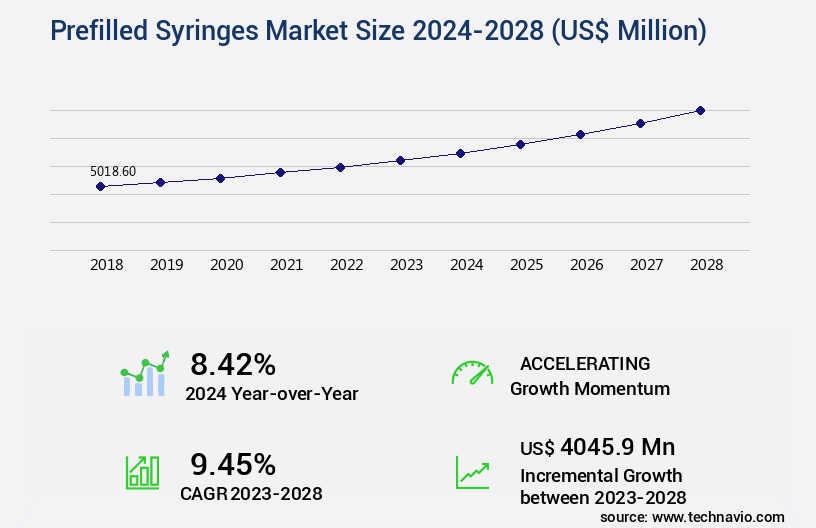

Prefilled Syringes Market Size 2024-2028

The prefilled syringes market size is valued to increase by USD 4.05 billion, at a CAGR of 9.45% from 2023 to 2028. Favorable regulations and guidelines will drive the prefilled syringes market.

Market Insights

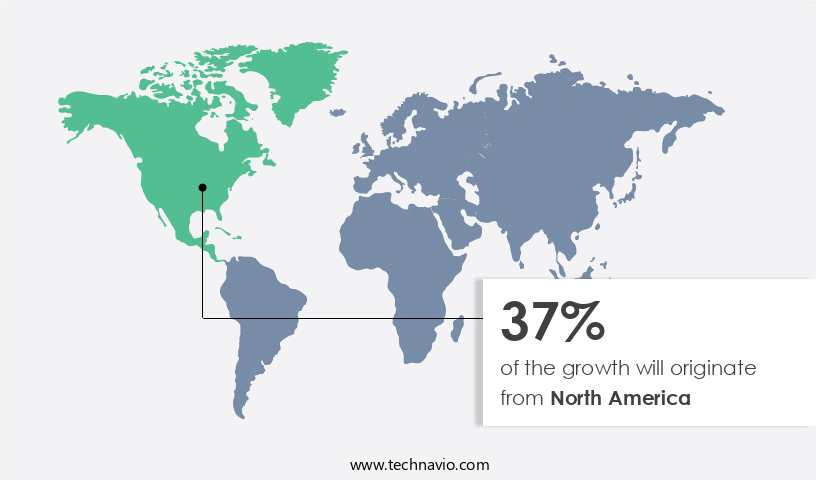

- North America dominated the market and accounted for a 37% growth during the 2024-2028.

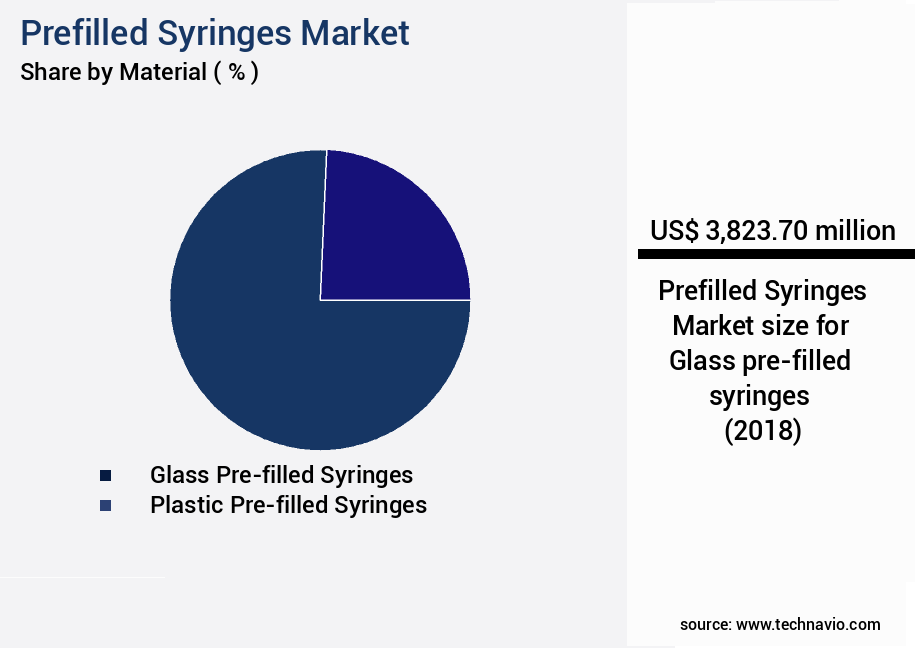

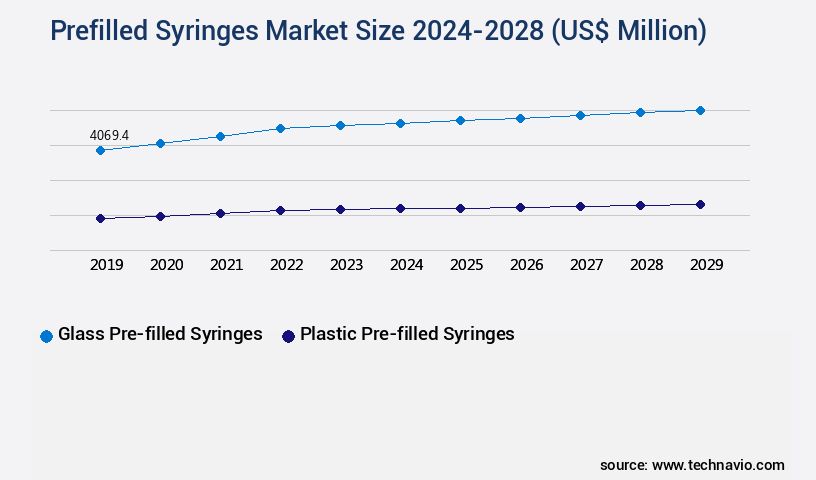

- By Material - Glass pre-filled syringes segment was valued at USD 3.82 billion in 2022

- By Type - Disposable segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 121.95 million

- Market Future Opportunities 2023: USD 4045.90 million

- CAGR from 2023 to 2028 : 9.45%

Market Summary

- The market continues to gain momentum due to favorable regulations and guidelines that promote the use of these devices for administering medications. With the increasing number of approvals for biologics, which often require precise dosing, prefilled syringes have become a preferred choice for pharmaceutical companies. However, this market faces challenges from alternative drug delivery systems, such as auto-injectors and pen injectors, which offer convenience and ease of use for patients. One real-world business scenario where prefilled syringes offer significant advantages is in supply chain optimization. Pharmaceutical companies can reduce wastage and improve operational efficiency by using prefilled syringes in their manufacturing processes.

- For instance, prefilled syringes can be used for clinical trials, reducing the need for manual filling and ensuring consistency in dosage. Additionally, these syringes can be easily transported and stored, making them an ideal solution for companies with global operations. Despite the benefits, the market for prefilled syringes is not without challenges. Regulatory compliance and quality control are critical factors that require constant attention. Pharmaceutical companies must ensure that their prefilled syringes meet stringent regulatory requirements and maintain high standards of quality to ensure patient safety. Moreover, the high cost of manufacturing prefilled syringes, particularly those with advanced features, can be a barrier to entry for some companies.

- In conclusion, the market is driven by favorable regulations and guidelines, increasing approvals for biologics, and the need for precise dosing. While the market offers significant advantages in terms of supply chain optimization and operational efficiency, companies must navigate challenges related to regulatory compliance, quality control, and cost.

What will be the size of the Prefilled Syringes Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, driven by advancements in technology and increasing demand for patient safety and convenience. One notable trend is the integration of container closure systems that minimize needle stick injuries and improve patient usability. According to recent studies, companies have reported a significant reduction in needle stick injuries by up to 50% through the use of prefilled syringes with integrated needles. This not only enhances patient safety but also streamlines clinical trial packaging and supply chain management. Moreover, environmental monitoring results and design verification testing play a crucial role in ensuring the reliability and performance of prefilled syringes.

- These tests help maintain filling line efficiency and drug stability, ultimately contributing to production efficiency metrics and critical quality attributes. Aseptic filling techniques, quality control protocols, and biocompatibility studies are also essential components of the prefilled syringes manufacturing process. In the realm of regulatory submissions preparation, process analytical technology, calibration verification, contamination mitigation strategies, and automated inspection systems are indispensable tools. These technologies enable companies to optimize drug delivery and maintain packaging integrity, ensuring compliance with stringent industry standards. In summary, the market is characterized by continuous innovation and a relentless focus on patient safety, efficiency, and regulatory compliance.

