Refractory Materials Market For Steel Industry Size 2024-2028

The refractory materials market for steel industry size is forecast to increase by USD 2.37 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for steel in various sectors such as construction, infrastructure, automotive, and others. This trend is driven by the expanding economies and urbanization in developing countries. Additionally, the rising popularity of monolithic refractories over shaped refractories is another growth factor, as monolithic refractories offer better insulation and durability. However, the market faces challenges such as the fluctuation in the cost of refractory raw materials and high energy consumption, which can impact the profitability of steel producers. Producers must focus on optimizing their energy usage and sourcing cost-effective raw materials to remain competitive In the market. Overall, the market for the steel industry is expected to continue its growth trajectory, driven by the demand for steel and the adoption of advanced refractory technologies.

What will be the Size of the Market During the Forecast Period?

- The refractory materials market for the steel industry caters to the demand for high-performance materials capable of withstanding extreme temperatures and harsh conditions. These materials, including fireclay, magnesite, bauxite, metal oxides, and various classifications of refractories such as acidic, basic, and neutral, play a crucial role In the steel production process. Fireclay refractories, with their specific chemical compositions, offer excellent thermal shock resistance and are widely used in various applications. Monolithic refractories, ramming mixes, plastic refractories, gunning mixes, castables, and insulating materials made from silica brick, alumina, and other high alumina materials are essential for maintaining the furnace's temperature stability and insulation properties.

- Advancements in nanotechnology have led to the development of innovative refractory materials, enhancing thermal conductivity, oxidation resistance, and chemical corrosion resistance. High-performance materials like silicon carbide (Sic) are increasingly used in continuous casting processes to improve productivity and reduce energy consumption. The market is driven by the growing demand for energy-efficient and cost-effective solutions. The market is expected to witness significant growth due to the increasing adoption of advanced refractory materials and the ongoing trend toward sustainable steel production.

How is this Market segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Brick

- Monolithic

- Type

- Acidic and neutral

- Basic

- Geography

- APAC

- China

- India

- Japan

- Europe

- North America

- US

- South America

- Middle East and Africa

- APAC

By Product Insights

- The brick segment is estimated to witness significant growth during the forecast period.

Refractory materials play a crucial role In the steel industry, particularly in high-temperature applications such as furnace linings. These materials are engineered to withstand extreme temperatures and resist thermal shock, chemical corrosion, and oxidation. The most common form is the rectangular brick, which features standard dimensions and uniform properties due to machine pressing. For specific applications, such as kilns and furnaces, bricks with custom shapes and dimensions are hand-molded. Insulation is a key property of refractory materials, achieved by incorporating air spaces within the brick structure. This prevents heat conduction while allowing only the solid particles to transmit heat. Refractory materials are classified into acidic, basic, and neutral types based on their chemical composition.

Get a glance at the Refractory Materials For Steel Industry Industry report of share of various segments Request Free Sample

The brick segment was valued at USD 5.17 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

