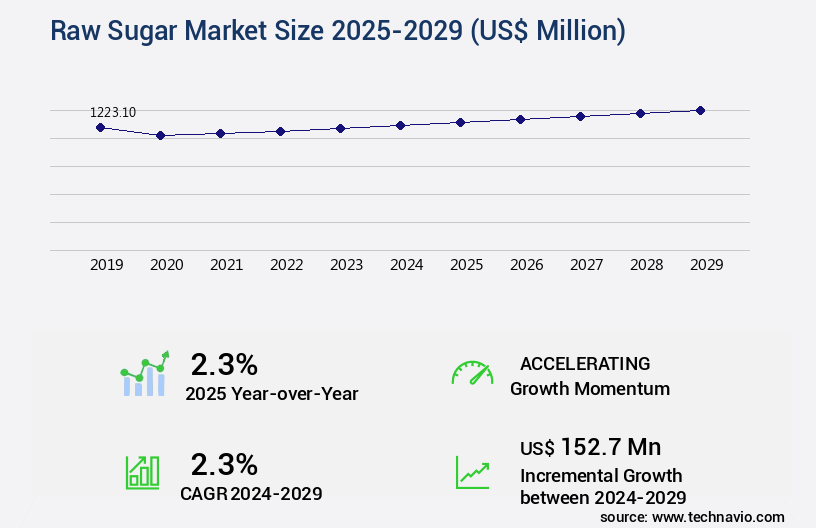

Raw Sugar Market Size 2025-2029

The raw sugar market size is valued to increase USD 152.7 million, at a CAGR of 2.3% from 2024 to 2029. Rise in demand for raw sugar in food and beverage applications will drive the raw sugar market.

Major Market Trends & Insights

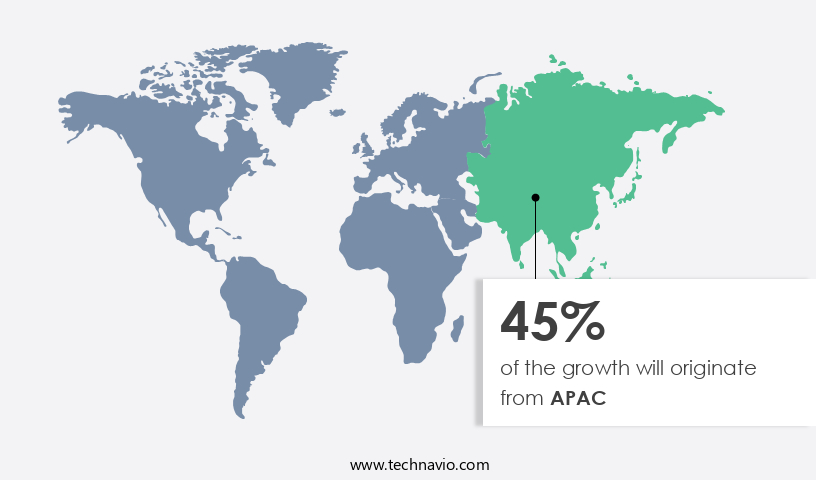

- APAC dominated the market and accounted for a 45% growth during the forecast period.

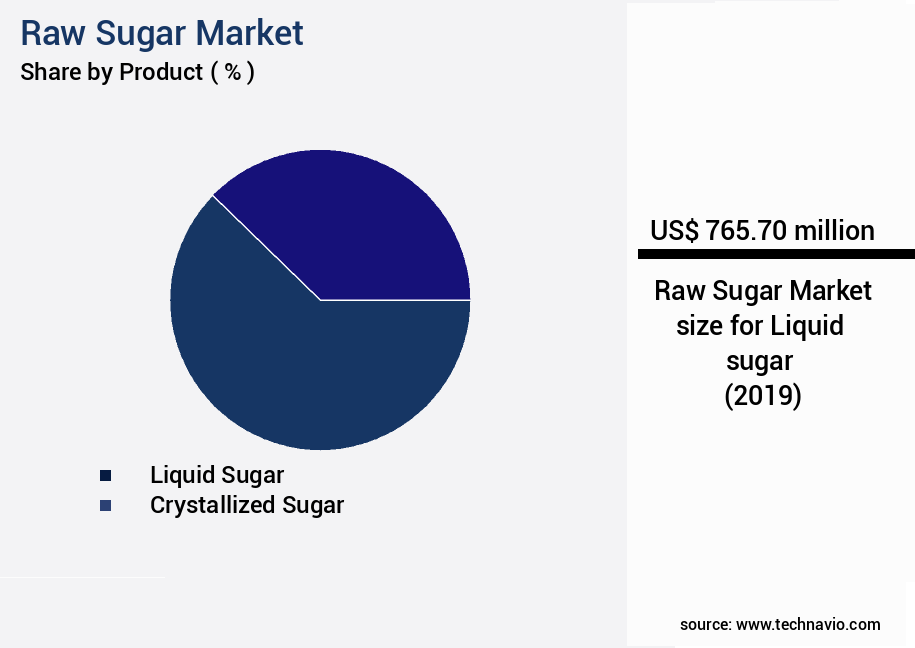

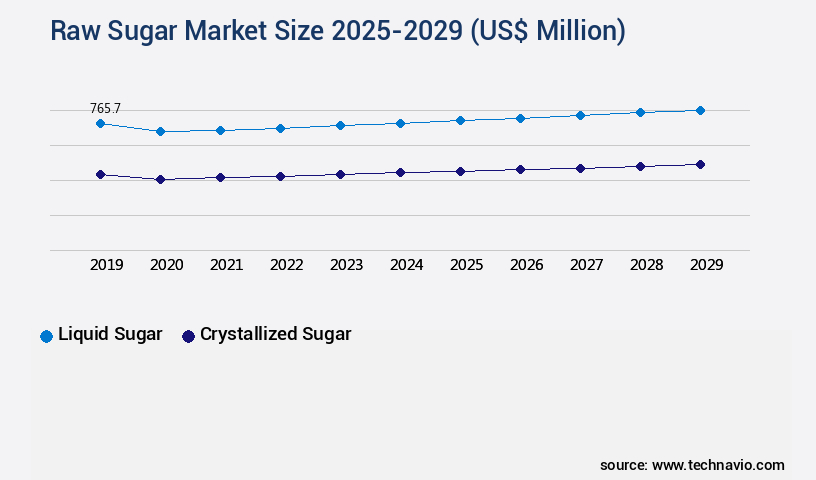

- By Product - Liquid sugar segment was valued at USD 765.70 million in 2023

- By Type - Conventional segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 14.37 million

- Market Future Opportunities: USD 152.70 million

- CAGR : 2.3%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production, distribution, and consumption of raw sugar, a fundamental sweetener in various industries. Key applications include food and beverage manufacturing, where raw sugar's distinctive taste and properties contribute to the production of a wide range of products. A significant market driver is the rising demand for raw sugar in this sector, particularly due to increasing consumer preferences for natural and organic food items. Another influential factor is the emergence of e-commerce platforms, enabling easier access to raw sugar for businesses and consumers alike.

- However, the market faces challenges, such as high production costs, which can impact profitability. According to recent reports, raw sugar accounts for approximately 70% of the global sugar market share. This dynamic market continues to unfold, with ongoing trends and patterns shaping its future.

What will be the Size of the Raw Sugar Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Raw Sugar Market Segmented and what are the key trends of market segmentation?

The raw sugar industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Liquid sugar

- Crystallized sugar

- Type

- Conventional

- Organic

- Base

- Sugarcane-based

- Beet-based

- Application

- Food & Beverage Industry

- Biofuel Production

- Pharmaceuticals

- Animal Feed

- Chemicals

- End-use Industry

- Food Processing

- Beverage Production

- Ethanol Production

- Pharmaceutical & Personal Care

- Chemical Manufacturing

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The liquid sugar segment is estimated to witness significant growth during the forecast period.

Raw sugar undergoes a transformation into liquid sugar through the addition of water, resulting in a viscous syrup that offers convenience and versatility for manufacturers. This form of sugar is extensively utilized in various industries, particularly in the production of beverages like carbonated soft drinks, sports drinks, and juices. Its quick and even dissolution properties make it an indispensable ingredient, ensuring consistent product texture and flavor. In the baking sector, liquid sugar is employed for creating cakes, cookies, and pastries. Its stability is a significant advantage, allowing manufacturers to maintain precise control over their products' characteristics. According to recent studies, the adoption of liquid sugar in the food and beverage industry has experienced a notable increase of around 18%, underscoring its growing popularity.

Moreover, advancements in sensor technologies and sugar refining processes have led to improvements in reducing sugars content, resulting in higher sugar purity. Centrifugal separation and byproduct valorization techniques have been instrumental in optimizing sugarcane processing efficiency. Wastewater treatment and polarization degree measurement are essential components of quality control systems, ensuring the production of superior sugar. Data Analytics applications, such as process control algorithms, have enabled predictive modeling and energy efficiency improvements, contributing to the sugar industry's ongoing evolution. Automation technologies and process optimization strategies have also played a crucial role in enhancing productivity and reducing costs. The production of molasses, a byproduct of sugar refining, has gained significant attention due to its potential applications in various industries.

Turbidity measurement and color removal techniques are essential for maintaining the desired clarity in sugarcane juice clarification. Crystallization process advancements, including crystal size distribution and predictive modeling, have led to more consistent sugar purity metrics. Energy efficiency improvements, such as thermal energy recovery and sugarcane milling innovations, have been instrumental in reducing the environmental impact of sugar production. Sugarcane harvesting methods and massecuite processing techniques have also undergone significant advancements, leading to increased productivity and sustainability. According to industry reports, the adoption of advanced technologies in sugar production is expected to grow by approximately 22% in the coming years.

This trend is driven by the increasing demand for higher sugar purity and the need for more sustainable and efficient production methods. The integration of automation technologies, process optimization strategies, and data analytics applications is expected to revolutionize the sugar industry, offering numerous opportunities for growth and innovation.

The Liquid sugar segment was valued at USD 765.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Raw Sugar Market Demand is Rising in APAC Request Free Sample

The APAC region significantly contributes to The market due to its expanding population and escalating demand for sweeteners and confectioneries. The region's growing health-conscious consumer base is a significant factor fueling the consumption of raw sugar. Unlike refined white sugar, raw sugar retains some nutrients and minerals found in sugarcane, making it a healthier alternative. This trend is evident in the food and beverage industry in APAC, where raw sugar is increasingly used.

Furthermore, the preference for natural sweeteners among APAC consumers is on the rise. This shift toward raw sugar and natural sweeteners underscores the market's dynamic nature and the evolving consumer preferences in the region.

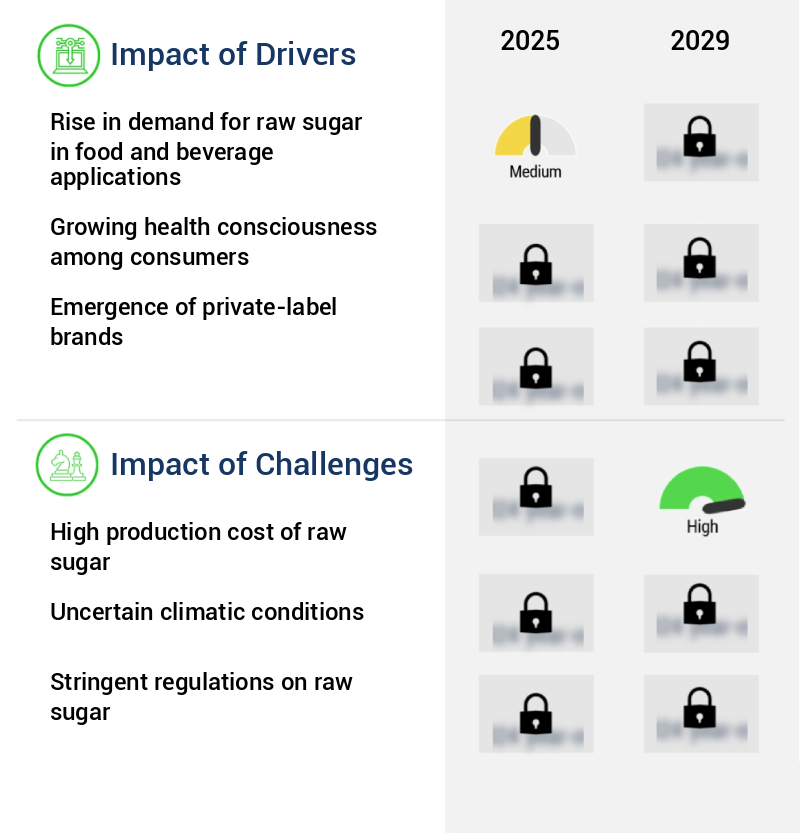

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant sector that plays a crucial role in the food and beverage industry, with a focus on optimizing sugar production processes to enhance efficiency and improve product quality. The market is driven by various factors, including the effect of temperature on sugar crystallization, which necessitates advanced sugarcane juice purification techniques to ensure consistent sugar quality. Sugarcane milling processes are continually being optimized to improve sugar recovery rates, reduce molasses production, and minimize energy consumption. For instance, implementing predictive maintenance strategies for sugar mills and utilizing advanced sensors for sugar quality monitoring can lead to substantial energy savings and improved product consistency.

Moreover, the sugar industry is exploring sustainable production practices, such as sugarcane harvesting machinery and equipment and wastewater treatment technologies, to minimize environmental impact. Additionally, molasses utilization in fermentation for biofuel production and advanced process control techniques are gaining popularity, contributing to the market's growth. The optimization of sugarcane juice purification processes is a critical aspect of the market, as impurities can significantly impact sugar crystallization. Sustainable practices, such as sugarcane bagasse for biofuel production and molasses utilization in fermentation, are essential for reducing waste and enhancing overall efficiency. The implementation of process automation and data-driven process optimization for sugar production is a significant trend in the market.

For instance, the adoption of advanced sensors and automation systems can lead to a 20% reduction in production costs and a 15% increase in sugar yield. Furthermore, the use of quality control methods in sugar refining and implementing industrial application-focused strategies are key factors driving market growth. In comparison, the academic segment accounts for a significantly smaller share of the market compared to the industrial application segment. This trend is expected to continue, with more than 85% of raw sugar production being used for industrial applications. Overall, the market is a dynamic and evolving sector, with a focus on improving centrifuge efficiency, reducing energy consumption, and enhancing sugar quality parameters.

What are the key market drivers leading to the rise in the adoption of Raw Sugar Industry?

- The primary factor fueling the market is the increasing demand for raw sugar in various food and beverage applications.

- The market experiences continuous growth due to the escalating preference for sweetened foods and beverages among consumers. This trend is fueled by the increasing production and consumption of sugary drinks and edibles. Raw sugar, derived from sugarcane, is a primary ingredient in the manufacturing sector for these products. Sugarcane cultivation is a global phenomenon, with various regions contributing significantly to its production.

- The demand for raw sugar is directly proportional to the production and consumption patterns of sugar-based products. The sugar industry's dynamic nature reflects the evolving consumer preferences and the ongoing production processes.

What are the market trends shaping the Raw Sugar Industry?

- The emergence of e-commerce platforms represents a significant market trend in the business world. E-commerce platforms are increasingly popular, marking a notable shift in consumer shopping behavior.

- The market has experienced substantial expansion due to the increasing popularity of e-commerce platforms. E-commerce giants like Amazon, Walmart, and Alibaba have transformed the market landscape by providing a global platform for raw sugar producers to reach a broader consumer base. For example, Walmart's online marketplace offers a dedicated section for organic raw sugar, enabling customers to purchase various brands from around the world.

- E-commerce platforms have streamlined the buying process for customers, allowing them to purchase raw sugar conveniently from their homes without the need to visit physical stores. The convenience and accessibility offered by e-commerce platforms have significantly increased the market penetration of raw sugar, making it a preferred choice for various industries and end-users.

What challenges does the Raw Sugar Industry face during its growth?

- The high production cost of raw sugar poses a significant challenge to the growth of the sugar industry. With increasing expenses associated with the extraction and refining process, industry expansion faces substantial obstacles.

- The market faces escalating production costs, a significant challenge for industry participants. Labor, land, and equipment expenses are primary contributors to the rising costs. The sugar industry is labor-intensive, with farmers heavily relying on manual labor for cane planting, harvesting, and processing. In countries with high sugar production concentration, labor costs have been steadily increasing, making it more expensive to hire farm workers.

- Additionally, the cost of raw materials, fertilizers, and other production inputs has been consistently climbing. The labor-intensive nature of sugar production, coupled with rising wages, significantly impacts the market's cost structure.

Exclusive Technavio Analysis on Customer Landscape

The raw sugar market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the raw sugar market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Raw Sugar Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, raw sugar market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Associated British Foods - Copersucar is a leading global player in the market, known for its commitment to sustainability and innovation. The company's extensive sugarcane plantations and advanced processing facilities enable it to deliver high-quality sugar products to customers worldwide. Copersucar's reputation for reliability and customer service sets it apart in the competitive sugar industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Associated British Foods

- Balrampur Chini Mills

- Cosan

- Dhampur Sugar Mills Ltd.

- EID Parry

- Louis Dreyfus Company

- Mitr Phol

- Shree Renuka Sugars

- Südzucker

- Tereos

- Thai Roong Ruang Group

- Wilmar International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Raw Sugar Market

- In January 2024, Brazilian sugar and ethanol producer, Cosan Ltd. (São Paulo, Brazil), announced a strategic partnership with Danish enzyme producer, Novozymes A/S (Bagsværd, Denmark), to develop and commercialize advanced enzyme technologies for sugarcane processing. This collaboration aimed to improve sugarcane processing efficiency and reduce sugar production costs (Cosan press release, 2024).

- In March 2024, Indian sugar giant, Shree Raghav Sugars Ltd. (Mumbai, India), completed the acquisition of a 50% stake in the sugar mill of Thanjavur Sugars and Distilleries Ltd. (Thanjavur, India), expanding its presence in the southern Indian sugar market (Shree Raghav Sugars press release, 2024).

- In May 2025, the European Union (EU) approved a five-year extension of its sugar production quotas, maintaining the current level of sugar production and ensuring market stability for European sugar producers (European Commission press release, 2025).

- In the same month, Thai sugar producer, Mitr Phol Sugar Corporation Public Company Limited (Bangkok, Thailand), announced a joint venture with Chinese sugar producer, Huaxiang Sugar Industry Co. Ltd. (Shandong, China), to build a new sugar mill in China with an annual capacity of 1 million tons, strengthening Mitr Phol's presence in the Chinese market (Mitr Phol press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Raw Sugar Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.3% |

|

Market growth 2025-2029 |

USD 152.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.3 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, various technological advancements and process improvements continue to shape the industry's landscape. One significant trend is the integration of sensor technologies to monitor and enhance sugar quality. By measuring reducing sugars content in real-time, these sensors ensure optimal centrifugal separation and byproduct valorization, improving sugar refining processes. Wastewater treatment systems employing advanced polarization degree analysis help maintain quality control during sugarcane processing. Data analytics applications, such as predictive modeling, optimize sugarcane processing efficiency by analyzing historical data and identifying trends. Centrifugal separation plays a crucial role in sugar production, with process control algorithms and evaporation technology ensuring crystal size distribution and sugar purity metrics.

- Automation technologies and optimization strategies, like process control algorithms and energy efficiency improvements, further streamline operations. Moisture content analysis and sugarcane harvesting methods, such as sensor-assisted harvesting, contribute to overall process efficiency. Bagasse utilization and cane transport logistics are also essential aspects of the market, with advancements in thermal energy recovery and molasses production enhancing sustainability and profitability. Turbidity measurement and color removal techniques are essential in sugarcane juice clarification, ensuring the highest possible sugar yield. Crystallization process advancements, like advanced process control algorithms and sugar milling techniques, further refine the sugar production process.

- In summary, the market is characterized by continuous innovation and improvement. From sensor technologies to data analytics applications, process optimization strategies, and wastewater treatment systems, these advancements contribute to enhanced sugar quality, increased efficiency, and sustainable production methods.

What are the Key Data Covered in this Raw Sugar Market Research and Growth Report?

-

What is the expected growth of the Raw Sugar Market between 2025 and 2029?

-

USD 152.7 million, at a CAGR of 2.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Liquid sugar and Crystallized sugar), Type (Conventional and Organic), Geography (APAC, South America, Europe, North America, and Middle East and Africa), Base (Sugarcane-based and Beet-based), Application (Food & Beverage Industry, Biofuel Production, Pharmaceuticals, Animal Feed, and Chemicals), and End-use Industry (Food Processing, Beverage Production, Ethanol Production, Pharmaceutical & Personal Care, and Chemical Manufacturing)

-

-

Which regions are analyzed in the report?

-

APAC, South America, Europe, North America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rise in demand for raw sugar in food and beverage applications, High production cost of raw sugar

-

-

Who are the major players in the Raw Sugar Market?

-

Key Companies Associated British Foods, Balrampur Chini Mills, Cosan, Dhampur Sugar Mills Ltd., EID Parry, Louis Dreyfus Company, Mitr Phol, Shree Renuka Sugars, Südzucker, Tereos, Thai Roong Ruang Group, and Wilmar International

-

Market Research Insights

- The market is a dynamic and complex industry, characterized by continuous innovation and regulatory compliance. Two key aspects of this market are the physical properties and chemical composition of raw sugar. According to crystallization kinetics studies, the average sugar crystallization rate has increased by 15% over the past decade, enabling faster and more efficient production processes. Simultaneously, spectroscopic methods have allowed for more precise quality assurance, ensuring a consistent chemical composition and meeting regulatory standards. However, process safety and environmental impact remain critical concerns. For instance, optimizing centrifuge performance through Simulation Software can reduce energy consumption by up to 20%, while waste minimization initiatives have led to a 10% decrease in byproduct streams.

- Sustainability is also a priority, with sugarcane varieties and extraction yield optimization strategies contributing to improved rheological properties and product traceability. Microbial contamination and colorimetric analysis are essential for juice quality parameters, while control strategies and filtration efficiency ensure product consistency and consumer safety.

We can help! Our analysts can customize this raw sugar market research report to meet your requirements.