Pro AV Market Size 2025-2029

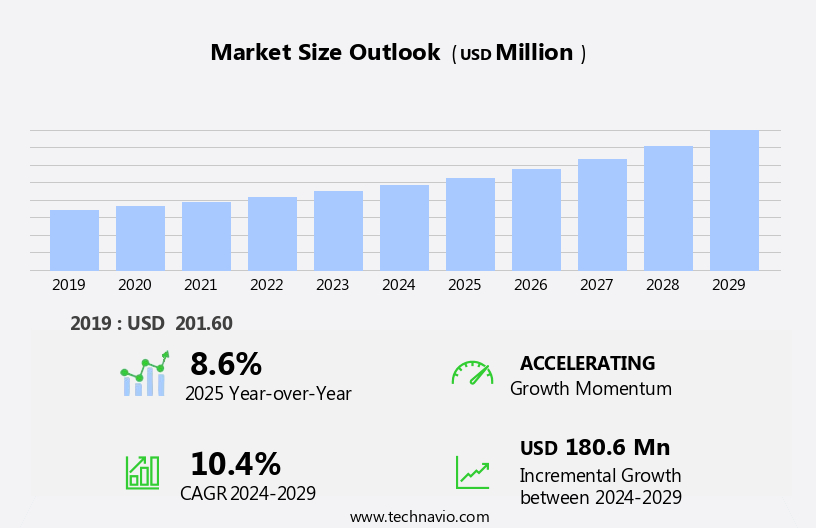

The pro av market size is forecast to increase by USD 180.6 million, at a CAGR of 10.4% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the increasing adoption of digital signage and a growing focus on personalized learning. Digital signage is transforming the Pro AV landscape, offering new opportunities for businesses to engage customers and enhance their brand presence. This trend is fueled by advancements in technology, enabling more interactive and dynamic displays. Meanwhile, the demand for one-on-one learning experiences is gaining momentum. As the workforce becomes more diverse and distributed, there is a growing need for flexible and personalized training solutions. Pro AV technology plays a crucial role in facilitating these learning environments, offering immersive and interactive experiences.

- However, this shift presents challenges as well. Integrating these technologies into existing infrastructure and ensuring seamless user experiences require significant investment and expertise. Additionally, ensuring security and privacy in these digital learning environments is a major concern. Companies seeking to capitalize on these opportunities must navigate these challenges effectively, investing in the right technologies and partnerships to stay competitive.

What will be the Size of the Pro AV Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Networking equipment plays a crucial role in ensuring seamless communication and signal distribution. Refresh rates and video conferencing solutions enhance user experience, while system integration brings cohesion to complex installations. Video walls and installation services provide visually engaging experiences, and power consumption remains a key consideration for energy-efficient solutions. Audio systems, from audio quality to remote monitoring and technical support, are integral to the Pro AV landscape. Firmware updates and signal processing ensure optimal performance, while AV over IP and streaming media expand accessibility.

LED lighting and cable management solutions contribute to efficient and visually appealing installations. Data analytics and control systems enable advanced functionality, with user experience at the forefront. Matrix switchers and interactive whiteboards offer interactive and customizable solutions. Maintenance contracts and cloud-based management streamline operations, while control protocols ensure compatibility and ease of use. Applications span industries, from houses of worship to digital signage and beyond. Continuous innovation drives the market forward, with ongoing advancements in networking, video conferencing, and system integration shaping the future of Pro AV.

How is this Pro AV Industry segmented?

The pro av industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Products

- Services

- Industry Application

- Entertainment

- Hospitality

- Retail

- Corporate

- Transportation

- Distribution Channel

- Online

- Offline

- Technology

- Wired Systems

- Wireless Systems

- Cloud-Based Solutions

- AI-Integrated Systems

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

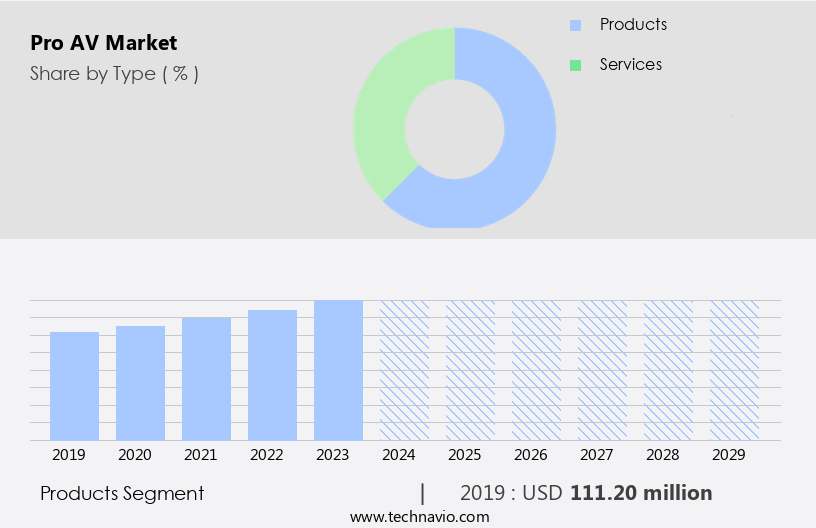

By Type Insights

The products segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven in part by the increasing adoption of digital signage in various industries. Digital signage, which delivers videos, web content, images, and texts on wide, bright displays, is used in retail, corporate settings, medical facilities, schools, libraries, transportation hubs, and hospitality venues, among others. These displays, which can be LCD or plasma, are controlled by PCs and servers using proprietary and public-domain software. Advancements in technology have led to the integration of audio systems, remote monitoring, data analytics, and AV over IP in digital signage solutions. Audio systems enhance the user experience, while remote monitoring and data analytics enable real-time performance tracking and optimization.

AV over IP allows for the distribution of audio and video content over a network, increasing flexibility and reducing the need for expensive cabling. Signal processing and refresh rate are crucial factors in ensuring high-quality display output. Video conferencing systems have become essential for remote communication and collaboration, driving demand for high-quality audio and video equipment. System integration and video walls are also becoming increasingly popular, requiring advanced signal distribution and matrix switching capabilities. Installation services and maintenance contracts ensure the smooth operation of Pro AV systems. Power consumption and audio quality are important considerations for businesses looking to reduce costs and improve the user experience.

LED lighting and technical support are also essential components of Pro AV solutions. Cloud-based management and cable management software solutions streamline the management and maintenance of Pro AV systems. Control systems and interactive whiteboards enable user-friendly control and collaboration. Control protocols and rack mounting ensure seamless integration and organization of Pro AV components. Houses of worship and other community spaces are also adopting Pro AV technology for improved communication and engagement. Overall, the market is dynamic and evolving, driven by advancements in technology and the growing demand for immersive and harmonious user experiences.

The Products segment was valued at USD 111.20 million in 2019 and showed a gradual increase during the forecast period.

