Recliner Sofas Market Size 2024-2028

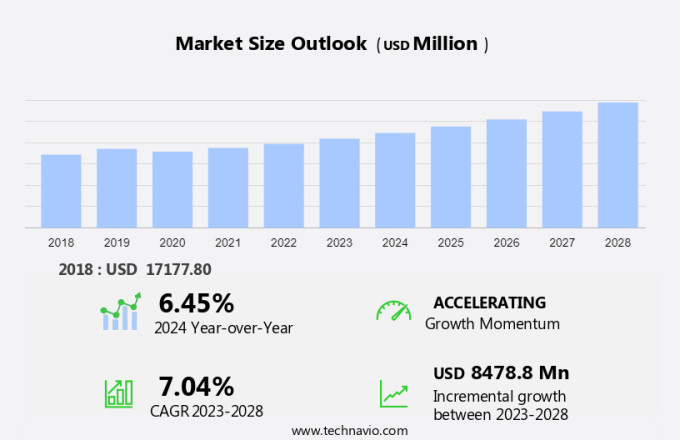

The recliner sofas market size is forecast to increase by USD 8.48 billion at a CAGR of 7.04% between 2023 and 2028.

- The market is experiencing significant growth, driven by evolving product ergonomics that cater to both style and functionality. These advancements include adjustable headrests, footrests, and lumbar support, making recliners increasingly popular for their comfort and utility. Additionally, the adoption of augmented reality (AR) technology in sales processes is a notable trend, enabling customers to visualize potential purchases in their homes before making a decision. However, the market is not without challenges, as fluctuations in raw material prices continue to impact manufacturers' costs and profitability. Overall, the market is poised for continued growth as consumers seek out comfortable and feature-rich furniture solutions.

What will the size of the market be during the forecast period?

- The recliner sofa market encompasses a wide range of armchairs designed for ultimate comfort and relaxation. These seating arrangements offer various features such as adjustable backrests, footrests, and headrests, catering to diverse consumer preferences. The ageing population's growing demand for ergonomic seating solutions has significantly influenced market growth. Recliner sofas find extensive applications in commercial settings, including spas, clubs, and real estate offices. In these environments, the emphasis is on providing premium and luxurious experiences, making recliners an essential component. The lever mechanism, enabling effortless adjustment, is a key feature that enhances user experience. The backrest and headrest, integral parts of recliner sofas, offer essential lumbar support, ensuring comfort and alleviating back pain.

- Advanced models incorporate heat massage, vibration, and other features to further enhance relaxation. The residential construction industry and home furnishing products sector also contribute significantly to the market's expansion. Online platforms have emerged as a popular sales channel, enabling easy access to a vast array of options for consumers. Recliner sofas are no longer confined to living rooms but are increasingly being used as stools, side chairs, or even rear seating in various settings. The versatility and comfort offered by these products make them a desirable addition to any space. The recliner sofa market is characterized by continuous innovation and the introduction of new features to cater to evolving consumer demands.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Residential

- Commercial

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

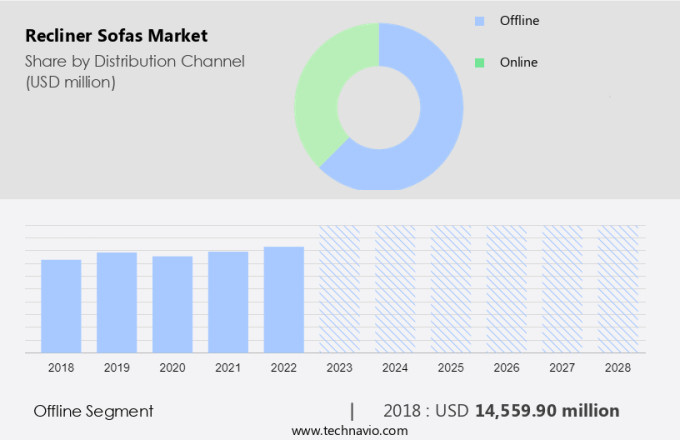

- The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses the sale of these furniture pieces through both online and offline channels. Offline sales involve distribution through specialty retail stores, department stores, and hypermarkets, among others. However, the shift towards online shopping has led to a decline in offline sales. To counteract this trend, manufacturers are collaborating with local retailers and opening their own outlets. Marketing strategies, such as promotions and targeted advertising, are also being employed to boost sales. Despite the challenges, offline sales are expected to maintain a steady growth rate during the forecast period due to the continued appeal of physical shopping experiences for some consumers.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 14.56 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

