Video Surveillance Market Size 2025-2029

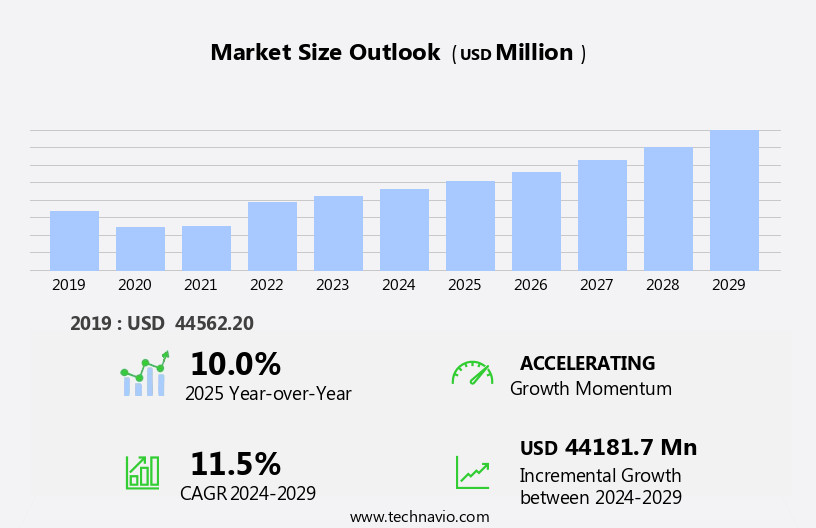

The video surveillance market size is forecast to increase by USD 44.18 billion, at a CAGR of 11.5% between 2024 and 2029.

- The market is driven by the pressing need to enhance security measures against criminal activities and terrorist attacks. The market is witnessing significant advancements with the advent of smart AI-based video surveillance systems. These advanced solutions offer improved image processing capabilities, facial recognition, and object detection, making them an essential tool for law enforcement and security agencies. However, the market faces challenges related to privacy concerns. As video surveillance becomes increasingly prevalent, there is growing apprehension regarding the misuse of personal data and potential breaches of privacy.

- This issue necessitates the development of robust data protection policies and transparency in data handling practices. Companies must navigate these challenges by implementing stringent data security measures and adhering to regulatory frameworks to build trust and maintain consumer confidence.

What will be the Size of the Video Surveillance Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the expanding application across various sectors. Artificial intelligence (AI) integration, such as intruder detection and pattern recognition, enhances security measures in public safety and transportation security. IP cameras, with high-definition video and remote monitoring capabilities, enable access control integration and license plate recognition. Frame rate optimization ensures smooth event logging and motion detection, while network video recorders and integration services facilitate cybersecurity standards and video surveillance standards. Deployment models, including cloud services and edge computing, offer cost optimization and real-time alerts. CCTV systems incorporate data encryption and image processing for retail analytics and compliance regulations.

Behavioral analysis and machine vision provide perimeter security, object tracking, and tamper detection. Smart home security systems offer mobile app access and low light performance, while maintenance and support services ensure system reliability. Software platforms and system design innovations, such as video archiving, behavioral analysis, and deep learning, advance video management and analytics capabilities. Weather resistance, traffic management, and field of view optimization cater to outdoor applications. Technical specifications, including frame rate, resolution, and hardware components, continue to improve, enhancing overall system performance. Ongoing advancements in AI, image processing, and cybersecurity standards shape the evolving video surveillance landscape.

How is this Video Surveillance Industry segmented?

The video surveillance industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Hardware

- Software

- Services

- End-user

- Public

- Commercial

- Residential

- Type

- IP video system

- Analog video system

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

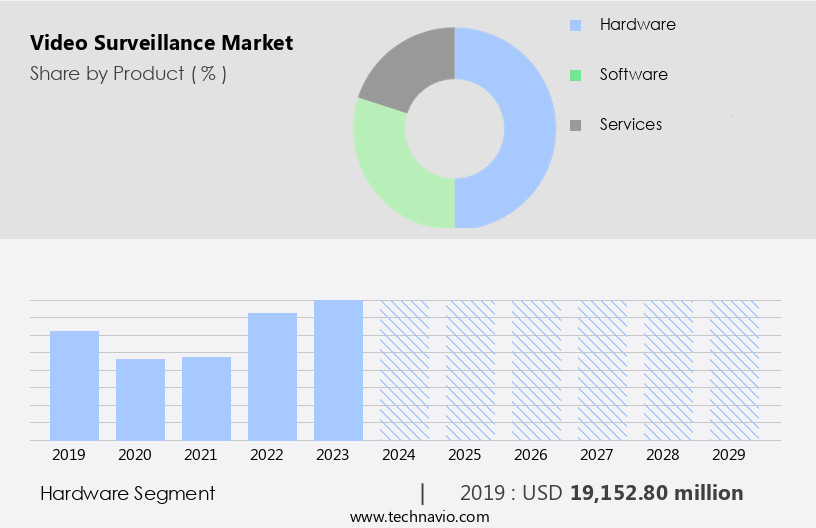

The hardware segment is estimated to witness significant growth during the forecast period.

