Commercial Carpet Market Size 2025-2029

The commercial carpet market size is valued to increase USD 13.38 billion, at a CAGR of 5.7% from 2024 to 2029. Growing non-residential buildings construction projects will drive the commercial carpet market.

Major Market Trends & Insights

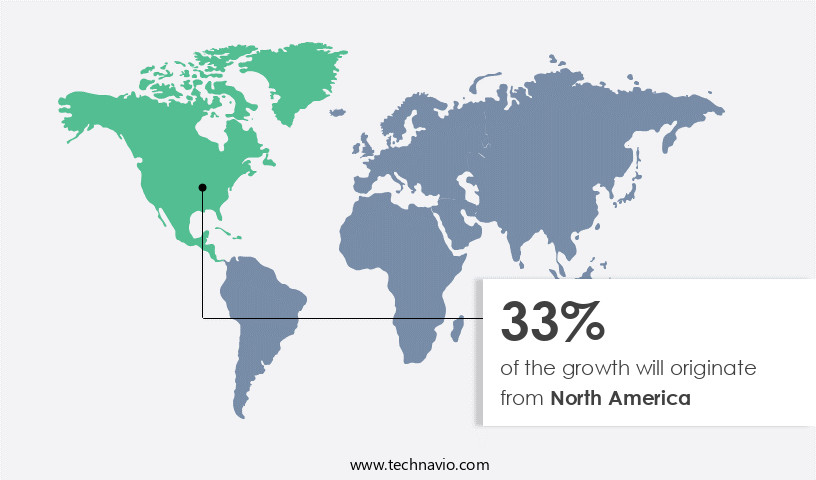

- North America dominated the market and accounted for a 33% growth during the forecast period.

- By Product - Carpet tiles segment was valued at USD 23.51 billion in 2023

- By Material - Nylon segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: 73.69 million

- Market Future Opportunities: USD 13.38 billion

- CAGR : 5.7%

- North America: Largest market in 2023

Market Summary

- The market represents a dynamic and ever-evolving industry, encompassing core technologies and applications, service types, and product categories that continue to shape the built environment. Technological advancements, such as modular carpets and carpet tiles, have gained significant traction, accounting for over 60% of the market share. In terms of applications, the sector caters primarily to the non-residential segment, with growing construction projects in various sectors, including healthcare industry, education, and hospitality, driving demand. However, the market faces challenges from emerging luminous carpets and the easy availability of substitutes.

- Regulations, including those related to indoor air quality and safety standards, also influence market trends. Looking ahead, the market is poised for continued growth in the forecast period, with opportunities arising from increasing focus on sustainability and design innovation.

What will be the Size of the Commercial Carpet Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Commercial Carpet Market Segmented and what are the key trends of market segmentation?

The commercial carpet industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Carpet tiles

- Broadlooms

- Material

- Nylon

- Polyester

- Type

- Direct glue down

- Stretch-in

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The carpet tiles segment is estimated to witness significant growth during the forecast period.

Commercial carpet tiles, a segment of the carpet industry, have gained significant traction in the market, particularly in commercial spaces like offices, universities, and the hospitality sector. These tiles, also known as modular or square carpets, are cut from wall-to-wall rolls and assembled to create a carpet. Commonly available sizes include 48x48, 50x50, 60x60, and 96x96 cm. The carpet tiles market has experienced substantial growth, driven by their numerous advantages. They offer cost savings due to their smaller size, minimal wastage during installation, and the ease of replacing individual tiles when necessary. Additionally, their recyclability and low-replacement expense make them an attractive investment for commercial customers.

According to recent market data, the carpet tiles market share accounted for approximately 30% of the overall carpet market in 2020. Furthermore, industry experts anticipate that this segment will continue to dominate the market, with a projected increase of 25% in demand during the upcoming forecast period. Carpet tile manufacturers employ various production methods, such as roll-to-roll manufacturing and tufting machine speeds, to cater to the increasing demand. Moreover, advancements in technology have led to improvements in pile height variations, yarn twist levels, and carpet density measurements. In terms of materials, polypropylene carpet fiber and nylon carpet construction are popular choices for commercial carpet tiles due to their durability and stain resistance.

