Simulation Software Market Size 2025-2029

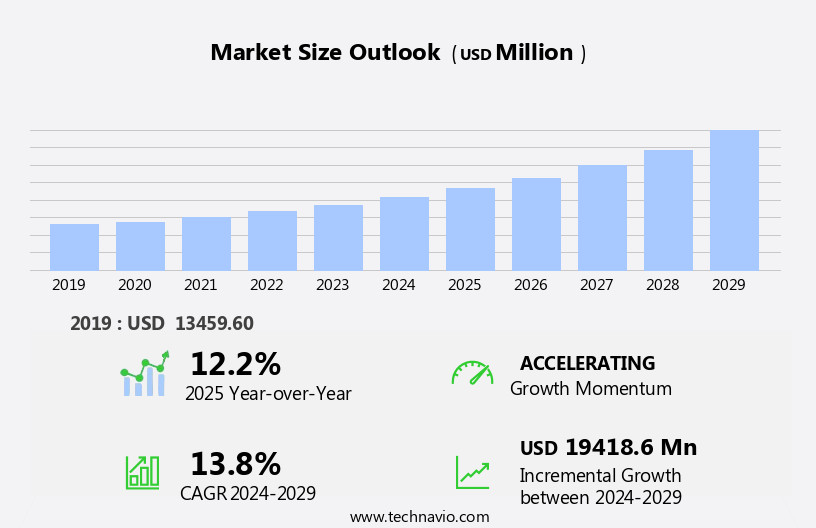

The simulation software market size is forecast to increase by USD 19.42 billion, at a CAGR of 13.8% between 2024 and 2029.

- The market is experiencing significant growth and innovation, driven by the increasing demand for advanced product development and process optimization. Companies are recognizing the value of simulation software solutions in streamlining operations, improving product quality, and reducing costs. Notably, recent developments in technology, such as the Internet of Things (IoT) and cloud computing, are fueling the market's expansion. However, the market's growth is not without challenges. Integration and compatibility issues with existing systems and software remain a significant obstacle for organizations seeking to implement simulation solutions.

- As such, companies must prioritize addressing these challenges through collaborative efforts and innovative solutions to ensure seamless integration and adoption. In summary, the market presents substantial opportunities for growth, driven by the need for product innovation and development, while requiring companies to navigate integration challenges for successful implementation.

What will be the Size of the Simulation Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with various sectors leveraging advanced technologies to optimize processes and enhance product design. Finite element analysis, manufacturing process simulation, fatigue analysis, crash simulation, statistical analysis, discrete element method, uncertainty quantification, thermal analysis, assembly simulation, and other simulation techniques are integral components of this dynamic landscape. These methods enable the accurate prediction of product behavior under various conditions, ensuring the highest level of performance and reliability. High-performance computing and mesh generation facilitate the processing of complex data sets, while validation and verification, design of experiments, multiphysics simulation, and virtual prototyping streamline the design process.

Boundary conditions, dynamic analysis, and parameter estimation are essential elements of simulation models, providing valuable insights into product behavior. Advancements in simulation software include the integration of virtual reality, parallel processing, model calibration, electromagnetic analysis, cloud-based simulation, computational fluid dynamics, acoustic analysis, particle-based simulation, and structural analysis. These innovations offer significant benefits, such as improved product design, reduced development time, and increased cost savings. Simulation accuracy is a critical factor in ensuring the success of these applications, with solver algorithms, simulation results, and digital twin technology playing essential roles in achieving precise and reliable simulations. Engineering consulting, simulation training, and optimization algorithms further enhance the value of simulation software, providing expert insights and guidance to businesses.

The ongoing development of simulation software is characterized by continuous innovation and integration, with new tools and techniques emerging to address the evolving needs of various industries. This dynamic market landscape underscores the importance of staying informed and adopting the latest simulation technologies to maintain a competitive edge.

How is this Simulation Software Industry segmented?

The simulation software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Software

