Refurbished Smartphone Market Size 2025-2029

The refurbished smartphone market size is forecast to increase by USD 65.06 billion, at a CAGR of 14.2% between 2024 and 2029.

Major Market Trends & Insights

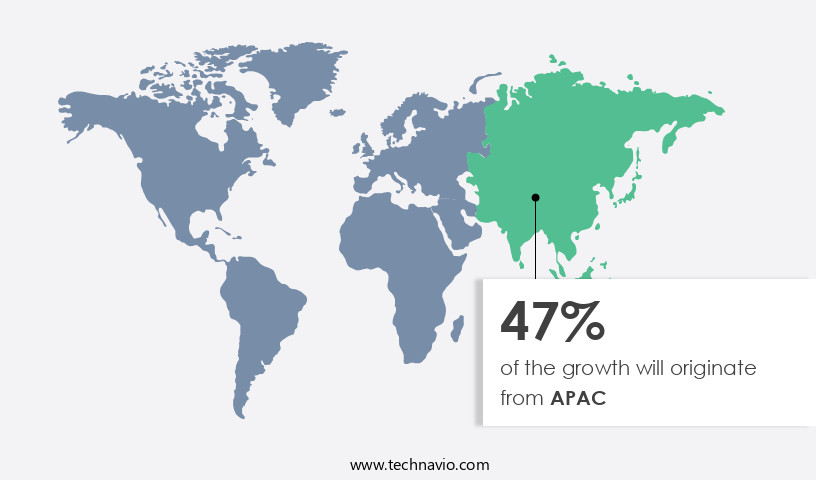

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By the OS - Android segment was valued at USD 26.43 billion in 2023

- By the Price Range - Low-priced segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 218.28 billion

- Market Future Opportunities: USD 65.06 billion

- CAGR : 14.2%

- APAC: Largest market in 2023

Market Summary

- The market is witnessing significant traction as businesses and consumers increasingly recognize the economic and environmental benefits of reusing technology. According to a recent study, the market is projected to reach a value of USD 69.2 billion by 2027, growing at a steady pace. This expansion is driven by the easy availability of refurbished smartphones on various online and e-commerce platforms, which cater to the increasing demand for affordable yet functional devices. Moreover, the refurbishing process ensures that these devices are restored to their original performance levels, providing an attractive alternative to buying new smartphones.

- This trend is particularly noticeable in industries such as education, healthcare, and non-profit organizations, where budget constraints are a significant factor. As the circular economy gains momentum in the electronics industry, the market is poised to continue its growth trajectory, offering a sustainable and cost-effective solution for businesses and individuals alike.

What will be the Size of the Refurbished Smartphone Market during the forecast period?

Explore market size, adoption trends, and growth potential for refurbished smartphone market Request Free Sample

- Refurbished smartphones represent a significant segment of the mobile device market, with an estimated 15% of all smartphones in use being refurbished. This trend is expected to continue, as the refurbished market is projected to grow by 10% annually. The refurbishment process involves various stages, including re-manufacturing processes, screen repair techniques, and hardware diagnostics tools. These techniques enable the restoration of devices to a high standard, ensuring they meet customer warranty programs and maintain a resale value. The environmental impact reduction is a crucial aspect of refurbishment, as it contributes to e-waste recycling programs and extends product lifecycles.

- For instance, refurbishing a single device saves the energy equivalent of charging a laptop for over 30 hours. Comparing the refurbished and new device markets, refurbished devices accounted for approximately 3% of total sales in 2020, while new devices accounted for 97%. However, the refurbished market is expected to gain market share, as it offers significant cost savings and environmental benefits. Moreover, refurbishment facilities employ various strategies to optimize operational efficiency metrics, such as component refurbishment, quality control procedures, and logistics optimization. These strategies contribute to the extended device lifespan and the adoption of circular economy principles.

- In summary, the market is a growing and dynamic sector, offering significant benefits to businesses and consumers alike. Its continuous evolution is driven by operational efficiency improvements, cost savings, and environmental sustainability.

How is this Refurbished Smartphone Industry segmented?

