Earphone And Headphone Market Size 2025-2029

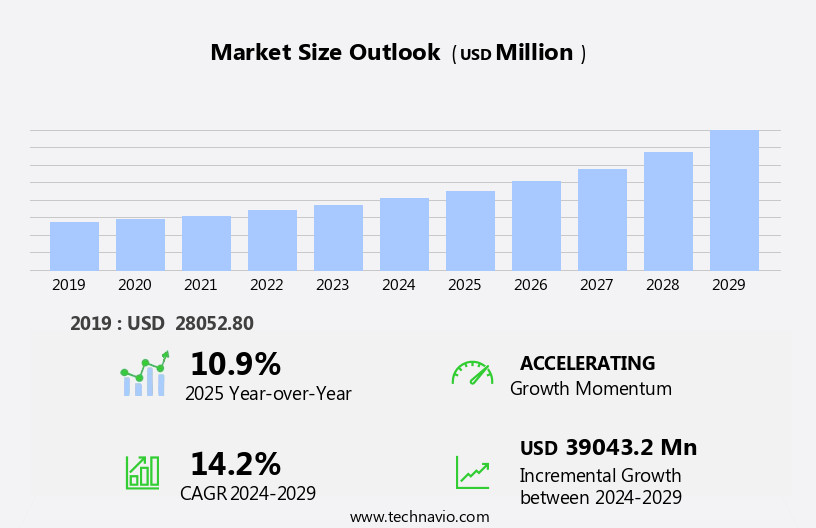

The earphone and headphone market size is forecast to increase by USD 39.04 billion, at a CAGR of 14.2% between 2024 and 2029.

- The market is witnessing significant growth, driven by the continuous advancements in technology leading to product enrichment. IPX-certified devices, offering water and sweat resistance, are gaining popularity among consumers, particularly in active lifestyles and fitness segments. However, the high prices associated with wireless variants pose a challenge for market penetration. As technology continues to evolve, integrating advanced features such as noise cancellation, voice assistants, and seamless connectivity, the market is expected to expand further.

- Companies must strike a balance between offering premium features and maintaining affordable pricing to cater to a broader consumer base. Additionally, partnerships and collaborations with technology giants and content providers can provide strategic advantages in this competitive landscape.

What will be the Size of the Earphone And Headphone Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic shifts in consumer preferences and technological advancements shaping its landscape. Audio drivers, a crucial component, are constantly being refined to deliver superior sound quality in various applications, from consumer electronics to professional audio setups. Over-ear headphones and in-ear earphones cater to diverse user needs, with on-ear headphones offering a balance between portability and sound quality. Voice assistant integration and phone call functionality are increasingly important features, enabling seamless multitasking and communication. Equalizer settings allow users to customize their listening experience, while signal-to-noise ratio (SNR) ensures clear audio playback. Wireless technologies, such as Bluetooth and wireless charging, have revolutionized the market, offering freedom of movement and convenience.

The rise of true wireless earbuds and Bluetooth headphones has disrupted traditional wired headphone sales, driving online sales and the emergence of new distribution channels. Market dynamics are further influenced by emerging trends, including water resistance, video conferencing, and fitness tracking capabilities in headphones. Ambient sound mode and transparency mode cater to users seeking awareness of their surroundings, while gaming headphones deliver immersive audio experiences. Manufacturing processes, including the use of advanced materials and manufacturing techniques, contribute to the ongoing evolution of earphones and headphones. The integration of digital audio, high-resolution audio, and podcast listening further expands the market's reach.

Consumer electronics companies continue to innovate, introducing new products and features to cater to diverse user needs. Microphone placement, headband adjustability, and personal audio preferences are increasingly important considerations in the design and development of earphones and headphones. The market's continuous dynamism is further reflected in the emergence of new categories, such as bone conduction headphones and wearable technology. The supply chain, from raw materials to retail sales, is constantly adapting to meet the evolving demands of consumers. In summary, the market is characterized by continuous innovation and evolution, with consumer preferences, technological advancements, and emerging trends shaping its dynamics.

From audio drivers to distribution channels, the market's diverse components are interconnected and interdependent, reflecting its dynamic and ever-changing nature.

How is this Earphone And Headphone Industry segmented?

The earphone and headphone industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- In-ear

- On-ear

- Over-ear

- Technology

- Wired

- Wireless

- TWS

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

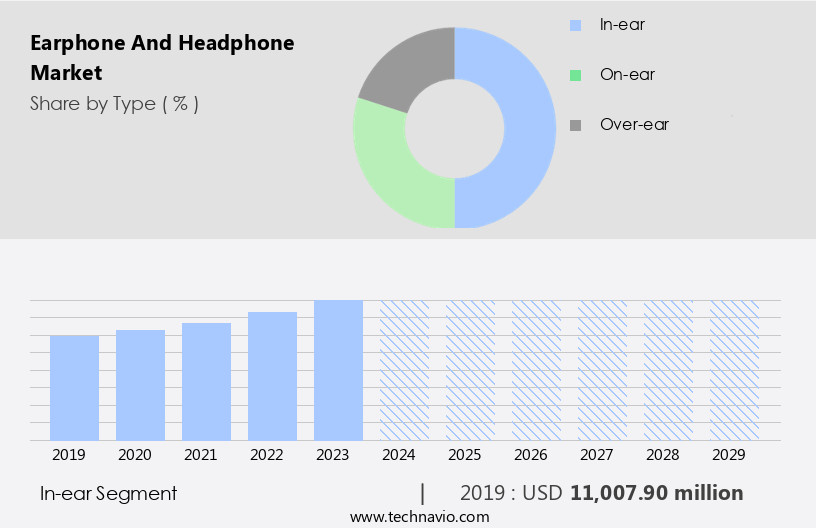

The in-ear segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of electronic audio devices designed to enhance the listening experience for consumers. These gadgets can connect via wired or wireless means to their source signal. The market is categorized into in-ear, on-ear, and over-ear headphones based on type. In-ear models, which fit snugly within the ear, offer effective noise cancellation, making them popular among fitness enthusiasts. In-ear headphones can be further divided into wired and wireless models. The advent of notch-less smartphones is expected to drive the growth of wireless in-ear headphones, as they eliminate the need for cords. Moreover, on-ear headphones, which rest on the ears, provide a more spacious soundstage and are ideal for hi-fi audio and long listening sessions.

Over-ear headphones, which completely cover the ears, offer superior sound quality and noise cancellation, making them popular among audiophiles and professionals. Technological advancements have led to the integration of features such as water resistance, video conferencing, ear tip sizes, Bluetooth codecs, audio streaming, ambient sound mode, and voice assistant integration into earphones and headphones. Additionally, gaming headphones, transparency mode, call quality, fitness tracking, noise-canceling headphones, battery life, health monitoring, and wireless charging are becoming increasingly common. Audio accessories, such as charging cases, supply chain optimization, and distribution channels, are also crucial aspects of the market. Manufacturing processes have evolved to include digital audio, passive noise cancellation, and high-resolution audio, among other advancements.

Portable audio devices, including true wireless earbuds and sports headphones, have gained popularity due to their convenience and versatility. Wearable technology has further expanded the market, with bone conduction headphones and headband adjustability catering to specific user needs. The market is a dynamic and evolving landscape, with consumer electronics companies continually innovating to meet the demands of discerning listeners.

The In-ear segment was valued at USD 11.01 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

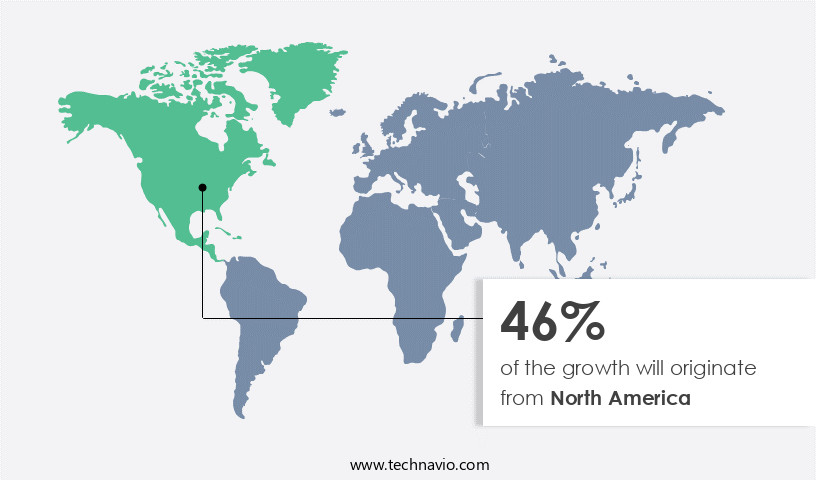

North America is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic consumer electronics landscape, the market for premium earphones and headphones in North America is poised for significant growth. With a strong culture of innovation and early adoption, North Americans have embraced digital audio subscriptions and podcasts, driving sales of high-quality headphones as essential accessories. Fitness and sports activities further fuel demand, as consumers invest in advanced audio solutions to enhance their workouts. Manufacturers focus on delivering features such as water resistance, video conferencing, and customizable ear tip sizes to cater to diverse consumer needs. Bluetooth codecs and audio streaming technologies ensure seamless connectivity and uninterrupted listening experiences.

