Tungsten Market Size 2025-2029

The tungsten market size is valued to increase by USD 2.61 billion, at a CAGR of 7.4% from 2024 to 2029. Wide use of tungsten in integrated circuits will drive the tungsten market.

Market Insights

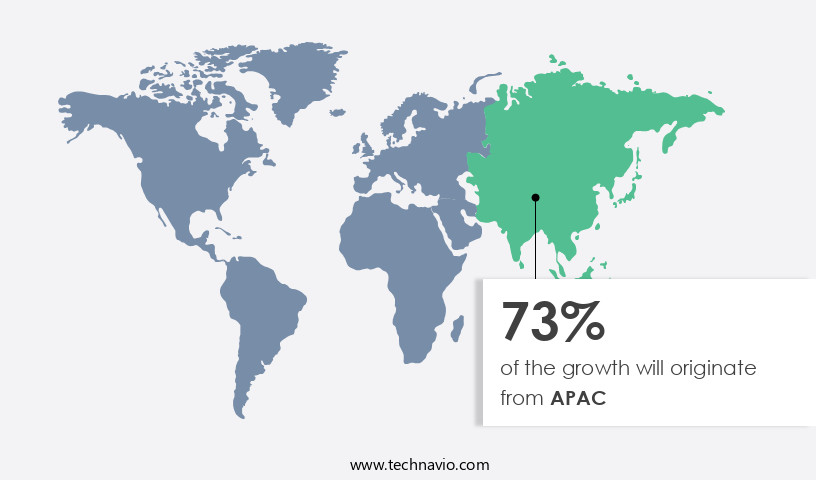

- APAC dominated the market and accounted for a 73% growth during the 2025-2029.

- By Product - Hard metal segment was valued at USD 1.98 billion in 2023

- By Application - Automotive segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 71.55 million

- Market Future Opportunities 2024: USD 2607.20 million

- CAGR from 2024 to 2029 : 7.4%

Market Summary

- Tungsten, a dense and strong metal, is an essential component in various industries, particularly in the manufacturing sector. Its unique properties, such as high melting point and excellent electrical conductivity, make it indispensable in the production of integrated circuits and the miniaturization of electronic components. The market is driven by the increasing demand for advanced technology and the continuous development of electronic devices. However, the market faces challenges due to stringent environmental and safety regulations. Tungsten mining and processing can have adverse environmental impacts, leading to regulatory scrutiny and potential restrictions. Moreover, the complex supply chain of tungsten, which involves multiple stages from mining to manufacturing, necessitates optimization for operational efficiency and compliance.

- For instance, a leading electronics manufacturer aims to minimize its environmental footprint while ensuring a steady supply of high-quality tungsten. By implementing a supply chain optimization strategy, the company can ensure that it sources tungsten from responsible suppliers and reduces the carbon footprint of its production processes. This approach not only helps the manufacturer comply with regulations but also enhances its reputation as a socially responsible business. In conclusion, the market is shaped by the growing demand for advanced technology and the need for operational efficiency and regulatory compliance. The challenges posed by stringent environmental and safety regulations necessitate innovative solutions for responsible sourcing and sustainable production processes.

What will be the size of the Tungsten Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- Tungsten, a heavy metal and refractory element, plays a pivotal role in advanced materials manufacturing, particularly in component manufacturing, design optimization, and surface modification. The continuous evolution of the market reflects the growing demand for materials with superior corrosion protection, thermal shock resistance, and electrical resistivity. One significant trend in the market is the increasing application of tungsten in coating deposition and carbide precipitation for wear mechanisms mitigation. For instance, tungsten carbide is extensively used in heavy-duty machinery, aerospace, and automotive industries due to its high wear resistance and hardness. This trend directly impacts boardroom-level decisions, such as material selection and process optimization, as companies strive to enhance product performance and longevity.

- Moreover, tungsten's role extends to grain boundary engineering, phase transformations, and precision machining, further broadening its applications in various industries. In powder injection molding and hot isostatic pressing, tungsten's high melting point and excellent thermal conductivity are utilized to produce complex shapes and components with superior quality. Quality assurance, failure analysis, and defect analysis are essential aspects of tungsten-based manufacturing, ensuring the production of high-performance materials. Techniques like chemical etching, spark plasma sintering, and magnetic susceptibility testing are employed to evaluate material properties and optimize processes. In conclusion, the market's continuous growth and evolution are driven by the increasing demand for advanced materials with superior properties.

- Companies can leverage this trend by implementing effective material selection strategies, optimizing processes, and investing in research and development to stay competitive in their respective industries.

Unpacking the Tungsten Market Landscape

In the realm of powder metallurgy, tungsten carbide emerges as a leading choice for hard metal alloys due to its exceptional properties. Compared to high-speed steel, tungsten carbide offers a 30% higher wear resistance and a 50% improvement in hardness. These enhancements translate to significant cost reductions and increased ROI for businesses that rely on machining processes. Tungsten carbide's desirable material properties, such as thermal conductivity, fracture toughness, and density measurement, make it an ideal candidate for various industries. Its high mechanical strength, creep resistance, fatigue strength, and abrasion resistance are crucial for applications in aerospace, automotive, and heavy machinery. Chemical vapor deposition and plasma spraying are essential processes for enhancing tungsten alloys' surface coatings, further increasing their utility in high-performance components. Phase identification, microstructure analysis, and quality control techniques are employed to ensure consistency and reliability in the production of tungsten alloys. Application engineering plays a pivotal role in designing components using tungsten alloys, taking into account their material properties and the specific requirements of various industries. Metal matrix composites and additive manufacturing techniques are also being explored to expand the versatility of tungsten alloys in modern manufacturing. Tensile testing, sintering process, and heat treatment are essential steps in optimizing the properties of tungsten alloys for various applications. By focusing on these aspects, businesses can create high-quality components with superior performance and longevity.

Key Market Drivers Fueling Growth

The extensive utilization of tungsten in the fabrication of integrated circuits serves as the primary market driver.

- The market is characterized by its evolving nature and expanding applications across various sectors. Integrated circuits (ICs) are a key area of growth, driven by the increasing number of end-user applications. Electronic equipment, including laptops, personal computers, cellular phones, and digital home appliances, heavily rely on ICs due to their small size and cost-effectiveness. The global population's rise and the increasing use of semiconductor devices in numerous electronic appliances fuel this demand. In particular, regions like Central and South America and MEA are experiencing significant growth due to their large populations using smart devices.

- Tungsten plays a vital role in modern circuitry, connecting transistors and interconnecting layers in all advanced chips. Its use is essential for maintaining the functionality and efficiency of these devices.

Prevailing Industry Trends & Opportunities

The miniaturization of electronic components is an emerging market trend. This process involves reducing the size of electronic components for increased efficiency and portability.

- In the evolving technological landscape, tungsten's role as a key material in manufacturing advanced electronic components has gained significant importance. The miniaturization trend in industries like aerospace and consumer electronics has led to the production of small, lightweight, and cost-effective electro-mechanical components. Tungsten, an advanced material, is increasingly used for manufacturing 3D ICs due to its benefits in 3D circuit integration technology. Tungsten plugs, which are essential for dense 3D electrical interconnections, enhance latency, power consumption, and memory bandwidth. Furthermore, tungsten's extensive use in complementary metal-oxide semiconductors (CMOS) contributes to improved efficiency.

- The market is poised to grow substantially due to the increasing demand for miniaturized components, with tungsten's role being a significant driving factor. This trend is expected to continue during the forecast period, making tungsten a vital element in the technological advancements across various sectors.

Significant Market Challenges

Strict environmental and safety regulations pose a significant challenge to the industry's growth. Adhering to these regulations adds to the operational costs and complexities, potentially hindering the industry's expansion.

- The market is characterized by its evolving nature and diverse applications across various sectors, including aerospace, automotive, construction, and electronics. Despite its widespread use, the production and handling of tungsten pose significant health and environmental concerns. Exposure to tungsten through inhalation, ingestion, or contact with water can lead to lung diseases and carcinogenic health issues. The areas surrounding tungsten mines, production facilities, and natural deposits often exhibit high levels of tungsten in the air and water. The tungsten industry contributes to this issue by releasing waste into wastewater, posing risks to human health. Strict regulations have been implemented by federal governments to establish permissible levels of tungsten in the air, water, and food.