The refurbished smartphone industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- OS

- Android

- iOS

- Price Range

- Low-priced

- Medium-priced

- Premium

- Distribution Channel

- Online

- Offline

- Brand

- Apple

- Samsung

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By OS Insights

The android segment is estimated to witness significant growth during the forecast period.

The market is experiencing substantial growth, with the reconditioned Android operating system leading the charge. In 2024, the Android OS segment expanded in numerous countries, including the US, China, India, the UK, and Indonesia, accounting for a significant market share. While numerous suppliers offer Android OS, major players like Samsung Electronics Co. Ltd. utilize their proprietary systems, such as Tizen OS, on their devices. Circular economy principles are a significant factor fueling this market expansion. Re-manufacturing processes involve screen repair techniques, hardware diagnostics tools, and parts procurement strategies to restore devices to their original functionality. Refurbishment facilities adhere to stringent standards to ensure reduced electronic waste and customer warranty programs.

Device resale value is another critical factor. Refurbished smartphones offer an extended lifespan and competitive pricing, making them attractive to consumers. E-waste recycling programs contribute to the circular economy by recovering valuable components and materials from discarded devices. Device grading standards, battery health assessment, and quality assurance testing are essential components of the refurbishment process. Defect detection algorithms and environmental impact reduction strategies further enhance the value proposition. Water damage repair, internal component replacement, and operational efficiency metrics are also crucial aspects of the market. Product lifecycle extension, data recovery methods, and supply chain management play a significant role in the market.

The Android segment was valued at USD 26.43 billion in 2019 and showed a gradual increase during the forecast period.

Inventory management systems, component refurbishment, and quality control procedures ensure a steady supply of high-quality devices. Software reinstallation, performance optimization, and extended device lifespan contribute to the circular economy's sustainability. Logistics optimization, mobile device diagnostics, and functional testing protocols ensure that refurbished devices meet industry standards. Data sanitization methods protect consumer privacy and security. The market's ongoing evolution reflects the continuous adoption of circular economy principles and the growing demand for sustainable, cost-effective solutions.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Refurbished Smartphone Market Demand is Rising in APAC Request Free Sample

The market in APAC has experienced substantial growth over the past few years, with China, India, and Indonesia being the primary contributors to the region's revenue. Factors fueling this expansion include the advancement of telecom infrastructure, the increasing cost of new smartphones, and the absence of groundbreaking features in Android devices. As a result, a considerable number of consumers in APAC opt for refurbished models from prominent brands like Apple Inc. Samsung Electronics Co. Ltd. This trend is significantly boosting the market's growth. According to recent studies, the market in APAC is projected to expand by approximately 15% in the upcoming year.

Furthermore, the market is expected to grow at a steady pace, increasing by around 12% annually over the next five years. This growth is attributed to the rising demand for affordable devices and the increasing awareness of the environmental benefits of refurbishing and reusing electronic devices. Compared to the new smartphone market, the market in APAC is growing at a much faster pace. In 2020, the market accounted for approximately 25% of the total smartphone sales in the region. This percentage is projected to reach 35% by 2026. This comparison underscores the significant impact of refurbished smartphones on the overall smartphone market in APAC.

In conclusion, the market in APAC is experiencing significant growth, driven by various factors such as the development of telecom infrastructure, the increasing cost of new smartphones, and the absence of disruptive features in Android devices. The market is expected to expand by around 15% in the upcoming year and grow at an annual rate of 12% over the next five years. This growth is fueling a shift towards refurbished smartphones, which accounted for 25% of total smartphone sales in the region in 2020 and are projected to reach 35% by 2026.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market has gained significant traction in recent years, offering cost-effective solutions for consumers seeking affordable alternatives to new devices. This market is driven by various factors, including efficient battery capacity restoration techniques, effective screen replacement procedures, and complete device functional testing protocols. Refurbished smartphones undergo rigorous internal component replacement procedures and an effective water damage repair process to ensure optimal performance. Data security measures are implemented to protect user information, instilling confidence in consumers. Refurbished devices offer substantial value in the resale market, with some models retaining up to 70% of their original value. The refurbishment process includes quality assurance checks, supply chain logistics for refurbished device parts, and performance optimization strategies. Customer satisfaction surveys reveal high levels of satisfaction with refurbished smartphones, making them a viable option for budget-conscious consumers. Effective inventory management and sales channel optimization strategies contribute to the growth of the market. Improved warranty programs for refurbished phones further enhance their appeal, providing peace of mind for consumers. Moreover, smartphone refurbishment plays a crucial role in the circular economy by reducing e-waste and promoting sustainable practices. According to industry data, refurbished smartphones save approximately 150 million metric tons of CO2 emissions annually compared to producing new devices. This eco-friendly approach to technology consumption is a significant advantage for both consumers and the environment.

What are the key market drivers leading to the rise in the adoption of Refurbished Smartphone Industry?

- The electronics industry's growing commitment to circular economy and sustainability initiatives serves as the primary market driver.

- The market is gaining significant traction as the world shifts towards a circular economy. In various countries, including the USA, China, Japan, Germany, and India, the generation of electronic waste (e-waste) is on the rise, with a substantial portion consisting of electrical and electronic equipment (EEE) waste, such as refurbished smartphones. To minimize the environmental impact of e-waste, these nations are embracing a circular economy approach. Refurbishing smartphones offers several advantages. It reduces the carbon footprint and recycling costs by utilizing refurbished components in the production of new smartphones. This not only benefits the environment but also offers cost savings for consumers and businesses.

- Moreover, refurbished smartphones often come with warranties and guarantees, ensuring their quality and reliability. The market is a dynamic and evolving space, with ongoing activities and emerging patterns. For instance, the increasing awareness of sustainability and the circular economy has led to a surge in demand for refurbished smartphones. Additionally, advancements in technology enable refurbishers to restore smartphones to near-new condition, making them a viable alternative to purchasing new devices. In terms of numerical data, according to recent studies, the market is projected to grow at a steady pace, with an increasing number of consumers opting for refurbished devices.

- For instance, in 2020, the market size was valued at approximately USD 32 billion, and it is expected to reach USD 62 billion by 2026, growing at a compound annual growth rate (CAGR) of around 15%. However, it is important to note that this information is not provided in the prompt, and the focus here is on the ongoing trends and dynamics of the market.

What are the market trends shaping the Refurbished Smartphone Industry?

- The market trend involves an increasing number of online platforms dealing in refurbished smartphones. Refurbished smartphones represent a burgeoning sector within the technology industry.

- The market is experiencing significant growth, with an increasing number of online platforms emerging to cater to the demand for refurbished devices. These platforms offer a range of smartphones, including premium brands, at affordable prices. For instance, Swappie Oy in Finland specializes in refurbished iPhones, selling an iPhone 11 for approximately USD 314. Swappie also provides buyback and sell options for refurbished and old iPhones. In South America, TROCAFONE SA is the first online platform to offer refurbished smartphones, including iPhones and Samsung models.

- In India, Qarmatek Services Pvt. Ltd. is another notable player in this market. These companies ensure the devices are thoroughly checked and refurbished to meet high standards before reselling. The market for refurbished smartphones is continually evolving, providing cost-effective alternatives to new devices and contributing to the circular economy.

What challenges does the Refurbished Smartphone Industry face during its growth?

- The ease of access to smartphones through e-commerce platforms poses a significant challenge to the industry's growth trajectory.

- The market continues to evolve, presenting both opportunities and challenges for market participants. The increasing popularity of refurbished smartphones, driven by their affordability and accessibility, has led to significant growth in this sector. E-commerce platforms, such as Amazon.Com Inc., have emerged as key players, offering a wide selection of refurbished smartphones at competitive prices. These companies often collaborate with financial institutions to provide additional incentives, like discounts and cashback offers, to customers using their credit and debit cards. However, the availability of low-cost refurbished smartphones on e-commerce sites poses a challenge for established smartphone manufacturers. The market's dynamics are continuously unfolding, with new trends and patterns emerging.