On-ear and over-ear headphones offer hi-fi audio and passive or active noise cancellation, while in-ear models prioritize compactness and personalized fit. Gaming headphones and bone conduction models cater to niche markets, while voice assistant integration and call quality are crucial considerations for professionals. True wireless earbuds and charging cases provide portability and convenience, while noise-canceling headphones and health monitoring features cater to the wellness-conscious consumer. Manufacturing processes prioritize durability and comfort, with sweat resistance and headband adjustability being essential features for active users. Bluetooth headphones and wireless charging enable wireless freedom, while analog audio enthusiasts continue to appreciate the richness of traditional audio.

Distribution channels, including retail sales and online platforms, ensure widespread availability, and consumer electronics companies invest in supply chain optimization to meet demand. As the market evolves, expect continued innovation in audio drivers, frequency response, and high-resolution audio to captivate discerning consumers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to consumers seeking immersive audio experiences, with various types including in-ear, on-ear, and over-ear models. Bluetooth technology enables wireless connectivity, while noise-canceling technology blocks external sounds for uninterrupted listening. Comfort is prioritized through adjustable fits and lightweight designs. Brands invest in advanced drivers for superior sound quality, while battery life is a significant consideration for wireless models. Customizable features like equalizer settings and app integration add value. The market also includes gaming headphones with enhanced bass and microphones for communication. Overall, the market offers a wide range of options to meet diverse consumer preferences and needs.

What are the key market drivers leading to the rise in the adoption of Earphone And Headphone Industry?

- The primary catalyst fueling market growth is the continuous advancement of technology, which enhances product offerings.

- The market is experiencing significant growth due to advancements in technology. Companies are introducing innovative products, such as Noise's touch-enabled Bluetooth neckband earphones, which were launched in January 2024. These neckband earphones feature touch inputs on the neckband instead of the earbuds, offering a unique user experience. Technological innovations, including augmented reality (AR), three-dimensional (3D), and artificial intelligence (AI), are driving market expansion. AI is being implemented to provide personalized audio experiences for users, enhancing the quality of audio and improving the music streaming experience. Market players are focusing on digital audio technologies, such as high-resolution audio and frequency response, to cater to the increasing demand for immersive and harmonious audio experiences.

- Additionally, features like passive noise cancellation, wireless charging, microphone placement, headband adjustability, and portable design are becoming increasingly popular among consumers. Bone conduction headphones are another emerging trend in the market, offering a unique listening experience by transmitting sound through the bones in the user's skull instead of the ear canal. These headphones are particularly popular among athletes and fitness enthusiasts. Overall, the market is expected to continue growing due to the increasing demand for personal audio devices and the continuous innovation in technology.

What are the market trends shaping the Earphone And Headphone Industry?

- IPX-certified devices are gaining significant traction in the market due to their waterproof and rugged features, making them an essential choice for professionals and consumers seeking durability. These devices, which hold the IPX certification, offer protection against water and dust, setting a new trend in technology.

- The market in consumer electronics continues to evolve, driven by advancements in technology and consumer preferences. Over-ear headphones with voice assistant integration have gained popularity for their convenience during phone calls and music playback. Audio drivers have been enhanced to deliver immersive and harmonious sound experiences. Consumer demand for durability, particularly in sports headphones, has led manufacturers to prioritize robust designs. Several models now boast sweat-proof and water-resistant features, ensuring functionality in various environmental conditions. Ingress protection (IP) ratings, which indicate a device's protection against dust and water, have become essential considerations. For instance, an IPX1-rated product offers resistance to water droplets, while IPX9 provides protection against high-pressure water jets.

- EQ settings and signal-to-noise ratio (SNR) are other crucial factors influencing consumer choices. The market is expected to grow as technology continues to advance, offering more personalized and immersive audio experiences. Wearable technology integration and seamless connectivity further enhance the appeal of earphones and headphones.

What challenges does the Earphone And Headphone Industry face during its growth?

- The escalating prices of wireless variants pose a significant challenge and hinder the growth of the industry.

