Stand-Up Pouches Market Size 2024-2028

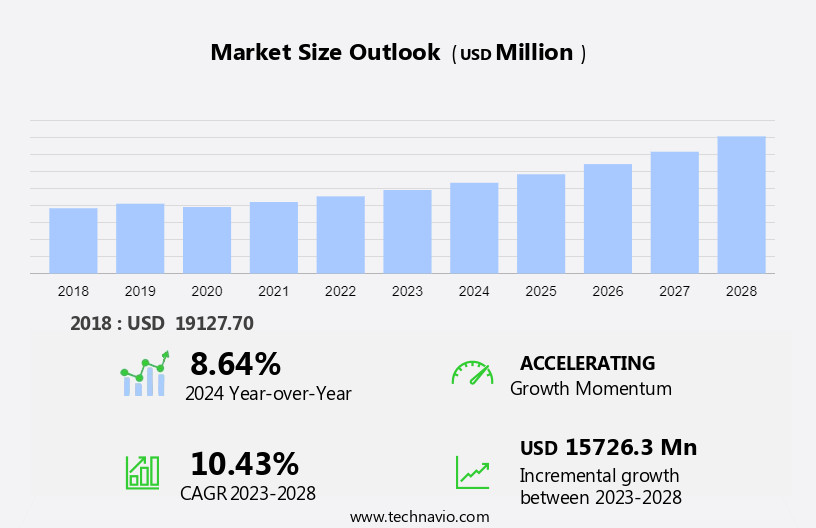

The stand-up pouches market size is forecast to increase by USD 15.73 billion at a CAGR of 10.43% between 2023 and 2028.

- The stand-up pouch market is witnessing significant growth due to the increasing demand for convenient packaging in various industries, particularly in food and beverages. Breakfast cereals, snacks, juices, soups, baby food, tea, yogurt, sauces, dressings, energy drinks, and even coffee are increasingly being packaged in stand-up pouches. The flexible nature of these pouches makes them ideal for a wide range of applications, from trail mixes and seafood to popcorn and potato chips. However, the hermetic seal protection challenge in stand-up pouches remains a significant concern. To address this issue, companies are turning to advanced materials such as bioplastics, polyethylene, polyethylene terephthalate, and biopolymers.

- Sustainability is also a key focus area, with companies promoting eco-friendly options and reducing the use of plastic and rigid packaging. The rise of e-commerce is another trend driving the market, as stand-up pouches offer easy shipping and handling. In addition, the market is witnessing innovation in applications, with pouches being used for personal care products and even some non-food items. The challenges, however, include the need for preservatives and the high cost of some advanced materials. Overall, the stand-up pouch market is poised for continued growth, with companies focusing on innovation, sustainability, and convenience to meet the evolving needs of consumers.

What will be the Size of the Stand-Up Pouches Market During the Forecast Period?

- The stand-up pouch market encompasses liquid and solid pouches used for packaging various products, including food, beverages, and non-food items. This market exhibits robust growth, driven by the versatility, convenience, and sustainability benefits of stand-up pouches. They offer advantages over rigid packaging, such as metal cans and bottles, by being lighter, more compact, and easier to transport and store.

- Flexible packaging, including stand-up pouches, has gained significant traction due to their ability to accommodate a wide range of products, from breakfast cereals and ready-to-eat meals to grains, frozen fruit pulp, frozen fruits, baby food, pet food, and various non-food items.

- Stand-up pouches come in various materials, such as polyester, polypropylene, polyethylene, polyamide, polyvinyl chloride, and metal (foil), catering to diverse product requirements. Spouts and zippers are common features that enhance the functionality and user experience of these pouches. Overall, the stand-up pouch market is poised for continued expansion, offering innovative solutions for various industries and consumer preferences.

How is this Stand-Up Pouches Industry segmented and which is the largest segment?

The stand-up pouches industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Food and beverages

- Personal care and cosmetics

- Healthcare

- Others

- Type

- Aseptic pouches

- Standard pouches

- Retort pouches

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Application Insights

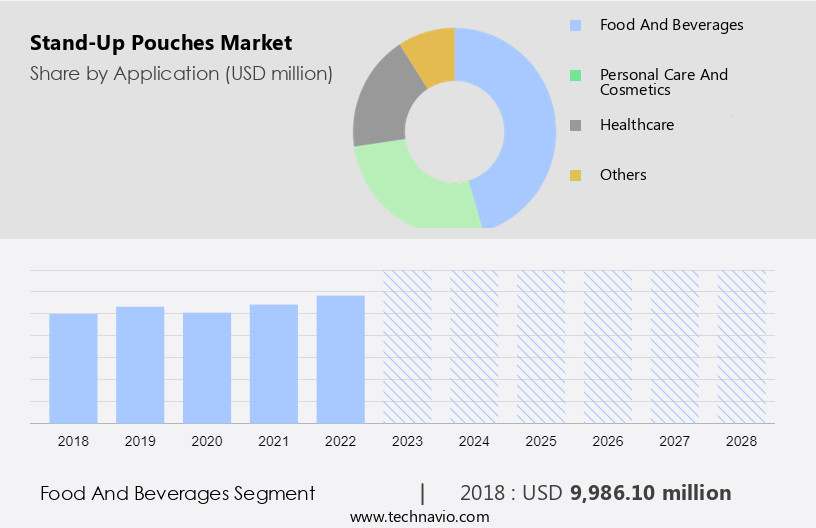

The food and beverages segment is estimated to witness significant growth during the forecast period. The market is experiencing substantial growth, particularly In the food and beverages segment. These pouches offer protection and convenience, making them an ideal choice for packaging various food and beverage products, including curry and sauces, ready-to-eat meals, seafood, soups, snacks, and beverages. The food industry's shift towards stand-up pouches is driven by their ability to preserve product freshness and extend shelf life. This trend is evident In the packaging of snacks such as popcorn, nuts, and trail mixes, which have replaced glass jars and bags. Stand-up pouches are also used for packaging non-food items like homecare products, and beverages such as energy drinks, flavored juices, coffee, tea, and ice-cream mixes.

The market's growth is further fueled by the use of advanced closure types like spouts and zippers, as well as sustainable raw materials like recyclable plastics, bioplastics, and foils. Stand-up pouches are increasingly being used for ready-to-cook and ready-to-eat food, pet food, and baby food. Traders, retailers, and consumers alike benefit from the lightweight, portable, and cost-effective nature of stand-up pouches. The market's growth is supported by the availability of various raw materials, including polypropylene (PP), polyethylene (PE), polyamide (PA), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and bioplastics.

Get a glance at the market report of various segments Request Free Sample

The Food and beverages segment was valued at USD 9.99 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

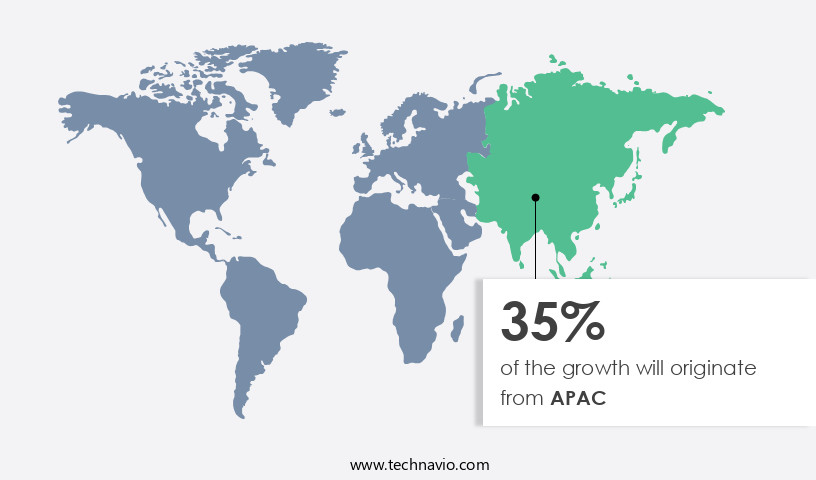

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The stand-up pouch market in Asia Pacific (APAC) is experiencing significant growth, driven by expanding industries such as e-commerce, FMCG, and personal care in countries like China and India. The region's e-commerce sector is thriving in nations such as China, South Korea, Singapore, and Australia. Packaging plays a crucial role in e-commerce, as products can be susceptible to damage during transportation. The increasing e-commerce industry is anticipated to boost the demand for flexible and lightweight packaging solutions, including stand-up pouches, due to their efficient shipping and handling properties. Stand-up pouches come in two main categories: liquid and solid. They are used extensively for various applications, such as food, beverage, non-food items, and homecare products.

