Instant Coffee Market Size 2025-2029

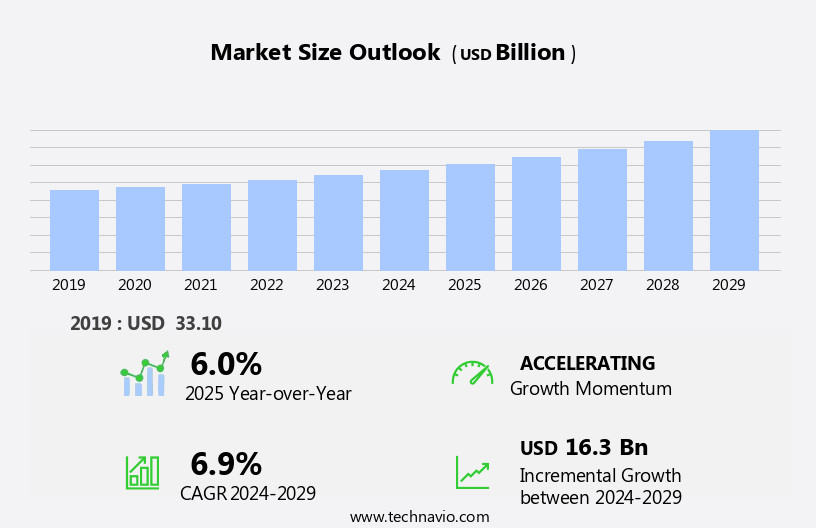

The instant coffee market size is forecast to increase by USD 16.3 billion at a CAGR of 6.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of instant coffee among millennials and the rising trend of preparing instant espresso coffee at homes. This demographic shift, coupled with the convenience and affordability of instant coffee, is fueling market expansion. However, the market faces challenges from substitute products, including traditional coffee and tea, which continue to compete for consumer preferences. To capitalize on market opportunities, companies must focus on product innovation, such as improving taste and texture, and expanding their reach through strategic partnerships and distribution channels.

- Additionally, addressing consumer concerns regarding sustainability and ethical sourcing will be crucial for long-term success. Overall, the market presents a compelling opportunity for companies to meet the evolving needs of modern consumers while navigating the competitive landscape.

What will be the Size of the Market during the forecast period?

- The market experiences continuous growth, driven by evolving consumer preferences and busy lifestyles. This market encompasses various segments, including single-serve formats, home consumption, and specialty offerings. Freeze-drying technology plays a crucial role in enhancing the taste and quality of instant coffee, making it a viable alternative to traditional brewed coffee. Packaging innovations, such as stand-up pouches and single-serve sachets, cater to the convenience-oriented consumers. Multinational players and local craft brands alike capitalize on the market's potential, offering unique flavors and functional properties.

- Single-origin coffee and premium blends cater to the increasing demand for high-quality instant coffee. Consumer preferences for coffee consumption patterns continue to shift, with online retailing gaining popularity. The working population's reliance on instant coffee as a quick and convenient solution fuels the market's expansion. Overall, the market is poised for significant growth, with various trends shaping its future.

How is this Instant Coffee Industry segmented?

The instant coffee industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Spray-dried

