Raw Coffee Beans Market Size 2025-2029

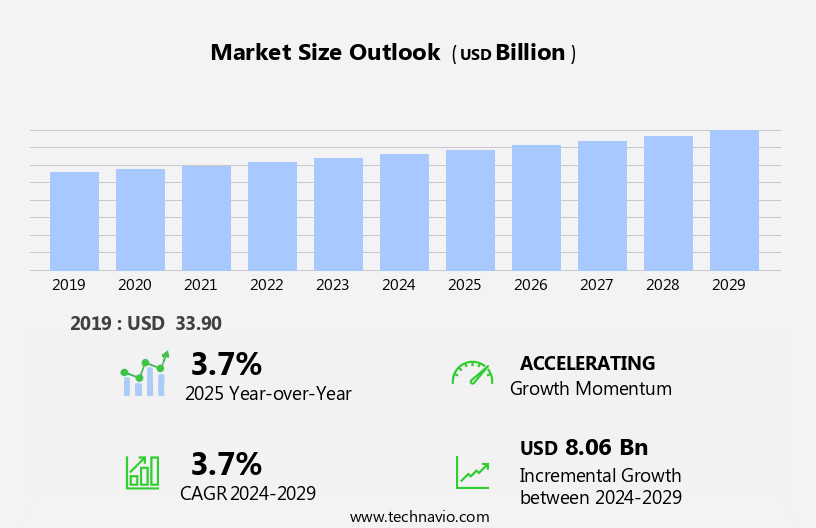

The raw coffee beans market size is forecast to increase by USD 8.06 billion at a CAGR of 3.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing number of cafes worldwide and the rising demand for sustainable and ethically sourced coffee beans. Furthermore, consumers are increasingly conscious of the environmental and social impact of their coffee consumption, leading to a preference for beans that are ethically sourced and grown sustainably. However, the market faces challenges, primarily in the form of price volatility for raw coffee beans.

- The prices of raw coffee beans have been notoriously unstable, with fluctuations influenced by various factors such as weather conditions, political instability, and economic factors. This volatility can pose significant challenges for coffee roasters and retailers, requiring them to manage their inventory and pricing strategies effectively to mitigate the impact of price fluctuations on their profitability. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay informed of market trends, build strong relationships with coffee bean suppliers, and adopt flexible pricing strategies to respond to price fluctuations.

What will be the Size of the Raw Coffee Beans Market during the forecast period?

- The market continues to evolve, shaped by dynamic market forces and shifting consumer preferences. Shade-grown coffee, specialty coffee, and Organic Coffee are gaining traction, with a focus on sustainability and traceability becoming increasingly important. Coffee capsules and ground coffee are popular formats in the convenience-driven consumer landscape. Sustainability is a key concern for coffee growers, leading to initiatives like bird-friendly coffee and fair trade certifications. Coffee bean density and cupping play crucial roles in determining bean quality. Coffee importers and exporters navigate complex logistical challenges, including storage and transportation, to ensure timely delivery of seeds. Coffee roasters and blenders innovate to meet diverse consumer demands, from filter coffee to cold brew and instant varieties. The market's continuous unfolding is shaped by ongoing efforts to improve seeds quality, enhance sustainability, and cater to evolving consumer tastes.

How is this Raw Coffee Beans Industry segmented?

The raw coffee beans industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Arabica

- Robusta

- Method

- Wet/Washed process

- Dry/Natural process

- Honey process

- Grade

- Specialty Grade

- Commercial Grade

- Premium Grade

- Consumer Segment

- Commercial (Cafes

- Roasters)

