Poufs Market Size 2024-2028

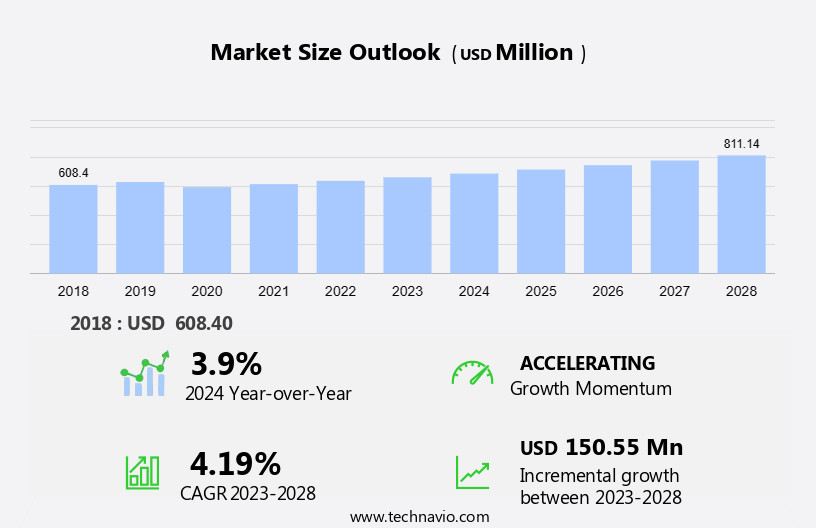

The poufs market size is forecast to increase by USD 150.55 million at a CAGR of 4.19% between 2023 and 2028.

- The market is experiencing significant growth due to the increase in residential and commercial construction projects. This trend is driven by the rising demand for comfortable and stylish seating solutions in various sectors. Additionally, the development of eco-friendly poufs, which are made from sustainable materials, is gaining popularity among consumers. The market is expanding as their versatility makes them a popular choice in both construction projects and home decor, adding functional and stylish elements to modern interiors. However, the market is also facing challenges, such as the high volatility in raw material prices, which can impact the profitability of poufs manufacturers. Despite these challenges, the market is expected to continue its growth trajectory, driven by the increasing demand for poufs in various applications. The market analysis report provides a comprehensive study of these trends and growth factors, offering valuable insights for stakeholders In the poufs industry.

What will be the Size of the Poufs Market During the Forecast Period?

- The market encompasses a diverse range of versatile seating solutions, including those made of fabric, metal, and wooden materials. This market has experienced significant growth due to its advanced versatility, catering to various applications in both residential and commercial settings. The latest trends reflect an increase In the variety of poufs, with designs that seamlessly blend into family rooms, offices, and public spaces.

- Driving factors include the infrastructure development in various industries and the demand for functional yet aesthetically pleasing seating options. The cost-effective nature of poufs, combined with their ability to accommodate multiple functions, makes them an attractive choice for consumers and businesses alike. Overall, the market is poised for continued expansion, offering numerous opportunities for innovation and growth.

How is this Poufs Industry segmented and which is the largest segment?

The poufs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Residential

- Commercial

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- Middle East and Africa

- South America

- North America

By Distribution Channel Insights

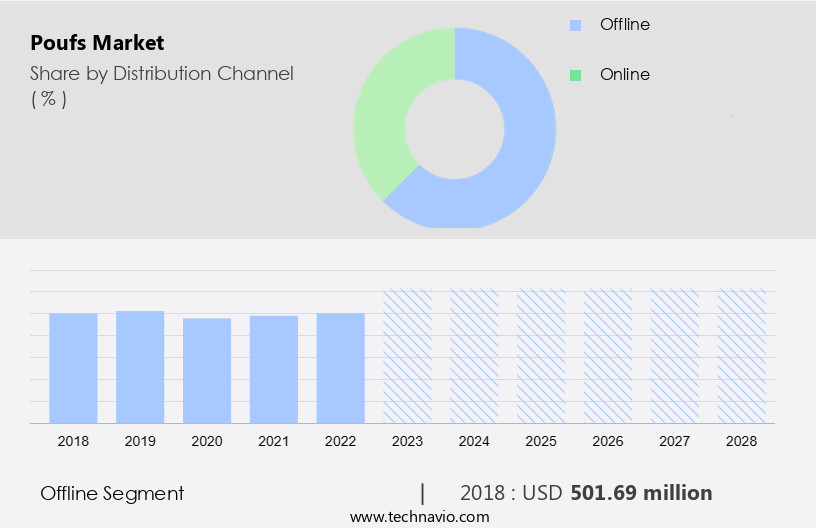

- The offline segment is estimated to witness significant growth during the forecast period.