- Freeze-dried

- Distribution Channel

- Offline

- Online

- Flavor

- Flavored

- Non-flavored

- Packaging

- Jars

- Pouches

- Sachets

- Bulk packaging

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- UK

- North America

- US

- Canada

- South America

- Brazil

- Middle East and Africa

- APAC

By Product Insights

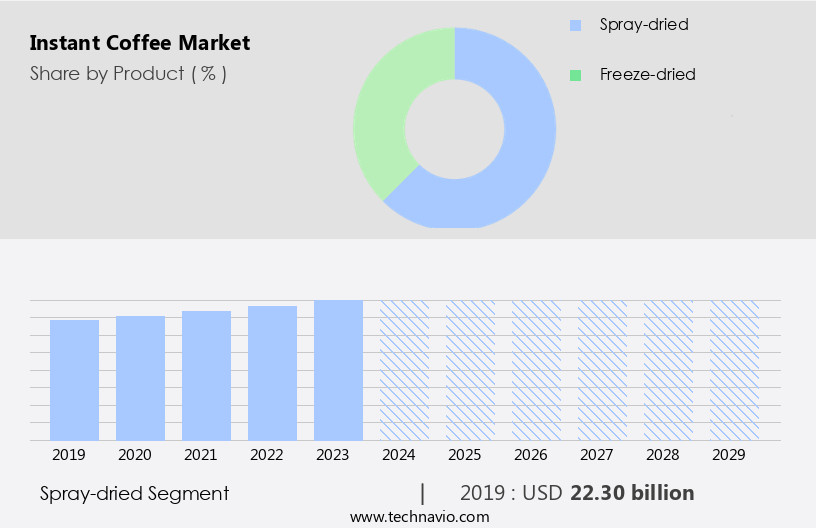

The spray-dried segment is estimated to witness significant growth during the forecast period. The market is driven by the increasing preference for convenience among busy consumers and the growing popularity of single-serve formats. Spray drying is the dominant method used in instant coffee production, accounting for a significant market share. This process involves spraying coffee extract into hot air, which transforms it into fine powder that is later agglomerated into granules. The affordability and time-saving benefits of spray-dried instant coffee make it a preferred choice for many consumers. Additionally, packaging innovations, such as single-serve packets and coffee pods, have contributed to the market's growth. Consumer preferences for unique flavors, functional properties, and premium blends have also influenced the market.

Get a glance at the market report of share of various segments Request Free Sample

The spray-dried segment was valued at USD 22.30 billion in 2019 and showed a gradual increase during the forecast period.

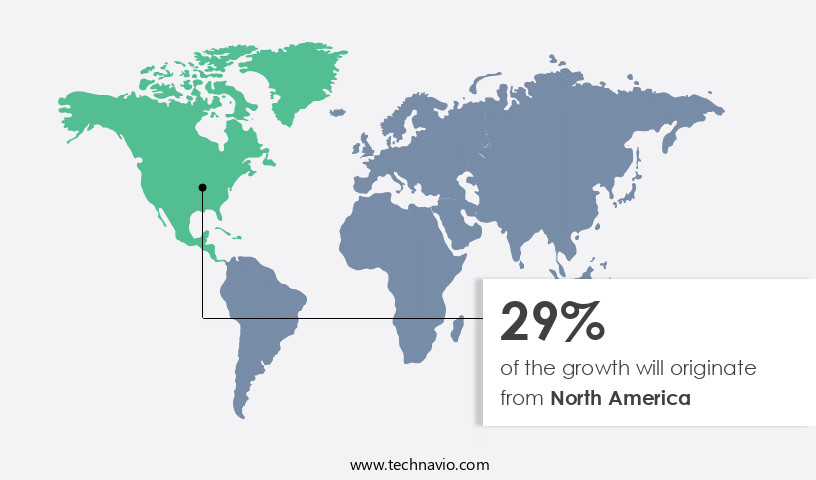

Regional Analysis

North America is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Asia Pacific (APAC) region, including China, Japan, South Korea, Australia, Malaysia, the Philippines, Vietnam, India, Taiwan, Thailand, Singapore, and Indonesia, presents significant growth opportunities for instant coffee companies. Major players in the APAC market in 2024 included Nestle, Unilever, Starbucks, Tata Global Beverages, and LUIGI LAVAZZA. Single-serve packets, such as those offered by Nestle, have gained popularity due to their affordability and convenience. Consumers appreciate the ability to sample new flavors without committing to larger packs, leading to strong demand for instant coffee in homes, cafes, hotels, and restaurants. Additionally, these packets cater to busy lifestyles, making them a preferred choice for the working population.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Instant Coffee Industry?

- Raising popularity of instant coffee among millennials is the key driver of the market. The market is experiencing significant growth due to the increasing preference among millennials, particularly in major markets like China and the US. Millennials, defined as individuals aged 21-36 years, possess greater spending power than previous generations and are expected to increase it further during the forecast period.

- Coffee consumption among this demographic is on the rise, with instant coffee gaining popularity due to its convenience and variety. Flavored instant drinks are particularly favored by millennial consumers, leading companies to introduce new products catering to this market segment. For instance, Starbucks has launched three new products under its Cold Craft range over the last three years. The trend is expected to continue, driving the growth of the market during the forecast period. The Instant Coffee Market is witnessing a surge in demand, driven by the convenience and versatility of this brewing method. With various packaging types, including sachets, jars, and sticks, instant coffee caters to diverse consumer preferences.

What are the market trends shaping the Instant Coffee Industry?

- Raising preparation of instant espresso coffee at homes is the upcoming market trend. Instant espresso coffee has gained popularity among consumers in developed countries, including the US, due to the convenience it offers in preparing coffee at home. While traditional espresso requires specialized equipment, the availability of espresso machines for individual use has enabled more consumers to prepare this type of coffee at home. Hot water is the only requirement for preparation, making instant coffee an ideal choice for travelers and office goers. The antioxidant content in instant coffee is comparable to that of freshly brewed coffee, making it a healthier alternative for some.

- Major players in the industry, such as Nestle and Starbucks Coffee, are catering to this demand by offering new espresso coffee pods for use in espresso machines. Peet's Coffee, for example, recently launched four new espresso blend capsules, which are compatible with Nespresso OriginalLine machines. This trend is expected to continue as consumers seek out convenient and high-quality coffee options. Specialty coffee lovers now enjoy artisanal blends in instant form, maintaining the rich flavor profiles of their favorite beans. Two primary production methods, spray-drying and freeze-drying, create distinct differences. Freeze-dried coffee retains more flavor and antioxidant content, while spray-dried coffee offers a quicker preparation time.

What challenges does the Instant Coffee Industry face during its growth?

- Rising threat from substitute products is a key challenge affecting the industry growth. The market has faced significant challenges over the past three decades due to the increasing popularity of various hot and cold beverages, including roast and ground coffee, soft drinks, carbonated drinks, nutritional and energy drinks, green tea, iced tea, and coffee pods.

- The emergence of energy drinks like Gatorade and Red Bull has led to a decline in instant coffee consumption in developed markets Moreover, the growing demand for coffee pods and the expanding range of innovative flavors in iced tea, green tea, and organic tea segments pose a threat to the market's growth. These trends have put pressure on instant coffee companies to adapt and innovate to maintain their market share. Innovations in the Instant Coffee Market include new product launches such as flavored drinks and ground coffee beans, catering to mental health-conscious consumers seeking caffeine fixes without added sugar or preservatives. Organized retailing platforms have made these options readily available, ensuring a long shelf life.