The food and beverage sector is a significant contributor to the market, with applications ranging from ready-to-cook and ready-to-eat food to snacks, breakfast cereals, and beverage products like energy drinks, flavored juices, coffee, and tea. The materials used to manufacture stand-up pouches include plastics like polypropylene (PP), polyethylene (PE), polyamide (PA), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and bioplastics. These pouches can be made of foils, papers, or laminates, and can feature various closure types, such as zippers and spouts. Sustainability is a growing concern, leading to the increased use of recyclable materials in stand-up pouches. Stand-up pouches offer several advantages over traditional rigid packaging, such as lighter weight and improved product protection.

They are also suitable for various applications, including pet food, sauces, dips, and condiments. Retailers, consumers, and traders all benefit from the convenience and cost-effectiveness of stand-up pouches. In conclusion, the stand-up pouch market in APAC is expected to continue growing due to the expanding e-commerce industry and the demand for flexible and lightweight packaging solutions. The market caters to a wide range of industries and applications, making it a versatile and essential component of the packaging industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Stand-Up Pouches Industry?

- Growing demand for convenient packaging in food industry is the key driver of the market.Stand-up pouches, a type of flexible packaging, have gained significant traction in various industries due to their numerous advantages. Both liquid and solid stand-up pouches are popular choices for packaging non-food items, food, and beverages. These pouches offer convenience through features like spouts and zippers, making them ideal for packaged food, ready-to-cook, and ready-to-eat food. Sustainability is a crucial factor in today's market, and stand-up pouches made from recyclable materials contribute to reducing waste. Flexible stand-up pouches, which include films made of plastics like polypropylene (PP), polyethylene (PE), polyamide (PA), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and bioplastics material, provide lightweight alternatives to traditional rigid packaging, such as metal cans and bottles.

The food industry uses various types of stand-up pouches, including aseptic, retort, standard, hot-filled, and spouted pouches, for packaging a wide range of products, from breakfast cereals and ready-to-eat meals to gourmet products, grains, frozen fruit pulp, frozen fruits, beverage products like energy drinks, flavored juices, coffee, tea, and homecare products like skincare creams, shampoos, and solutions. Stand-up pouches offer several benefits, including preservation, reduction of waste, and convenience. Preservation is essential for food and beverage products, as packaging protects them from external influences, such as chemical and biological contaminants. By extending the shelf-life of these products, stand-up pouches help reduce food waste.

Additionally, their lightweight and convenient design makes them a preferred choice for consumers, retailers, and traders alike.

What are the market trends shaping the Stand-Up Pouches market?

- Increasing vendor initiatives to promote sustainable packaging is the upcoming market trend.The market is witnessing significant growth due to the increasing demand for sustainable packaging solutions. End-user industries, including food and beverage, medical, and personal care, are shifting their focus towards eco-friendly packaging alternatives. Amcor, for instance, offers AmLite Standard Recyclable stand-up pouches, which are metal-free and recyclable. Sustainability is a top priority for retailers, consumers, and traders alike, leading companies to initiate sustainable packaging initiatives. Biopolymers, derived from renewable raw materials like corn, wheat, and sugarcane, are emerging as a viable solution for sustainable packaging. With the increasing availability of bio-based and renewable raw materials such as cornstarch, sugarcane, and potato starch, the usage of bioplastics is anticipated to rise in various applications.

Liquid and solid stand-up pouches find extensive applications in food, beverage, non-food items, and homecare products. Flexible stand-up pouches, made of plastics, foils, paper, or laminates, offer advantages such as lightweight, easy handling, and extended shelf life. Aseptic pouches, retort pouches, and standard pouches are popular closure types, including zippers and spouts. The market caters to various industries, including pet food, coffee, tea, skincare creams, shampoos, sauces, dips, and condiments, among others. The market's growth is driven by the increasing demand for convenience, longer shelf life, and the versatility of stand-up pouches. Key raw materials include polypropylene (PP), polyethylene (PE), polyamide (PA), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and bioplastics.

The market's future growth is expected to be influenced by advancements in technology, increasing consumer awareness, and the availability of recyclable materials.

What challenges does the Stand-Up Pouches Industry face during its growth?

- Hermetic seal protection challenge in stand-up pouches is a key challenge affecting the industry growth.Stand-up pouches, available in both liquid and solid varieties, have gained significant traction In the packaging industry for their versatility in storing various products, including food, beverages, non-food items, and homecare products. These pouches offer advantages such as sustainability, lightweight, and convenience, making them a popular choice among retailers, consumers, and traders. The market caters to a wide range of products, including packaged food, ready-to-cook and ready-to-eat food, snacks, beverage products like energy drinks, flavored juices, coffee, and tea, and various industrial applications such as sauces, dips, and condiments. The closure types for these pouches include spouts and zippers. Preserving the hermetic seal of stand-up pouches during processing is essential to maintain product integrity.