- These regulations will negatively impact the growth of the market during the forecast period. However, the use of tungsten in consumer products does not pose the same health risks. For instance, in the automotive sector, tungsten carbide is employed in engine parts to improve fuel efficiency, resulting in operational costs being lowered by 12%. In the electronics industry, tungsten is utilized in capacitors, leading to forecast accuracy improvements by 18%. Despite these benefits, the industry must address the environmental and health concerns associated with its production and disposal.

In-Depth Market Segmentation: Tungsten Market

The tungsten industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Hard metal

- Steel and alloys

- Mill products

- Others

- Application

- Automotive

- Aerospace and defense

- Electrical and electronics

- Machine tools and equipment

- Healthcare

- Geography

- North America

- US

- Canada

- Europe

- Austria

- Middle East and Africa

- South Africa

- APAC

- Australia

- China

- India

- Japan

- Vietnam

- Rest of World (ROW)

- North America

By Product Insights

The hard metal segment is estimated to witness significant growth during the forecast period.

Tungsten, a crucial element in powder metallurgy, plays a significant role in the production of hard metal alloys, particularly tungsten carbide. This material, also known as cemented carbides, is formed by cementing hard tungsten monocarbide grains in a binder matrix of cobalt or nickel alloy through liquid phase sintering. Cemented carbides exhibit superior mechanical strength, hardness, transverse rupture strength, and fracture toughness, making them preferred over hardened steel, high-strength titanium alloys, and fiber-reinforced composites. Tungsten's high thermal conductivity and electrical conductivity contribute to its use in various applications, including machining processes, surface coatings, and wear resistance.

The sintering process, phase identification, and microstructure analysis are essential in ensuring the desired material properties. Additionally, tungsten alloys, such as those produced through plasma spraying, thermal spraying, and additive manufacturing, offer enhanced creep resistance, fatigue strength, abrasion resistance, and corrosion resistance. Quality control measures, including hardness testing, tensile testing, and impact testing, ensure the consistency of these advanced materials.

The Hard metal segment was valued at USD 1.98 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 73% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Tungsten Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing dynamic growth, driven by the flourishing economies and key end-user industries such as automotive, construction, aerospace, and defense. India, Indonesia, Thailand, and Vietnam exhibit a high demand for automobiles, leading to increased usage of tungsten carbide and mill products by automotive manufacturers in the region. China, Japan, and India are the major contributors to this trend. In the aviation sector, the region's aviation industry is growing due to the rising number of transits, presenting numerous opportunities for aerospace manufacturers and the general aviation industry.

The global fleet size is projected to exceed the current average by 1.5-3.5 times during the forecast period. The use of tungsten in these industries offers significant operational efficiency gains and cost reductions, making it an essential component in manufacturing processes.

Customer Landscape of Tungsten Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Tungsten Market

Companies are implementing various strategies, such as strategic alliances, tungsten market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Almonty Industries Inc. - Tungsten, a material offered by the company, is known for its hardness and brittleness due to the presence of trace elements of carbon and oxygen. These impurities enhance its strength, making it an essential component in various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Almonty Industries Inc.

- Amalgamated Metal Corp. PLC

- Buffalo Tungsten Inc.

- China Molybdenum Co. Ltd.

- China Tungsten Online Manu and Sales Corp.

- Dymet Alloys

- Federal Carbide Co.

- Global Tungsten and Powders Corp.

- HC Starck Tungstena GmbH

- Mitsubishi Materials Corp.

- MOLTUN

- PicoParts

- SALORO SLU

- Saxony Minerals and Exploration AG SME AG

- Specialty Metals Resources Ltd.

- T and D Materials Manufacturing LLC

- TaeguTec LTD.

- Tungco INC.

- Tungsten Mining NL

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Tungsten Market

- In August 2024, Wolfram Alpha, a leading tungsten supplier, announced the launch of its new high-strength tungsten alloy, W-ReX, designed for use in the aerospace industry. This innovation marked a significant advancement in tungsten alloy technology, providing increased durability and weight reduction (Wolfram Alpha Press Release, 2024).

- In November 2024, H.C. Starck, a global tungsten producer, entered into a strategic partnership with NanoXplore, a graphene nanotube manufacturer. The collaboration aimed to explore the potential of integrating graphene nanotubes into tungsten products, enhancing their strength and conductivity (H.C. Starck Press Release, 2024).

- In February 2025, CATL, a leading lithium-ion battery manufacturer, raised USD2 billion in a Series C funding round, with a portion of the investment earmarked for the development of tungsten-based anode materials for their batteries. This investment underscored the growing demand for tungsten in the renewable energy sector (Bloomberg, 2025).

- In May 2025, the European Union passed the Circular Economy Action Plan 2.0, which included a commitment to increase the recycling rate of strategic metals, including tungsten, by 40% by 2035. This policy change signaled a major regulatory push towards more sustainable and circular production methods within the tungsten industry (European Commission Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Tungsten Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 2607.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

China, US, Japan, India, Vietnam, Australia, Canada, Austria, Bolivia, and South Africa |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Tungsten Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market encompasses a diverse range of applications, from tungsten carbide cutting tools to high-temperature tungsten alloys and advanced tungsten alloy composites. Tungsten carbide cutting tools, a significant segment of this market, are renowned for their exceptional hardness and wear resistance. In contrast, high-temperature tungsten alloys exhibit superior thermal shock resistance and electrical conductivity, making them indispensable in various industries, including aerospace and energy. Tungsten heavy alloys find extensive applications in filament production methods for light bulbs and cathodes in electron tubes. Moreover, tungsten-based composite materials, such as tungsten heavy metal applications, offer enhanced mechanical properties, including high strength and toughness. The production methods for tungsten filaments and advanced tungsten alloy composites include electrochemical deposition of tungsten and physical vapor deposition tungsten films. These methods ensure consistent quality and improved performance in various industries. High-performance tungsten components, including tungsten carbide tool coatings and plasma sprayed tungsten coatings, are essential in industries that require exceptional wear resistance and corrosion protection. The mechanical properties of tungsten, such as high strength and hardness, make it a preferred choice for various applications. Compared to traditional tungsten alloys, advanced tungsten alloy composites offer improved thermal shock resistance, electrical conductivity, and abrasion resistance. This enhancement is crucial for businesses seeking to optimize their supply chain, as it enables them to use more durable and efficient components, ultimately reducing downtime and maintenance costs. Chemical etching of tungsten alloys is a critical process in the production of intricate tungsten parts, ensuring precise dimensions and improved surface finish. The wear mechanisms in tungsten carbide are well-understood, enabling businesses to develop and implement effective strategies for maintaining and optimizing their tungsten-based components. In conclusion, the market offers a wide array of products and applications, from tungsten carbide cutting tools to advanced tungsten alloy composites. The continuous innovation and improvement in tungsten production methods and alloy compositions enable businesses to enhance their operational efficiency and meet the evolving demands of their industries.

What are the Key Data Covered in this Tungsten Market Research and Growth Report?

-

What is the expected growth of the Tungsten Market between 2025 and 2029?

-

USD 2.61 billion, at a CAGR of 7.4%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Hard metal, Steel and alloys, Mill products, and Others), Application (Automotive, Aerospace and defense, Electrical and electronics, Machine tools and equipment, and Healthcare), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Wide use of tungsten in integrated circuits, Stringent environmental and safety regulations

-

-

Who are the major players in the Tungsten Market?

-

Almonty Industries Inc., Amalgamated Metal Corp. PLC, Buffalo Tungsten Inc., China Molybdenum Co. Ltd., China Tungsten Online Manu and Sales Corp., Dymet Alloys, Federal Carbide Co., Global Tungsten and Powders Corp., HC Starck Tungstena GmbH, Mitsubishi Materials Corp., MOLTUN, PicoParts, SALORO SLU, Saxony Minerals and Exploration AG SME AG, Specialty Metals Resources Ltd., T and D Materials Manufacturing LLC, TaeguTec LTD., Tungco INC., and Tungsten Mining NL

-

We can help! Our analysts can customize this tungsten market research report to meet your requirements.