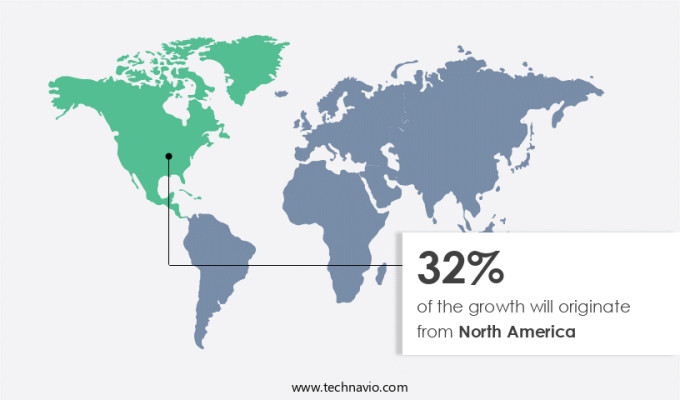

- North America is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is projected to experience consistent expansion over the forecast period. The advanced retail sector in the US, particularly furniture and furnishing stores, supermarkets, and clubhouses, serves as a significant foundation for market growth. Additionally, the increasing trend towards online retailing in the US home furniture market is anticipated to boost the demand for recliner sofas. The emergence of technology such as Augmented Reality and virtual reality, employed by companies like IKEA, allowing consumers to preview products in real-time, is also expected to contribute to market growth. The organized retail sector's rise in the US further strengthens the market's growth trajectory.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Recliner Sofas Market?

Evolving product ergonomics in terms of style, utility, and features is the key driver of the market.

- The market, also known as Armchairs with adjustable Backrests and Footrests, has experienced notable growth due to shifting consumer preferences towards comfort and luxury. This trend is particularly prominent among the ageing population and the millennial demographic, who value ergonomic design and multi-functional furniture. companies in the market have responded to this demand by introducing a wide range of styles, including modern, traditional, and contemporary designs. For instance, Cellini offers the Mila, Grande, and Sho recliner sofas, which are motorized leather sofas with USB charging ports. Commercial settings, such as spas, clubs, and real estate offices, have also shown a strong interest in recliner sofas, recognizing their potential to enhance customer experience and productivity.

- The residential construction industry and home furnishing products have also contributed to the growth of the market, with fully furnished apartments and luxury or premium properties featuring recliner sofas as standard. Online and offline platforms, including e-retailers, have expanded distribution channels, making it easier for consumers to access these products. In summary, the market is experiencing strong growth due to evolving consumer preferences, with demand coming from both commercial and residential sectors. companies are responding to this trend by offering a wide range of styles and features, while addressing environmental concerns through sustainable manufacturing practices and alternative materials.

What are the market trends shaping the Recliner Sofas Market?

Growing adoption of AR for enabling recliner sofa sales is the upcoming trend in the market.

- The market, also known as the armchair market, has witnessed significant growth due to the seating arrangement's increasing popularity in both commercial and residential settings. Backrest and footrest features are in high demand, particularly among an ageing population and those suffering from back pain. Recliner sofas come in various styles, including casual, traditional, and contemporary, and can be found in commercial settings such as spas, clubs, real estate offices, and even in the residential construction industry as home furnishing products. Technological advancements have played a pivotal role in the market's growth. For instance, comfort air technology, including comfort air recliners, has gained traction, offering features like heat massage, vibration, and swivel functions.

- Customizable products, such as those with adjustable headrests, lumbar support, and stools for the side, rear, or front, add to the market's appeal. The market's environmental impact is a concern, with deforestation and carbon footprint being critical issues. However, efforts are being made to address these concerns through the use of sustainable materials, such as fabric, faux leather, and micro-fiber, and energy-efficient manufacturing processes. The market caters to various segments, including luxury and premium sofas for fully furnished apartments, and single-seater and multi-seater options. Online distribution channels, including e-retailers, have emerged as a popular platform for purchasing recliner sofas, alongside offline platforms like furniture stores.