Video surveillance solutions encompass various components, with cameras being the most essential element. IP cameras, a fusion of cameras and computers within a networked infrastructure, are widely utilized. These cameras possess their unique IP addresses, enabling remote access. Comprised of a lens, image sensor, memory, and processors, IP cameras offer image processing, compression, networking, and storage capabilities. Deployed for surveillance, they can be strategically placed within a network and transmit data efficiently to a select group of monitors via an IP network. High-definition video is a significant trend, with cameras delivering crisp, clear images. Project management software facilitates system design and integration with access control and license plate recognition.

Motion detection, event logging, and intruder detection are critical features. Network video recorders and integration services ensure seamless system functionality. Cybersecurity standards and video surveillance standards are crucial considerations, ensuring data privacy and system reliability. Weather resistance and traffic management are essential for outdoor installations. Field of view, frame rate, and low light performance are vital technical specifications. Software platforms and analytics dashboards provide behavioral analysis, machine vision, and retail analytics. Perimeter security, tamper detection, and smart home security enhance safety. Mobile app access and maintenance services ensure user convenience. Cloud services, cost optimization, and real-time alerts offer flexibility and efficiency.

Deep learning, computer vision, and artificial intelligence are transforming video surveillance, enabling advanced pattern recognition, object tracking, and facial recognition. Video archiving and compliance regulations ensure data retention and adherence to industry standards. Edge computing and data encryption secure data at the source. Video management software and hardware components, including NVRs, video encoders, and network infrastructure, form the backbone of video surveillance systems. Deployment models cater to various business needs, from transportation security to CCTV systems. Frame rate, intruder detection, and ROI analysis are essential performance metrics.

The Hardware segment was valued at USD 19.15 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

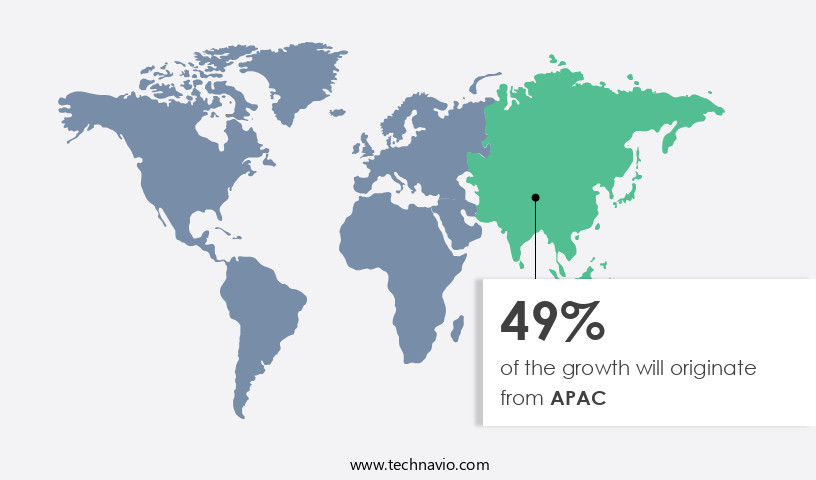

APAC is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to urbanization, industrialization, and increasing defense spending in countries like China and India. Beijing, China, leads the way in public video surveillance systems installation. Japan, South Korea, and Australia adopt video surveillance for advanced industries and citizen safety. Developed countries boast a mature end-user base, driven by industry standardization and public safety frameworks. In emerging economies, improving household incomes and heightened security awareness fuel demand for high-definition video systems and urban living. Video surveillance solutions are integrated with access control, project management, and cybersecurity standards. High-definition video, license plate recognition, event logging, motion detection, network video recorders, and integration services are essential components.

Edge computing, video archiving, behavioral analysis, machine vision, perimeter security, tamper detection, and smart home security are evolving trends. Low light performance, maintenance services, support services, cloud services, technical specifications, and deep learning are crucial considerations. Video management software, analytics dashboards, and video analytics provide valuable insights. Hardware components, such as ip cameras, frame rate, intruder detection, and pattern recognition, ensure optimal functionality. Compliance regulations, real-time alerts, facial recognition, and object tracking further enhance system capabilities. CCTV systems, data encryption, image processing, retail analytics, and installation services complete the comprehensive video surveillance landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Video Surveillance Industry?

- To effectively address criminal activities and terrorist threats, there is a significant market demand for solutions and services that enhance security and mitigate risks. This market trend is driven by the pressing need to ensure public safety and protect assets from potential harm.

