Primary Biliary Cholangitis Therapeutics Market Size 2024-2028

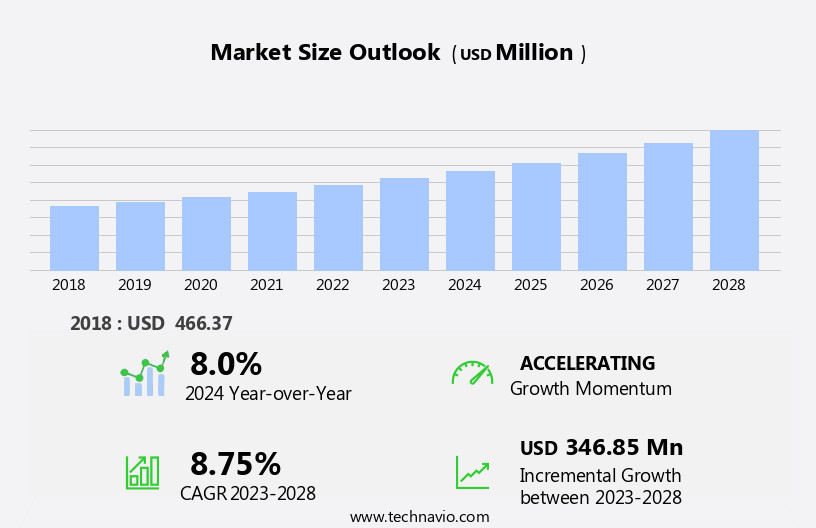

The primary biliary cholangitis therapeutics market size is forecast to increase by USD 346.85 million at a CAGR of 8.75% between 2023 and 2028.

- The Primary Biliary Cholangitis (PBC) Therapeutics Market is experiencing significant growth, driven by several key factors. The emergence of telehealth and remote monitoring technologies is revolutionizing the delivery of healthcare services, enabling better patient management and improved access to care for PBC patients. This trend is particularly relevant in light of the chronic nature of the disease, which requires long-term monitoring and management. Another significant driver is the increasing demand for research and development (R&D) in the field of PBC therapeutics, fueled by growing government healthcare expenditure. Governments worldwide are investing heavily in healthcare research to address unmet medical needs and improve patient outcomes.

- This investment is expected to yield new treatments and therapies for PBC, providing significant opportunities for market growth. However, the PBC Therapeutics Market is not without challenges. Stringent government regulations on the development and approval of new therapeutics pose significant hurdles for market entrants. These regulations are necessary to ensure the safety and efficacy of new treatments but can add considerable time and cost to the development process. Companies seeking to capitalize on market opportunities and navigate these challenges effectively must stay abreast of regulatory requirements and develop robust R&D pipelines to bring innovative treatments to market.

- In summary, the PBC Therapeutics Market is poised for growth, driven by the adoption of telehealth and remote monitoring technologies and increasing government investment in healthcare R&D. However, market entrants must navigate the complex regulatory landscape to bring innovative treatments to market and meet the evolving needs of PBC patients. Companies that can successfully navigate these challenges will be well-positioned to capitalize on the significant opportunities in this market.

What will be the Size of the Primary Biliary Cholangitis Therapeutics Market during the forecast period?

- Primary Biliary Cholangitis (PBC), an autoimmune liver disease, causes damage to small bile ducts in the liver, leading to bile flow disruption and eventual cirrhosis. Despite a growing understanding of its causes, including genetic predispositions and environmental triggers, the diagnosis of PBC remains challenging due to a lack of awareness and clinical trials. The immune system plays a significant role in the disease progression, making it an area of intensive research. The pharmaceutical supply chain is crucial in addressing this condition, with treatments such as ursodeoxycholic acid and obeticholic acid being key therapeutic options. Advancements in treatment have led to the exploration of combination therapies, aiming to improve efficacy and mitigate potential side effects.

- Bile flow disruptions and liver damage can lead to complications like infections and cirrhosis. The complex interplay between the immune system and liver function necessitates a robust healthcare infrastructure to ensure proper diagnosis and treatment. Genetic predispositions and environmental triggers contribute to the development of PBC, an autoimmune liver disease. The immune system's role in disease progression necessitates ongoing research to better understand the underlying mechanisms and develop effective treatments. The pharmaceutical industry continues to invest in research and development, striving to address the challenges posed by PBC and improve patient outcomes. This commitment to innovation is essential in addressing the unmet needs in the treatment of this autoimmune disease.

How is this Primary Biliary Cholangitis Therapeutics Industry segmented?

The primary biliary cholangitis therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Primary drug

- Secondary drug

- Distribution Channel

- Drug stores and retail pharmacies

- Hospital pharmacies

- Online pharmacies

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- Middle East and Africa

- APAC

- China

- South America

- Rest of World (ROW)

- North America

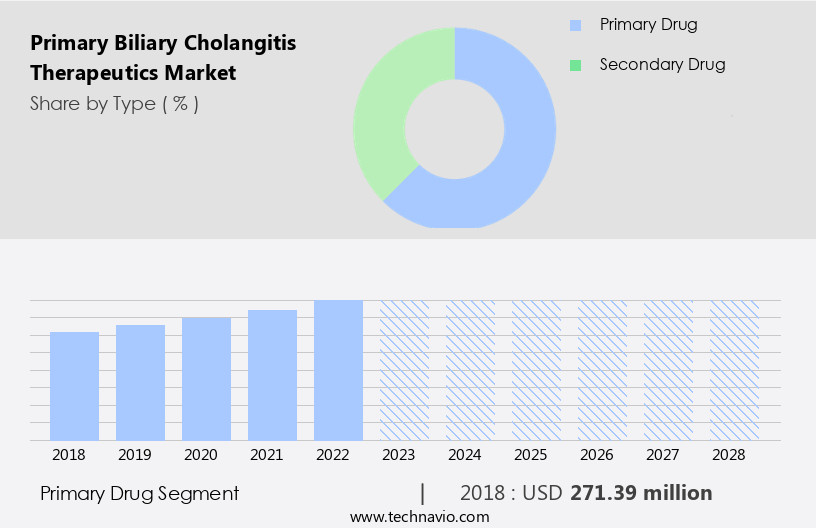

By Type Insights

The primary drug segment is estimated to witness significant growth during the forecast period.

Primary biliary cholangitis (PBC) is a chronic and progressive autoimmune liver disease that damages the small bile ducts in the liver. The primary drug segment dominates the therapeutics market for PBC due to its high adoption for treatment and the effectiveness of drugs like Ursodeoxycholic acid (UDCA). Factors contributing to the growth of this segment include the increasing prevalence of PBC, the availability of various primary drugs in the pipeline, and the rise in patients diagnosed with the condition. The immune system plays a significant role in the development of PBC, with environmental triggers and genetic predispositions being potential causes.

The diagnosis of PBC relies on clinical symptoms, laboratory tests, and imaging techniques. The limited treatment options for PBC have led to the exploration of combination therapies, which involve the use of multiple drugs to target various underlying mechanisms of the disease. These mechanisms include inflammation, bile flow disruption, and liver damage. Symptomatic therapies, such as ursodeoxycholic acid, aim to improve bile flow and reduce inflammation, while drugs like Obeticholic acid target the farnesoid X receptor (FXR) to modulate bile acid metabolism. The pharmaceutical manufacturing industry plays a crucial role in the development and supply of these therapies, with clinical trials and regulatory approvals being essential steps in the process.

Online pharmacies and hospital pharmacies are key distribution channels for these drugs, ensuring that patients have access to effective therapies. The healthcare infrastructure, including advanced healthcare facilities, is essential for the proper diagnosis and treatment of PBC patients. The prevalence of PBC is relatively low, with an estimated 1 in 500 women and 1 in 1,000 men affected. Autoimmune biliary diseases, including PBC, are often underdiagnosed due to a lack of awareness among both patients and healthcare professionals. The high cost of treatments and limited treatment options further exacerbate the challenges faced by patients. Investments in healthcare and the pharmaceutical supply chain are crucial for the development of new therapies and the improvement of existing ones.

The ongoing research into the underlying mechanisms of PBC and the development of combination therapies offer promising avenues for the advancement of treatment options. The patient pool for PBC is expected to grow as awareness and diagnosis rates improve, further driving the demand for effective therapies.

Get a glance at the market report of share of various segments Request Free Sample

The Primary drug segment was valued at USD 271.39 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Primary biliary cholangitis (PBC), an autoimmune liver disease affecting small bile ducts, has a significant impact on the global therapeutics market. The disease, characterized by inflammation and damage to the liver, is often linked to genetic predispositions, environmental triggers, and infections. The prevalence of PBC is relatively low, but it can lead to cirrhosis and liver failure if left untreated. The pharmaceutical manufacturing sector has seen a growing focus on developing effective therapies for PBC. Ursodeoxycholic acid (UDCA) has been a leading treatment for decades, addressing the underlying mechanisms of bile flow disruption. However, the limited treatment options and lack of awareness about the disease necessitate advancements in treatment.

Recent research has shown potential in combining therapies, such as UDCA with obeticholic acid, to improve patient outcomes. Clinical trials are underway to evaluate the efficacy of these combination therapies. Hospitals and hospital pharmacies play a crucial role in diagnosing and treating PBC, as early intervention is essential for managing the disease. The healthcare investments in research and development, driven by the patient pool and the need for better symptomatic therapies, are expected to propel the growth of the PBC therapeutics market. The pharmaceutical supply chain is also adapting to cater to the increasing demand for these treatments. Despite the advancements, challenges remain, including the genetic predisposition to PBC and the potential for harmful substances to trigger the disease.

The immune system's role in PBC and its relationship with other autoimmune liver diseases are areas of ongoing research. In conclusion, the market is evolving, driven by the need for effective treatments and a growing awareness of the disease. The market is expected to continue growing, with a focus on developing combination therapies and improving patient outcomes.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Primary Biliary Cholangitis Therapeutics Industry?

- Emergence of telehealth and remote monitoring is the key driver of the market.

- The adoption of telehealth services has gained momentum in the healthcare industry due to the COVID-19 pandemic, revolutionizing the way primary biliary cholangitis patients receive care. Telehealth enables remote consultations, diagnosis, treatment, and monitoring, making it an essential tool for individuals with this condition. For those who face challenges traveling, telehealth platforms offer the opportunity to consult specialists virtually. Healthcare providers can diagnose primary biliary cholangitis remotely using video consultations, patient histories, and shared medical data. Telehealth and remote monitoring alleviate the burden on healthcare facilities by preventing unnecessary in-person visits and focusing resources on critical cases.

- Additionally, remote monitoring technologies facilitate care delivery at patients' homes, ensuring continuous care and improving overall patient outcomes. The integration of telehealth in primary biliary chilangitis care enhances access to specialized treatment and supports the efficient allocation of healthcare resources.

What are the market trends shaping the Primary Biliary Cholangitis Therapeutics Industry?

- Increasing demand for R and D due to government healthcare expenditure is the upcoming market trend.

- In the realm of specialty pharmaceuticals, the ability to procure enriched samples of small molecules, cells, proteins, nucleic acids, or clean solutions is crucial for various applications, ranging from small-scale laboratory studies to large-scale production of primary biliary cholangitis therapeutics. Adherence to government regulations concerning the purity and consistency of these therapeutics necessitates a well-planned enrichment strategy. Pharmaceutical companies are significantly increasing their research and development (R&D) expenditures, with an average investment of 15%-20% of their revenue.

- This enhanced R&D spending is anticipated to boost the number of primary biliary cholangitis therapeutics in the market, thereby fueling the demand for these treatments.

What challenges does the Primary Biliary Cholangitis Therapeutics Industry face during its growth?

- Stringent government regulations on primary biliary cholangitis therapeutics is a key challenge affecting the industry growth.

- Primary biliary cholangitis (PBC) therapeutics companies face regulatory hurdles in bringing their products to market. In the US, the Food and Drug Administration (FDA) sets the standards, while Europe follows the CE Marking. Other regions and countries have their regulations. Obtaining premarket approval from recognized notified bodies is essential but involves clinical trials, which are costly, time-consuming, and uncertain. The approval process varies across countries, posing a significant challenge for multinational companies.

- companies must navigate these complexities to commercialize their PBC therapeutics, ensuring they meet the stringent requirements of various regulatory bodies.

Exclusive Customer Landscape

The primary biliary cholangitis therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the primary biliary cholangitis therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, primary biliary cholangitis therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in diagnostic solutions for various health conditions, encompassing infectious diseases, cardiometabolic disorders, toxicology, and consumer health. In the realm of primary biliary cholangitis treatment, our offerings prioritize rapid diagnostics to ensure accurate and timely results. By combining advanced technologies and expertise in multiple diagnostic areas, we deliver comprehensive solutions that cater to diverse healthcare needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AbbVie Inc.

- Alkem Laboratories Ltd.

- Eli Lilly and Co.

- GENFIT SA

- Glenmark Pharmaceuticals Ltd.

- ICE S.p.a.

- Intercept Pharmaceuticals Inc.

- Ipsen Pharma

- Leeford Healthcare Ltd.

- NGM Biopharmaceuticals Inc.

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- Zydus Lifesciences Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Primary Biliary Cholangitis (PBC), a rare liver condition, is characterized by the progressive destruction of small bile ducts in the liver. The underlying mechanisms of PBC involve complex interactions between environmental triggers, the immune system, and genetic predispositions. This condition can lead to liver damage, inflammation, and, in severe cases, cirrhosis and liver failure. The diagnosis of PBC relies on various clinical and laboratory tests, which may include liver function tests, imaging studies, and biopsy. Once diagnosed, patients often face limited treatment options, relying primarily on symptomatic therapies. Ursodeoxycholic acid (UDCA) is a bile-acid modulator commonly used to treat PBC.

It helps improve bile flow and reduce liver damage. However, its effectiveness varies among patients, and some may require combinations of therapies to manage their symptoms. Pharmaceutical manufacturing plays a crucial role in ensuring a consistent supply of UDCA and other essential drugs for PBC treatment. Online pharmacies have emerged as a convenient option for patients to access their medications, especially in areas with a lack of robust healthcare infrastructure. Clinical trials continue to explore new treatments for PBC, including obeticholic acid, which shows promise in modulating the immune system and reducing inflammation. The prevalence of PBC is relatively low, with estimates suggesting that it affects approximately 1 in 1,000 people.

Autoimmune biliary diseases, including PBC, are increasingly recognized as significant health concerns. Environmental triggers, such as exposure to harmful substances, may contribute to the development of these conditions. Genetic predispositions also play a role, highlighting the need for further research into the underlying mechanisms. The healthcare industry is investing in advanced healthcare facilities and research initiatives to address the unique challenges posed by rare liver conditions like PBC. The pharmaceutical supply chain must remain resilient to ensure a steady supply of effective therapies for patients. As the understanding of PBC and other autoimmune liver diseases grows, so too will the potential for new treatments and improved patient outcomes.

In the realm of PBC therapeutics, the market dynamics are shaped by various factors, including the prevalence of the condition, the effectiveness of existing treatments, and the ongoing research and development efforts. The market for PBC therapies is expected to grow as new treatments emerge and the awareness of this condition increases. The market for PBC therapeutics is driven by the unmet medical need for effective treatments and the potential for combinations of therapies to improve patient outcomes. The ongoing research into the underlying mechanisms of PBC and other autoimmune liver diseases is expected to yield new insights and treatment options.

The pharmaceutical industry is responding to this growing demand by investing in research and development, collaborating with academic institutions, and partnering with regulatory agencies to bring new treatments to market. The role of healthcare investments in advancing the field of PBC therapeutics is crucial, as it provides the financial resources necessary to drive innovation and improve patient care. In conclusion, the market for PBC therapeutics is an evolving landscape shaped by the complex interplay of various factors, including the prevalence of the condition, the effectiveness of existing treatments, and ongoing research and development efforts. The potential for combinations of therapies and advancements in our understanding of the underlying mechanisms of PBC and other autoimmune liver diseases offers significant opportunities for innovation and improved patient outcomes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.75% |

|

Market growth 2024-2028 |

USD 346.85 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.0 |

|

Key countries |

US, Canada, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Primary Biliary Cholangitis Therapeutics Market Research and Growth Report?

- CAGR of the Primary Biliary Cholangitis Therapeutics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the primary biliary cholangitis therapeutics market growth of industry companies

We can help! Our analysts can customize this primary biliary cholangitis therapeutics market research report to meet your requirements.