What challenges does Recliner Sofas Market face during the growth?

Fluctuations in raw material prices is a key challenge affecting the market growth.

- The market encompasses a range of seating solutions, including Armchairs with adjustable Backrests and Footrests, designed for optimal comfort and support. This market caters to both commercial settings, such as Spas, Clubs, Real estate offices, and the residential construction industry for Home furnishing products. Design advancements have led to customizable products, offering various styles like Casual, Traditional, and Contemporary, and features like Heat massage, Vibration, and Comfort air technology. However, the market faces challenges such as increasing raw material prices, particularly for materials like leather, metals, and wood, which can impede growth. Manufacturers source these materials from various suppliers, leading to price fluctuations due to import and export duties.

- The ageing population's growing demand for ergonomic seating solutions, such as recliner sofas with Lumbar support, Headrests, and Levers, presents an opportunity for growth. The market includes various product offerings, from Manual to Power recliners, available in Fabric, Faux leather, and Micro-fiber, catering to both Luxury and Premium consumers. The market's reach extends to Online and Offline platforms, with E-retailers increasingly becoming a significant distribution channel. The market's applications span across sectors like Tourism and Hospitality, with Single-seater and Multi-seater options available. The market continues to evolve, offering innovative solutions for Back pain sufferers and those seeking comfort in their homes and workplaces.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Leather Operations

- Ashley Global Retail LLC

- CHATEAU DAX SPA

- COA Inc.

- Dorel Industries Inc.

- Ekornes Ltd.

- Franklin Corp.

- Haverty Furniture Companies Inc.

- Inter IKEA Holding BV

- Jackson Furniture Industries

- Klaussner Home Furnishings

- Lane Home Furnishings

- LaZBoy Inc.

- Little Nap Designs Pvt. Ltd.

- Natuzzi SpA

- Pepperfry Pvt. Ltd.

- PREMIEREHTS LLC

- Raymour and Flanigan Furniture and Mattresses

- Recliners India Pvt. Ltd.

- Southern Motion Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Recliner sofas, also known as armchairs with adjustable backrests and footrests, have gained significant popularity in both residential and commercial settings due to their comfort and functionality. This article explores the market dynamics and trends shaping the recliner sofas industry, focusing on various sectors and design advancements. The global ageing population is a significant factor driving the demand for recliner sofas. As people age, they often experience back pain and joint issues, making recliners an attractive option for their comfort and support. This trend is particularly noticeable in the residential construction industry, where fully furnished apartments catering to the elderly population are increasingly popular. Recliner sofas are not just limited to residential settings. They are also widely used in commercial settings such as spas, clubs, and real estate offices. In these environments, recliners offer a luxurious and relaxing experience for customers and clients. Design advancements, such as comfort air technology and customizable products, have further enhanced their appeal. As consumers become more environmentally conscious, there is a growing demand for eco-friendly furniture options. Some manufacturers are addressing this trend by using sustainable materials, such as reclaimed wood or recycled fabrics, in their recliner designs.

Additionally, efforts to reduce deforestation and minimize the carbon footprint of production processes are becoming essential considerations for companies in the market. Design advancements continue to shape the market, with various styles catering to diverse preferences. From casual and contemporary to traditional and luxury, there is a recliner sofa for every taste and budget. Some of the latest design trends include lever-operated mechanisms for easy adjustment, headrests for added comfort, and heat massage and vibration features for ultimate relaxation. the market is served by both online and offline platforms. E-retailers have gained popularity due to their convenience and wide product selection, while traditional brick-and-mortar stores continue to offer a tactile shopping experience.

Moreover, the tourism sector and hospitality industry also contribute to the market by offering recliner sofas in hotels, resorts, and vacation rentals. Recliner sofas are a versatile and popular furniture category, with applications ranging from residential to commercial settings. Market trends include an ageing population, increasing demand for eco-friendly materials, and design advancements such as comfort air technology and customizable features. Both online and offline distribution channels cater to the diverse preferences of consumers, ensuring that recliner sofas remain a desirable and functional furniture choice for years to come.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.04% |

|

Market growth 2024-2028 |

USD 8.48 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.45 |

|

Key countries |

US, China, UK, Canada, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch