Power Over Ethernet Market Size 2024-2028

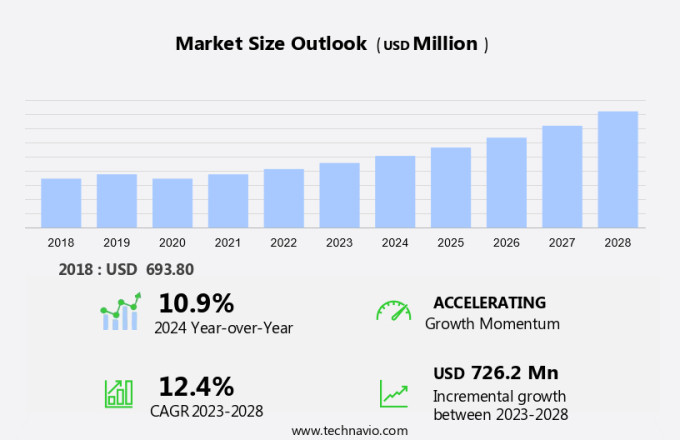

The power over ethernet market size is forecast to increase by USD 726.2 million at a CAGR of 12.4% between 2023 and 2028.

- The Power Over Ethernet (PoE) market is witnessing significant growth due to several key trends. The increasing adoption of Voice over Internet Protocol (VoIP) phones and wireless networking is driving market growth. PoE technology enables the delivery of both power and data over a single Ethernet cable, making it an ideal solution for powering VoIP phones and wireless access points. Additionally, the growing adoption of energy-efficient LED lighting systems is another trend boosting the PoE market. However, the limitation on the amount of power that can be delivered to end devices remains a challenge. This can be addressed through advancements in PoE technology, such as PoE+ and PoE++, which offer higher power budgets to support more power-hungry devices. Overall, the PoE market is expected to continue its growth trajectory, driven by these trends and the increasing demand for power and data delivery over Ethernet networks.

What will be the Size of the Power Over Ethernet Market During the Forecast Period?

- The Power over Ethernet (PoE) market encompasses communications technology that enables the transmission of both power and data through twisted pair Ethernet cabling. Copper cabling, specifically Category 5 (Cat 5) cable, is the primary medium for PoE. The Ethernet Alliance, a leading industry association, plays a crucial role in standardization and interoperability, ensuring compatibility among various PoE devices and power sourcing equipment. PoE technology allows powered devices, such as security cameras, wireless access points, VoIP phones, and more, to receive power directly from the Ethernet cable, eliminating the need for separate power sources. This not only increases convenience but also leads to significant cost savings and installation efficiency.

- Additionally, recently ratified standards, like IEEE 802.3af and 802.3at, have increased the power transmitted through these cables, enabling more power-hungry devices to operate without additional power sources. Spare pairs in Cat 5 cables are utilized for power transmission, while data pairs continue to carry the Ethernet signal. A resistor In the power sourcing equipment ensures safety during power transfer. The PoE market's growth is driven by the demand for more efficient and convenient network infrastructure, as well as the increasing prevalence of powered devices in various industries. This technology's functionality and efficiency make it an essential component of modern communications networks.

How is this Power Over Ethernet Industry segmented and which is the largest segment?

The power over ethernet industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Powered device (PD)

- Power sourcing equipment (PSE)

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

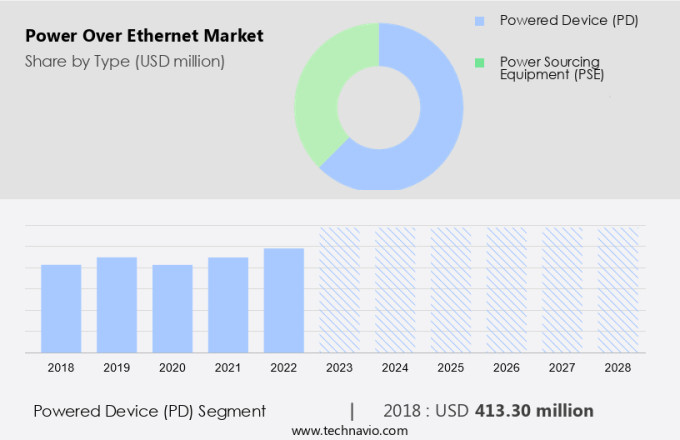

- The powered device (PD) segment is estimated to witness significant growth during the forecast period.

Power over Ethernet (PoE) technology enables the transmission of power and data signals through a single Ethernet cable, eliminating the need for separate power sources. PD controllers, integrated into PoE switches, classify power demands of Powered Devices (PDs) to ensure Power Sourcing Equipment (PSE) delivers the appropriate power level. Some PD controllers incorporate efficient DC-to-DC converters, while others allow designers to select their own for optimized cost-efficiency. PoE injectors eliminate the need for additional electrical cables, making installations more flexible and convenient.

Further, the increasing adoption of VoIP phones, wireless access points, IP cameras, and other powered devices in various applications, such as telecommunications and security systems, is driving the growth of the global PoE market. This technology offers increased power capabilities, safety features, and energy savings, making it an environmentally friendly solution for connectivity. PoE modes, such as PoE+ and PoE++, cater to the varying power requirements of devices, ensuring compatibility and interoperability. PoE-enabled devices, including CCTV cameras and HD video equipment, can transmit power and data through standard Ethernet cables, increasing installation flexibility and scalability.

Get a glance at the Power Over Ethernet Industry report of share of various segments Request Free Sample

The Powered device (PD) segment was valued at USD 413.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

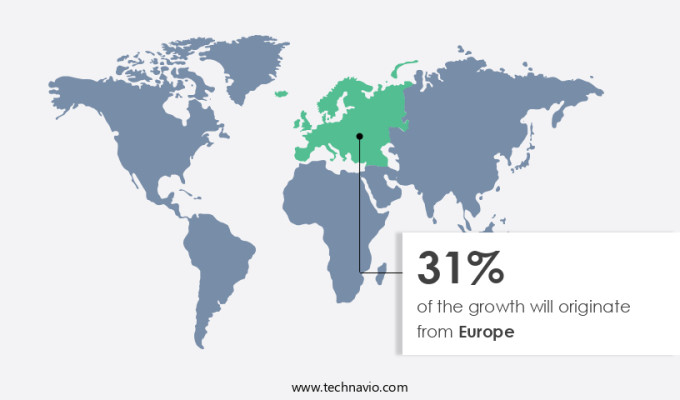

- Europe is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Power Over Ethernet (PoE) technology is gaining significant traction in Asia-Pacific (APAC) due to the region's rapid urbanization and industrial growth. The increasing urban population and the widespread use of smartphones and the Internet are driving the demand for PoE solutions in APAC. For instance, China recorded a mobile internet traffic growth of over 1.9% from 2022 to 2023, with over 73.7% of its population having internet access as of January 2023. In India, the introduction of Reliance Jio has disrupted the telecom sector, leading to increased penetration of 4G, 5G, and data consumption. PoE technology delivers electrical power and data signals over Ethernet cables, eliminating the need for separate power sources. It is particularly beneficial for powering devices such as communications equipment, security cameras, wireless access points, VoIP phones, and IP cameras. The use of PoE technology results in cost savings, increased power availability, and improved installation flexibility and scalability.

Moreover, the Ethernet Alliance and other industry bodies have standardized PoE technology through various ratified standards, ensuring interoperability among different PoE-enabled devices and power sourcing equipment. The use of spare pairs in Ethernet cables enables the delivery of power to devices, while managed and unmanaged PoE switches offer control and functionality. Power budget considerations and environmental friendliness are essential factors in PoE implementation. PoE modes, such as PoE+ and PoE++, offer increased power delivery capabilities. PoE-enabled devices, such as cameras and wireless access points, require a compatible power supply for safe and efficient operation. PoE technology is also being extended to other applications, such as Power over Coax (PoC) and Power over HDBaseT (PoH), which deliver power and data signals over coaxial cables and HDBaseT cables, respectively. These technologies offer the convenience of transmitting power and data through a single cable, reducing clutter and installation costs. However, it is crucial to consider power budget and safety considerations when implementing these technologies.

Market Dynamics

Our power over ethernet market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Power Over Ethernet Industry?

Growing adoption of voice over internet protocol (VoIP) phones and wireless networking is the key driver of the market.

- The Power over Ethernet (PoE) market is experiencing significant growth due to the increasing demand for powered devices such as IP cameras, wireless access points, VoIP phones, and CCTV cameras. PoE technology enables the delivery of electrical power and data signals over standard Ethernet cables, eliminating the need for separate power sources and reducing installation costs and clutter. PoE technology utilizes twisted pairs of copper cabling for data and power transmission. The Ethernet Alliance plays a crucial role in the standardization and interoperability of PoE devices and power sourcing equipment. Ratified PoE modes include IEEE 802.3af and IEEE 802.3at, which provide increased power delivery to support high-power devices. PoE switches transmit power to Powered Devices (PDs) through a process called Power Sourcing Equipment (PSE). Power is delivered through the data pairs, with spare pairs used for non-data functions such as safety and control. PoE modes allow for transmit power ranging from 15.4 watts to 30 watts, depending on the device requirements.

- Moreover, PoE technology offers numerous benefits, including increased power, flexibility, scalability, and convenience. Managed and unmanaged switches support PoE functionality, providing control over power delivery and device management. PoE technology is also energy-efficient and environmentally friendly, reducing energy waste and aligning with industry standards. Power-over-Cable (PoC) technologies, such as Power over HDBaseT (PoH), offer extended functionality, including HD video, audio, and control signals, making them suitable for various applications. PoE technology is a valuable investment for businesses seeking to streamline their communications infrastructure while enhancing functionality and efficiency.

What are the market trends shaping the Power Over Ethernet Industry?

Increasing adoption of LED lighting is the upcoming market trend.

- Power over Ethernet (PoE) technology revolutionizes communications systems by delivering electrical power and data signals through Ethernet cables. This innovation eliminates the need for separate power sources, reducing installation costs and clutter, especially in applications such as IP cameras, wireless access points, VoIP phones, and CCTV cameras. PoE is based on standardized protocols, ensuring interoperability among powered devices (PDs) and power sourcing equipment (PSE). The Ethernet Alliance plays a crucial role in ratifying these standards, enhancing safety and efficiency. PoE solutions are increasingly popular In the electrical industry due to their flexibility, scalability, and convenience. Managed and unmanaged switches, PoE modes, and power injectors are essential components of this technology.

- Further, PoE modes, such as PoE+ and PoE++, deliver increased power to support high-power devices. HDBaseT technology, a power over cable solution, delivers power, HD video, audio, and control signals through a single Ethernet cable. PoE solutions offer significant cost savings and environmental benefits by reducing the need for electrical power outlets and cabling infrastructure. This technology is an essential component of modern building automation systems, providing increased functionality and efficiency. However, it is crucial to ensure that power budgets are not exceeded to prevent energy waste. By adhering to industry standards, PoE solutions offer safe and reliable power delivery, making them an indispensable tool for businesses and organizations.

What challenges does the Power Over Ethernet Industry face during its growth?

Limitation on amount of power delivered to end devices is a key challenge affecting the industry growth.

- The Power over Ethernet (PoE) market growth is influenced by several factors. While PoE technology enables the delivery of electrical power and data signals through standard Ethernet cables, its limited power capacity hinders the expansion of the market. Traditional PTZ cameras can be sufficiently powered by PoE solutions, but high-power consumption network devices, such as IP cameras, require more electrical energy. This issue is further compounded when a single PoE power source or switch is connected to multiple devices. In the event of a problem with one device, all connected devices may fail. Moreover, PoE's convenience and efficiency have led to its widespread adoption in various applications, including security cameras, wireless access points, VoIP phones, and PoE switches. The technology's flexibility and scalability make it an attractive option for installations, resulting in significant cost savings. However, safety concerns and the need for standardization and interoperability remain key challenges. Power sourcing equipment must adhere to ratified standards to ensure safe and compatible power delivery. Spare pairs in Ethernet cables can be used for power, but this reduces the number of available data pairs.

- Moreover, PoE modes, such as PoE+ and PoE++, offer increased power capabilities, but these require more strong power sourcing equipment. Separate power sources can be used to address power budget constraints, but this adds to the installation complexity and clutter. PoE-enabled devices, such as PoE cameras and PoH devices, require compatible power supplies. Non-standardized, proprietary systems can limit interoperability and increase costs. The electrical power transmitted through PoE and PoH technologies must comply with industry standards to ensure safety and energy efficiency. Voltage ranges and power delivery methods must be carefully managed to avoid electrical hazards and energy waste. The market's growth is further influenced by the increasing adoption of video-over-IP technology, such as HDBaseT, which supports HD video, audio, and control signals over a single cable. The integration of PoE and PoH technologies with these systems offers significant advantages in terms of convenience, functionality, and environmental friendliness.

Exclusive Customer Landscape

The power over ethernet market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the power over ethernet market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, power over ethernet market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advantech Co. Ltd.

- Analog Devices Inc.

- Avaya LLC

- Axis Communications AB

- Belden Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- CommScope Holding Co. Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- Kinetic Technologies

- Microchip Technology Inc.

- Monolithic Power Systems Inc.

- NETGEAR Inc.

- ON Semiconductor Corp.

- Silicon Laboratories Inc.

- STMicroelectronics International N.V.

- Texas Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Power over Ethernet (PoE) market encompasses the use of Ethernet cables to deliver both data and electrical power to connected devices. This innovative technology has revolutionized communications networks by eliminating the need for separate power sources, reducing installation costs, and increasing convenience. PoE technology relies on twisted pairs of copper cabling to transmit both data signals and electrical power. The Ethernet Alliance, a global consortium of companies committed to advancing Ethernet technologies, has played a significant role In the standardization and interoperability of PoE. Powered devices (PDs) such as security cameras, wireless access points, VoIP phones, and IP cameras can all benefit from PoE. These devices require power to function, and PoE delivers it through the same Ethernet cable that carries data. Power sourcing equipment (PSE), such as PoE switches, injectors, and midspans, is responsible for transmitting power to the PDs. Safety is a critical consideration In the design and implementation of PoE systems. Proper installation and adherence to industry standards are essential to ensure the safety of both the users and the devices. PoE technology is designed to comply with electrical industry standards, with voltage ranges typically ranging from 44.7V to 57V. PoE offers several advantages over traditional power delivery methods.

Additionally, by delivering power over the same cable used for data transmission, PoE reduces clutter and the need for multiple cables. It also offers increased flexibility and scalability, as devices can be easily added or removed from the network without requiring separate power outlets. Moreover, PoE technology is energy-efficient and environmentally friendly. By delivering power only to devices that require it, PoE reduces energy waste and contributes to a greener network infrastructure. PoE technology offers several modes, including PoE+ and PoE++, which deliver increased power to support high-power devices such as HD video cameras and wireless access points. Managed switches and unmanaged switches are both used in PoE implementations, with managed switches offering more advanced features and control. Power over Ethernet is a game-changer In the communications industry. It offers cost savings, increased power delivery, and the convenience of delivering both data and electrical power over the same cable. As PoE technology continues to evolve, it will undoubtedly play an increasingly important role in the future of network infrastructure.

|

Power Over Ethernet Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.4% |

|

Market growth 2024-2028 |

USD 726.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.9 |

|

Key countries |

China, Japan, US, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Power Over Ethernet Market Research and Growth Report?

- CAGR of the Power Over Ethernet industry during the forecast period

- Detailed information on factors that will drive the Power Over Ethernet growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the power over ethernet market growth of industry companies

We can help! Our analysts can customize this power over ethernet market research report to meet your requirements.