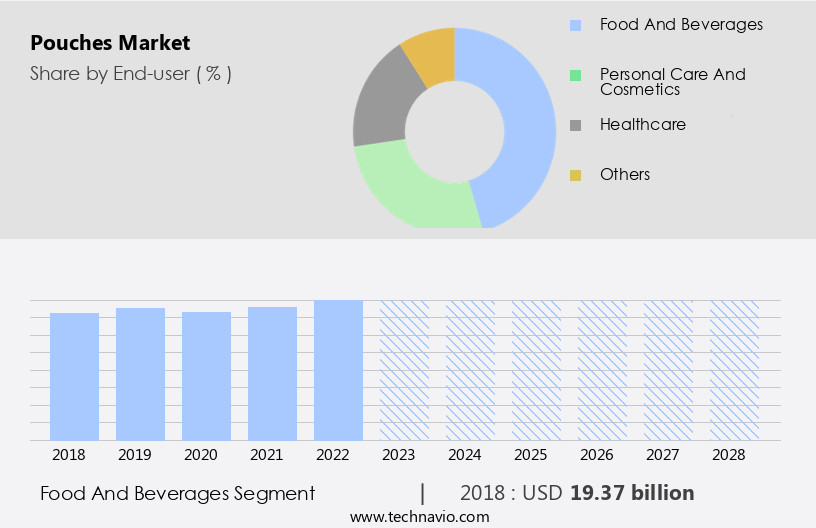

The food and beverages segment is estimated to witness significant growth during the forecast period.

The market experiences substantial growth due to its widespread adoption in the food and beverage industry. Pouches offer several advantages to food and beverage companies, including lightweight design, convenient inventory management, and extended shelf life for perishable goods. In the food sector, pouches are widely used for packaging various products such as snacks, sauces, condiments, baby food, pet food, and ready-to-eat meals. The versatility of pouch packaging allows for innovative designs, including stand-up pouches with spouts for easy pouring and resealable closures for multiple uses. Advancements in printing techniques, such as gravure printing and digital printing, enable high-quality labeling and packaging design.

Sealing technologies, including ultrasonic sealing and heat sealing, ensure product protection and maintain the integrity of the packaging. Barrier films, made from food-grade materials, provide moisture, oxygen, aroma, and light barriers, extending the shelf life of the packaged products. Major players in the market, like Amcor Plc and other packaging companies, invest in research and development to create advanced packaging solutions. They focus on sustainability initiatives, such as compostable pouches and laminated pouches, to cater to evolving consumer preferences. Filling machines and child-resistant closures are essential components of the packaging lines to ensure efficient production and product safety.

The market is driven by the increasing demand for convenient and sustainable packaging solutions. Companies are investing in advanced packaging machinery and technologies to meet the growing market needs. The focus on material science and barrier properties is crucial in creating high-performance pouches that cater to various industries, including pharmaceuticals and cosmetics. Testing methods and quality control are essential to ensure seal strength and product safety throughout the supply chain.

The Food and beverages segment was valued at USD 19.37 billion in 2018 and showed a gradual increase during the forecast period.