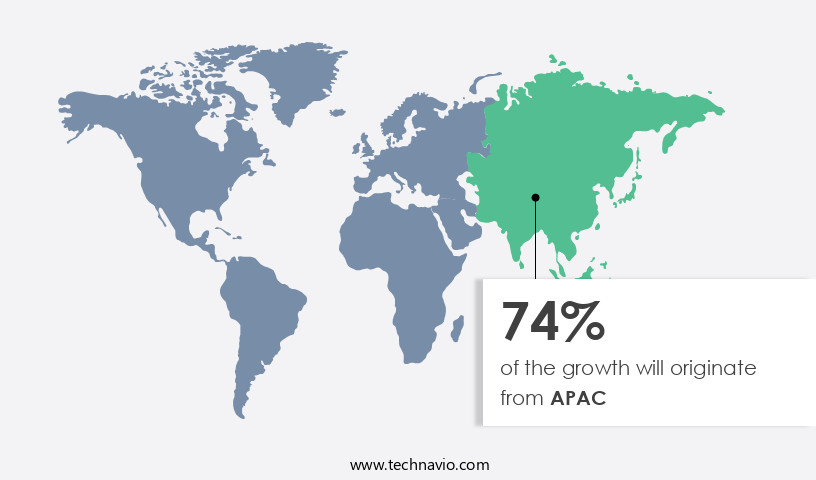

- APAC is estimated to contribute 74% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific (APAC) holds the largest market share due to the significant crude steel production In the region. Driven by the presence of emerging and developed economies, such as China, Japan, and India, the demand for refractory materials is increasing. These countries are major producers of steel, catering to various industries like automotive, construction, aerospace, infrastructure, heavy industries, and consumer goods. The extensive use of steel In these industries necessitates the application of refractory materials for thermal management, high temperatures, and resistance to chemical and oxidative corrosion. Key refractory materials include high alumina materials, silica brick, magnesia-based, carbon, zirconia, and silicon carbide.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Refractory Materials For Steel Industry?

Increasing demand for steel from construction, infrastructure, automotive, and other sectors is the key driver of the market.

- The market is a significant sector, catering to the high-temperature requirements of steel production processes. These materials, including fireclay, magnesite, bauxite, metal oxides, and others, are essential for insulation, fire resistance, and thermal shock resistance in steel manufacturing. The chemical composition and classification of refractory materials include acidic refractories (silica brick), basic refractories (magnesia-based), and neutral refractories (silica-alumina and aluminous materials). High alumina materials, such as silica brick, are used for their thermal shock resistance, while fireclay classifications, such as monolithic refractories, ramming mixes, plastic refractories, and gunning mixes, offer various advantages in terms of installation and mechanical demand.

- Castables and insulating materials, including oxides like zirconia and silicon carbide (SiC), are crucial for thermal management and chemical corrosion resistance. Nanotechnology plays a role in refractory materials through the development of composite powders and advanced materials like hafnium dioxide (HfO2), which exhibit improved dielectric properties and ferroelectricity. Refractory alloys, such as those based on tungsten, molybdenum, and other metal oxides, offer enhanced oxidation resistance and chemical character for specific industrial processes. The steel industry's refractory materials market is influenced by various factors, including thermal and chemical demands, industrial processes in electricity generation, waste treatment, petrochemicals, and production processes.

What are the market trends shaping the Refractory Materials For Steel Industry?

Rising popularity of monolithic refractories over shaped refractories is the upcoming market trend.

- Monolithic refractories, consisting of dry granular or cohesive plastic materials with an indefinite form, are gaining significant traction in various industries, including the steel sector. These refractories, which are produced as suspensions that eventually harden to form a solid mass, offer several advantages over shaped refractories. Monolithic refractories are known for their ability to create virtually joint-free linings, which are only provided shape upon application. Their production involves large refractory particulates, fine filler constituents, and a binder phase. Monolithic refractories come in various forms, such as castables, plastics, gunning mixes, mortar, and ramming mixes. Castables are pre-blended dry powders that, when mixed with water, form a paste that can be poured or pumped into place and then harden.

- Plastics are similar to castables but contain a higher percentage of binders, making them more plastic and easier to shape. Gunning mixes are similar to plastics but are designed to be pumped through pipes and are used to line the inside of large vessels or pipes. Mortar and ramming mixes are used for installing refractory bricks and blocks in place. Insulating refractories, such as silica brick, are a crucial component of monolithic refractories due to their excellent thermal insulation properties. The thermal conductivity of insulating refractories is significantly lower than that of other refractories, making them ideal for high-temperature applications.

What challenges does the Refractory Materials For Steel Industry face during its growth?

Fluctuation in cost of refractory raw materials and high energy consumption is a key challenge affecting the industry growth.

- Refractory materials play a crucial role In the steel industry, particularly at high temperatures, where they serve as insulation and provide resistance to thermal shock and chemical corrosion. The primary raw materials for refractory production include fireclay, magnesite, bauxite, and various metal oxides. The chemical composition of these materials determines their classification as acidic, basic, or neutral refractories. Acidic refractories, such as silica brick, are suitable for use in acidic environments, while basic refractories, like magnesia-based materials, are effective in basic environments. Neutral refractories, such as alumina and silica-alumina, are utilized in a wide range of applications due to their versatility.