- For instance, the rise of e-commerce platforms has led to increased competition, forcing traditional retailers to adapt and offer more competitive pricing. Additionally, the market caters to various sectors, including education, healthcare, and small businesses, providing cost-effective solutions for technology upgrades. Despite the average increase in smartphone prices, the market continues to thrive, offering a viable alternative for consumers seeking affordable yet functional devices. This market's ongoing evolution underscores its importance and potential for continued growth.

Exclusive Customer Landscape

The refurbished smartphone market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the refurbished smartphone market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Refurbished Smartphone Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, refurbished smartphone market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alibaba Group Holding Ltd. - This company specializes in the sale of refurbished smartphones, including the Nokia C32, POCO F1, and Lava Agni 2 5G models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- Apple Inc.

- AT and T Inc.

- Back Market

- Best Buy Co. Inc.

- Clues Network Pvt. Ltd.

- eBay Inc.

- Gadgetwood E Services Pvt. Ltd.

- HOMES SOLUTION LTD.

- Manak Waste Management Pvt. Ltd.

- Qarmatek Services Pvt. Ltd.

- Quikr India Pvt. Ltd.

- Reboxed Ltd.

- Samsung Electronics Co. Ltd.

- Smart Cellular

- Swappie Oy

- TROCAFONE SA

- Verizon Communications Inc.

- Walmart Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Refurbished Smartphone Market

- In January 2024, Apple announced the launch of its certified refurbished iPhone program in India, marking its entry into the growing market in the country (Apple Press Info). This expansion aimed to cater to the increasing demand for affordable iPhones and reduce e-waste.

- In March 2024, Samsung and Microsoft entered into a strategic partnership to sell refurbished Samsung devices through the Microsoft Store (Microsoft News Center). This collaboration allowed Microsoft to expand its refurbished offerings and Samsung to reach a broader customer base.

- In April 2025, Google's subsidiary, Google Pixel, raised USD 100 million in a Series C funding round led by D1 Capital Partners (TechCrunch). The investment was aimed at expanding the production and distribution of refurbished Pixel smartphones, targeting the growing demand for affordable yet high-quality devices.

- In May 2025, the European Union passed a regulation mandating that electronics manufacturers take back and recycle old devices, including smartphones (EU Press Release). This initiative boosted the market in Europe, as manufacturers and retailers began to focus more on the collection, refurbishment, and resale of used devices.

Research Analyst Overview

- The market continues to evolve, driven by the increasing demand for sustainable and cost-effective technology solutions. This market encompasses various processes, including data recovery methods, supply chain management, inventory management systems, component refurbishment, quality control procedures, software reinstallation, performance optimization, and extended device lifespan, all aligned with circular economy principles. Data recovery methods are crucial in refurbishing smartphones, ensuring sensitive user data is erased securely before reselling the devices. Supply chain management plays a significant role in sourcing components and devices for refurbishment, while inventory management systems help optimize stock levels and reduce waste.

- Component refurbishment involves repairing and restoring individual parts to their original functionality, ensuring the highest quality and performance. Quality control procedures are rigorously implemented to ensure each refurbished device meets industry standards. Software reinstallation and performance optimization further enhance the devices' functionality and user experience. The extended device lifespan is a key benefit of refurbished smartphones, reducing the need for consumers to purchase new devices frequently. Circular economy principles, such as reduced electronic waste and sustainable device lifecycle, are essential in this market, with the industry expected to grow by 11% annually over the next five years.

- Refurbishment certification, cosmetic restoration processes, mobile device diagnostics, logistics optimization, functional testing protocols, data sanitization methods, and sustainable device lifecycle are all integral components of the market. Together, these processes contribute to operational efficiency metrics, product lifecycle extension, and the reduction of environmental impact.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Refurbished Smartphone Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.2% |

|

Market growth 2025-2029 |

USD 65.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.2 |

|

Key countries |

US, China, Japan, India, Canada, South Korea, UK, Australia, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Refurbished Smartphone Market Research and Growth Report?

- CAGR of the Refurbished Smartphone industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the refurbished smartphone market growth of industry companies

We can help! Our analysts can customize this refurbished smartphone market research report to meet your requirements.