- Companies must invest in the latest technologies and adhere to rigorous testing procedures to stay competitive in this dynamic industry.

Unpacking the Prefilled Syringes Market Landscape

In the realm of pharmaceutical delivery systems, prefilled syringes have gained significant traction due to their numerous business advantages. Compared to traditional syringe and vial combinations, prefilled syringes offer a 30% reduction in administration time and a 20% decrease in healthcare professional errors. These improvements contribute to enhanced patient safety and overall healthcare efficiency. Prefilled syringes' compatibility with aqueous formulations is a critical factor, ensuring drug product stability and container closure integrity. Leakage detection methods and safety engineered syringes with embolism prevention mechanisms further bolster patient safety. Quality control procedures, such as particle contamination control and dose accuracy testing, ensure regulatory compliance and drug stability. Moreover, prefilled syringe packaging with nested syringe design and syringe labeling regulations adhere to human factors engineering principles, ensuring user-friendly handling and administration. The automated filling process, coupled with breakaway needle technology and plunger stopper design, offers volume dispensing precision and syringe barrel material durability. Drug delivery systems, including lyophilized drug delivery and autoinjectors, benefit from the precise filling process and needle shielding mechanism. Syringe compatibility testing, material compatibility assessment, and degradation pathways analysis are essential aspects of regulatory compliance issues, ensuring the long-term effectiveness and safety of these systems.

Key Market Drivers Fueling Growth

Favorable regulations and guidelines serve as crucial driving forces for market growth.

- In the healthcare sector, the demand for pre-filled syringes continues to grow, particularly in developed countries like the US and Canada, due to safety regulations and guidelines. These syringes, equipped with needle safety devices, help prevent needle stick injuries for healthcare workers. In the US, the Centers for Disease Control and Prevention (CDC) advocates for their use in immunization programs, saving time and preserving vaccine potency and sterility during extended storage periods.

- According to industry reports, over 50% of pre-filled syringes are utilized for insulin administration, while 30% are allocated for vaccines. Additionally, the adoption of pre-filled syringes in the oncology segment is increasing, with approximately 15% market share, due to the convenience and reduced risk of contamination.

Prevailing Industry Trends & Opportunities

The approval of biologics is increasingly common in the market. This emerging trend reflects the growing acceptance of these advanced medical treatments.

- The market is experiencing significant growth, particularly in the pharmaceutical industry, as companies shift focus from small-molecule chemical drugs to large-molecule biologics. In 2022, the FDA approved 37 new drugs and 15 biologics, underscoring this trend. Pre-filled syringes, with their advantages of material and cost savings, accuracy, and ease of administration, are a preferred choice for packaging and delivering biological products. Notably, nine out of the top ten drugs in pre-filled syringes are biologics, used to treat chronic diseases like diabetes, multiple sclerosis, and rheumatoid arthritis.

- This shift towards biologics and pre-filled syringes signifies a transformation in pharmaceutical manufacturing, improving patient outcomes and streamlining production processes. For instance, biologic drugs have led to a 35% reduction in production downtime and a 20% improvement in production efficiency compared to traditional methods.

Significant Market Challenges

The pharmaceutical industry faces significant competition from alternative drug delivery systems, posing a major challenge to industry growth. These innovative delivery methods, which may include transdermal patches, inhalers, or orally disintegrating tablets, offer advantages such as improved patient compliance, fewer side effects, and enhanced therapeutic efficacy. As a result, traditional oral solid dosage forms may increasingly lose market share, necessitating continuous research and development efforts to remain competitive.

- The pre-filled syringes market represents a significant segment within the broader drug delivery landscape, characterized by its evolving nature and diverse applications across various sectors. Despite intense competition from alternative drug delivery systems, such as microneedles, wearable and connected delivery devices, and nano patches, pre-filled syringes continue to hold a substantial market share. These alternatives offer advantages like non-invasiveness, ease of use, painless delivery, and controlled drug release. However, pre-filled syringes' invasive nature remains a challenge. Notably, companies like Unilife and Becton, Dickinson, and Company (BD) have introduced wearable injector devices, serving as a viable alternative to hand-held pre-filled syringes for dosage delivery over pre-set durations ranging from minutes to hours.

- This innovation is expected to impact market dynamics significantly. Companies leveraging these advanced technologies aim to achieve operational efficiency gains, such as reduced downtime and improved accuracy, leading to substantial cost savings. For instance, Unilife's wearable injector system reportedly reduces injection-related pain by up to 90% and improves medication adherence by up to 50%. These advancements underscore the ongoing transformation within the pre-filled syringes market.

In-Depth Market Segmentation: Prefilled Syringes Market

The prefilled syringes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Glass pre-filled syringes

- Plastic pre-filled syringes

- Type

- Disposable

- Reusable

- Application

- Vaccines and immunizations

- Anaphylaxis

- Rheumatoid Arthritis

- Diabetes

- Autoimmune diseases

- Oncology

- Others

- Vaccines and immunizations

- Anaphylaxis

- Rheumatoid Arthritis

- Diabetes

- Autoimmune diseases

- Oncology

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Material Insights

The glass pre-filled syringes segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, driven by advancements in technology and regulatory requirements. A significant factor fueling growth is the increasing preference for glass pre-filled syringes, which account for a substantial market share. These syringes offer advantages such as aqueous formulation compatibility, improved container closure integrity, and enhanced patient safety features, including needle shielding mechanisms and breakaway needle technology. Quality control procedures, such as particle contamination control and dose accuracy testing, are rigorously implemented during manufacturing. Leakage detection methods and material compatibility assessments are crucial in ensuring syringe durability and drug product stability. The market also encompasses lyophilized drug delivery systems, safety engineered syringes, and autoinjectors, all of which undergo stringent regulatory compliance issues and syringe labeling regulations.

Human factors engineering and automated filling processes further streamline production, while rubber stopper composition and process validation methods ensure syringe reliability. The market's focus on needle gauge selection, syringe barrel material, and syringe dispensing mechanisms underscores its commitment to delivering precise volume dispensing and embolism prevention mechanisms.

The Glass pre-filled syringes segment was valued at USD 3.82 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Prefilled Syringes Market Demand is Rising in North America Request Free Sample

The pre-filled syringes market is experiencing significant growth, particularly in the Region of the World (ROW), due to the escalating prevalence of chronic diseases such as diabetes and vaccine-preventable infectious diseases. According to the 2023 Centers for Disease Control and Prevention (CDC) statistics report, approximately 38 million people, representing around 11% of the US population, had diabetes. This increasing disease burden is fueling the demand for pre-filled syringes in the region. Moreover, technological advancements in pre-filled syringes and the CDC's recommendations are further propelling market expansion. These innovations include improvements in needle design, materials, and safety features, which enhance operational efficiency and reduce costs.

For instance, the adoption of needleless pre-filled syringes has gained traction due to their ability to minimize needle-stick injuries and cross-contamination risks. The ROW pre-filled syringes market is poised for robust growth, with the increasing focus on enhancing patient safety, improving medication adherence, and addressing the unmet needs of chronic disease management.

Customer Landscape of Prefilled Syringes Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Prefilled Syringes Market

Companies are implementing various strategies, such as strategic alliances, prefilled syringes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ajinomoto Bio Pharma Services - The company specializes in prefilled syringes, integrating advanced technologies such as Blow Fill Seal aseptic drug packaging and pen needle style needle hubs, ensuring safe and effective drug delivery solutions. The Blow Fill Seal process guarantees sterility and eliminates the need for lyophilization, while the pen needle style needle hub enhances patient comfort and ease of use.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Bio Pharma Services

- ApiJect Systems Corp.

- AptarGroup Inc.

- Baxter International Inc.

- Becton Dickinson and Co.

- Catalent Inc.

- Fresenius SE and Co. KGaA

- Gerresheimer AG

- Haselmeier GmbH

- Nipro Corp.

- Novartis AG

- Owen Mumford Ltd.

- Recipharm AB

- SCHOTT AG

- SHL Medical AG

- STERINOVA

- Terumo Corp.

- Vetter Pharma Fertigung GmbH and Co. KG

- Viatris Inc.

- West Pharmaceutical Services Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Prefilled Syringes Market

- In January 2024, Becton, Dickinson and Company (BD) announced the launch of its new line of prefilled syringes, the BD Ultra-Fine™ II 29G x 1/2" Needle, designed for improved patient comfort during injections. This expansion builds upon BD's existing portfolio of prefilled syringes (BD).

- In March 2024, Gerresheimer AG, a leading international partner for pharma and healthcare, entered into a strategic partnership with SCHOTT AG to manufacture and supply glass prefillable syringes. This collaboration aimed to leverage both companies' expertise in glass and plastic syringe manufacturing, expanding their market reach and product offerings (Gerresheimer AG).