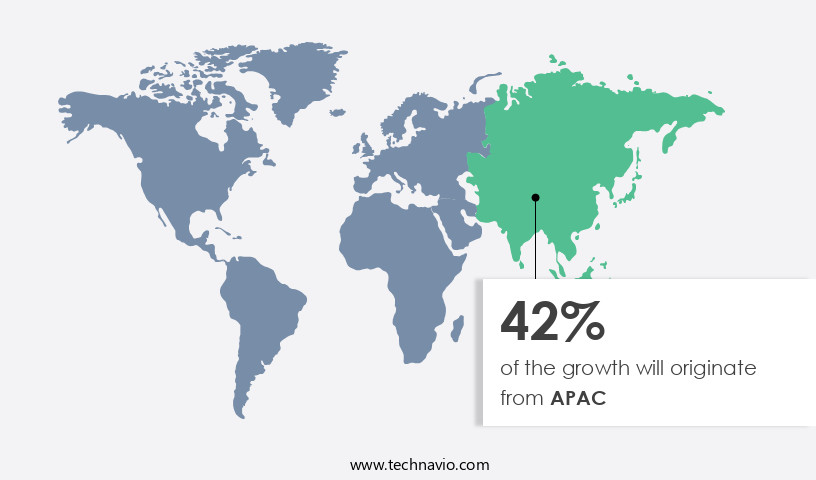

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth, driven by the expanding economies of China and India. This growth is largely attributed to the burgeoning industries of e-commerce, FMCG, and personal care. In the e-commerce sector, which is rapidly expanding in countries like China, South Korea, Singapore, and Australia, packaging plays a crucial role in protecting products during transportation. Pouches, in particular, offer cost savings by eliminating expenses related to damage, replacement, returns, waste, and shipping. Industrial-grade materials, such as aluminum foil and barrier films, are essential in ensuring product protection and extending shelf life. Inventory management and supply chain efficiency are enhanced through the use of labeling machines, printing techniques like gravure and digital, and automated packaging solutions.

Tamper-evident closures and resealable options add value for consumers, while sustainability initiatives, such as compostable and laminated pouches, align with evolving consumer preferences. Packaging engineering, heat sealing, and ultrasonic sealing technologies ensure seal strength and product safety. Flexible packaging, including stand-up pouches, retort pouches, spouted pouches, and vacuum pouches, cater to various industries and product requirements. Pharmaceutical and cosmetic grade materials are also finding increasing use in specialized applications. Filling machines and child-resistant closures further enhance the functionality and safety of pouches. Testing methods and quality control measures ensure the highest standards for consumers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Pouches Industry?

- The primary focus on extending product shelf life is the major market trend, with companies investing significantly in research and development to meet consumer demands for longer-lasting goods.

- Pouches have emerged as an effective solution for extending the shelf life of various products, particularly perishables such as food, medicines, and cosmetics. By using industrial grade materials and advanced packaging technologies like gravure printing and labeling machines, manufacturers can ensure the integrity and freshness of their offerings. The implementation of tamper-evident closures and the use of aroma and moisture barriers made of food grade materials, such as aluminum foil, further enhance the pouch's capabilities. These features enable the safe transportation and export of sensitive items to different locations without compromising their quality.

- In the context of inventory management, extending the shelf life of products translates to reduced wastage and improved profitability. Quality control measures, including offset printing and rigorous testing, ensure that the pouches meet the highest industry standards.

What are the market trends shaping the Pouches Industry?

- company initiatives to promote sustainable packaging are gaining momentum in the market. This trend reflects a growing commitment to reducing environmental impact through innovative and eco-friendly packaging solutions.

- Sustainability is a growing priority in packaging, particularly in industries such as food and beverage, medical, and personal care. In response, companies are introducing eco-friendly initiatives, including the use of sustainable materials like biopolymers. Biopolymers, derived from renewable resources such as corn, wheat, and sugarcane, offer a more sustainable alternative to traditional plastics. One sustainable packaging solution gaining popularity is retort pouches, which use heat sealing and ultrasonic sealing for airtight seals. These pouches are also available with light barrier properties and resealable closures, ensuring product freshness and convenience. Automated packaging techniques, such as digital printing, have streamlined the production process, making sustainable pouches more cost-effective.

- High-barrier films, a key component of sustainable pouches, are essential for maintaining product quality and extending shelf life. Amcor Plc and ProAmpac Holdings Inc. Are among the companies offering sustainable packaging solutions, including recyclable pouches made from metal-free materials. By focusing on sustainable packaging, these companies are addressing both environmental concerns and consumer preferences.

What challenges does the Pouches Industry face during its growth?

- The industry's growth is significantly influenced by the increasing emphasis on minimizing plastic packaging usage, posing a major challenge for businesses in this sector.

- The market faces growing concerns regarding the environmental impact of plastic packaging. Plastic pouches, including ziplock and vacuum types, are commonly used due to their oxygen barrier properties and convenience. However, these pouches are primarily made from non-biodegradable materials, contributing significantly to packaging waste. After use, they are often disposed of in landfills, where they do not decompose. Moreover, when plastic packaging degrades, it releases harmful substances such as styrene monomer, styrene dimer, and styrene trimer, which are known to be carcinogenic. To mitigate these environmental concerns, there is a growing emphasis on sustainability initiatives in the packaging industry.

- This includes the development and adoption of oxygen barrier materials with better environmental profiles, such as compostable pouches. Advanced material science and packaging machinery innovations are crucial in enhancing product protection while reducing environmental impact. Packaging lines are being upgraded with sealing machines that ensure strong seals, reducing the likelihood of product spoilage and waste. These efforts aim to create a more harmonious balance between product preservation and environmental stewardship in the market.

Exclusive Customer Landscape

The pouches market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pouches market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pouches market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in manufacturing and supplying advanced medical instrument pouches, including the 3M Steri drape instrument pouches 1018NS, 9097NS, and 1018LNS, designed for optimal sterility and functionality in medical procedures.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Amcor plc

- American Packaging Corp.

- Berry Global Inc.

- CCL Industries Inc.

- Clifton Packaging Group Ltd.

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- Dai Nippon Printing Co. Ltd.

- Huhtamaki Oyj

- Mondi Plc

- Montana Tech Components AG

- Nabtesco Corp.

- Polymer Packaging Inc.

- ProAmpac Holdings Inc.

- Sealed Air Corp.

- Smurfit Kappa

- Sonoco Products Co.

- Stora Enso Oyj

- Tetra Pak Group

- UFlex Ltd.

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pouches Market

- In January 2024, Amcor, a global packaging company, announced the launch of its new line of recyclable and sustainable PET pouches, named "Bio-Lite," in collaboration with Danone, a leading food company. This innovation marked a significant stride towards sustainable packaging solutions in the market (Amcor Press Release, 2024).

- In March 2024, Sealed Air, a packaging solutions provider, acquired Automated Packaging Systems, a manufacturer of pouch filling and closing machinery, for approximately USD350 million. This strategic acquisition aimed to strengthen Sealed Air's product offerings and capabilities in the market (Sealed Air Press Release, 2024).

- In May 2024, the European Commission approved the use of polyethylene (PE) and polypropylene (PP) pouches for certain food applications, marking a key regulatory approval for the market. This decision reversed a previous ban on these materials, expanding the market scope for these types of pouches (European Commission Press Release, 2024).

- In April 2025, Tetra Pak, a leading food processing and packaging solutions company, announced a major investment of USD200 million to expand its manufacturing capabilities for aseptic carton and pouch packaging in Brazil. This expansion is expected to increase Tetra Pak's market share in the South American the market (Tetra Pak Press Release, 2025).

Research Analyst Overview

- The market encompasses various sectors, including medical, industrial, retail, and e-commerce packaging. Product design plays a crucial role in meeting consumer preferences for lightweight, optimized pouch dimensions, and aesthetics. Brand protection and product traceability are essential in maintaining trust and ensuring food safety, particularly in the medical and food industries. Supplier relationships are pivotal in sourcing materials, such as bio-based polymers and recycled materials, for sustainable packaging solutions. Waste management and cost analysis are key considerations in the circular economy, with end-of-life solutions and packaging waste reduction gaining traction. Anti-counterfeiting measures, such as water-based and solvent-based inks, and UV-curable inks, are essential in protecting brands and maintaining product integrity.

- Product lifecycle management is another critical aspect, with the adoption of advanced technologies, like digital printing, streamlining production and enhancing efficiency. Consumer behavior continues to influence market trends, with a growing preference for eco-friendly and sustainable packaging options. Industrial packaging applications, such as waste management and logistics, require robust and durable pouches, while medical packaging necessitates stringent regulations and certifications. Overall, the market is dynamic, with a focus on sustainability, cost efficiency, and consumer preferences shaping the future of the industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pouches Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2024-2028 |

USD 15.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.35 |

|

Key countries |

US, Canada, China, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pouches Market Research and Growth Report?

- CAGR of the Pouches industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pouches market growth of industry companies

We can help! Our analysts can customize this pouches market research report to meet your requirements.