Produced Water Treatment Market Size 2024-2028

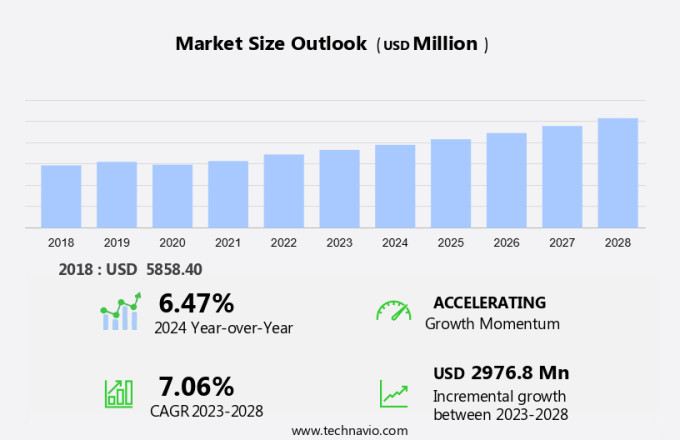

The produced water treatment market size is forecast to increase by USD 2.98 billion at a CAGR of 7.06% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. The increasing global concerns regarding water scarcity and the need for freshwater usage in various industries are major factors fueling market growth. Additionally, the rise in unconventional gas resources, such as shale formations, has led to an increase in produced water generation. This water must be treated before it can be safely disposed of or reused, creating a demand for advanced water treatment technologies. Furthermore, the increasing use of renewable energy sources, particularly in oil and gas operations, is driving the adoption of membrane filtration and electrocoagulation techniques for produced water treatment. Population growth and urbanization are also putting pressure on freshwater resources, making the treatment and reuse of produced water an essential solution for meeting future water demands. Overall, the market is expected to continue growing as companies seek sustainable and cost-effective solutions for managing produced water.

The produced water market is witnessing significant growth due to the increasing oil & gas exploration activities. Urbanization and population growth in various regions have led to an increase in the demand for fossil fuels, resulting in a wave in crude oil and natural gas production. This, in turn, leads to the generation of large volumes of produced water. Produced water contains impurities such as oil droplets, sediments, mud particles, heavy metal particles, salts, hydrocarbons, and organic compounds. Regulatory requirements, water scarcity, environmental concerns, freshwater usage, and energy consumption are some of the key factors driving the demand for produced water treatment.

Moreover, membrane filtration and electrocoagulation are the most commonly used treatment technologies for producing water. These technologies help in removing impurities and making the water suitable for reuse or disposal. The oil and gas industry generates produced water from oil and gas reservoirs, and it also enters the water stream through river streams during transportation and industrial activities. Therefore, the market is expected to grow significantly in the coming years.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Onshore

- Offshore

- Technology

- Secondary treatment

- Primary treatment

- Tertiary treatment

- Geography

- North America

- US

- Europe

- Middle East and Africa

- South America

- Brazil

- APAC

- North America

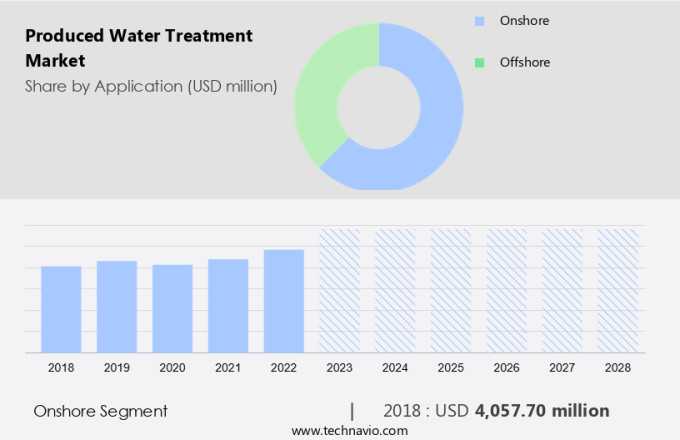

By Application Insights

The onshore segment is estimated to witness significant growth during the forecast period. The market in the onshore segment is projected to expand at a steady pace over the upcoming years. Onshore oil and gas production has been the primary contributor to global production, making the onshore segment a significant market for produced water treatment. The wave in shale gas production in the US, particularly in recent years, has significantly boosted the demand for produced water treatment. During shale gas extraction, vast quantities of water are utilized for hydraulic fracturing, resulting in the production of large volumes of water containing oil droplets, sediments, mud particles, heavy metal particles, salts, hydrocarbons, and organic compounds.

