Debt Financing Market Size 2025-2029

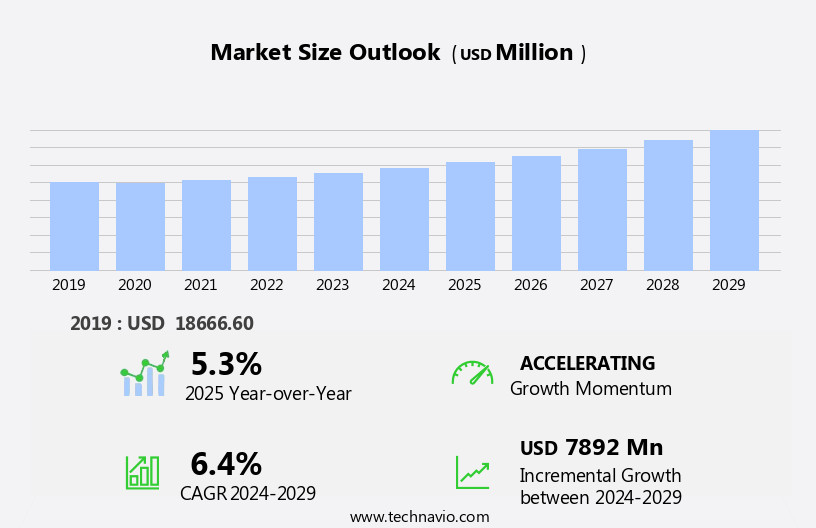

The debt financing market size is forecast to increase by USD 7.89 billion at a CAGR of 6.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the tax advantages of debt financing for businesses. The ability to deduct interest payments from taxable income makes debt financing an attractive option for companies seeking capital. Another key trend in the market is the increasing collaboration and mergers and acquisitions (M&A) activity, which often involves the use of debt financing to fund transactions. However, it is important to note that collateral may be necessary for some forms of debt financing, adding layer of complexity to the process.

- Companies seeking to capitalize on these opportunities must navigate the challenges of securing adequate collateral and managing debt levels to maintain financial health and wellness. Effective debt management strategies, such as optimizing debt structures and maintaining strong credit ratings, will be essential for companies looking to succeed in this dynamic market. Debt financing is a significant component of the regional capital markets, with financial institutions, banks, and insurance companies serving as major players.

What will be the Size of the Debt Financing Market during the forecast period?

- The market encompasses various debt instruments issued by entities to secure funds for business operations and growth. Market dynamics are influenced by several factors, including interest rate cycles, monetary policy, and economic growth. Basel Accords and the Financial Stability Board set standards for financial institutions' risk management and capital adequacy, impacting debt issuance. Government debt, securitization transactions, and various debt instruments like interest rate swaps, loan-to-value ratios, and credit-linked notes, shape the market landscape. Market volatility, driven by factors such as business cycles, credit spreads, and risk appetite, influences investor sentiment. Debt sustainability, fiscal policy, and ESG investing are increasingly important considerations for issuers and investors.

- Asset managers are focusing on leveraging technology and data analytics to improve operational efficiency and meet the evolving needs of investors. The market is, however, not without challenges, with regulatory compliance and interest rate risks being major concerns. Overall, the income asset management market in North America is poised for steady growth, driven by the demand for debt financing and wealth management solutions, and the increasing adoption of advanced analytics and ETFs.

How is this Debt Financing Industry segmented?

The debt financing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Source

- Private

- Public

- Type

- Long-term

- Short-term

- Long-term

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

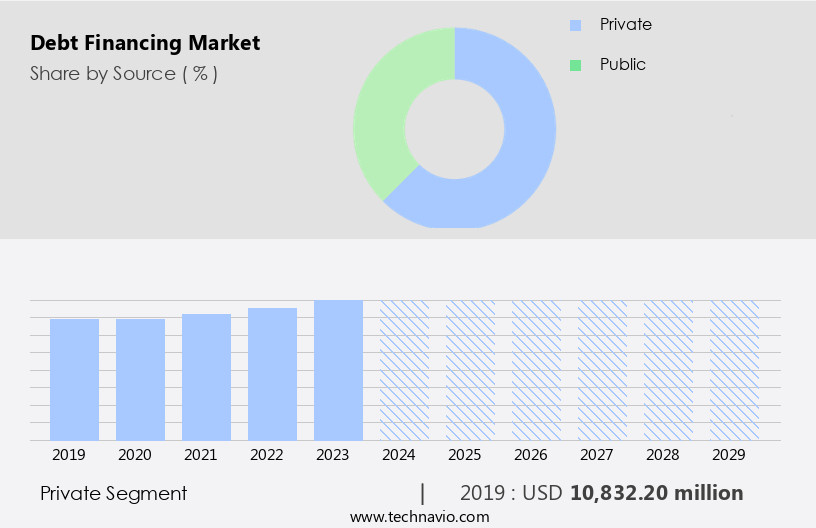

By Source Insights

The private segment is estimated to witness significant growth during the forecast period. Debt financing is a popular financing method for businesses seeking to expand operations while maintaining ownership. Private debt financing, in particular, has gained significant traction among financial specialists worldwide due to its importance in funding small- and mid-sized organizations globally. The demand for debt financing by startups has increased annually, leading to the sector's substantial growth over the last five years. This financing option's flexibility enables businesses to customize their financing solutions to address specific needs, making it an allure for numerous organizations. Private debt financing encompasses various instruments such as Real Estate Debt, Term Loans, Leveraged Buyouts, Asset Securitization, Infrastructure Financing, Loan Servicing, and more.

Financial Leverage, Debt Covenants, Credit Risk, and Interest Rate Risk are essential considerations in this sector. Hedge Funds, Collateralized Loan Obligations, High Yield Debt, and Investment Grade Debt are alternative investment areas. Private Equity, Syndicated Loans, Venture Debt, Bridge Financing, and Mezzanine Financing are also integral components. Financial Institutions offer various debt financing solutions, including Capital Markets, Expansion Financing, Growth Capital, Debt Refinancing, and Debt Consolidation. Financial Modeling, Return on Investment, and Risk Management are crucial aspects of debt financing. Debt Advisory, Financial Engineering, and Debt Capital Markets are essential services in this field. Small Business Loans, Supply Chain Finance, Online Lending Platforms, and Regulatory Compliance are other areas of focus.

Debt Management, Debt Relief, and Debt Restructuring are essential for businesses dealing with financial challenges. Debt financing plays a vital role in Corporate Finance, Project Finance, Invoice Factoring, Digital Lending, Trade Finance, and Working Capital Financing. The debt financing's intricacies, including its benefits and risks, is essential for businesses seeking to make informed financing decisions.

Get a glance at the market report of share of various segments Request Free Sample

The Private segment was valued at USD 10.83 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

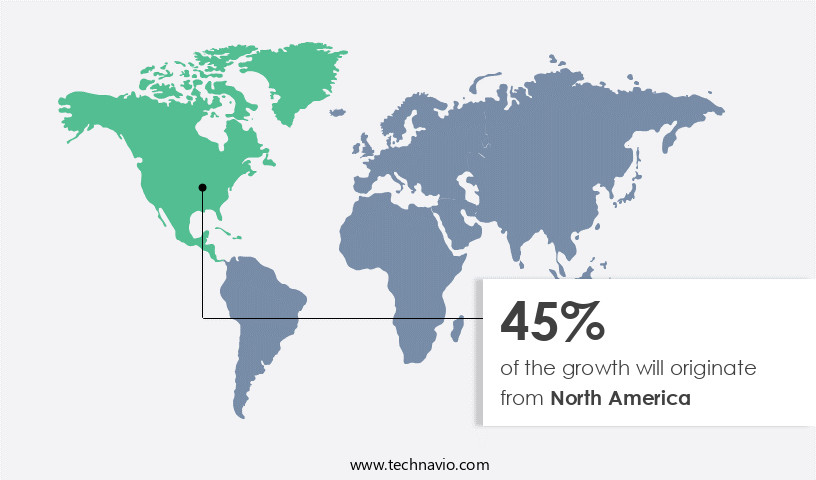

North America is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

They offer various debt financing instruments, such as term loans, revolving credit, asset-based lending, and syndicated loans, enabling businesses to manage their working capital, fund expansions, and execute acquisitions. Startups and small businesses seek debt financing to maintain ownership control and fuel growth without diluting equity. Debt financing options include venture debt, bridge financing, and mezzanine financing. Asset securitization, leveraged buyouts, and infrastructure financing are other debt financing applications. Hedge funds, private equity, alternative investments, and investment banks also participate in the market.

They provide high yield debt, investment grade debt, and structured finance solutions, contributing to the market's diversity and depth. Non-bank lenders, online lending platforms, and supply chain finance are emerging players, offering niche financing solutions and increasing competition. Regulatory compliance and risk management are essential considerations, with debt advisory and financial engineering services offering expertise in debt management, debt relief, and debt capital markets. Debt financing involves due diligence, loan origination, and loan servicing. Interest rate risk and credit risk are critical factors, with credit scoring and debt restructuring essential for mitigating risks. Capital structure optimization, cost of capital, and return on investment are essential financial modeling considerations.

In summary, the market is a dynamic and diverse landscape, with various players offering a range of debt financing solutions to businesses, enabling growth, expansion, and financial stability.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Debt Financing Industry?

- Tax-deductible debt interest costs is the key driver of the market. Debt financing is a popular financing option for businesses worldwide due to its tax advantages. The interest costs associated with business loans are considered business expenses and are fully tax-deductible, allowing companies to reduce their net tax obligation at the end of the year. This financial instrument provides stability for businesses in budgeting and planning.

- Debt financing is accessible to businesses of all sizes, making it a preferred choice for startups and small- to medium-sized enterprises (SMEs) seeking to manage their cash flow and build their credit score by making consistent EMI payments. The tax-deductible nature of debt interest costs makes it an attractive financing solution for businesses aiming to minimize their tax liabilities and effectively manage their financial obligations.

What are the market trends shaping the Debt Financing Industry?

- Increasing collaboration and mergers, and acquisitions are the upcoming market trend. Companies in the market are employing strategies such as collaborations and mergers, and acquisitions to boost their market share and global presence. These strategies are essential for achieving growth, enhancing competitive standing, and expanding market reach. Notable mergers and acquisitions include JPMorgan's acquisition of First Republic Bank in May 2023, which aimed to expand JPMorgan's wealth management capabilities and strengthen its position in the banking sector.

- UBS Group completed the integration of Credit Suisse Group AG's operations following its acquisition in May 2024, enabling UBS to offer a broader range of services to clients and enhance its market presence. These transactions underscore the dynamic nature of the market and the importance of strategic maneuvers for market growth.

What challenges does the Debt Financing Industry face during its growth?

- Collateral may be necessary for some forms of debt financing is a key challenge affecting the industry's growth. When seeking debt financing, businesses may be required to provide collateral as a form of security for the loan. Collateral can include cash and hard assets of the company, putting some of these assets at risk if the company fails to make debt payments. For startups, lenders might also request that the company's owners or stakeholders personally guarantee the loan. This means that the owner's personal assets could be at risk to secure the desired funding.

- As an assistant, it's essential to understand the implications of providing collateral and personal guarantees when applying for debt financing. These arrangements can provide lenders with added security, but they also increase the risk for the borrowing business. It's crucial for businesses to carefully consider the potential risks and benefits before agreeing to these terms.

Exclusive Customer Landscape

The debt financing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the debt financing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, debt financing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Banco Santander SA - The company offers debt financing services such as syndicated loans and corporate bonds.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Banco Santander SA

- Bank of America Corp.

- Barclays PLC

- Citigroup Inc.

- Deutsche Bank AG

- European Investment Bank

- Frontier Development Capital Ltd.

- JPMorgan Chase and Co.

- Larsen and Toubro Ltd.

- Morgan Stanley

- Royal Bank of Canada

- SSAB AB

- The Goldman Sachs Group Inc.

- U.S. International Development Finance Corp.

- UBS Group AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Debt financing is a critical component of the financial landscape, providing businesses and organizations with essential capital to fund operations, expand, and execute strategic initiatives. This form of financing involves borrowing funds from financial institutions or investors, typically in the form of term loans, syndicated loans, or other debt securities. Non-bank lenders have emerged as significant players in the market, offering alternative sources of financing for businesses that may not qualify for traditional bank loans or prefer more flexible terms. Financial leverage, the use of borrowed funds to increase the potential return on investment, is a common strategy employed in various transactions, including leveraged buyouts and infrastructure financing.

Debt financing arrangements often include debt covenants, which outline the borrower's obligations and restrictions to protect the lender's interests. Term loans provide businesses with a set repayment schedule and interest rate, while leveraged buyouts involve the use of significant amounts of debt to finance the acquisition of another company. Asset securitization is another popular debt financing method, where financial assets, such as mortgages or loans, are pooled and sold as securities to investors. This process can provide access to large amounts of capital and help manage risk through the transfer of asset exposure. Infrastructure financing, loan servicing, and debt capital markets are essential components of the debt financing ecosystem.

Hedge funds, private equity firms, and alternative investment vehicles often participate in these markets, seeking attractive returns through various debt investment strategies. Collateralized loan obligations (CLOs), high yield debt, and investment grade debt are popular debt securities that offer varying levels of risk and return. Private debt, bond issuance, and commercial banks are significant providers of debt financing, catering to a wide range of borrowers and industries. Financial engineering, risk management, and regulatory compliance play crucial roles in the market. Due diligence, financial modeling, and debt advisory services help ensure that transactions are structured effectively and efficiently. Expansion financing, growth capital, and debt refinancing are common reasons businesses seek debt financing.

Cost of capital, return on investment, and capital structure are essential considerations in the decision-making process. Small business loans, venture debt, bridge financing, and mezzanine financing cater to the unique financing needs of smaller businesses and startups. Online lending platforms and supply chain finance have disrupted traditional debt financing models, offering faster and more accessible financing solutions. Regulatory compliance, debt management, and debt relief are essential aspects of managing debt financing arrangements. Debt restructuring and loan syndication help businesses adapt to changing financial circumstances and market conditions. Asset-based lending, invoice factoring, digital lending, trade finance, and working capital financing are specialized debt financing solutions that cater to specific business needs.

The Federal Reserve's monetary policy and the secondary market's bid-ask spreads, particularly for 10-year Treasury securities, significantly impact the income market. Project finance and construction loans are essential for financing large-scale infrastructure projects. The market is a dynamic and complex ecosystem that plays a crucial role in fueling economic growth and business development. It encompasses various debt financing instruments, providers, and services, each with unique features and risks.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 7.89 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, UK, Canada, China, Germany, Japan, South Korea, France, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Debt Financing Market Research and Growth Report?

- CAGR of the Debt Financing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the debt financing market growth of industry companies

We can help! Our analysts can customize this debt financing market research report to meet your requirements.