REIT Market Size 2025-2029

The reit market size is forecast to increase by USD 372.8 billion, at a CAGR of 3% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing global demand for warehousing and storage facilities. This trend is fueled by the e-commerce sector's continued expansion, leading to an increased need for efficient logistics and distribution networks. An emerging trend in the market is the rise of self-storage as a service, offering investors attractive returns and catering to the growing consumer preference for flexible and convenient storage solutions. However, the market faces challenges as well. Vertical integration by e-commerce companies poses a threat to the industry, as these companies increasingly control the entire supply chain from production to delivery, potentially reducing the need for third-party logistics and storage providers.

- Additionally, regulatory changes and economic uncertainties can impact REITs' profitability and investor confidence. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay informed of these trends and adapt to the evolving landscape.

What will be the Size of the REIT Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with various sectors such as retail, industrial, and commercial real estate experiencing dynamic shifts. Family offices, pension funds, high-net-worth individuals, and sovereign wealth funds increasingly invest in this asset class, seeking diversification and stable returns. Market volatility, driven by economic cycles and interest rate fluctuations, influences investment strategies. Artificial intelligence and property technology are transforming the industry, with data analytics and digital platforms streamlining property management, investment, and appraisal processes. Multifamily housing and single-family homes remain popular choices due to their rental income potential and capital appreciation opportunities. Property taxes, inflation risk, and maintenance costs are essential considerations for investors, requiring effective risk management strategies.

Net operating income, return on equity, and occupancy rates are critical performance metrics. Regulatory environment and property regulations also impact the market, influencing capitalization rates and shareholder value. Institutional investors explore equity and debt financing, real estate brokerage, and securities offerings to capitalize on opportunities. Property investment platforms, real estate syndications, and property management companies facilitate access to diverse offerings. Green building standards and sustainable development are gaining traction, attracting socially responsible investors. The ongoing digital transformation of the real estate sector, including smart buildings and hybrid REITs, offers new investment opportunities and challenges. Investors must stay informed of market trends and adapt their strategies accordingly.

How is this REIT Industry segmented?

The reit industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Industrial

- Commercial

- Residential

- Application

- Warehouses and communication centers

- Self-storage facilities and data centers

- Others

- Product Type

- Triple net

- Double net

- Modified gross lease

- Full service

- Percentage

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Singapore

- Rest of World (ROW)

- North America

By Type Insights

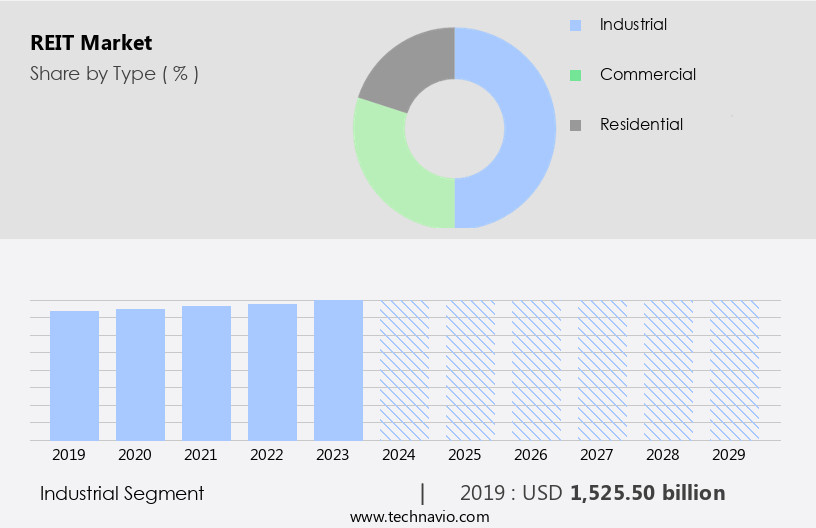

The industrial segment is estimated to witness significant growth during the forecast period.

The retail and industrial real estate sectors dominate the market, with industrial real estate leading in 2024. The industrial segment's growth is driven by the increasing demand for warehousing space due to the surge in e-commerce and online sales during the COVID-19 pandemic. Supply chain disruptions have compelled companies to lease more warehouse space to store additional inventory, leading to increased occupancy and rental rates. Furthermore, the proximity of fulfillment centers to metropolitan areas caters to the growing number of online consumers. This trend will continue to fuel the expansion of industrial REITs, offering significant growth opportunities for the market.