Moreover, the produced water, which emerges at the surface, requires treatment to meet regulatory standards and to minimize environmental impact. This high volume of produced water in the US, driven by its shale gas boom, has resulted in a high water-oil ratio (WOR), making the market a vital sector in the country.

Get a glance at the market share of various segments Request Free Sample

The onshore segment was valued at USD 4.05 billion in 2018 and showed a gradual increase during the forecast period.

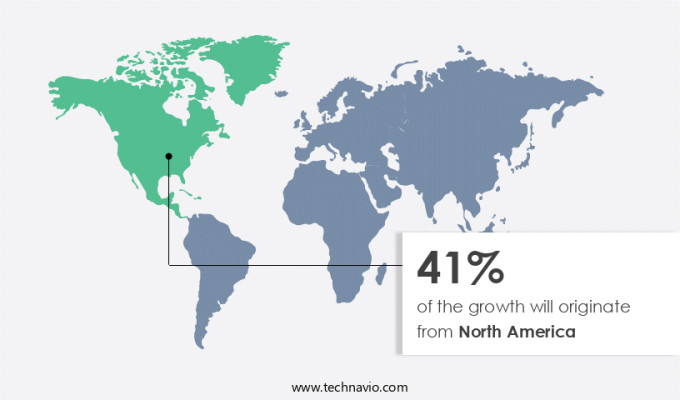

Regional Insights

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The United States and Canada are significant contributors to oil and gas production in North America, with the US being the world's largest crude oil producer. With the maturity of many oilfields in the US and the expansion of the shale gas industry, there is an increase in the generation of produced water. This water contains oil droplets, sediments, mud particles, heavy metal particles, salts, hydrocarbons, and organic compounds. To address the challenges posed by this wastewater, companies in the region are advancing their oil and gas exploration technologies, leading to improved produced water treatment solutions. These innovations will help manage the produced water more effectively and mitigate potential environmental concerns.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing global concerns regarding water scarcity are the key drivers of the market. The depletion of global water resources is a pressing issue, with over 2 billion people currently lacking access to safe drinking water according to the UN's 2022 World Water Development Report. With population growth projected to increase by nearly one-third by 2050, the demand for water is anticipated to rise significantly. The UN defines water stress as occurring when a country's water availability falls below 1,700 m3/year or 4,600 liters/day per person. Absolute water scarcity is considered for countries with less than 500 m3/year or approximately 1,400 liters/day per person. The oil & gas exploration industry, urbanization, population growth, transportation, and industrial activities are major contributors to the increasing demand for water. The produced water generated from the extraction of crude oil and natural gas exacerbates this issue. Effective produced water treatment is crucial to mitigate the strain on already limited water resources.

Market Trends

The rise in unconventional oil and gas resources is the upcoming trend in the market. The oil and gas industry is witnessing a shift towards unconventional resources, such as tight oil, shale gas, coalbed methane, and oil from unconventional sources. These resources are located in low permeability formations, including limestone, carbonates, siltstones, and fine-grained organic-rich rock. The extraction of these resources necessitates advanced well completion and stimulation methods, including hydraulic fracturing and acidizing. With the rise of unconventional oil and gas exploration, population growth and urbanization in various regions are driving the demand for these resources. Fossil fuels, including crude oil and natural gas, continue to play a significant role in transportation and industrial activities.