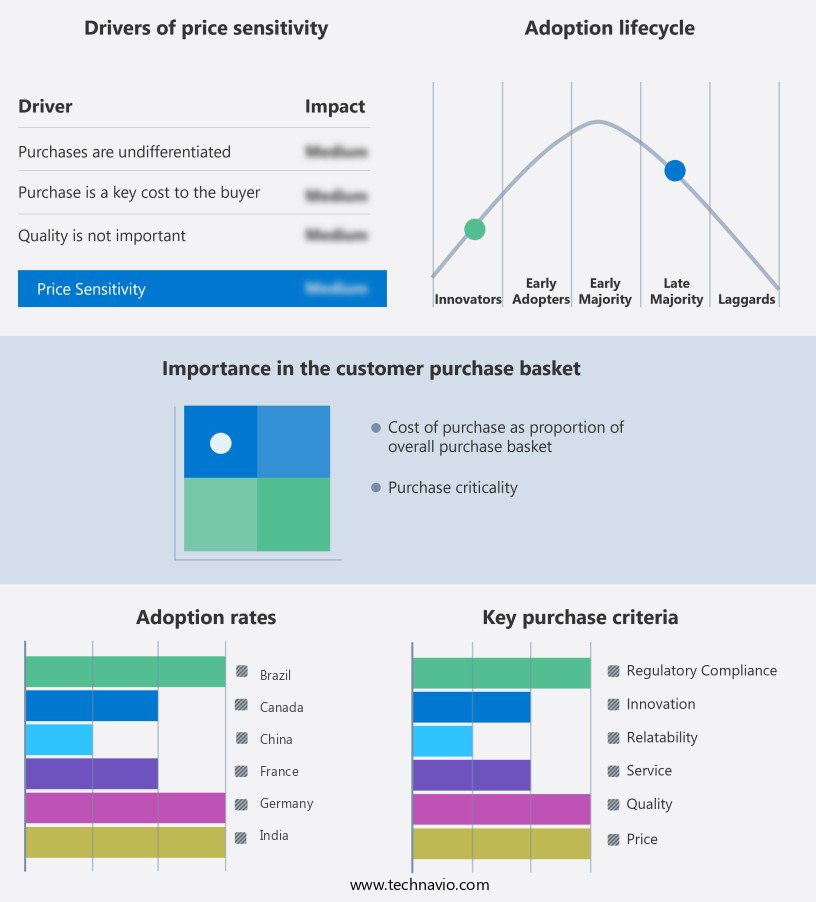

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anthonys Goods - The company offers instant coffee such as Anthony Organic Instant Coffee that easily dissolves when added to water.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bevzilla

- Death Wish Coffee

- Giraldo Farms

- illycaffe S.p.A.

- ITC Ltd.

- JDE PEETs NV

- Keurig Dr Pepper Inc.

- Lens Coffee LLC

- Louis Dreyfus Co. BV

- LUIGI LAVAZZA SPA

- Massimo Zanetti Beverage Group

- Nestle SA

- Starbucks Corp.

- Strauss Group Ltd.

- Tchibo GmbH

- The Good life Co.

- The J.M. Smucker Co.

- UCC Ueshima Coffee Co. Ltd.

- Unilever PLC

- WAKA COFFEE INC.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve, driven by consumer preferences for convenience and unique flavors. One of the key trends shaping the industry is the adoption of advanced freeze-drying technology, which allows for the preservation of coffee's rich flavor and aroma. This technology is particularly popular in single-serve formats, catering to the busy lifestyles of the working population. Packaging innovations have also played a significant role in the growth of the market. Single-serve coffee pods and single-origin coffee packets have gained popularity due to their convenience and ability to deliver a consistent cup of coffee every time.

In addition, premium blends and artisanal coffee brands have also entered the market, offering consumers a wider range of choices and higher-quality products. Consumer preferences for functional properties have also influenced the development of the market. Coffee is known for its health benefits, including improved brain function, reduced disease risk, and liver health. As a result, many companies have started to focus on highlighting the health benefits of their products in their marketing efforts. Another trend in the market is the growing popularity of flavored coffee and iced beverages. These products cater to consumers who seek variety and are looking for new and exciting flavors.

Furthermore, online retailing has also become an important channel for instant coffee sales, allowing consumers to purchase products from the comfort of their own homes. The market is highly competitive, with both multinational players and local craft brands vying for market share. Companies are constantly launching new products to differentiate themselves and meet the evolving needs of consumers. For instance, there has been a rise in the number of premium coffee blends and functional coffee products, catering to consumers who are willing to pay a premium for high-quality and health benefits. Despite the competition, the market remains strong, driven by the convenience and affordability of the product.

In addition, the market is expected to continue growing, with innovations in technology, packaging, and product offerings expected to shape the industry in the coming years. The adoption of advanced freeze-drying technology, packaging innovations, and online retailing have all contributed to the growth of the market. The competition remains fierce, with both multinational players and local craft brands offering a wide range of products to meet the evolving needs of consumers. The future of the market looks promising, with continued innovation and product development expected to drive growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

237 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 16.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, China, Japan, India, South Korea, UK, Germany, France, Brazil, and Canada |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Instant Coffee industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.