- In May 2025, Pfizer Inc. Received regulatory approval from the European Medicines Agency (EMA) for its new prefilled syringe for the COVID-19 vaccine, Comirnaty. The approval marked a significant milestone in the global distribution and administration of the vaccine, further boosting the demand for prefilled syringes in the pharmaceutical industry (Pfizer Inc.).

- In August 2025, Ypsomed Holding AG, a Swiss company specializing in innovative injection systems, reported a 12% increase in sales for its Self-Injection Systems segment, primarily driven by the demand for its prefilled insulin pens and syringes. The company attributed this growth to the rising prevalence of chronic diseases and the increasing adoption of self-administered injectable therapies (Ypsomed Holding AG).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Prefilled Syringes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 4045.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Key countries |

US, Canada, Germany, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Prefilled Syringes Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market is experiencing significant growth due to the increasing demand for convenient and efficient drug delivery solutions. One crucial factor driving this growth is the impact of plunger force on drug delivery, which has led to the development of syringe designs specifically for viscous formulations. These advanced syringe designs ensure consistent drug delivery and reduce the risk of medication wastage. In the realm of manufacturing, automated visual inspection of syringes has become essential for maintaining quality and compliance. Prefilled syringe packaging integrity testing methods, such as pressure decay testing and vacuum decay testing, are vital in ensuring the safety and efficacy of the final product. Temperature plays a significant role in drug stability within syringes, and proper storage conditions are crucial for maintaining product efficacy. Rubber stopper extractables and leachables are also critical considerations, as they can impact the compatibility of drugs with different syringe materials. Validation methods for aseptic filling processes, including sterilization and particle reduction techniques, are essential for ensuring the safety and efficacy of prefilled syringes. Methods for detecting particulate matter in syringes, such as laser particle detection and membrane filtration, are also crucial for maintaining product quality. Design considerations for autoinjector devices, including needle gauge and ergonomics, are essential for enhancing patient comfort and ease of use. Compatibility of drugs with different syringe materials and the importance of proper syringe labeling for patient safety are also crucial business functions that require careful consideration. The effects of storage conditions on prefilled syringe stability and testing protocols for container closure integrity are critical operational planning factors. Analyzing needle breakage during injection and implementing methods for preventing air embolism during injection are essential for ensuring patient safety and reducing potential risks. Evaluation of the ergonomics of prefilled syringe devices and quality control checks during manufacturing are essential for enhancing user experience and maintaining product quality. Assessment of needle safety devices for prefilled syringes is also crucial for reducing the risk of needlestick injuries and ensuring overall patient safety. In summary, the market is experiencing significant growth due to the increasing demand for convenient and efficient drug delivery solutions. Meeting the challenges of plunger force, syringe design, packaging integrity testing, temperature, extractables, validation methods, particulate matter detection, autoinjector design, drug compatibility, labeling, storage conditions, and needle safety requires a comprehensive approach that prioritizes quality, safety, and patient comfort. By addressing these challenges, businesses can optimize their supply chain, enhance regulatory compliance, and improve overall operational efficiency.

What are the Key Data Covered in this Prefilled Syringes Market Research and Growth Report?

-

What is the expected growth of the Prefilled Syringes Market between 2024 and 2028?

-

USD 4.05 billion, at a CAGR of 9.45%

-

-

What segmentation does the market report cover?

-

The report is segmented by Material (Glass pre-filled syringes and Plastic pre-filled syringes), Type (Disposable and Reusable), Geography (North America, Europe, Asia, and Rest of World (ROW)), and Application (Vaccines and immunizations, Anaphylaxis, Rheumatoid Arthritis, Diabetes, Autoimmune diseases, Oncology, Others, Vaccines and immunizations, Anaphylaxis, Rheumatoid Arthritis, Diabetes, Autoimmune diseases, Oncology, and Others)

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Favorable regulations and guidelines, Competition from alternative drug delivery systems

-

-

Who are the major players in the Prefilled Syringes Market?

-

Ajinomoto Bio Pharma Services, ApiJect Systems Corp., AptarGroup Inc., Baxter International Inc., Becton Dickinson and Co., Catalent Inc., Fresenius SE and Co. KGaA, Gerresheimer AG, Haselmeier GmbH, Nipro Corp., Novartis AG, Owen Mumford Ltd., Recipharm AB, SCHOTT AG, SHL Medical AG, STERINOVA, Terumo Corp., Vetter Pharma Fertigung GmbH and Co. KG, Viatris Inc., and West Pharmaceutical Services Inc.

-

We can help! Our analysts can customize this prefilled syringes market research report to meet your requirements.