The Carpet tiles segment was valued at USD 23.51 billion in 2019 and showed a gradual increase during the forecast period.

Additionally, the market offers various carpet backing systems, including latex backing adhesion and antimicrobial fibers, to ensure optimal performance and longevity. The carpet industry also focuses on waste reduction strategies, such as dye sublimation printing and broadloom carpet widths, to minimize manufacturing waste. Furthermore, carpet recycling processes and sustainable carpet options, like wool carpet characteristics and fire retardant treatments, are becoming increasingly important in the market. Carpet maintenance schedules and cleaning techniques, such as colorfastness properties and carpet cleaning methods, are essential aspects of the carpet tiles market. Commercial customers prioritize carpets with high abrasion resistance ratings and acoustic performance metrics to ensure a comfortable and functional workspace.

In conclusion, the commercial carpet tiles market is a dynamic and evolving industry, driven by the increasing demand for cost-effective, durable, and sustainable flooring solutions. The market's continuous growth and advancements in technology and production methods are expected to maintain its dominance during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Commercial Carpet Market Demand is Rising in North America Request Free Sample

The market in North America, primarily driven by the US and Canada, is experiencing significant growth due to the expansion of non-residential construction activities and increasing demand from the real estate sector. The US, in particular, is a major contributor to the market, with commercial carpet adoption increasing in response to growing restoration and remodeling projects. Commercial carpet tiles have gained popularity due to their durability and versatility, further fueling market growth.

The region's dominance in the market is expected to continue, with the US accounting for a substantial market share. The market in North America is on an upward trajectory, driven by the construction industry's expansion and the real estate sector's increasing demand for carpet tiles.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry, driven by advancements in carpet fiber selection, manufacturing technologies, and sustainability. Commercial carpet installation best practices prioritize high-performance carpet fibers, such as nylon and polyester, which offer superior carpet durability and resilience. These fibers are subjected to improved testing methods, ensuring their ability to withstand heavy foot traffic and wear. Manufacturers are also investing in advanced carpet manufacturing technologies, reducing environmental impact through sustainable material sourcing options. Carpet fiber composition and performance play a crucial role in determining carpet resilience and durability. Sustainable carpet disposal and recycling strategies are gaining traction, with a focus on optimizing carpet cleaning effectiveness and improving acoustical performance.

Comparing different carpet backing materials, such as woven and tufted, reveals that woven carpets offer enhanced durability and dimensional stability. The latest developments in carpet manufacturing technology include the use of nanotechnology for stain resistance and antimicrobial properties. Understanding carpet fiber properties and applications is essential for architects, interior designers, and facility managers. Testing for carpet stain resistance and resilience is a critical consideration, with some manufacturers offering warranties against stains and wear. Sustainable carpet disposal and recycling strategies are becoming increasingly important, with many companies investing in closed-loop recycling systems. Advanced techniques in carpet cleaning and maintenance, such as hot water extraction and encapsulation, help ensure the longevity of commercial carpets.

Analysis of commercial carpet performance metrics, including wear resistance, stain resistance, and acoustical performance, is essential for making informed decisions about carpet selection and installation. The effects of different carpet constructions, such as loop pile and cut pile, on overall aesthetics and functionality are also important factors to consider. According to recent market data, nylon carpets accounted for approximately 35% of global commercial carpet sales, while polyester carpets held a 30% market share. This comparison highlights the significant role of these two fiber types in the market. However, the market is continually evolving, with emerging trends in carpet technology and sustainability shaping future developments.

What are the key market drivers leading to the rise in the adoption of Commercial Carpet Industry?

- The non-residential building construction sector serves as the primary growth engine for the market, with a significant number of projects underway.

- The non-residential and commercial construction sector undergoes continuous transformation in 2024, demonstrating diverse trends across various geographies. In North America, spending on non-residential buildings is projected to experience moderate growth, with manufacturing construction leading the charge at approximately 10%. In contrast, commercial facility expenditures are anticipated to remain stationary, influenced by economic challenges. Institutional construction, encompassing healthcare and education, is poised for mid-single-digit advancements.

- Europe's commercial construction sector maintains a steady pace, with emerging markets like the Netherlands, Belgium, and Denmark exhibiting consistent growth. Conversely, mature markets such as Germany and the UK are encountering a deceleration. Overall, the non-residential and commercial construction landscape remains dynamic, with ongoing shifts and evolving patterns shaping the sector's future.

What are the market trends shaping the Commercial Carpet Industry?

- The emergence of luminous carpets represents the latest market trend. This innovative design concept is gaining significant attention in the interior design industry.

- The market is evolving, with innovative solutions gaining traction. One such development is luminous carpets, a collaboration between Desso (a Tarkett company) and Philips. These carpets integrate LED lighting from Philips with light transmissive carpet developed by Tarkett, resulting in a unique, patented technology. Luminous carpets offer durability and style, providing directional guidance through LED lights embedded in the carpet. This technology has garnered attention in corporate offices, such as Axel Springer/BILD newspaper in Germany. The adoption of luminous carpets signifies a shift towards more functional and visually appealing flooring solutions. This technology offers a significant difference in lighting and functionality compared to traditional carpets.

- Its integration of LED lights provides a unique selling proposition, making it an attractive option for businesses seeking to enhance their office spaces. The use of luminous carpets not only adds to the aesthetics but also offers practical benefits, such as improved navigation and wayfinding.

What challenges does the Commercial Carpet Industry face during its growth?

- The easy accessibility of substitutes poses a significant challenge to the industry's growth trajectory.

- The market encompasses a diverse range of flooring materials, including ceramic, cork, laminate, linoleum, stone, vinyl, and wood. In North America and Europe, commercial carpet manufacturers hold substantial market shares. However, the market in APAC is in its initial stages, with builders favoring ceramics and other hardwood flooring alternatives. Consumer preferences lean towards these substitutes due to their affordability and availability.

- Notably, flooring material producers are distinguishing their products based on pricing, weight, and color options. The market's dynamics are characterized by the absence of significant switching costs for buyers, enabling them to explore various flooring alternatives.

Exclusive Customer Landscape

The commercial carpet market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial carpet market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Commercial Carpet Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial carpet market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AHF LLC. - This company specializes in commercial carpets, featuring Diamond 10 Technology for enhanced scratch, stain, and scuff resistance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AHF LLC.

- Balta Group NV

- Beaulieu International Group

- Berkshire Hathaway Inc.

- Burmatex Ltd.

- Ege Carpets AS

- Engineered Floors LLC

- Forbo Management SA

- Heckmondwike FB Ltd.

- Interface Inc.

- Koch Industries Inc.

- Mannington Mills Inc.

- Milliken and Co.

- Mohawk Industries Inc.

- Newhey Carpets Ltd.

- Remland Carpets Online Ltd.

- Tarkett

- Thomas Witter Carpets Ltd.

- Toli Floor Corp.

- Victoria Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Carpet Market

- In January 2024, Shaw Industries, a leading player in the market, announced the launch of its new product line, "EcoWorx," which includes carpets made from recycled materials. This initiative marked a significant stride towards sustainability in the industry (Shaw Industries Press Release, 2024).

- In March 2024, Mohawk Industries, another major player, formed a strategic partnership with Interface, a global manufacturer of modular carpet tiles, to expand their product offerings and enhance their market presence (Mohawk Industries Press Release, 2024).

- In May 2024, Tarkett, a leading European flooring solutions provider, acquired Desso, a Dutch carpet manufacturer, for € 215 million, expanding its product portfolio and strengthening its position in the European market (Tarkett Press Release, 2024).