- Household

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

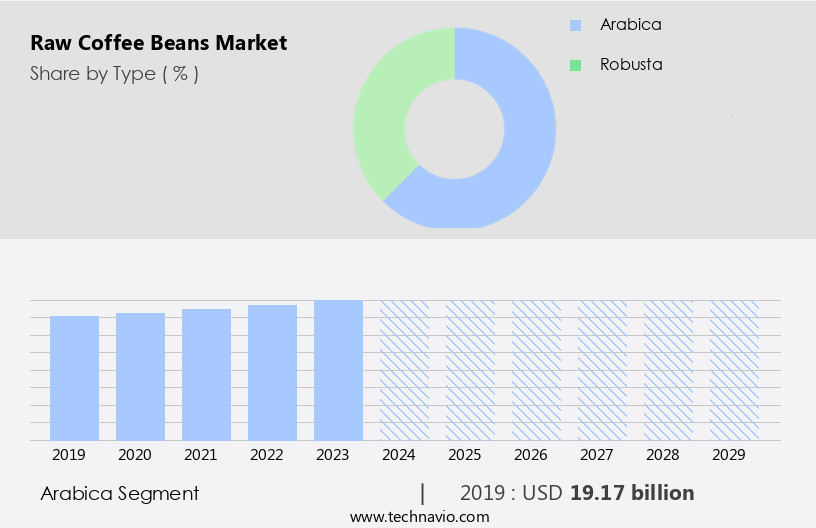

The arabica segment is estimated to witness significant growth during the forecast period.

The global coffee market is driven by the increasing preference for specialty coffee, particularly Arabica beans, among consumers, especially in developed countries. Arabica beans, known for their superior taste and lower caffeine content, are highly sought after for their smooth and mild flavor profile. The gourmet coffee shop and café industry's growing popularity, which prioritizes Arabica-based blends, further boosts demand. Arabica coffee is primarily cultivated in regions such as Latin America, with Brazil being the world's largest producer, followed by Colombia and its renowned Medellin beans. Sustainability is a significant factor in the coffee industry, with a growing emphasis on fair trade, organic, and shade-grown coffee.

Coffee cooperatives and direct trade initiatives also play a crucial role in ensuring fair prices for coffee farmers. The coffee supply chain involves various entities, including coffee growers, importers, exporters, roasters, and retailers. Coffee beans undergo various processes, such as grading, cupping, and storage, to ensure optimal quality. The market also caters to various coffee consumption preferences, including ground, whole bean, filter, cold brew, and instant coffee, as well as various coffee pod and capsule systems. Coffee bean traceability and sustainability are essential factors for consumers, leading to an increased focus on transparency and ethical sourcing. The coffee industry continues to evolve, with emerging trends such as bird-friendly and single-origin coffee, Cold Brew Coffee, and the increasing popularity of coffee capsules and pods.

The Arabica segment was valued at USD 19.17 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

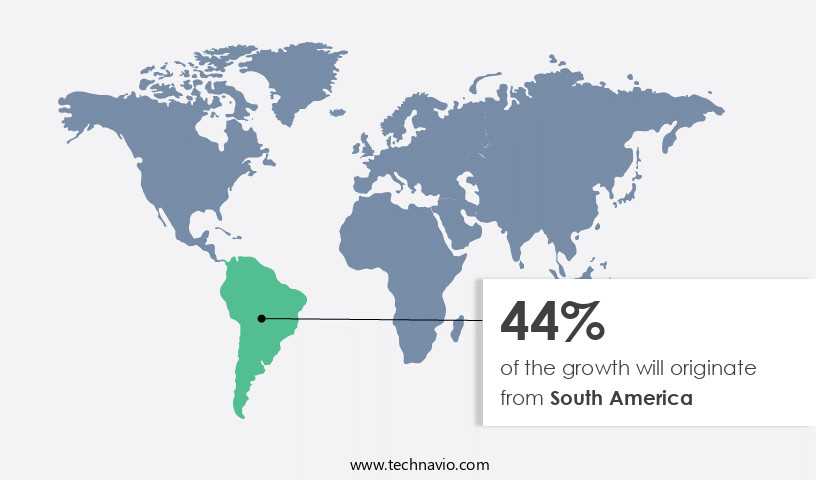

South America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The South American the market is experiencing significant growth due to the region's optimal conditions for coffee cultivation. With extensive coffee-growing areas and a diverse range of coffee varieties, South America dominates the global market. Brazil, Colombia, and Peru are notable countries in the region, benefiting from ideal altitude, temperature, and rainfall for producing high-quality Arabica and robusta beans. Coffee certification, such as fair trade and organic, plays a crucial role in the market. Consumers increasingly demand sustainable and ethically sourced coffee, leading to a rise in demand for certified beans. Coffee cooperatives and direct trade relationships between farmers and roasters further support this trend.