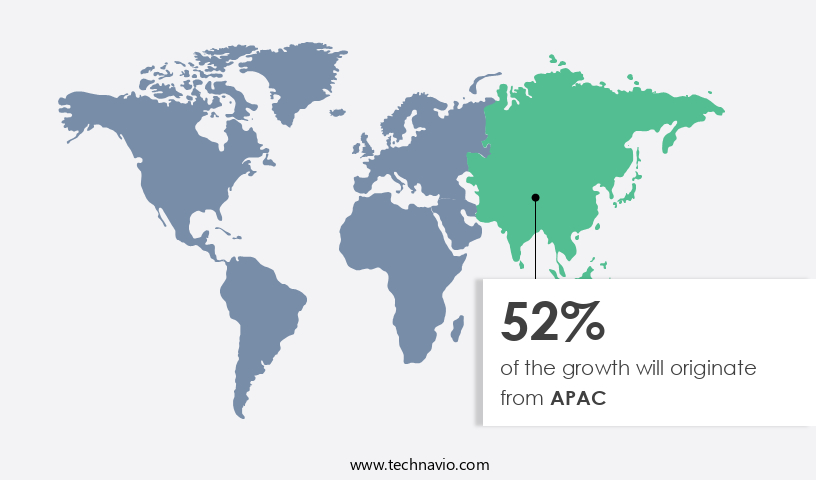

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth, driven by the expanding education sector and the increasing adoption of advanced tools in corporate environments. In classrooms, diagnostic tools and firmware updates ensure the optimal performance of audio systems and video conferencing equipment. Remote monitoring and data analytics enable educators to assess student engagement and progress in real-time, while AV over IP and signal processing enhance the user experience. Networking equipment and signal distribution solutions facilitate seamless communication and collaboration. The refresh rate and audio quality of video conferencing systems are crucial for immersive and harmonious virtual learning experiences.

Houses of worship and other institutions also utilize pro AV technology for streaming media, control systems, and interactive whiteboards. Maintenance contracts and cloud-based management systems ensure the longevity and efficiency of these installations. In the corporate sector, power consumption and cable management are essential considerations for large video walls and matrix switchers. The integration of LED lighting and technical support further enhances the functionality and aesthetics of pro AV systems. Control protocols and rack mounting ensure the seamless operation and organization of these complex setups. Government initiatives, such as those in China, prioritize the implementation of advanced pro AV technology to bridge the gap between rural and urban education.

This focus on improving access to quality education contributes to the market's growth. The corporate sector's increasing reliance on pro AV solutions for communication, collaboration, and productivity further fuels the market's expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market, a significant segment of the audio-visual industry, caters to professional applications, from broadcast and live events to corporate training and education. This market encompasses high-end equipment, including video walls, projectors, sound systems, and control systems. Integration of cutting-edge technologies like 4K resolution, virtual reality, and augmented reality is transforming the pro av landscape. Advanced features like real-time processing, networked systems, and customizable interfaces are in high demand. Collaboration tools, wireless connectivity, and easy-to-use software solutions are essential for seamless integration and operation. The market continues to evolve, driven by innovation and the ever-growing need for immersive and interactive experiences.

What are the key market drivers leading to the rise in the adoption of Pro AV Industry?

- The significant growth in the adoption of digital signage is the primary factor fueling market expansion.

- In the market, diagnostic tools and firmware updates play a crucial role in ensuring optimal performance of audio systems and signal processing for digital signage applications. Remote monitoring and data analytics enable businesses to efficiently manage their AV systems from a distance, enhancing the user experience. AV over IP technology is a significant trend, allowing for seamless integration and centralized control of AV systems. Interactive features, such as touchscreens and motion sensors, are increasingly popular, creating immersive and harmonious environments for audiences. The retail industry is a major adopter of digital signage, utilizing it to influence consumer behavior through dynamic content and promotions.

- These advancements in Pro AV technology underscore the industry's commitment to delivering engaging and effective communication solutions.

What are the market trends shaping the Pro AV Industry?

- Pro AV equipment training is an essential trend in the industry. As a professional, staying informed and skilled in this area is crucial for providing optimal solutions to clients.

- The market is witnessing significant growth due to the increasing demand for advanced networking equipment and signal distribution solutions. With the rise of video conferencing and video walls, there is a growing need for system integration and installation services. These technologies are essential for creating immersive and harmonious experiences in various sectors, including events and retail, education, and business. To meet this demand, established companies are offering comprehensive training programs to AV professionals. For instance, Seiko Epson's Pro AV Academy provides detailed knowledge of their latest AV technology to engineers, operators, sales personnel, and service engineers.

- This expertise enables AV professionals to effectively arrange, maintain, operate, and market these technologies across the pro AV rental sector. Power consumption is also a critical factor in the market, with companies focusing on developing energy-efficient solutions to reduce environmental impact and operating costs.

What challenges does the Pro AV Industry face during its growth?

- One-on-one learning holds significant importance and poses a notable challenge to the industry's growth due to its resource-intensive nature.

- The market is experiencing significant growth due to the increasing demand for immersive and harmonious audio-visual experiences in various sectors. One such sector is houses of worship, where high-quality audio and LED lighting are essential for creating an engaging and spiritual environment. Streaming media and control systems are also becoming increasingly popular, enabling remote access and management of AV systems. Technical support and maintenance contracts are crucial for ensuring the smooth operation of these complex systems. Cloud-based management solutions are gaining traction, offering easy access to real-time data and remote troubleshooting capabilities. The rise of one-on-one learning and homeschooling may negatively impact the demand for certain AV equipment, such as document cameras.

- However, the need for high-quality audio and visual experiences in remote learning environments remains strong. Overall, the market is expected to continue growing, driven by advancements in technology and the increasing demand for engaging and effective AV solutions.

Exclusive Customer Landscape

The pro av market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pro av market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pro av market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Samsung Electronics - Professionally, we deliver advanced pro AV solutions: Microphone & Sound Systems, Request to Speak, Pro Audio Systems, Assistive Listening, Acoustics Management. Enhancing communication effectiveness through technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Samsung Electronics

- Sony Corporation

- LG Electronics

- Panasonic Corporation

- Hitachi Ltd.

- Yamaha Corporation

- AVI-SPL Inc.

- AVI Systems Inc.

- Anixter International Inc. (Wesco International Inc.)

- Biamp Systems LLC

- Harman International Diversified

- Ford Audio-Video Systems LLC

- New Era Technology Inc.

- Solutionz Inc.

- Sennheiser Electronic GmbH & Co. KG

- Vistacom Inc.

- Professional Audio Visual Ltd.

- Almoe Digital Solutions

- Audinate Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pro AV Market

- In January 2024, Christie Digital Systems, a leading player in the market, announced the launch of its new line of 4K laser projectors, the Christie Mirage Quad X4K, at the Consumer Electronics Show (CES) (Christie Digital Systems press release, 2024). This innovative product development marks a significant leap in image quality and brightness for large-format installations.

- In March 2024, Panasonic and Sony formed a strategic partnership to collaborate on the development and production of Pro AV displays using OLED technology. This collaboration aims to combine Panasonic's expertise in Pro AV solutions and Sony's OLED technology to create high-performance, energy-efficient displays for various applications (Panasonic press release, 2024).

- In May 2024, Barco, a global technology company, acquired Videotec, a leading provider of pan-tilt-zoom cameras and PTZ control systems. This strategic acquisition strengthened Barco's position in the market by expanding its product portfolio and enhancing its capabilities in the video surveillance and control systems segment (Barco press release, 2024).

- In April 2025, the European Union passed the Audiovisual Media Services Directive, which set new standards for audio-visual media services, including those used in Pro AV applications. The directive focused on issues like media literacy, the protection of minors, and the promotion of European content (European Parliament press release, 2025). This regulatory development will impact the market by necessitating compliance with new content and technical requirements.

Research Analyst Overview

- In the professional audio-visual (Pro AV) market, wireless microphones have gained significant traction, enabling mobility and flexibility during presentations. Sensor integration is another trend, allowing systems to respond to environmental conditions and optimize performance. KVM switching and data encryption ensure secure remote access to AV equipment. Fiber optic cables facilitate long-distance transmission of 4k and 8k resolution signals for superior image quality. Sound design and voice control enhance user experience, while unified communications and collaboration tools foster seamless communication and productivity.

- Digital media players and video processing technologies enable high-quality content delivery. Room acoustics remain a crucial factor, with solutions like artificial intelligence and machine learning optimizing sound performance. Automation systems streamline operations, while wireless transmission technologies enable gesture recognition and lighting control. Audio mixing and media servers provide advanced functionality for large-scale installations. Interactive displays offer immersive experiences, further elevating the market's potential.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pro AV Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.4% |

|

Market growth 2025-2029 |

USD 180.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.6 |

|

Key countries |

US, China, UK, Canada, Japan, India, South Korea, Germany, France, Italy, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pro AV Market Research and Growth Report?

- CAGR of the Pro AV industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pro av market growth of industry companies

We can help! Our analysts can customize this pro av market research report to meet your requirements.