Improper vacuum levels or mishandling can negatively impact the seal, leading to product contamination or spoilage. Liquid stand-up pouches, for instance, can experience seal breakage due to high vacuum levels, while solid pouches may get physically damaged during inappropriate handling. Flexible stand-up pouches are increasingly replacing traditional rigid packaging like metal cans and bottles for various products, including breakfast cereals, ready-to-eat meals, gourmet products, grains, frozen fruit pulp, frozen fruits, and ice-cream mixes. Raw material supply, such as plastics like polypropylene (PP), polyethylene (PE), polyamide (PA), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and bioplastics material, plays a crucial role In the production of these pouches.

Additionally, various closure types like zippers and spouts enhance the functionality and user experience of these pouches.

Exclusive Customer Landscape

The stand-up pouches market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the stand-up pouches market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, stand-up pouches market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Allegion Public Ltd. Co. - The subsidiary of the company provides innovative stand up pouch solutions, catering to various industries and applications. These pouches offer advantages such as extended shelf life, product protection, and convenience for consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allegion Public Ltd. Co.

- Amcor Plc

- Berry Global Inc.

- Bryce Corp.

- Clondalkin Group Holdings BV

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- Flexible Packaging LLC

- Glenroy Inc.

- Guala Pack S.p.a.

- Huhtamaki Oyj

- Mondi Plc

- Packman Packaging Pvt. Ltd.

- ProAmpac Holdings Inc.

- Sealed Air Corp.

- Smurfit Kappa Group

- Sonoco Products Co.

- Swiss Pac Pvt. Ltd.

- UFlex Ltd.

- Wihuri International Oy

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Stand-up pouches have emerged as a popular packaging solution in various industries due to their versatility and convenience. These pouches, which come in both liquid and solid variants, offer numerous benefits that make them an attractive choice for packaging a wide range of products. Food and beverage industries are significant consumers of stand-up pouches. The use of these pouches for packaged food and ready-to-eat meals has gained considerable traction due to their ability to maintain product freshness and extend shelf life. Beverage products, including energy drinks, flavored juices, coffee, and tea, also benefit from the use of stand-up pouches.

The lightweight nature of these pouches makes them ideal for transporting and storing these products. Stand-up pouches are not limited to food and beverage applications. They are also used for packaging non-food items such as homecare products, skincare creams, shampoos, and solutions. In the homecare sector, stand-up pouches are used for packaging cleaning agents, laundry detergents, and other household items. The closure systems used in stand-up pouches, such as spouts and zippers, enhance their functionality. Spouts enable easy dispensing of liquids, while zippers provide a resealable option for solid products. These features make stand-up pouches a preferred choice for consumers, as they offer convenience and ease of use.

Sustainability is a crucial factor driving the growth of the stand-up pouch market. Manufacturers are increasingly using recyclable materials, such as bioplastics, to produce these pouches. This shift towards more sustainable packaging solutions is expected to gain momentum In the coming years. Raw material supply is a significant factor influencing the stand-up pouch market. The availability and cost of raw materials, such as plastics, foils, and papers, impact the production costs of these pouches. The price fluctuations of these raw materials can affect the profitability of manufacturers and, in turn, the market growth. The use of stand-up pouches is not limited to food, beverage, and homecare industries.

They are also used for packaging pet food, gourmet products, grains, frozen fruit pulp, frozen fruits, ice-cream mixes, yogurt, baby food, and fruit juices. The versatility of stand-up pouches makes them a popular choice for various industries. Stand-up pouches offer several advantages over traditional packaging solutions, such as metal cans and rigid packaging. They are lighter, more portable, and offer better product protection. Flexible stand-up pouches, which are made of flexible plastic packaging materials like polypropylene (PP), polyethylene (PE), polyamide (PA), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and bioplastics material, offer the added benefit of being easily shaped and customized to fit various product sizes and shapes. The stand-up pouch market is driven by various factors, including the convenience and functionality offered by these pouches, the shift towards sustainable packaging solutions, and the versatility of the raw materials used In their production. The market is expected to continue growing, as more industries discover the benefits of using stand-up pouches for packaging their products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.43% |

|

Market growth 2024-2028 |

USD 15.73 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.64 |

|

Key countries |

China, US, Japan, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Stand-Up Pouches Market Research and Growth Report?

- CAGR of the Stand-Up Pouches industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the stand-up pouches market growth of industry companies

We can help! Our analysts can customize this stand-up pouches market research report to meet your requirements.