- The market is witnessing significant growth due to the increasing demand for advanced features, such as water resistance, video conferencing capabilities, and customizable ear tip sizes. Bluetooth codecs and audio streaming technologies are driving innovation in wireless headphones, with on-ear models prioritizing immersive, harmonious sound and hi-fi audio quality. Manufacturing processes have evolved to accommodate these advancements, resulting in products with ambient sound mode and transparency features. Audio accessories, including gaming headphones, are also gaining popularity, offering enhanced audio experiences for specific applications.

- Despite the high price points associated with many of these premium products, the market continues to expand as consumers seek out the latest technology. However, the cost of these advanced features may limit adoption in certain markets, potentially hindering overall market growth.

Exclusive Customer Landscape

The earphone and headphone market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the earphone and headphone market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, earphone and headphone market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - The company provides a range of Apple audio products, including the second generation AirPods Pro, AirPods Max, Mini HomePod earphones, and standard EarPods. These devices offer advanced sound technology and seamless integration with Apple devices. The AirPods Pro boast active noise cancellation and a customizable fit, while the AirPods Max deliver over-ear comfort and high-fidelity sound. Mini HomePod earphones provide a compact and portable solution for high-quality audio, and EarPods offer a wired alternative with a sleek design and clear sound. With these offerings, the company caters to various consumer preferences and needs in the audio market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- Bose Corp.

- Bowers and Wilkins

- GN Store Nord AS

- Grado Labs Inc.

- JVCKENWOOD Corp.

- Koninklijke Philips NV

- Logitech International SA

- Matrics Inc.

- Panasonic Holdings Corp.

- Pioneer India Electronics Pvt. Ltd.

- Samsung Electronics Co. Ltd.

- Sennheiser Electronic GmbH and Co. KG

- Shure Inc.

- Skullcandy Inc.

- Sony Group Corp.

- Xiaomi Inc.

- Zound Industries International AB

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Earphone And Headphone Market

- In January 2024, Sony Corporation announced the launch of its new premium wireless noise-canceling headphones, WH-1000XM5, featuring advanced noise-canceling technology and improved sound quality (Sony press release). In March 2024, Apple Inc. And leading audio technology company, Dolby Laboratories, formed a strategic partnership to integrate Dolby Atmos technology into Apple's AirPods Pro 2, providing users with immersive spatial audio experience (Apple press release).

- In April 2024, Sennheiser Electronic GmbH & Co. KG, a leading German audio equipment manufacturer, acquired Audeze, LLC, a US-based premium headphone brand, to expand its product portfolio and strengthen its presence in the high-end audio market (Sennheiser press release). In May 2025, Jabra, a Danish audio device manufacturer, received regulatory approval from the US Food and Drug Administration (FDA) for its Elite 85h wireless headphones, featuring hearing aid compatibility, making them the first headphones with this feature to receive FDA clearance (Jabra press release).

Research Analyst Overview

- The market is characterized by continuous innovation and competition, driven by consumer preferences for superior audio quality, customization, and user experience (UX). Brands are focusing on positioning themselves based on unique features such as virtual surround sound, user interface, and audio customization. Manufacturing efficiency and product lifecycle management are crucial for staying competitive, with firms implementing software updates and firmware improvements to enhance product offerings. Customer support and repair services are essential for maintaining brand perception and consumer loyalty. Price points and pricing strategies vary, with sales forecasts indicating a trend towards premium offerings. Product development is influenced by environmental impact, safety standards, and patent landscape.

- Market share analysis reveals a growing demand for hearing protection, sound isolation, and immersive audio experiences, including 3D audio and spatial audio. Channel management and app compatibility are also key considerations for brands seeking to expand their reach. Brands are investing in marketing campaigns to differentiate themselves, leveraging user experience, product design aesthetics, and brand positioning to attract customers. The market is also witnessing a shift towards more sustainable manufacturing practices and eco-friendly materials. In the realm of UX, user interface and channel management are critical factors, with firms focusing on seamless integration and intuitive controls.

- Firmware updates and app compatibility are essential for maintaining a competitive edge and ensuring a positive customer experience. The market is a dynamic and evolving landscape, with trends such as hearing protection, virtual surround sound, and customization shaping the future of audio technology. Brands must navigate the complexities of product development, pricing strategies, and environmental impact while delivering innovative and high-quality solutions to meet the demands of discerning consumers.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Earphone And Headphone Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.2% |

|

Market growth 2025-2029 |

USD 39.04 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.9 |

|

Key countries |

US, China, Canada, Germany, UK, Japan, India, Brazil, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Earphone And Headphone Market Research and Growth Report?

- CAGR of the Earphone And Headphone industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the earphone and headphone market growth of industry companies

We can help! Our analysts can customize this earphone and headphone market research report to meet your requirements.