- High alumina materials, like alumina bricks and blocks, offer excellent thermal shock resistance and are widely used in continuous casting processes for steel production. Insulating materials, such as nanotechnology-enhanced castable refractories and gunning mixes, provide excellent thermal insulation and are essential for energy efficiency In the steel industry. Refractory materials are subjected to various industrial processes, including electricity generation, waste treatment, petrochemicals, and nonferrous metals production. The physical and chemical properties of refractories, such as oxidation resistance, chemical corrosion resistance, and thermal conductivity, are critical to their performance In these applications. Refractory raw materials, including magnesite, bauxite, alumina, and silica systems, exhibit high volatility due to economic conditions, political unrest, and other market factors.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allied Mineral Products LLC

- Chosun Refractories ENG Co. Ltd.

- Compagnie de Saint-Gobain S.A.

- HarbisonWalker International Inc.

- Imerys S.A.

- Krosaki Harima Corp.

- Magnezit Group

- Minerals Technologies Inc.

- Morgan Advanced Materials Plc

- Puyang Refractories Group Co. Ltd.

- Refractarios Alfran S.A

- Refractory Minerals Co. Inc.

- Refratechnik Holding GmbH

- RHI Magnesita GmbH

- Saudi Refractory Industries

- Shinagawa Refractories Co. Ltd.

- Unifrax I LLC

- Vesuvius Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Refractory materials play a crucial role In the steel industry by providing resistance to extreme temperatures and harsh conditions during various industrial processes. These materials are essential in maintaining the integrity of furnaces, kilns, and other high-temperature equipment, ensuring efficient and effective production. The refractory market for the steel industry is driven by the demand for high-performance materials that can withstand thermal shock, chemical corrosion, and oxidation. The selection of refractory materials depends on the specific requirements of the industrial process, including thermal conductivity, mechanical demand, and chemical demand. Refractory materials can be classified into three main categories: acidic, basic, and neutral.

Moreover, acidic refractories are suitable for applications where the environment is acidic, while basic refractories are used in basic environments. Neutral refractories are used in applications where the environment is neither acidic nor basic. High alumina materials, such as silica brick, are commonly used In the steel industry due to their excellent thermal shock resistance and high melting points. Fireclay, a natural clay material, is another widely used refractory material due to its good thermal insulation properties and low thermal conductivity. Magnesite, bauxite, and metal oxides are also used as raw materials In the production of refractory materials. The chemical composition of these materials plays a significant role In their performance in high-temperature applications.

However, monolithic refractories, ramming mixes, plastic refractories, gunning mixes, castables, and insulating materials are some of the various forms of refractory materials used In the steel industry. Each type of refractory material has its unique properties and applications. Refractory materials are used extensively in various industrial processes, including continuous casting, production of nonferrous metals such as aluminum, tungsten, and molybdenum, and refractory alloys. They are also used In thermal management applications, such as in electricity generation, waste treatment, petrochemicals, and production processes. The selection and installation of refractory materials require trained personnel with expertise In the field. The installation process is critical to ensure the longevity and performance of the refractory lining.

In addition, the demand for refractory materials in the steel industry is driven by the mechanical, thermal, and chemical demands of various industrial processes. The development of new refractory materials, such as composite powders and nanotechnology-based materials, offers opportunities for improved performance and cost savings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2.37 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.2 |

|

Key countries |

China, India, Japan, Russia, and US |

|

Competitive landscape |

Leading Companies, market research and growth, market research report, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Refractory Materials Market For Steel Industry Research and Growth Report?

- CAGR of the Refractory Materials For Steel Industry industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the refractory materials market for steel industry growth of industry companies

We can help! Our analysts can customize this refractory materials market for steel industry research report to meet your requirements.