- Services

- Deployment

- On-premises

- Cloud-based

- Application

- ERM and ST

- High fidelity experiential 3D training

- Gaming and immersive experiences

- Manufacturing process optimization

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

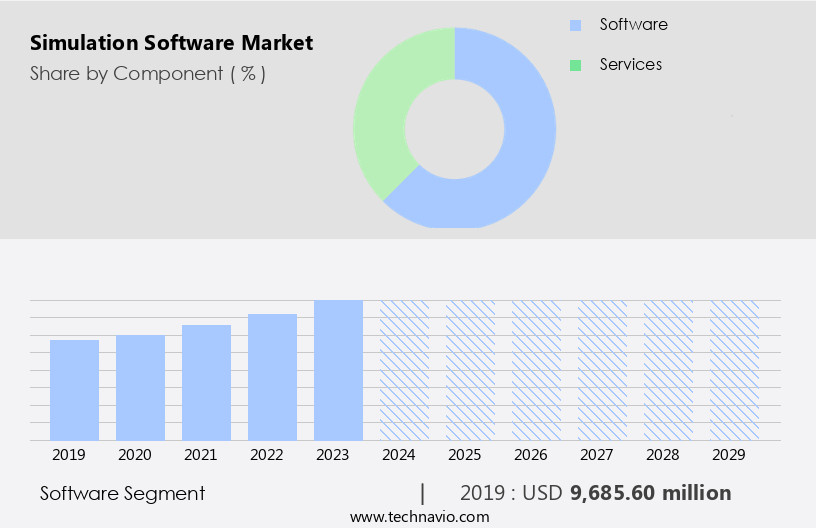

By Component Insights

The software segment is estimated to witness significant growth during the forecast period.

The market encompasses a software segment that offers core applications and tools for modeling, simulating, and analyzing various systems and processes. This segment caters to diverse industries, providing functionalities for finite element analysis, manufacturing process simulation, fatigue analysis, crash simulation, statistical analysis, discrete element method, uncertainty quantification, thermal analysis, assembly simulation, and more. High-performance computing, mesh generation, validation and verification, design of experiments, multiphysics simulation, virtual prototyping, process optimization, and boundary conditions are integral components of this segment. Software solutions employ advanced algorithms, solvers, and mathematical models to simulate and replicate physical or conceptual systems' behavior. Users can input parameters, run simulations, and analyze outcomes using post-processing tools, optimization algorithms, and sensitivity analysis.

The software segment also offers advanced features like virtual reality, augmented reality, and parallel processing for immersive and harmonious user experiences. Simulation models can be calibrated using data visualization tools and material properties databases. Electromagnetic analysis, fluid dynamics analysis, human body modeling, and particle-based simulation are specialized applications within the software segment. Simulation software licensing, parameter estimation, and model calibration are essential aspects of the segment, ensuring simulation accuracy and reliability. Cloud-based simulation, computational fluid dynamics, acoustic analysis, and structural analysis are emerging trends in the software segment. Digital twin technology and engineering consulting services further enhance the value proposition of simulation software, enabling performance analysis, failure prediction, and optimization.

Simulation training and convergence criteria are crucial aspects of the software segment, ensuring effective adoption and utilization of simulation tools.

The Software segment was valued at USD 9.69 billion in 2019 and showed a gradual increase during the forecast period.

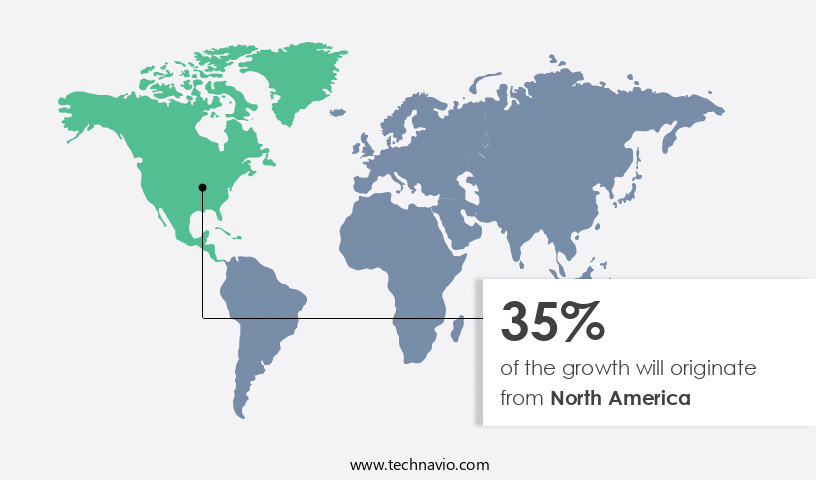

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

North America dominates the market with significant revenue share, attributed to the adoption of advanced technologies, innovation-driven culture, and the presence of major simulation software companies. The region caters to diverse industry verticals, including automotive, aerospace and defense, healthcare, manufacturing, energy, architecture and construction, and gaming and entertainment. The market is poised for steady growth due to ongoing technological advancements and increasing demand from various industries. Simulation software solutions facilitate improved product design, process optimization, and performance analysis across various sectors. Technologies like high-performance computing, parallel processing, and cloud-based simulation enable faster and more accurate simulations. Additionally, multiphysics simulation and virtual prototyping allow for more comprehensive analysis, while uncertainty quantification and sensitivity analysis aid in risk assessment and decision-making.

The market's evolution is driven by the integration of advanced technologies, such as artificial intelligence, machine learning, and the Internet of Things, which enhance simulation capabilities and provide valuable insights for businesses. Furthermore, the increasing adoption of digital twins and engineering consulting services supports the market's growth. In conclusion, The market is witnessing significant growth due to the increasing demand for advanced simulation solutions across various industries. The market's expansion is driven by factors such as technological advancements, the integration of emerging technologies, and the growing need for data-driven decision-making.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Simulation Software Industry?