Asset management companies, pension funds, and high-net-worth individuals are increasingly investing in REITs for their attractive dividend yields and potential for capital appreciation. Private equity firms and family offices are also active players in the market, providing equity financing for REITs. Real estate agents and brokers facilitate transactions, while debt financing from banks and insurance companies support the development of new properties. Data analytics and property technology (proptech) are transforming the real estate industry, enabling better property performance metrics and risk management. Property regulations, tax incentives, and green building standards also influence the market. Sovereign wealth funds and institutional investors are significant investors in REITs, seeking portfolio diversification and stable returns.

The economic cycle and market volatility impact the market, with interest rate risk and inflation risk being key concerns. Securities offerings provide capital for REITs to fund their growth, while property appraisals ensure accurate asset valuation. Property regulations and capitalization rates determine shareholder value, and the regulatory environment continues to evolve. Office space, multifamily housing, and residential real estate are other sectors within the market, with varying growth dynamics. Hybrid REITs combine multiple sectors, offering investors exposure to a diverse range of property types. Sustainable development and net operating income are essential metrics for REIT performance, with maintenance costs and occupancy rates also playing crucial roles.

In conclusion, the market is dynamic and complex, with various entities and factors influencing its growth and trends. Industrial REITs are currently leading the market due to the e-commerce boom, while other sectors, such as retail and office space, face challenges. The use of technology, regulatory environment, and investor demand will continue to shape the market's future.

The Industrial segment was valued at USD 1525.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

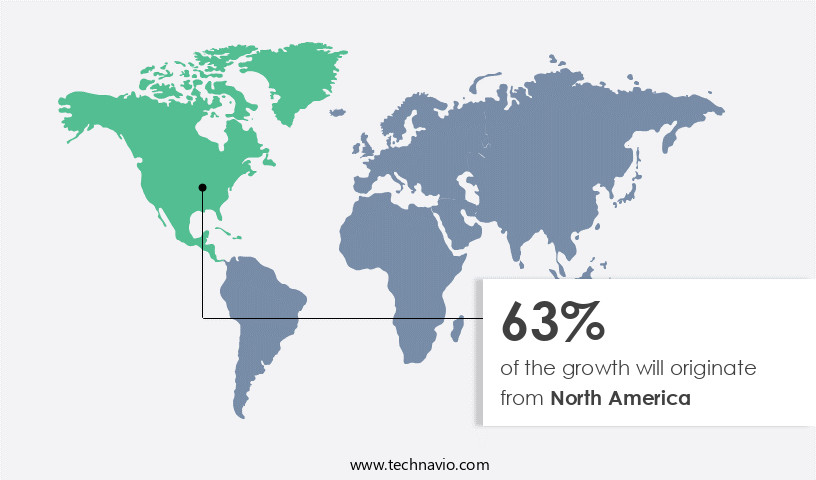

North America is estimated to contribute 63% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market holds a significant position in the global REIT industry, driven by the expansion of sectors like manufacturing, food and beverages, chemical, and e-commerce. Industrial real estate, particularly storage and warehouses, experiences low vacancy rates of approximately 3%-6%, leading to increased rent prices in the US. Self-ownership of warehouses is less favored due to high capital requirements, resulting in a strong preference for leased facilities among end-users. Commercial real estate, including retail and office spaces, also contributes to the market's growth. Pension funds, high-net-worth individuals, and institutional investors continue to invest in REITs for their attractive dividend yields and potential for capital appreciation.

Asset management firms, real estate agents, and property management companies play crucial roles in the market, while private equity firms and venture capitalists provide equity financing. Economic cycles and regulatory environments influence REIT performance, with property taxes, inflation risk, and insurance premiums impacting net operating income. Property valuation is crucial for investors, with property appraisal and performance metrics essential for assessing property value. Digital transformation and property technology (proptech) are revolutionizing the industry, with smart buildings, sustainable development, and hybrid REITs gaining popularity. Sovereign wealth funds, family offices, and retirement funds also invest in REITs for portfolio diversification and risk management.

Market volatility and interest rate risk are significant factors affecting REITs, with securities offerings providing opportunities for capital infusion. Mortgage REITs and equity REITs cater to different investment strategies, with rental income and return on equity key performance indicators. Debt financing and equity financing are essential for REIT growth, with real estate brokerage facilitating transactions. Green building standards and property regulations ensure sustainable development and compliance. Capitalization rates and shareholder value are critical for REIT success, with occupancy rates and property performance metrics essential for assessing property health. Inflation risk, maintenance costs, tax incentives, and risk management are ongoing concerns for REIT investors.

Overall, the market is dynamic, with various entities shaping its growth and trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of REIT Industry?

- The surge in global demand for efficient warehousing and storage solutions serves as the primary market driver.

- The Real Estate Investment Trust (REIT) market is experiencing significant growth due to various market dynamics. One of the key drivers is the increasing demand for property technology (proptech) in the real estate industry. Sovereign wealth funds and institutional investors are investing heavily in Equity REITs, which derive income from rental properties, to capitalize on this trend. The digital transformation of real estate, including smart buildings and automation, is enhancing the tenant experience and increasing property value. Equity financing and debt financing are essential for the development and expansion of REITs. Real estate agents and brokers play a crucial role in facilitating transactions and ensuring regulatory compliance.

- Property regulations, such as zoning laws and building codes, are evolving to accommodate the changing landscape of the industry. Insurance premiums and mortgage REITs provide alternative sources of income for REITs. The demand for warehousing and storage facilities is also driving the growth of the market. The construction of new warehouses and storage facilities is capital-intensive, making REITs an attractive investment option for those seeking return on equity. Portfolio diversification is another reason for the growing popularity of REITs. They offer investors exposure to various sectors, including residential, commercial, industrial, and hospitality, among others. The potential for capital appreciation and stable income streams make REITs an attractive investment option for both individual and institutional investors.

- In conclusion, the market is experiencing a period of growth driven by various factors, including the demand for proptech, increasing institutional investment, and the need for warehousing and storage facilities. REITs offer investors stable income streams, capital appreciation potential, and diversification benefits, making them an attractive investment option for those seeking exposure to the real estate sector.

What are the market trends shaping the REIT Industry?

- Self-storage as a service is gaining prominence as the next major market trend. This emerging sector is poised for significant growth due to increasing consumer demand for flexible and convenient storage solutions.

- Self-storage market growth is driven by the increasing requirement for storage solutions from various industries, including pharmaceuticals, chemicals, e-commerce, food and beverages, automotive, electronics, and manufacturing. Self-storage facilities offer flexibility and convenience, enabling businesses and individuals to store their belongings safely and access them as needed. These facilities come in different types, such as climate-controlled and non-climate-controlled, based on the specific storage needs of the items. Climate-controlled self-storage maintains a temperature between 60 and 80 degrees Fahrenheit, preserving temperature- and climate-sensitive goods. Self-storage services have gained popularity due to market volatility and the need for effective risk management. Investment strategies, such as real estate syndications and property investment platforms, have made self-storage a lucrative investment option for retirement funds, family offices, and other investors.

- Net operating income, tax incentives, and maintenance costs are essential factors in the self-storage market. Artificial intelligence (AI) and property management systems are increasingly being adopted to optimize operations and enhance the customer experience. Self-storage facilities provide a stable investment opportunity with consistent returns and low vacancy rates, making them an attractive option for investors seeking diversification in their portfolios.

What challenges does the REIT Industry face during its growth?

- E-commerce companies' pursuit of vertical integration poses a significant challenge to the industry's growth trajectory. This trend, which involves expanding business operations to include multiple stages of the production and distribution process, can lead to increased complexity, higher costs, and potential operational inefficiencies. Consequently, striking the right balance between integration and outsourcing becomes crucial for maintaining competitiveness and ensuring long-term success in the rapidly evolving e-commerce landscape.

- The market continues to attract institutional investors due to its potential for stable returns and exposure to real estate. Real estate brokerage firms play a crucial role in facilitating transactions between buyers and sellers, while green building standards have become increasingly important in property appraisal and performance metrics. Venture capital firms also invest in REITs, particularly those focused on sustainable development and hybrid properties. The regulatory environment significantly influences REITs, with capitalization rates and occupancy rates being key performance metrics. Shareholder value is a primary concern, as interest rate risk can impact REITs' profitability. Securities offerings provide liquidity for REITs, enabling them to expand their portfolios and meet investor demand.

- Property performance metrics, such as net operating income and cash flow, are essential indicators of a REIT's financial health. Office space remains a significant segment of the market, with a focus on creating immersive, harmonious work environments that emphasize productivity and sustainability. In conclusion, recent research indicates a continued growth in the market, driven by institutional investors, real estate brokerage, and the importance of property performance metrics. The regulatory environment and interest rate risk will continue to influence the market, while sustainable development and hybrid REITs are expected to gain popularity. Capitalization rates and occupancy rates remain critical performance indicators, and securities offerings provide essential liquidity for REITs.

Exclusive Customer Landscape

The reit market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the reit market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, reit market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Automotive Properties REIT - The company specializes in Real Estate Investment Trusts (REITs) for automotive dealership properties. By investing in these REITs, clients gain access to a diversified portfolio of dealership real estate assets. These assets may include land, buildings, and other infrastructure essential to the operation of dealerships. The REIT structure allows for passive income through rental income and potential capital appreciation. This investment opportunity caters to those seeking stable returns in the commercial real estate sector, with the added benefit of exposure to the automotive industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Automotive Properties REIT

- CapitaLand Integrated Commercial Trust Management Ltd.

- Deutsche WohnenDeutsche Wohnen SE

- Dexus Group

- Federal Realty Investment Trust

- FIBRA Prologis

- Gecina REIT SA

- GPT Management Holdings Ltd.

- Iron Mountain Inc.

- Japan Real Estate Investment Corp.

- Klepierre Reit SA

- Link Asset Management Ltd.

- Mirvac Group

- NorthWest Healthcare Properties

- Omega Heathcare Investors Inc.

- RioCan Real Estate Investment Trust

- Segro Plc

- STAG Industrial Inc.

- Stockland Corp. Ltd.

- W. P. Carey Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in REIT Market

- In February 2024, Blackstone Group, a leading global investment firm, announced the acquisition of Forest City Realty Trust's office and apartment portfolio for approximately USD11.3 billion (Reuters). This strategic move expanded Blackstone's real estate investment trust (REIT) footprint in the United States and marked one of the largest REIT deals in recent years.

- In May 2024, Prologis, a leading global logistics real estate company, and InfraRed Capital Partners, a global real estate investment manager, formed a strategic partnership to develop and operate logistics real estate in Europe (Prologis Press Release). The collaboration aimed to capitalize on the growing e-commerce market and the increasing demand for modern logistics facilities.

- In August 2025, Simon Property Group, the largest REIT in the world, secured regulatory approval for its acquisition of Taubman Centers, another major mall owner, in a USD3.6 billion deal (Wall Street Journal). The merger created a dominant player in the retail real estate sector and allowed Simon to expand its portfolio and diversify its revenue streams.

- In November 2025, Brookfield Asset Management, a global alternative asset manager, launched Brookfield REIT Income Fund, a new Canadian REIT focused on acquiring and managing income-producing real estate assets (Brookfield Press Release). The fund aimed to provide investors with stable, growing income and capital appreciation through investments in a diversified portfolio of high-quality commercial real estate properties.

Research Analyst Overview

- In the dynamic global real estate market, REITs (Real Estate Investment Trusts) have emerged as a popular investment vehicle for business readers seeking stable returns. Risk assessment plays a crucial role in infrastructure investment through REITs, as property listing platforms provide valuable data for real estate analytics. Real estate law, including tax strategies and lease agreements, governs REIT operations, ensuring legal compliance and maximizing investment returns. Environmental sustainability is a growing trend, with REITs adopting green initiatives to enhance building efficiency and attract tenants. Property valuation models and services are essential for accurate asset appraisal during acquisition and disposition.

- Due diligence, cash flow analysis, and property valuation are crucial elements of the investment process. REIT performance tracking relies on financial statements, indices, and property renovation and maintenance records. Tenant screening and property management software facilitate efficient operations, while real estate sales, ETFs, and title services streamline transactions. Market research, urban planning, capital expenditures, and real estate data inform strategic investment decisions. Property acquisition involves thorough due diligence, including building inspections, environmental assessments, and lease agreement reviews. Real estate marketing, property insurance, and property maintenance are ongoing concerns for REITs, requiring effective strategies and efficient tools.

- In the context of emerging markets, REITs offer opportunities for investors seeking exposure to diverse property sectors and geographies. REITs' ability to navigate legal complexities, manage risk, and optimize building efficiency makes them attractive investment options in the global real estate landscape.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled REIT Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market growth 2025-2029 |

USD 372.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.8 |

|

Key countries |

US, Canada, China, UK, Germany, Japan, India, France, Singapore, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this REIT Market Research and Growth Report?

- CAGR of the REIT industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the reit market growth of industry companies

We can help! Our analysts can customize this reit market research report to meet your requirements.