- In April 2025, the US Green Building Council (USGBC) introduced new LEED v4.1 certification standards, which included stricter guidelines for indoor environmental quality and material health, creating a surge in demand for eco-friendly commercial carpet solutions (USGBC Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Carpet Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 13377.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, Germany, China, Canada, Japan, UK, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving industry, with continuous advancements in technology, materials, and design. High-traffic carpet choices undergo rigorous durability testing to ensure longevity and resilience against wear and tear. One crucial aspect of carpet evaluation is latex backing adhesion, which significantly impacts the carpet's overall performance. Antimicrobial carpet fibers are gaining popularity due to their ability to inhibit the growth of bacteria and microorganisms, contributing to healthier indoor environments. Carpet lifecycle assessments and assessments of carpet tile dimensions are essential for organizations seeking to minimize waste and optimize their investment. Foot traffic simulation and carpet density measurements are essential in understanding the carpet's ability to withstand heavy usage.

- Waste reduction strategies, such as dye sublimation printing and broadloom carpet widths, are increasingly adopted to minimize environmental impact. Carpet maintenance schedules and colorfastness properties are vital considerations for commercial applications, ensuring the carpet remains visually appealing and functional over time. Acoustic performance metrics, such as sound absorption and insulation, are also essential for creating productive and comfortable workspaces. Polypropylene carpet fiber and carpet backing systems are popular choices due to their durability and cost-effectiveness. Pile height variations and yarn twist levels influence the carpet's appearance and wear resistance. Tufting machine speeds and roll-to-roll manufacturing techniques have revolutionized carpet production, increasing efficiency and reducing costs.

- Carpet installation methods, carpet cleaning techniques, carpet recycling processes, wool carpet characteristics, stain resistance testing, sustainable carpet options, abrasion resistance rating, nylon carpet construction, fiber composition analysis, carpet manufacturing waste, and carpet fiber types are all critical aspects of the market, reflecting the industry's ongoing evolution and innovation.

What are the Key Data Covered in this Commercial Carpet Market Research and Growth Report?

-

What is the expected growth of the Commercial Carpet Market between 2025 and 2029?

-

USD 13.38 billion, at a CAGR of 5.7%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Carpet tiles and Broadlooms), Material (Nylon and Polyester), Type (Direct glue down and Stretch-in), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing non-residential buildings construction projects, Easy availability of substitutes

-

-

Who are the major players in the Commercial Carpet Market?

-

Key Companies AHF LLC., Balta Group NV, Beaulieu International Group, Berkshire Hathaway Inc., Burmatex Ltd., Ege Carpets AS, Engineered Floors LLC, Forbo Management SA, Heckmondwike FB Ltd., Interface Inc., Koch Industries Inc., Mannington Mills Inc., Milliken and Co., Mohawk Industries Inc., Newhey Carpets Ltd., Remland Carpets Online Ltd., Tarkett, Thomas Witter Carpets Ltd., Toli Floor Corp., and Victoria Plc

-

Market Research Insights

- The market experiences ongoing evolution, driven by advancements in manufacturing processes and consumer preferences. Two significant trends include the increasing use of solution-dyed nylon and improvements in carpet wear resistance. Solution-dyed nylon carpets offer enhanced color consistency and durability due to the dyeing process occurring during fiber extrusion. In contrast, traditional carpet manufacturing involves yarn spinning and subsequent dyeing, which can result in variations in fiber denier and potential color inconsistencies. Moreover, carpet manufacturers focus on enhancing wear resistance by employing advanced fiber extrusion technology, tuft bind strength, and stain protection coatings.

- For instance, a leading manufacturer reports a 25% increase in wear resistance for their latest carpet line compared to previous models. This improvement not only benefits the end-users but also reduces the frequency of carpet replacement, contributing to sustainability efforts by minimizing carpet disposal and the need for new production.

We can help! Our analysts can customize this commercial carpet market research report to meet your requirements.