Coffee packaging, including bags and capsules, is essential for preserving the beans' freshness and quality during transportation and storage. Roasters and importers rely on efficient transportation and storage methods to maintain the beans' integrity. Sustainable and shade-grown coffee, specialty coffee, and various roast types, such as filter, cold brew, and instant, cater to diverse consumer preferences. Coffee bean defects and grading are essential considerations for ensuring consistent product quality. In conclusion, the South American the market is thriving due to the region's ideal growing conditions, diverse coffee varieties, and increasing consumer demand for sustainable and ethically sourced beans. The market is dynamic, with various players, including coffee growers, cooperatives, importers, exporters, roasters, and packaging providers, contributing to its growth and evolution.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Raw Coffee Beans Industry?

- The expanding number of cafes globally serves as the primary catalyst for market growth.

- The global coffee market is experiencing significant growth due to the increasing preference for coffee consumption and the cultural significance of coffee shops, particularly in urban areas. This trend is driving the demand for high-quality raw coffee beans, including whole bean coffee and roasted coffee. The rise of cafes and service outlets has become a necessity for the growing population and workforce in various industries. Coffee farmers and direct trade partnerships play a crucial role in supplying these coffee beans, ensuring their quality and ethical production. However, the presence of defects in coffee beans can impact the final taste and quality of the coffee, making it essential to maintain stringent quality control measures.

- The size of coffee beans can also influence the roasting process and final taste, adding another layer of complexity to the coffee production process. Overall, the coffee market is characterized by its dynamic nature, with various factors influencing its growth and trends.

What are the market trends shaping the Raw Coffee Beans Industry?

- The increasing preference for sustainably and ethically sourced coffee beans reflects a significant market trend. This demand signifies a shift towards more conscious and responsible consumer choices in the coffee industry.

- The coffee industry is witnessing a significant shift towards sustainability and ethical practices, driven by increasing consumer consciousness. Deforestation, habitat loss, and exploitation of coffee farmers are pressing issues that consumers are increasingly concerned about. In response, they are seeking assurance that their coffee purchases support environmentally friendly cultivation methods and fair treatment of farmers and workers along the supply chain. Certifications such as Fair Trade, Rainforest Alliance, and Organic have gained prominence as indicators of responsible purchasing decisions. These certifications ensure that coffee beans are sourced in a manner that promotes fair wages, safe working conditions, and environmental conservation.

- Coffee cooperatives and direct trade relationships between coffee growers and roasters are also on the rise, allowing for more transparency and better prices for farmers. Green coffee, which is unroasted coffee beans, is often packaged in jute or other sustainable coffee bags to minimize the environmental impact of packaging. Coffee blenders are also incorporating sustainable practices, such as using renewable energy sources and reducing waste, to meet consumer demand for eco-friendly products. The trend towards sustainable coffee is expected to continue, with Coffee Pods, a convenient but often wasteful coffee brewing method, also exploring more sustainable options.

- Overall, the coffee industry is evolving to meet the changing needs and values of consumers, prioritizing sustainability and ethical practices throughout the supply chain.

What challenges does the Raw Coffee Beans Industry face during its growth?

- The volatility in the prices of raw coffee beans poses a significant challenge to the growth of the coffee industry. This market instability, characterized by fluctuations in the cost of unroasted coffee beans, presents a formidable obstacle for industry expansion and profitability.

- Coffee farming faces challenges due to price volatility, making it difficult for farmers to plan and invest in sustainable practices. Unpredictable coffee prices can discourage farmers from expanding production or improving quality, impacting overall supply capacity. This instability also affects traders, exporters, and roasters, disrupting business planning and increasing financial risks. The uncertainty can lead market participants to hesitate in engaging in long-term contracts or investments, reducing market liquidity and efficiency. Consumers and businesses seeking high-quality coffee, such as specialty coffee, organic coffee, and coffee capsules, can benefit from initiatives promoting coffee bean sustainability, traceability, and cupping.

- Shade-grown coffee, which offers environmental benefits, is gaining popularity among specialty coffee buyers. Market dynamics remain complex, requiring continuous monitoring and adaptation to ensure profitability and financial stability across the coffee supply chain.