- The demand for video surveillance solutions is escalating globally due to rising security concerns, particularly in the wake of increasing criminal and terrorist activities. According to recent data, there was a significant increase in crimes against children in India during 2024, as reported by the National Crime Records Bureau (NCRB). Furthermore, the number of terrorist attacks in countries like the US and the UK has underscored the need for advanced video surveillance systems. Governments worldwide are implementing stringent regulations mandating the installation of video surveillance systems in public areas such as hypermarkets, hospitals, airports, ports, railway stations, hotels, and malls to ensure public safety.

- These systems offer various features such as software platforms for system design, edge computing for real-time processing, video archiving for long-term storage, behavioral analysis using machine vision, tamper detection, mobile app access, and low light performance. Maintenance and support services, cloud services, and technical specifications are essential considerations for businesses and organizations seeking to implement video surveillance solutions. Key features include tamper detection to prevent unauthorized access and ensure system reliability, mobile app access for remote monitoring, and low light performance for effective surveillance in poorly lit environments. Additionally, cloud services enable remote access and storage, reducing the need for on-premises infrastructure.

- In conclusion, video surveillance solutions provide essential security benefits for businesses and organizations, enabling them to protect their assets, employees, and customers from criminal and terrorist threats.

What are the market trends shaping the Video Surveillance Industry?

- The emergence of advanced AI-driven video surveillance systems is currently shaping market trends. This technology enhances security capabilities by enabling more efficient monitoring and analysis of video footage.

- Artificial intelligence (AI) is revolutionizing video surveillance, moving beyond a passive deterrent to an intelligent tool for analyzing vast amounts of data. AI enables real-time analysis of live video streams with minimal human intervention, offering superior accuracy in facial, faceless, behavioral, and object detection. For instance, Intel's Movidius uses AI and deep learning for proactive surveillance, detecting unattended objects and monitoring behavior. Partnerships between Movidius and industry leaders like Hangzhou Hikvision Digital Technology and Dahua Technology will accelerate the adoption of AI-based video surveillance. IP cameras, a critical component of modern video surveillance systems, are increasingly integrating AI capabilities, including pattern recognition and intruder detection.

- Furthermore, advanced image processing techniques and data encryption ensure privacy and compliance with regulations. Retail analytics and transportation security are among the sectors benefiting from AI-driven video surveillance, providing valuable insights for business intelligence and enhancing safety and security. Real-time alerts and frame rate optimization are essential features for effective video surveillance, ensuring that businesses stay informed and responsive to potential threats.

What challenges does the Video Surveillance Industry face during its growth?

- The growth of the industry is significantly impacted by the complex issues surrounding privacy. It is essential for businesses to address these challenges in a professional and ethical manner to maintain consumer trust and compliance with regulations.

- Video surveillance has become an essential component of modern security systems, offering object tracking, security monitoring, and cost optimization. The market is driven by advancements in technology, including computer vision, video management software, and analytics dashboards. Video analytics and deep learning enable more accurate object identification and behavior analysis. Hardware components, such as high-definition analog cameras, ensure superior image quality. Cloud storage solutions offer scalability and cost savings, while computer vision algorithms facilitate automatic incident detection. Installation services ensure seamless integration and proper functionality. However, privacy concerns persist, as extensive video surveillance may infringe on individuals' right to anonymity.

- This raises ethical questions about the balance between security and privacy. The use of video surveillance systems must be transparent and respectful of individuals' privacy rights. In conclusion, the market is dynamic, driven by technological advancements and the need for enhanced security. It offers numerous benefits, including object tracking, security monitoring, and cost optimization. However, privacy concerns must be addressed to ensure the ethical use of these systems. The right to anonymity is a fundamental right that must be respected in the implementation of video surveillance systems.

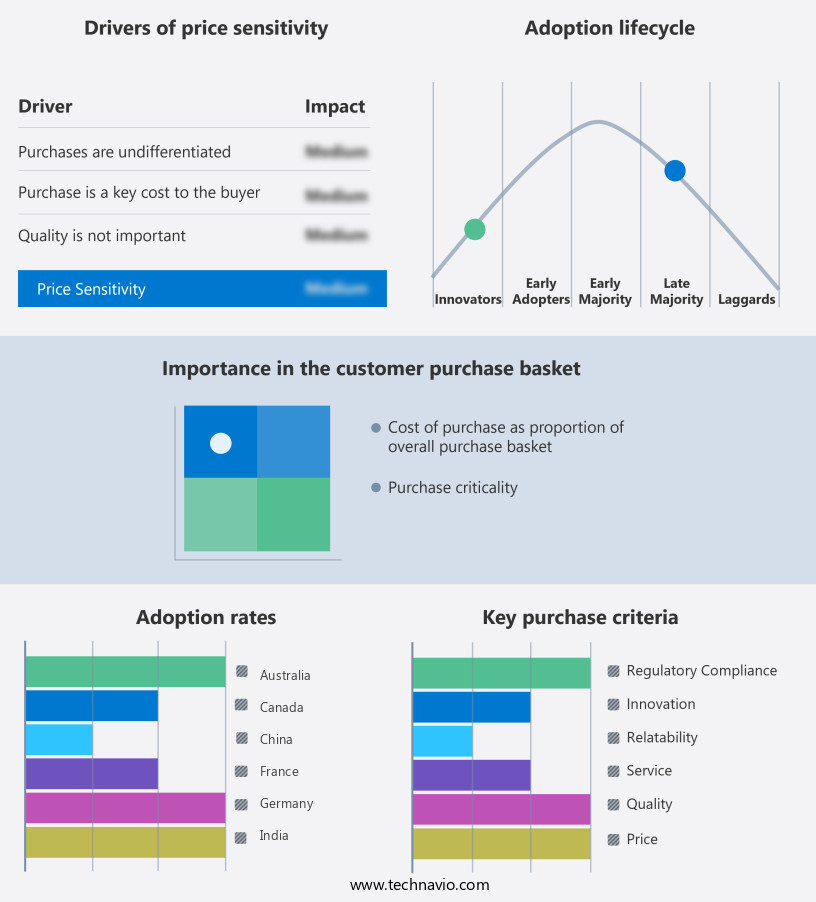

Exclusive Customer Landscape

The video surveillance market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the video surveillance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, video surveillance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agent Video Intelligence Ltd. - The company specializes in advanced video surveillance solutions, including the innovative innoVi technology. This system leverages artificial intelligence and machine learning algorithms to provide real-time analytics and actionable insights. By continuously monitoring and assessing video feeds, innoVi enhances security measures, enabling proactive response to potential threats. This intelligent solution adaptively learns normal behavior patterns, minimizing false alarms and maximizing efficiency. With a commitment to staying at the forefront of technology, the company's video surveillance solutions empower businesses to protect their assets and maintain a secure environment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agent Video Intelligence Ltd.

- Canon Inc.

- Costar Technologies Inc.

- CP PLUS International

- Dahua Technology Co. Ltd.

- Genetec Inc.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Hanwha Corp.

- Hexagon AB

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- i PRO Co. Ltd.

- Motorola Solutions Inc.

- NEC Corp.

- Robert Bosch GmbH

- Teledyne Technologies Inc.

- Tiandy Technologies Co. Ltd.

- Zhejiang Uniview Technologies Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Video Surveillance Market

- In February 2023, Hikvision, a leading player in the market, unveiled its latest AI-powered cameras, featuring advanced analytics capabilities and improved low-light performance (Hikvision Press Release). This development underscores the growing trend towards smarter, more sophisticated surveillance systems.

- In May 2024, Bosch and Google announced a strategic partnership to integrate Google Cloud's AI capabilities into Bosch's video surveillance solutions. This collaboration aims to enhance security systems with advanced analytics and real-time threat detection (Bosch Press Release).

- In August 2024, Honeywell completed the acquisition of Elster, a leading provider of gas and water metering technologies. This strategic move is expected to expand Honeywell's offerings in the smart city segment, including video surveillance and energy management solutions (Honeywell Press Release).

- In November 2025, the European Union approved new data protection regulations, imposing stricter rules on video surveillance systems, including clearer consent requirements and stronger data security measures. This development is a significant shift towards privacy-focused surveillance systems (European Commission Press Release).

Research Analyst Overview

- The market encompasses various technologies, including night vision cameras, dome cameras, PTZ cameras, bullet cameras, and panoramic cameras, among others. One emerging trend is the integration of edge-based video analytics, enabling real-time object detection, pedestrian detection, and vehicle detection. This technology enhances security incident management by providing quicker response times and reducing false alarms. Vulnerability assessments and security audits are crucial components of the market, ensuring security hardening and risk assessment. Threat intelligence and penetration testing are essential for proactive cyber threat detection, while predictive analytics offers insights into potential security incidents. Cloud-based video analytics and multi-sensor cameras expand the capabilities of video surveillance, offering business intelligence and crowd management.

- Underwater cameras and drone surveillance cater to specific industries, such as marine security and border patrol. Active deterrence, including bullet cameras and thermal cameras, plays a vital role in preventing security breaches. Security incident response and data analysis are integral parts of the market, enabling organizations to effectively address and learn from security incidents.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Video Surveillance Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.5% |

|

Market growth 2025-2029 |

USD 44.18 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.0 |

|

Key countries |

US, China, Japan, India, South Korea, Canada, UK, Australia, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Video Surveillance Market Research and Growth Report?

- CAGR of the Video Surveillance industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the video surveillance market growth of industry companies

We can help! Our analysts can customize this video surveillance market research report to meet your requirements.