The market exhibits significant growth due to various driving factors, including the increasing demand for advanced versatility and comfort in furniture. The market caters to diverse segments, including family, office, and driving, among others. The fabric, metal, and wooden poufs are popular choices based on material preference. The infrastructure development in commercial areas and increasing government spending on public spaces further boost the market growth. The market offers an extensive variety of poufs, enabling consumers to choose according to their specific needs and preferences. Companies have adopted various strategies, such as cost reduction and product pricing, to cater to the price-sensitive consumer base.

Intermediaries play a crucial role In the distribution network, ensuring the availability of poufs in various retail channels. Despite the challenges posed by the shutdown of industries, the market is expected to continue its positive growth trajectory.

Get a glance at the Poufs Industry report of share of various segments Request Free Sample

The offline segment was valued at USD 501.69 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

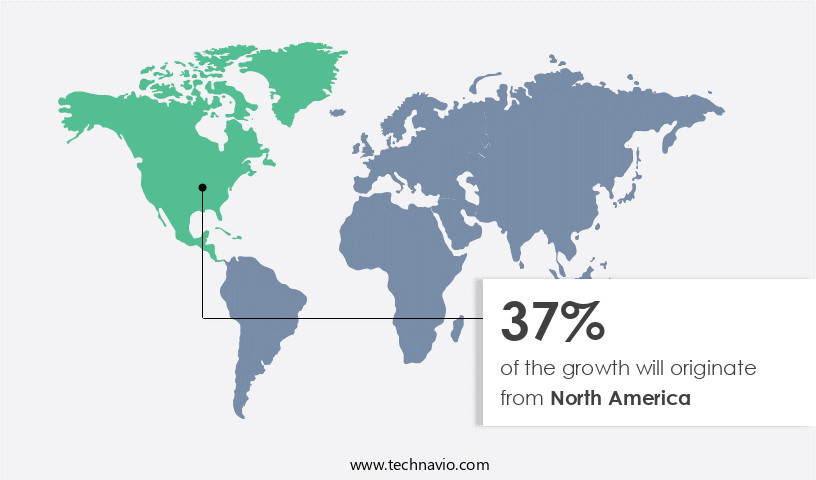

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing growth due to the expanding residential and commercial construction sectors. The US and Canada are major importers of poufs In the region, with the demand for office furniture and luxury poufs being key growth drivers. The real estate and commercial leasing industries have seen significant expansion, leading to an increase in commercial properties and the subsequent sale of office furniture, including poufs. The strong economy and the shift towards modern workspaces are compelling companies to invest in advanced and versatile furniture solutions in North America. Infrastructure development and government spending on commercial projects further boost the market. Cost-effective pricing and the involvement of intermediaries also contribute to the market's growth. The market in North America is poised for continued expansion In the coming years.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Poufs Industry?

An increase in residential and commercial construction is the key driver of the market.

- The market is experiencing significant growth due to the expansion of the real estate sector and the rise in residential and commercial construction projects worldwide. In developed economies, such as the US, substantial investments in infrastructure development are anticipated, fueling the demand for furniture products, including poufs. In emerging economies like India, the potential for 100% Foreign Direct Investment (FDI) in townships and settlement projects is projected to boost the demand for furniture during the forecast period. Government initiatives such as the Smart Cities Mission, Pradhan Mantri Awas Yojana (PMAY), and the Sardar Patel National Urban Housing Mission are estimated to increase urban population growth, which will be a crucial factor driving market expansion.

- The market dynamics include the use of various materials, such as fabric, metal, and wooden poufs, advanced versatility, and an increase in variety to cater to diverse customer preferences. Cost remains a significant factor, with commercial development and product pricing influencing market growth. Intermediaries play a vital role In the supply chain, ensuring the smooth distribution of poufs to consumers. Government spending on urban infrastructure and housing projects is expected to bring about positive changes for the market.

What are the market trends shaping the Poufs Industry?

The development of environment-friendly poufs is the upcoming market trend.

- The market is experiencing significant shifts due to increasing environmental concerns and the drive for advanced versatility. Traditional poufs, often made from foam and either metal or wooden frames, are being replaced with eco-friendly alternatives. These new poufs are manufactured using fabric derived from recycled materials, such as sailcloth, esparto grass, and cypress wood. Moreover, regenerated fiberfill and soy-based foam made from recycled plastic waste are gaining popularity. The soy-based foam offers the same retention rate as traditional foam, making it an acceptable alternative among pouf companies. This shift towards sustainable materials is driven by the need to reduce the environmental impact of the industry and the energy required for manufacturing foam.

- The infrastructure development and commercial growth in various sectors, including offices and families, are key factors fueling the increase in variety and demand for these eco-friendly poufs. Government spending on green initiatives and the cost savings associated with using recycled materials further contribute to the positive changes In the market.

What challenges does the Poufs Industry face during its growth?

High volatility in raw material prices of poufs is a key challenge affecting the industry growth.

- The market is currently experiencing increased costs for raw materials, including wood, metal, and fabric. Prices for chipboard, timber, foam, polish chemical materials, color paints, hardware, and other essential components have risen significantly. The volatility of input and transportation costs, coupled with decreased production capacities among pouf manufacturers, has led to a narrowing gap between production costs and companies' ability to increase product prices. This market dynamic poses a challenge for companies, as they strive to maintain profitability amidst these rising costs. The infrastructure required for commercial development of poufs, such as machinery and labor, also adds to the overall expense.

- Government spending and the increase in variety and advanced versatility of poufs are driving factors for growth In the market. Intermediaries play a crucial role In the supply chain, but their involvement can add to the cost of production and distribution. Despite these challenges, the market continues to show positive changes, offering opportunities for companies to innovate and adapt to the changing market landscape.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, poufs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbyson Living LLC

- Artisanal Abode

- Ashley Global Retail LLC

- Century Furniture LLC

- Dunns Furniture

- Ethan Allen Interiors Inc.

- FurnitureRoots

- Giessegi Industria Mobili Spa

- Godrej and Boyce Manufacturing Co. Ltd.

- HNI Corp.

- hulsta werke Huls GmbH and Co. KG

- Inter IKEA Holding BV

- LaZBoy Inc.

- MillerKnoll Inc.

- Nitori Holdings Co. Ltd.

- Restoration Hardware Inc.

- ROCHE BOBOIS SA

- Roomstogo.com Inc.

- Steelcase Inc.

- Wayfair Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years, driven by various factors that have influenced its advanced versatility and increased variety. One of the primary driving forces behind this expansion has been the infrastructure development in both residential and commercial sectors. In the family setting, poufs have emerged as a popular alternative to traditional seating options due to their compact size and multifunctional capabilities. These flexible pieces of furniture can serve as footrests, additional seating, or even as a storage solution, making them an essential addition to modern homes. Simultaneously, In the office environment, poufs have gained traction as an innovative solution for creating collaborative and flexible workspaces.

Moreover, their compact design allows for easy rearrangement, making them an ideal choice for open-plan offices and meeting areas. The increase in variety within the market can be attributed to the evolution of materials used in their production, along with the rise of e-commerce platforms and the growing demand for charcoal products. While traditional poufs were often made of fabric, recent advancements have led to the emergence of metal and wooden options. Each material offers unique benefits, with metal poufs providing a modern and sleek look, while wooden poufs add a touch of warmth and natural elegance. Cost has also played a significant role In the growth of the market. With their affordability, poufs have become an accessible furniture option for both homeowners and businesses, allowing them to enhance their spaces without breaking the bank.

Furthermore, intermediaries, such as retailers and distributors, have played a crucial role in the commercial development of the market. These entities have facilitated the distribution of poufs to various markets, enabling widespread access and adoption. Government spending on infrastructure projects and public spaces has further fueled the demand for poufs. These investments have led to the creation of new parks, plazas, and public spaces, which in turn have increased the need for versatile and affordable seating solutions like poufs. Despite the positive changes In the market, product pricing remains a critical factor influencing its growth. Producers and retailers must have a balance between maintaining competitive pricing and ensuring profitability, as price sensitivity remains a significant concern for consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.19% |

|

Market Growth 2024-2028 |

USD 150.55 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.9 |

|

Key countries |

US, Canada, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Poufs Market Research and Growth Report?

- CAGR of the Poufs industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the poufs market growth of industry companies

We can help! Our analysts can customize this poufs market research report to meet your requirements.