Pre Workout Supplements Market Size 2024-2028

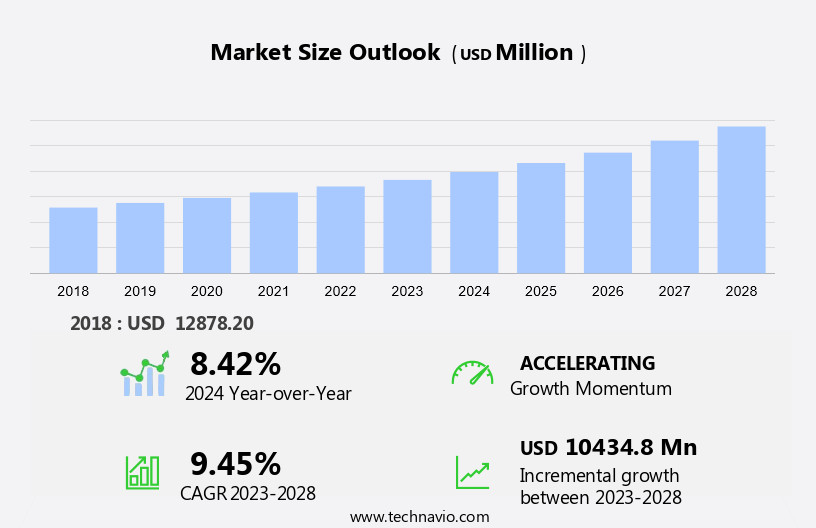

The pre workout supplements market size is forecast to increase by USD 10.43 billion at a CAGR of 9.45% between 2023 and 2028.

- Pre-workout supplements have gained significant traction in the market due to the rising trend of sports and fitness activities. The increasing number of health and wellness conscious consumers seeking enhanced performance and energy during workouts is driving the market growth. Additionally, the convenience of online sales channels has boosted market expansion. However, the market faces challenges related to potential side effects, including increased heart rate, anxiety, and insomnia. Consumers are advised to consult healthcare professionals before incorporating pre-workout supplements into their fitness regimens. The market analysis also highlights the importance of product innovation and transparency in labeling to address consumer concerns and maintain market competitiveness.

What will be the Size of the Pre Workout Supplements Market During the Forecast Period?

- The nutritional products market encompassing workout supplements experiences continuous growth due to the increasing global awareness towards maintaining an active lifestyle and optimal health. This segment includes a wide array of offerings, such as proteins, energy-boosting products, and amino acids like BCAAs, beta-alanine, creatine, and nitric oxide. These supplements cater to diverse fitness regimens, including exercise routines at the gym, yoga sessions, and self-diagnosed health concerns. Developed regions witness significant market expansion, driven by consumers seeking to enhance their workout performance and overall well-being. Workout supplements often contain caffeine and proprietary blends to provide energy and focus, while some offer organic alternatives to cater to health-conscious consumers.

- However, potential side effects, artificial flavors, dyes, and various forms like powder, capsules, and tablets may influence consumer preferences. Brands like Nutrabolt and Project Clear Evolution have gained popularity in this market, offering a range of products to cater to diverse consumer needs.

How is this Pre Workout Supplements Industry segmented and which is the largest segment?

The pre workout supplements industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Powder

- Ready to drink

- Capsule/tablets

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

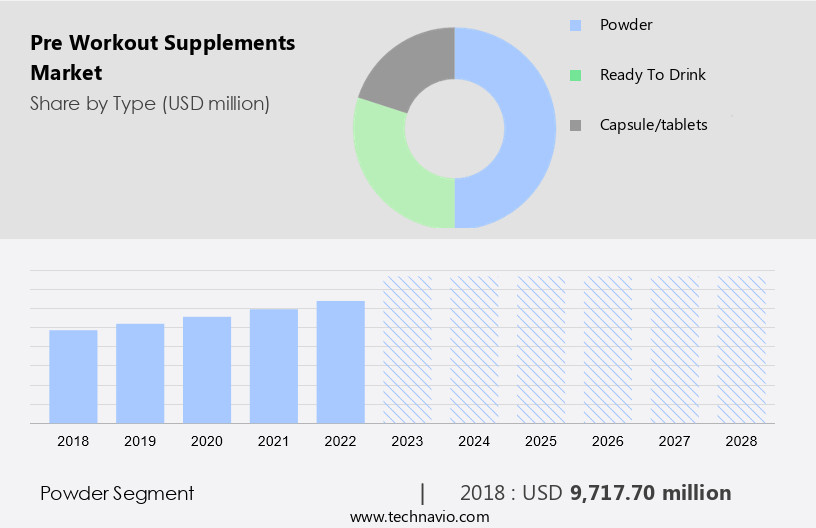

- The powder segment is estimated to witness significant growth during the forecast period.

Pre workout supplements In the form of powders have gained significant traction In the global market due to their ease of use and effectiveness. These supplements are essential for individuals seeking to enhance their athletic performance, endurance, and focus during intense workout sessions. The ingredients in pre workout powders typically include amino acids, caffeine, creatine, beta-alanine, and nitric oxide boosters. These components contribute to increased energy levels, muscle growth, and improved muscle pump. The market for pre workout powders is expanding as more people adopt an active lifestyle and prioritize their health. Nutritional products, such as organic food and protein supplements, have become increasingly popular, and pre workout powders are a natural extension of this trend.

Get a glance at the Pre Workout Supplements Industry report of share of various segments Request Free Sample

The powder segment was valued at USD 9.72 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

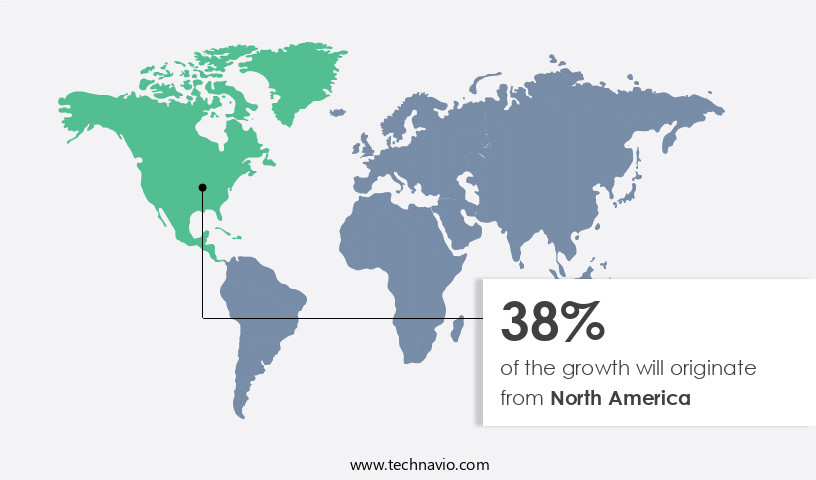

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the North American market, the pre workout supplement sector experienced significant growth in 2023, primarily driven by the US. Fueled by the increasing recognition of the health benefits associated with proteins and an active lifestyle, consumers have shown a heightened interest In these supplements. The athletic community, including bodybuilders and athletes, has embraced pre workout supplements as a means to enhance stamina and endurance during intense physical activities. Manufacturers have responded to this trend by introducing more user-friendly formulations and diverse product formats, such as powders, capsules, tablets, and ready-to-drink options. Additionally, the shift in consumer demographics has broadened the market's reach beyond traditional user groups.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Pre Workout Supplements Industry?

Growing interest in sports and fitness activities is the key driver of the market.

- The nutritional products market, specifically workout supplements, has experienced significant growth due to the increasing emphasis on an active lifestyle and improved health. With the rise of yoga, gym memberships, and other fitness activities, the demand for energy-boosting products, proteins, and nutrients has increased. Organic food and sports equipment retailers, such as GNC and Vitamin Shoppe, have capitalized on this trend, offering a range of workout supplements, including those with ingredients like caffeine, beta-alanine, BCAAs, creatine, and nitric oxide. These supplements are available in various forms, including powders, capsules, tablets, ready-to-drink, and proprietary blends. Customization is a key factor In the market, with consumers seeking personalized supplements based on their fitness goals and dietary needs.

What are the market trends shaping the Pre Workout Supplements Industry?

Rise in online sales is the upcoming market trend.

- Pre workout supplements, a category of nutritional products, have gained significant traction In the US market as consumers seek to enhance their exercise routines and maintain an active lifestyle. These supplements, available in various forms such as powders, capsules, tablets, and ready-to-drink, contain a blend of ingredients including proteins, energy-boosting products like caffeine, Beta-alanine, BCAA's, Creatine, Nitric Oxide, and proprietary blends. Organic food enthusiasts can opt for supplements free from artificial flavors, dyes, and other additives. The pre-workout supplement market is witnessing growth due to the increasing popularity of fitness, yoga, and gym activities. Self-diagnosis and fitness authorities' recommendations are driving the demand for these supplements.

- Furthermore, developed regions, including the US, are leading the market due to a higher focus on health and wellness. companies are offering customization options, such as milk-based or vegan formulas, to cater to diverse consumer preferences. The absorption rate and side effects of these supplements are under FDA regulation, ensuring consumer safety. Online sales are on the rise due to the convenience and wider reach, with retailers like GNC, Vitamin Shoppe, Stance Supplements, and MERK offering pre-workout supplements. Notable ingredients in pre-workout supplements include Citrulline Malate, VitaCholine, AlphaSize, Vitamin B12, Himalayan Rock Salt, ActiGin, and Astragin, which enhance energy, focus, and muscle recovery.

What challenges does the Pre Workout Supplements Industry face during its growth?

Risk of side effects is a key challenge affecting the industry growth.

- Pre-workout nutritional products, a segment of the broader workout supplements market, are consumed prior to exercise to enhance performance and endurance. These supplements, available in various forms such as powder, capsules, tablets, and ready-to-drink, contain nutrients like proteins, caffeine, Beta-alanine, BCAA's, Creatine, Nitric Oxide, and proprietary blends. While these supplements can boost energy levels and improve workout results, they may cause side effects, including stomach discomfort, weight gain, and increased heart rate, especially if not taken as directed. Some pre-workout supplements contain milk-derived proteins, such as whey and casein, which can cause digestive issues for lactose-intolerant individuals. Additionally, artificial flavors, dyes, and sweeteners found in certain supplements can lead to increased blood sugar levels.

- Therefore, it is crucial to choose the right pre-workout supplement and adhere to the recommended dosage. The pre-workout supplement market caters to an active lifestyle, with fitness authorities and fitness centers promoting their use. Consumers can purchase these supplements from various channels, including online retailers like Amazon, GNC, Vitamin Shoppe, and Stance Supplements, as well as offline retail stores. Brands like Nutrabolt, Project Clear Evolution, and MERK offer a range of pre-workout supplements with different ingredients and flavors. The FDA regulates the production and labeling of pre-workout supplements to ensure their safety and efficacy. However, it is essential to self-diagnose any potential health issues before consuming these supplements and consult a healthcare professional if necessary.

Exclusive Customer Landscape

The pre workout supplements market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pre workout supplements market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pre workout supplements market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Amway Corp.

- BPI Sports

- eFlow Nutrition LLC

- EFX Sports

- EVLUTION NUTRITION LLC

- FINAFLEX

- Ghost LLC

- Glanbia plc

- JNX Sports

- Jym Supplement Science

- KAGED

- MusclePharm

- Nutrex Research Inc.

- ProSupps USA LLC

- QNT s.a.

- RSP Nutrition Staging

- SANN Corp.

- Woodbolt Distribution LLC

- World Health Products LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Pre-workout supplements have gained significant traction In the nutritional products market as consumers seek to enhance their exercise performance and energy levels. These supplements are designed to provide various benefits, such as increased energy, improved focus, and enhanced muscle pumps during workouts. The pre-workout supplement category encompasses a wide range of ingredients, including proteins, creatine, beta-alanine, nitric oxide boosters, and caffeine. The market for pre-workout supplements is driven by several factors. One key factor is the growing trend towards an active lifestyle and fitness. Consumers are increasingly prioritizing their health and well-being, leading to a rise in demand for products that can help them optimize their workouts and achieve better results.

Additionally, the increasing awareness of the benefits of certain nutrients, such as creatine and beta-alanine, has led to an increase in demand for supplements that contain these ingredients. Another factor driving the growth of the pre-workout supplement market is the increasing customization options available to consumers. Supplements come in various forms, including powders, capsules, tablets, and ready-to-drink options, allowing consumers to choose the format that best suits their preferences and lifestyles. Furthermore, some companies offer customizable blends, allowing consumers to tailor their supplements to their specific fitness goals. Despite the growing popularity of pre-workout supplements, there are also concerns regarding their safety and regulation.

Moreover, the Food and Drug Administration (FDA) regulates these supplements as dietary supplements, which means that they are not subject to the same level of oversight as prescription drugs. This has led to concerns regarding the safety and efficacy of some supplements, particularly those that contain proprietary blends or artificial flavors and dyes. Despite these concerns, the pre-workout supplement market is expected to continue growing, driven by increasing consumer demand and innovation In the industry. Companies are investing in research and development to create more effective and safer supplements, while also focusing on transparency and labeling to address consumer concerns.

In addition, as the market continues to evolve, it is likely that we will see more personalized and science-backed supplements that can help consumers optimize their workouts and achieve their fitness goals. Therefore, the pre-workout supplement market is a dynamic and growing industry that is driven by consumer demand for products that can help them enhance their exercise performance and energy levels. Despite concerns regarding safety and regulation, the market is expected to continue growing, driven by innovation and a focus on transparency and customization. As consumers become more health-conscious and prioritize their fitness goals, pre-workout supplements are likely to remain a popular choice for those seeking to optimize their workouts and achieve better results.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 10.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Key countries |

US, China, UK, Germany, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pre Workout Supplements Market Research and Growth Report?

- CAGR of the Pre Workout Supplements industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pre workout supplements market growth of industry companies

We can help! Our analysts can customize this pre workout supplements market research report to meet your requirements.