- The market's growth is primarily fueled by the escalating demand for product innovation and development.

- Simulation software plays a pivotal role in product innovation and development by enabling organizations to virtually test and analyze the behavior of their products. This software allows for the assessment of various design iterations and parameters, leading to informed decisions and reduced reliance on costly physical prototypes. Key features of simulation software include optimization algorithms, material properties databases, solver algorithms, and data visualization tools. These capabilities enable organizations to understand product performance and behavior under different operating conditions. Furthermore, simulation software can integrate with augmented reality technology, creating immersive and harmonious digital twin models. Performance analysis and failure prediction are also crucial aspects of simulation software, ensuring that organizations can identify and address potential issues before product launch.

- Engineering consulting and simulation training further enhance the value of simulation software, providing expertise and knowledge transfer to organizations. Convergence criteria ensure accurate simulation results, while the use of advanced solver algorithms ensures efficient and reliable simulations. In conclusion, The market is a vital tool for organizations seeking to innovate and develop high-performing products, providing insights into product behavior and performance under various conditions.

What are the market trends shaping the Simulation Software Industry?

- The trend in the market is leaning towards the growing developments in simulation software solutions. This mandated advancement is a significant focus in today's professional environments.

- The market is experiencing significant growth due to the increasing adoption of advanced engineering solutions. One of the key trends driving market expansion is the development of sophisticated simulation software for various industries. For instance, Ansys Inc. Recently launched its latest release, Ansys 2024 R1, which features an enhanced user experience designed to boost digital engineering productivity through AI integration. This solution streamlines engineering workflows, fosters stronger collaboration, and facilitates real-time interactions, ultimately elevating project outcomes. Another significant trend is the application of simulation software in manufacturing processes. Companies are increasingly investing in manufacturing process simulation, finite element analysis, fatigue analysis, crash simulation, statistical analysis, thermal analysis, assembly simulation, and uncertainty quantification to optimize production and improve product quality.

- High-performance computing and mesh generation technologies enable simulation software to handle complex models and deliver accurate results. Altair Engineering Inc. Also made strides in the market by introducing new solutions and expanding its offerings. These developments demonstrate the industry's commitment to innovation and the growing importance of simulation software in various sectors. The market is expected to continue its growth trajectory as more companies recognize the benefits of using simulation software for design optimization, performance analysis, and risk assessment.

What challenges does the Simulation Software Industry face during its growth?

- The integration and compatibility issues between simulation software solutions pose a significant challenge to the industry's growth, hindering the seamless implementation and optimization of technology applications within organizations.

- Simulation software plays a crucial role in validation and verification, design of experiments, multiphysics simulation, and virtual prototyping for various industries. It enables process optimization, model calibration, electromagnetic analysis, and dynamic analysis, among other applications. However, the integration and compatibility issues with simulation software solutions pose significant challenges in the market. Seamless integration with other software systems and workflows is essential for data exchange, collaboration, and interoperability. Compatibility with computer-aided design (CAD) software, product lifecycle management (PLM) systems, or data management platforms is a primary concern.

- Moreover, parallel processing, virtual reality, and boundary conditions are essential features that enhance the functionality of simulation software. Organizations must address these challenges to fully leverage the benefits of simulation software for product design and development.

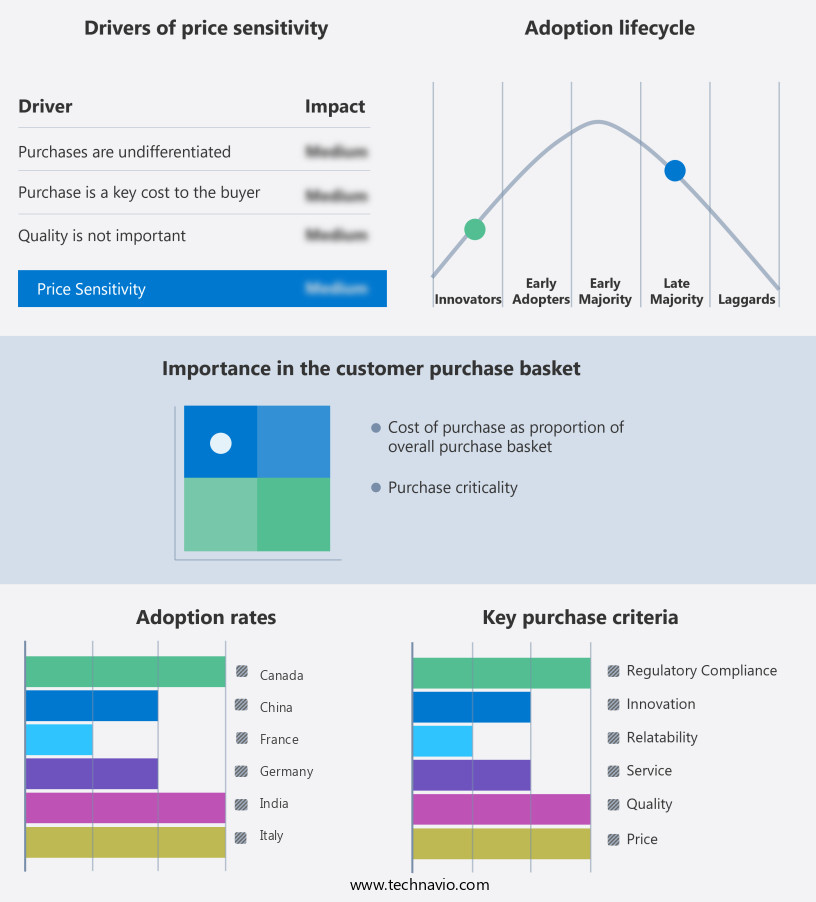

Exclusive Customer Landscape

The simulation software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the simulation software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, simulation software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Altair Engineering Inc. - The company specializes in providing advanced simulation software solutions, including the Altair HyperWorks suite, for efficient multi-disciplinary analysis and optimization. This software enables users to streamline their design processes by integrating various engineering disciplines, reducing development time and costs. By utilizing state-of-the-art simulation technology, organizations can make data-driven decisions, improve product performance, and enhance overall competitiveness in the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altair Engineering Inc.

- ANSYS Inc.

- AnyLogic North America LLC

- Autodesk Inc.

- Bentley Systems Inc.

- COMSOL AB

- Cybernet Systems Corp.

- Dassault Systemes SE

- Design Simulation Technologies Inc.

- Hexagon AB

- PTC Inc.

- Rockwell Automation Inc.

- Royal HaskoningDHV

- Schneider Electric SE

- Siemens AG

- Simio LLC

- SimScale GmbH

- Simul8 Corp.

- Synopsys Inc.

- The MathWorks Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Simulation Software Market

- In February 2024, ANSYS, a leading simulation software provider, announced the launch of its new product, ANSYS TwinBuilder for Process Industries. This solution enables digital twins for process industries, allowing real-time monitoring and optimization of manufacturing processes (ANSYS Press Release, 2024).

- In May 2024, PTC and Siemens Digital Industries Software entered into a strategic partnership to integrate their respective simulation and digital twin offerings. This collaboration aims to provide customers with a comprehensive digital twin solution, combining PTC's ThingWorx and Siemens' Simcenter (PTC Press Release, 2024).

- In August 2025, Siemens Digital Industries Software raised USD1.1 billion in a funding round. The investment, led by Koch Industries, will be used to expand its simulation software portfolio and accelerate research and development efforts (Bloomberg, 2025).

- Dassault Systèmes acquired IQMS, a manufacturing ERP software provider. This acquisition will enable Dassault Systèmes to offer a more comprehensive digital manufacturing solution, integrating simulation software with manufacturing operations (Dassault Systèmes Press Release, 2025).

Research Analyst Overview

- The market encompasses various industries, including medical devices, robotics, aerospace, and manufacturing. Simulation-based optimization plays a pivotal role in industry-specific applications, enabling process automation and software integration. Artificial intelligence and machine learning algorithms enhance simulation capabilities, while computational science and experimental design drive model complexity. Cloud computing platforms and high-performance computing clusters facilitate data analytics in medical device simulation and climate modeling. Manufacturing simulation and energy simulation rely on data-driven approaches and statistical modeling for solver accuracy. Automotive simulation and open-source simulation software leverage deep learning techniques to improve model complexity and data exchange formats. Robotics simulation and aerospace simulation require high simulation time, necessitating advanced simulation engines.

- Climate modeling and scientific computing applications benefit from advanced data analytics and statistical modeling techniques. Simulation software integration with industry-specific tools and processes is crucial for market growth. Computational science and machine learning algorithms enable the optimization of complex systems, while climate modeling and energy simulation require high-fidelity models for accurate results. Simulation time and data exchange formats are essential considerations for software selection in various industries. Incorporating artificial intelligence and deep learning into simulation software enhances model accuracy and complexity, driving innovation in various sectors. The future of simulation software lies in the integration of advanced technologies and industry-specific applications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Simulation Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.8% |

|

Market growth 2025-2029 |

USD 19418.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.2 |

|

Key countries |

US, China, Canada, UK, Japan, Germany, India, Italy, South Korea, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Simulation Software Market Research and Growth Report?

- CAGR of the Simulation Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the simulation software market growth of industry companies

We can help! Our analysts can customize this simulation software market research report to meet your requirements.