Power Monitoring And Control Software Market Size 2025-2029

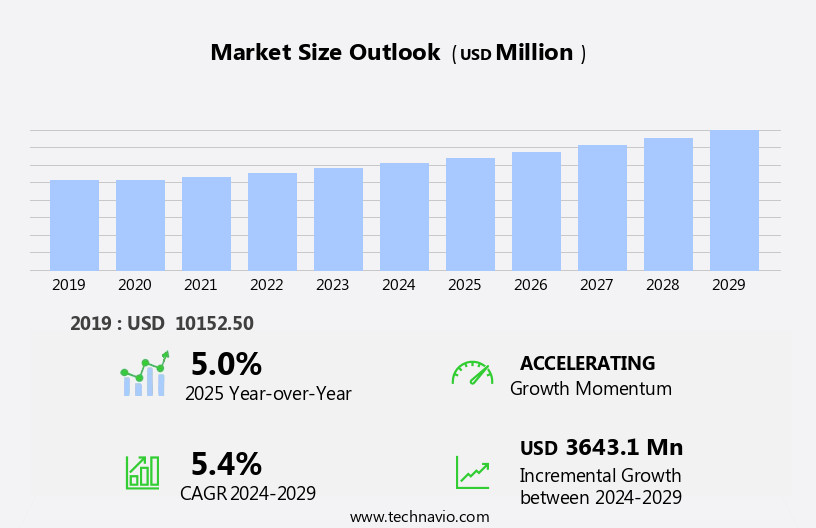

The power monitoring and control software market size is forecast to increase by USD 3.64 billion, at a CAGR of 5.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing need for efficient power management in various industries. Energy efficiency is a top priority for businesses and organizations, leading to a heightened demand for advanced power monitoring and control solutions. These systems enable real-time monitoring of power consumption, identifying areas for improvement, and optimizing energy usage to reduce costs and minimize environmental impact. However, the market also faces challenges, primarily from cyber threats. As power systems become increasingly digitized and connected, they become vulnerable to cyber attacks.

- These threats can result in significant downtime, financial losses, and reputational damage. As such, ensuring robust cybersecurity measures are in place is essential for market participants. Companies must invest in developing secure software and implementing strong cybersecurity protocols to protect their systems and maintain customer trust.

What will be the Size of the Power Monitoring And Control Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the increasing demand for real-time monitoring, reporting, and analysis of power consumption and energy usage across various sectors. Data processing and control systems are integrated with IoT technology and wireless communication to optimize energy management and improve grid stability. SCADA systems and data analytics enable data visualization and performance benchmarking, while API integration facilitates seamless data backup and access control. Power monitoring software supports industry standards such as Modbus protocol and DNP3 protocol for system integration, enabling the management of power metering, system upgrades, and customer support. Data security is paramount, with power monitoring software offering advanced security features to protect sensitive data.

Renewable energy integration and data center infrastructure require specialized power monitoring solutions, with server farms and technical documentation providing essential support. Power optimization and system upgrades ensure energy efficiency and improve overall performance. Training and consulting services offer expertise in power analytics, demand response, and compliance reporting. Hardware integration and network infrastructure are crucial for on-premise deployment and cloud deployment, ensuring data integrity and enabling remote monitoring and power quality monitoring. Transient events, fault detection, and alerting systems provide critical insights for asset management and industrial automation. Power monitoring software continues to evolve, with the integration of artificial intelligence, machine learning, and open source software enhancing functionality and reducing costs.

Ongoing system upgrades and software updates ensure compatibility with the latest industry standards and trends.

How is this Power Monitoring And Control Software Industry segmented?

The power monitoring and control software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Industrial

- Commercial

- Residential

- Deployment

- Cloud

- On-premises

- End-user

- Manufacturing

- Data centers

- Healthcare

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The industrial segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing demand for real-time monitoring, reporting, and analysis of power consumption in various industries. Energy management is a key focus area, with data processing and analysis playing a crucial role in optimizing power usage and improving energy efficiency. Control systems are being integrated with IoT and wireless communication technologies for remote monitoring and control, while SCADA systems provide data visualization and performance benchmarking. Power metering and data logging are essential components of power monitoring software, which enable compliance reporting and historical data analysis. Power quality monitoring, fault detection, and alerting systems help maintain grid stability and ensure data integrity.

Renewable energy integration and load shedding are becoming increasingly important as industries shift towards sustainable energy sources and demand response programs. Data analytics and machine learning are driving innovation in the market, with artificial intelligence and predictive analytics enabling power optimization and system upgrades. Power monitoring software is also being integrated with OPC UA, Modbus Protocol, and DNP3 protocol for seamless software and hardware integration. The industrial segment is the largest contributor to the market due to the high-power requirements in energy-intensive industries such as iron and steel, aluminum, cement, fertilizer, refining, oil and gas, and mining.

With increasing automation and the focus on controlling energy consumption, power monitoring software is becoming an essential tool for industrial facilities to manage their power usage effectively. Data security is a critical concern in the market, with customer support, software updates, and technical documentation essential for ensuring system reliability and user experience. Cloud-based monitoring and hybrid deployment models are gaining popularity due to their flexibility and cost-effectiveness. In conclusion, the market is experiencing significant growth due to the increasing demand for energy management, data analytics, and automation in various industries. The market is driven by the need to optimize power usage, improve energy efficiency, and ensure grid stability, with data security and system reliability key considerations for end-users.

The Industrial segment was valued at USD 4.95 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

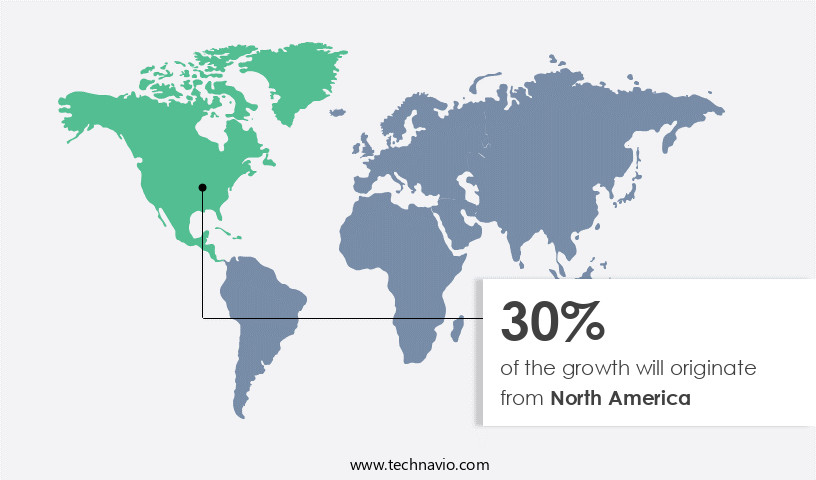

North America is estimated to contribute 30% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, driven by the increasing adoption of IoT integration, wireless communication, and SCADA systems for real-time monitoring, reporting, and analysis. Data processing capabilities are essential for power monitoring software, enabling energy management, data visualization, and performance benchmarking. Control systems require software updates, support, and maintenance for optimal performance. Europe is a major market for power monitoring and control software, with a strong focus on renewable energy integration and grid stability. The European economy's recovery from the Eurozone crisis has led to a surge in demand for power monitoring solutions to ensure data integrity and compliance reporting.

Data centers and server farms require robust power monitoring software for asset management, user authentication, and power optimization. Industry standards such as Modbus protocol and DNP3 protocol facilitate software integration, while OPC UA and hybrid deployment enable seamless system upgrades and load shedding. Power quality monitoring, fault detection, and alerting systems ensure energy efficiency and demand response. Historical data analysis and trend analysis provide valuable insights for power factor correction and machine learning applications. Network infrastructure and Ethernet communication are crucial for data acquisition systems, transient events, and industrial automation. Compliance reporting, power analytics, and data logging are essential for grid stability and performance benchmarking.

Subscription models offer flexible pricing options for businesses, while open source software and proprietary software cater to varying needs. Power monitoring software plays a vital role in ensuring data security, access control, and demand response in various industries. Voltage sags, harmonic analysis, and fault detection are critical features for power monitoring software in industrial applications. The market's growth is further driven by the integration of renewable energy sources and the increasing focus on power optimization and system upgrades.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Power Monitoring And Control Software Industry?

- The increasing demand for power monitoring and control systems, driven by the need for energy efficiency and cost savings, is a primary market growth factor.

- Power monitoring and control software plays a crucial role in power monitoring systems, enabling organizations to capture and analyze essential power metrics in real-time. This software offers various benefits, including the ability to monitor and identify potential issues with critical electrical equipment such as motors, pumps, and transformers. By providing early indicators of equipment health, power monitoring systems help reduce downtime and maintenance costs. Moreover, power monitoring software can help minimize nuisance tripping, which occurs when safety devices like circuit breakers unexpectedly trip. This feature is particularly important for industries where power interruptions can lead to significant losses.

- Power monitoring systems offer advanced features such as data processing, reporting and analysis, data visualization, and data backup. They can also integrate with IoT devices, wireless communication systems, SCADA systems, and APIs for seamless data flow. Additionally, these systems employ data analytics, artificial intelligence, and data storage to provide valuable insights for energy management and optimization. Industry standards ensure the interoperability and reliability of power monitoring systems, making them a must-have for organizations seeking to maintain efficient and cost-effective power management. Power metering, control systems, and data processing are essential components of these systems, which can be supported and maintained through ongoing service agreements.

What are the market trends shaping the Power Monitoring And Control Software Industry?

- Market trends indicate a growing emphasis on energy efficiency. It is a mandatory and professional approach for businesses to prioritize this focus.

- The demand for power monitoring software is escalating due to the increasing focus on energy efficiency and reducing carbon emissions. Both industrial and commercial sectors are prioritizing energy management in their operations. Industries, as significant consumers of electricity, aim to optimize energy usage by monitoring and controlling their power consumption. Regulatory norms, such as the EU's Directive 2009/125/EC, mandate energy efficiency in industries to curb energy costs and carbon emissions. Power monitoring software enables real-time tracking of energy usage, identifying areas of improvement, and implementing power optimization strategies. Cloud-based monitoring solutions offer the advantage of remote access and real-time data analysis.

- The integration of renewable energy sources and system upgrades require seamless integration of power monitoring software with Modbus protocol, DNP3 protocol, and other hardware and server farm infrastructure. Software updates, customer support, data security, and performance benchmarking are essential features for power monitoring software. System integration, technical documentation, training, and consulting services ensure smooth implementation and operation. The market offers various solutions catering to different industries and power infrastructure, including data centers and server farms. The focus on power optimization and cost savings makes power monitoring software a valuable investment for businesses.

What challenges does the Power Monitoring And Control Software Industry face during its growth?

- The expansion of the industry faces significant hurdles due to mounting concerns regarding cyber threats and the potential damage they can inflict.

- The market is a critical component for industries managing infrastructure in sectors such as power, oil and gas, and water and wastewater treatment. However, the increasing use of connected devices and web-based communication networks has heightened concerns over data security. In recent years, the energy sector has been a prime target for cyberattacks, with hackers employing new tactics such as ransomware and distributed denial of service (DDoS) attacks. Despite efforts to enhance software security, the evolving nature of cyber threats poses a significant risk to the use of power monitoring and control software. This uncertainty may hinder market growth during the forecast period.

- Data integrity is paramount in power monitoring and control applications, as trend analysis, load shedding, power quality monitoring, historical data, access control, demand response, harmonic analysis, fault detection, alerting systems, energy efficiency, and data acquisition systems all rely on accurate and secure data. Software integration is also essential to ensure seamless communication between various systems and devices. Transient events, such as surges and spikes, can impact power quality and grid stability, necessitating real-time monitoring and response. In conclusion, the market faces challenges from cyber threats, but its importance in maintaining infrastructure reliability and efficiency remains undeniable. Companies must prioritize data security and software integration to mitigate risks and ensure the market's continued growth.

Exclusive Customer Landscape

The power monitoring and control software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the power monitoring and control software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, power monitoring and control software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in power monitoring and control solutions, including the ABB Ability Energy Management System. This software enables efficient energy management and optimization, enhancing operational performance and sustainability. By providing real-time data analysis and predictive insights, our offerings empower businesses to make informed decisions, reduce energy consumption, and minimize costs. Our expertise in power management technology ensures reliable and effective implementation for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Eaton Corp. plc

- Emerson Electric Co.

- Fortive Corp.

- Fuji Electric Co. Ltd.

- General Electric Co.

- Honeywell International Inc.

- ITRS Group Ltd.

- Legrand SA

- Littelfuse Inc.

- Mitsubishi Electric Corp.

- OMRON Corp.

- Packet Power LLC

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Tata Power DDL

- Tenzing Corp.

- Vertiv Holdings Co.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Power Monitoring And Control Software Market

- In March 2024, Schneider Electric, a leading energy management and automation company, announced the launch of its new EcoStruxure Power Monitoring Expert software, which combines advanced analytics and IoT technology to optimize power distribution and improve energy efficiency in industrial and commercial applications (Schneider Electric Press Release, 2024).

- In July 2024, Siemens and Microsoft entered into a strategic partnership to integrate Siemens' Simatic Energy Management System with Microsoft Azure IoT to offer advanced energy management solutions, enabling real-time monitoring, analysis, and optimization of energy consumption for industries and utilities (Microsoft News Center, 2024).

- In November 2024, ABB secured a significant contract from the New York Power Authority to provide its Ability Power Monitoring System, which includes advanced analytics and digital services, to optimize the grid performance and improve energy efficiency in New York State (ABB Press Release, 2024).

- In January 2025, Sense, a leading AI energy management startup, raised USD60 million in a Series C funding round, bringing the total investment to USD137 million, to expand its presence in the residential and commercial energy management markets and accelerate the development of its AI-driven energy management solutions (TechCrunch, 2025).

Research Analyst Overview

- The market is witnessing significant growth due to the increasing emphasis on cost reduction, infrastructure monitoring, and efficiency improvement in various industries. Energy storage and renewable energy sources, such as wind power and solar power, are driving the demand for advanced software solutions that enable predictive analytics, energy consumption management, and power distribution optimization. In the industrial sector, manufacturing processes are being automated to reduce carbon footprint and improve safety monitoring. HVAC control, lighting control, and building automation are essential components of this trend. Additionally, power plant operators are leveraging data center optimization, distributed generation, and remote management to enhance performance and reduce operational costs.

- Battery management systems and power consumption monitoring are critical for energy storage applications, while oil and gas companies are focusing on risk management and process automation to ensure safe and efficient operations. Water treatment facilities are also adopting these technologies to optimize their processes and ensure regulatory compliance. Business intelligence and data interpretation are becoming essential tools for decision-makers in the power sector. Mobile apps and smart grid technologies enable remote control and monitoring of power generation, distribution, and consumption in real-time. Environmental monitoring is another key area of focus, as companies seek to minimize their impact on the environment while maintaining operational excellence.

- Predictive analytics and decision support systems are transforming the way power generation and distribution companies manage their operations. Power plant operators are using these technologies to optimize their operations, improve safety, and reduce downtime. Hydro power and other renewable energy sources are also benefiting from these advancements, as they require precise control and monitoring to ensure optimal performance. Overall, the market is a dynamic and evolving landscape, driven by the need to reduce costs, improve efficiency, and ensure safety and regulatory compliance across various industries. From energy storage and renewable energy sources to manufacturing processes and power generation, software solutions are playing an increasingly important role in optimizing power systems and reducing the carbon footprint of businesses.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Power Monitoring And Control Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 3643.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, China, Germany, Canada, Japan, UK, India, France, Russia, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Power Monitoring And Control Software Market Research and Growth Report?

- CAGR of the Power Monitoring And Control Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the power monitoring and control software market growth of industry companies

We can help! Our analysts can customize this power monitoring and control software market research report to meet your requirements.