Exclusive Customer Landscape

The raw coffee beans market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the raw coffee beans market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, raw coffee beans market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Nestlé S.A. - The company specializes in providing a selection of raw coffee beans, including ,honey processed, and naturally processed varieties. These beans undergo meticulous processing methods to preserve their unique flavors and aromas. The Robusta beans undergo a washing process, while honey processed beans are dried with honeyed water, imparting a distinct sweetness. Naturally processed beans are sun-dried, retaining their original taste profile. By sourcing and offering these diverse beans, we cater to the discerning palates of coffee connoisseurs worldwide. Our commitment to quality and authenticity sets US apart in the global coffee market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Nestlé S.A.

- Starbucks Corporation

- JAB Holding Company

- The Kraft Heinz Company

- Olam International

- Louis Dreyfus Company

- Sucafina SA

- Volcafe Ltd.

- Neumann Kaffee Gruppe

- Ecom Agroindustrial Corp. Ltd.

- Mercon Coffee Group

- Coex Coffee International

- INTL FCStone Inc.

- Cofco International

- Trung Nguyen Group

- Itochu Corporation

- Mitsui & Co. Ltd.

- Tata Coffee Ltd.

- Jacobs Douwe Egberts

- UCC Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Raw Coffee Beans Market

- In February 2024, Nestlé, the global food and beverage company, announced the acquisition of a 40% stake in Blue Bottle Coffee, a leading specialty Coffee Roaster based in the United States. This strategic partnership aimed to strengthen Nestlé's presence in the premium coffee market and expand its offerings (Nestlé Press Release, 2024).

- In March 2025, Starbucks Corporation, the world's largest coffeehouse chain, launched its new line of nitro cold brew coffee in cans, marking a significant expansion of its product portfolio. This innovation targeted the growing demand for ready-to-drink coffee beverages and increased competition in the market (Starbucks Press Release, 2025).

- In August 2024, the Colombian Coffee Growers Federation and the National Federation of Coffee Growers of El Salvador signed a memorandum of understanding to collaborate on improving the quality and sustainability of their coffee production. This collaboration represented a key geographic expansion and a significant step towards enhancing the global coffee industry's sustainability practices (Colombian Coffee Growers Federation Press Release, 2024).

- In October 2025, the European Union approved a new regulation on organic production and labeling of coffee. The regulation set stricter standards for the use of the "organic" label, aiming to ensure authenticity and transparency in the market. This regulatory approval marked a significant shift in consumer trust and demand for organic coffee products (European Commission Press Release, 2025).

Research Analyst Overview

The market experiences significant volatility due to various factors, including disease and pest outbreaks, weather conditions, and global supply and demand dynamics. Coffee culture continues to evolve, with coffee education and training playing a crucial role in enhancing the skills of coffee baristas and retailers. Coffee development is a constant pursuit, with innovation in coffee technology and processing methods driving industry advancements. Coffee e-commerce platforms have gained traction, allowing consumers to purchase coffee beans, brewing equipment, and accessories with ease. Coffee consumption trends shift as consumers explore new brewing methods and seek out unique coffee experiences. Coffee investment remains a popular choice for those seeking to capitalize on price fluctuations in the market.

Coffee agronomics and research are essential to addressing challenges such as disease and pest management and improving coffee crop yields. Coffee subscription services offer consumers a convenient and personalized way to enjoy a regular supply of freshly roasted beans. Coffee retail, shops, restaurants, and cafes remain key players in the market, providing diverse coffee experiences for consumers. Coffee brewing equipment, from kettles to grinders to coffee makers, continues to evolve to meet the demands of coffee enthusiasts. Coffee gift sets and filters cater to the growing market for coffee accessories. Coffee trends, such as cold brew and nitro coffee, add excitement to the industry.Speculation and technology play a role in shaping the future of the coffee market. Coffee processing and roasting techniques also impact the final product's flavor and quality.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Raw Coffee Beans Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.7% |

|

Market growth 2025-2029 |

USD 8.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.7 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Raw Coffee Beans Market Research and Growth Report?

- CAGR of the Raw Coffee Beans industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across South America, APAC, Middle East and Africa, North America, and Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the raw coffee beans market growth of industry companies

We can help! Our analysts can customize this raw coffee beans market research report to meet your requirements.