However, the extraction of unconventional resources requires vast amounts of water, making water management services essential. As the share of oil and gas extracted from unconventional sources is projected to increase significantly over the next decade, the need for effective water management solutions will become even more critical. The urbanization and population growth in areas with unconventional resources will further increase the demand for these services. Therefore, the market for produced water treatment is expected to grow substantially in the coming years.

Market Challenge

Increasing use of renewable energy sources is a key challenge affecting the market growth. Fossil fuels, primarily crude oil, and natural gas have historically met the world's energy demands. However, over the past two decades, there has been a significant shift in the global energy landscape. Renewable energy sources, such as wind and solar, are increasingly becoming competitive in terms of cost and are producing lower greenhouse gas emissions compared to fossil fuels. This trend is being driven by urbanization, population growth, and the increasing demand for transportation and industrial activities. Europe, in particular, is making strides towards decarbonization with a firm commitment to the Paris Agreement of 2015. The European Union aims to generate 35% of its power from renewable sources by 2030. This transition towards renewable energy is a response to the need for a more sustainable and low-carbon energy future.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alderley Plc - The company offers produced water treatment solutions such as AP20 Hydrocyclone Liner. Also, the company offers gas metering systems, turbine meters, and de-oiling and de-sanding hydro-cyclone equipment.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aker Solutions ASA

- Aquatech International LLC

- Baker Hughes Co.

- Enviro Tech Systems

- Exterran Corp.

- Frames Energy Systems BV

- Genesis Water Technologies Inc.

- Halliburton Co.

- IDE Water Technologies

- Minerals Technologies Inc.

- NOV Inc.

- Ovivo Inc.

- Prosep Inc.

- Schlumberger Ltd.

- Siemens Energy AG

- SUEZ SA

- TechnipFMC plc

- Veolia Environnement SA

- Weatherford International Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The produced water market in the oil & gas exploration industry is experiencing significant growth due to urbanization and population growth, leading to increased demand for fossil fuels such as crude oil and natural gas. Produced water, which is water that comes up with oil and natural gas during extraction, contains various contaminants like oil droplets, sediments, mud particles, heavy metal particles, salts, hydrocarbons, and organic compounds. These contaminants pose environmental concerns when discharged into water bodies, leading to stringent regulations. Well exploration projects result in large volumes of produced water, which requires compliance with regulatory requirements for disposal.

Moreover, the traditional methods like saltwater disposal wells and lined evaporation pits have been used, but innovative treatment solutions are gaining popularity to reduce the environmental impact. Advanced treatment technologies like membrane filtration, electrocoagulation, and chemical treatment processes are being adopted to remove harmful contaminants from produced water. Environmental concerns, water scarcity, and freshwater usage are driving the demand for efficient and cost-effective water treatment methods. The oil & gas reservoirs and river streams are the primary sources of produced water, and the wastewater industry is also adopting these advanced treatment technologies to address the challenges of handling large volumes of contaminated water.

Further, the focus on productivity, water table management, and filtration techniques like flotation is essential for the sustainable use of produced water. Siemens Energy and other leading players are investing in research and development to provide efficient and eco-friendly produced water treatment solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.06% |

|

Market growth 2024-2028 |

USD 2.97 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.47 |

|

Regional analysis |

North America, Europe, Middle East and Africa, South America, and APAC |

|

Performing market contribution |

North America at 41% |

|

Key countries |

US, Russia, Saudi Arabia, United Arab Emirates, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aker Solutions ASA, Alderley Plc, Aquatech International LLC, Baker Hughes Co., Enviro Tech Systems, Exterran Corp., Frames Energy Systems BV, Genesis Water Technologies Inc., Halliburton Co., IDE Water Technologies, Minerals Technologies Inc., NOV Inc., Ovivo Inc., Prosep Inc., Schlumberger Ltd., Siemens Energy AG, SUEZ SA, TechnipFMC plc, Veolia Environnement SA, and Weatherford International Plc |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Middle East and Africa, South America, and APAC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch