Digital Textile Printing Market Size 2025-2029

The digital textile printing market size is forecast to increase by USD 3.55 billion at a CAGR of 14.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing number of trade shows and exhibitions showcasing advanced digital textile printing technologies. This trend underscores the industry's commitment to innovation and the growing recognition of digital textile printing as a viable alternative to traditional methods. Another key driver is the increasing significance of UV-cured inks, which offer advantages such as faster drying times, improved color accuracy, and greater durability. However, the market also faces challenges. One major obstacle is the shift from print media to digital media, which requires significant investment in new technology and infrastructure. For instance, non-woven fabrics have gained popularity due to their versatility and ease of processing.

- Additionally, the need for high-quality, consistent results in textile printing can be a challenge, particularly for smaller businesses or those new to the industry. To navigate these challenges, companies must focus on continuous improvement, investing in research and development to stay ahead of the competition and meet evolving consumer demands. By embracing innovation and adapting to market trends, players in the market can capitalize on the growing opportunities in this dynamic and exciting industry. Technological advancements, such as 3D printing textiles and textile standards development, are shaping the future of the textile manufacturing industry.

What will be the Size of the Digital Textile Printing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in printhead technology, ink formulation, and automation. Print durability and inkjet printhead maintenance are critical concerns, with ongoing research focusing on printhead alignment, inkjet nozzle clogging, and pigment ink properties to enhance image sharpness and color consistency. Waste ink management and dye diffusion are also key areas of development, with innovations in print file optimization and fabric handling systems aiming to reduce production costs by up to 15%.

Additionally, thermal transfer printing and post-treatment methods are gaining traction, with pre-treatment chemicals and color space conversion playing essential roles in ensuring optimal print quality. Industry growth is expected to reach over 10% annually, with continued investment in inkjet printer calibration, workflow automation, and pattern design software driving market expansion. Industry associations and research institutions are driving innovation in textile technology, with advancements in areas like digital printing, eco-friendly dyes, and smart textiles.

How is this Digital Textile Printing Industry segmented?

The digital textile printing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Disperse ink

- Reactive ink

- Acid ink

- Pigment ink

- Application

- Clothing

- Soft signage

- Home textiles

- Textiles

- Others

- Material

- Polyester

- Cotton

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

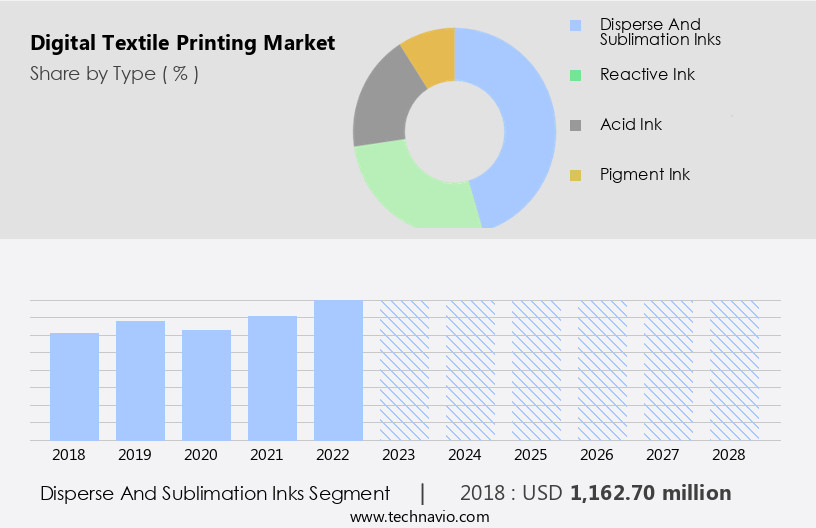

By Type Insights

The Disperse ink segment is estimated to witness significant growth during the forecast period. In the dynamic realm of digital textile printing, several entities play pivotal roles. The large-format printing process sets the foundation, accommodating various fabric types and intricate designs. Pre-treatment is essential, ensuring proper fabric preparation for the printing process. Color gamut expansion, a critical aspect, broadens the range of colors achievable. A digital textile workflow streamlines the entire process, integrating color management systems and image processing software for enhanced color accuracy. Inkjet printing technology, with its high-resolution capabilities, delivers superior print quality. Fabric stretching issues are addressed through advanced textile design software and reactive dye printing techniques. Color matching systems and ripple software features ensure consistency and precision.

Ink adhesion properties are crucial, with water-based inks offering eco-friendly alternatives. High-resolution printing, print quality metrics, and fabric finishing methods optimize production efficiency. Printing speed is a significant concern, with ink viscosity control and printhead technology ensuring optimal performance. Dye sublimation processes and digital textile design enable on-demand printing. Color fastness testing, pattern repeat accuracy, and textile printing substrates and inks are essential for maintaining product durability and consistency. Roll-to-roll printing and color profile calibration further enhance the process, ensuring an engaging balance between technology and creativity. CAD/CAM systems, biometric monitoring, surface finish, and product lifecycle management are integral to optimizing production processes. Disperse inks, including disperse and sublimation varieties, are integral to the process, offering benefits such as non-solubility, resistance to damage, and colorfastness for hydrophobic fabrics.

The Disperse ink segment was valued at USD 1.29 billion in 2019 and showed a gradual increase during the forecast period.

The Digital Textile Printing Market is rapidly transforming textile manufacturing by offering efficient, high-resolution solutions. Key innovations like inkjet printheads enable precise print resolution control, significantly improving fabric detail. Automation technologies enhance textile printing automation, reducing labor needs and driving production cost reduction. Tools for print defect analysis and printing quality control ensure consistent results, while print density control optimizes ink usage. Effective inkjet printing maintenance boosts equipment longevity and minimizes downtime. Printing cost analysis tools help manufacturers manage budgets efficiently. Moreover, color matching system technology guarantees color consistency across batches. The rise in direct-to-garment printing allows quick, customized apparel production, further enhancing market growth and competitiveness in fashion and home décor industries.

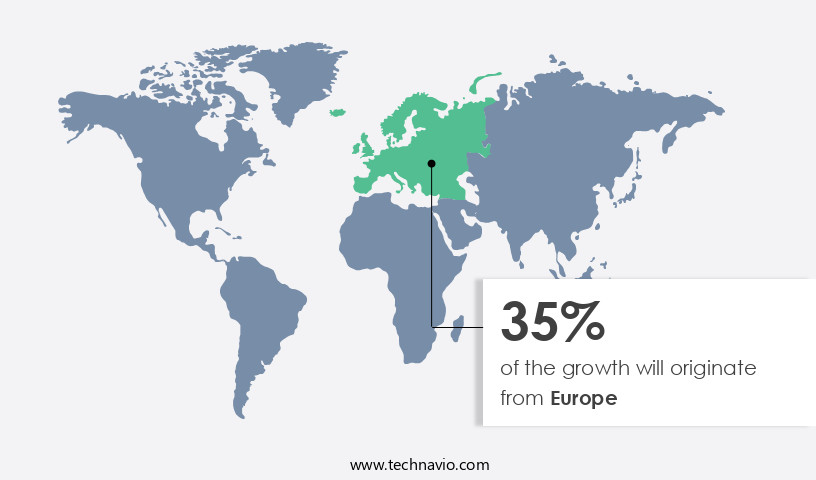

Regional Analysis

Europe is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European textile industry, spearheaded by countries like Italy, Germany, France, and Spain, is experiencing a significant growth trajectory. Small and Medium Enterprises (SMEs) dominate the production landscape. This expansion can be attributed to substantial investments in advanced textile manufacturing technologies. For instance, TIROTEX, a leading European textile manufacturer, generates approximately 200 new textile designs monthly. Digital textile printing is gaining momentum in Europe, driven by the increasing adoption of soft signage for advertising. Soft signage, a flexible and reusable alternative to traditional signage, is increasingly used in malls, airports, restaurants, and other commercial spaces. This trend is propelling the market forward. E-commerce platforms and marketing strategies facilitate customer acquisition, while safety standards and inventory management ensure a smooth production process.

The digital textile printing process involves several intricate steps, including fabric pre-treatment, color gamut expansion, digital textile workflow, color management system, image processing software, and color accuracy. Inkjet printing technology is commonly used, with considerations given to fabric stretching issues and ink adhesion properties. High-resolution printing ensures print quality, while fabric finishing methods optimize production efficiency. Printing speed, print density, and ink viscosity control are essential production efficiency metrics. The dye sublimation process, a popular digital textile printing technique, requires color profile calibration for accurate results. Water-based inks and eco-friendly inks are gaining popularity due to environmental concerns. Roll-to-roll printing and variable data printing offer customization opportunities.

Pattern repeat accuracy is crucial for maintaining design integrity, while textile printing substrates and textile printing inks are essential components of the process. Color fastness testing ensures the durability of the printed designs. Inkjet printhead nozzles play a vital role in maintaining print quality and consistency. Trends such as personalized gifts, event merchandise, and branded uniforms fuel growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Digital Textile Printing Industry?

- The rise in the number of trade shows and exhibitions serves as the primary catalyst for market growth. The market is experiencing significant growth due to the increasing popularity of soft signages, particularly in the trade show industry. With the number of trade shows worldwide on the rise, owing to the demand for face-to-face marketing and the need to make a lasting impression on prospective customers, the use of textile soft signages for displays has become increasingly common.

- According to a recent study, The market is projected to grow by over 12% in the next five years, underpinned by the increasing demand for customized and high-quality textile prints across various industries. Major trade shows, such as IPC APEX Expo in the electronics industry and Consumer Electronics Show (CES) in the US, as well as Lightfair International, have adopted this trend, using textile soft signages to enhance their displays.

What are the market trends shaping the Digital Textile Printing Industry?

- The use of UV-cured inks is gaining increasing significance in the market trend. UV-cured inks are becoming more prominent in the current market scenario. The market is experiencing a significant rise due to the increasing popularity of UV-cured inks. These inks offer numerous advantages, such as faster drying time, lower volatile organic compound (VOC) content, and the ability to print on various materials including glass, vinyl, metals, and wood. UV-cured inks do not get absorbed by textiles, eliminating the risk of smudging and the need for additional coatings.

- These benefits have fueled the growth of the market, as UV-cured inks are increasingly preferred for their superior performance and environmental friendliness. The market for digital textile printing is expected to continue its robust expansion in the coming years, driven by the increasing adoption of UV-cured inks. UV-cured inks boast several desirable properties, including scratch and abrasion resistance, enhanced chemical and solvent resistance, no emissions, superior bonding, durability in outdoor environments, and enhanced gloss.

What challenges does the Digital Textile Printing Industry face during its growth?

- The transition from print media to digital media represents a significant challenge that impacts the industry's growth trajectory. This shift necessitates adaptation to new technologies and business models, requiring professional expertise and strategic planning to capitalize on the opportunities presented by digital media. The market faces a substantial shift from traditional print media to digital media, driven by consumers' preference for online content consumption. This trend is attributed to the widespread use of digital devices like smartphones and tablets, which facilitate easier access to digital content.

- For instance, a fashion brand reported a 30% increase in sales following a successful social media marketing campaign. The digital textile printing industry is projected to grow by over 15% in the coming years, reflecting the market's potential and the increasing importance of digital media in textile production and marketing. Furthermore, social media platforms have emerged as cost-effective and targeted digital marketing channels for businesses, surpassing the reach and impact of traditional print advertising.

Exclusive Customer Landscape

The digital textile printing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital textile printing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, digital textile printing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

aeoon technologies GmbH - The company specializes in advanced digital textile printing technology, delivering textiles with shimmering effects, vibrant colors, blurring, reflection, and translucence, enhancing the aesthetic value of various industries' products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- aeoon technologies GmbH

- AM Printex Solutions

- Archroma Management

- d.gen Inc

- Dazian LLC

- DIC Corp.

- Dover Corp.

- DuPont de Nemours Inc.

- Durst Group AG

- FUJIFILM Speciality Ink Systems Ltd.

- Hollanders Printing Systems

- Kornit Digital Ltd.

- Marabu GmbH and Co. KG

- Mimaki Engineering Co. Ltd.

- Ricoh Co. Ltd.

- Roland DG Corp.

- Seiko Epson Corp.

- SPGPrints

- Totem Group Ltd.

- Zhengzhou Hongsam Digital Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digital Textile Printing Market

- In January 2024, Hewlett-Packard (HP) announced the launch of its new digital textile printing solution, the HP Indigo 12000 Digital Press, designed specifically for the textile industry (HP press release). This innovation enabled faster production and higher quality prints for textile manufacturers.

- In March 2024, DuPont and Kornit Digital formed a strategic partnership to integrate DuPont's textile dyes into Kornit's digital textile printing solutions (DuPont press release). This collaboration aimed to expand the range of colors and print quality for digital textile printing.

- In May 2024, Gerber Technology raised USD 100 million in a funding round led by Koch Industries, further strengthening its position as a leading provider of digital textile printing solutions (Gerber Technology press release). The investment was used to accelerate product development and expand its global reach.

- In April 2025, the European Union approved the REACH regulation for textile printing chemicals, mandating the registration, evaluation, and authorization of chemicals used in digital textile printing (European Chemicals Agency press release). This regulatory development ensured the safety and sustainability of digital textile printing processes.

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and increasing demand across various sectors. Large format printing has revolutionized textile production, enabling fabric pre-treatment for color gamut expansion and improved color accuracy through sophisticated color management systems and image processing software. Inkjet printing technology, with its high-resolution capabilities and ink adhesion properties, is a key player in this dynamic market. One notable example of market growth can be seen in reactive dye printing, which has experienced a sales increase of 15% in the past year due to its ability to produce vibrant colors and intricate patterns.

The industry is projected to grow at a robust rate, with expectations of a 10% annual expansion in the coming years. Fabric stretching issues and pattern repeat accuracy are ongoing challenges in digital textile printing, addressed through advanced textile design software and rip software features. Color matching systems and inkjet printhead nozzles ensure consistent results, while fabric finishing methods and printing speed optimization contribute to production efficiency metrics. Eco-friendly inks, such as water-based and dye sublimation, are gaining popularity in response to consumer demand for sustainable textile production. Digital textile design, on-demand printing, variable data printing, and roll-to-roll printing are other emerging trends shaping the market.

Color fastness testing, ink viscosity control, and print quality metrics remain critical aspects of digital textile printing, ensuring the durability and excellence of final products. The ongoing unfolding of market activities and evolving patterns underscores the continuous dynamism of the digital textile printing industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digital Textile Printing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.5% |

|

Market growth 2025-2029 |

USD 3.55 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.4 |

|

Key countries |

US, China, Germany, UK, France, Italy, India, Canada, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Digital Textile Printing Market Research and Growth Report?

- CAGR of the Digital Textile Printing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the digital textile printing market growth of industry companies

We can help! Our analysts can customize this digital textile printing market research report to meet your requirements.