Hospice Market Size 2024-2028

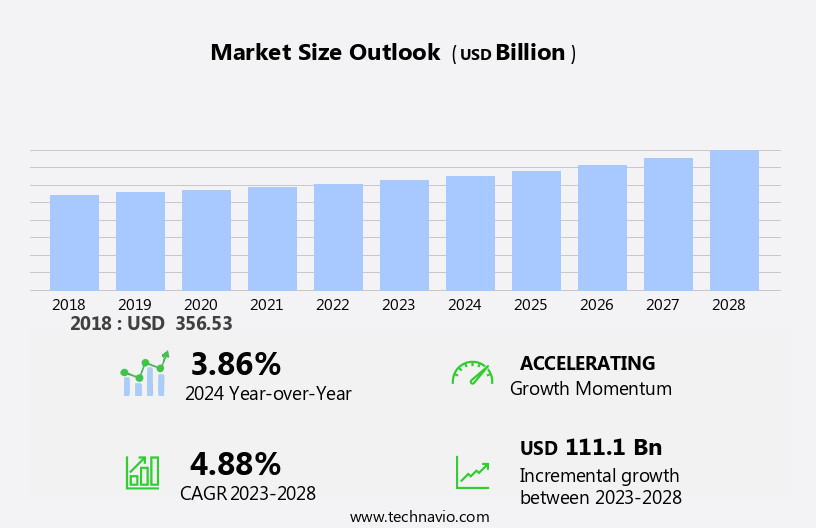

The hospice market size is forecast to increase by USD 111.1 billion, at a CAGR of 4.88% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing geriatric population and increasing geriatric medicine and the rising emphasis on person-centered care in hospice settings. The aging demographic trend is fueling a surge in demand for hospice services and digital health as the elderly population is more likely to require end-of-life care. This demographic shift is a major opportunity for hospice providers to expand their offerings and cater to the unique needs of this population. However, the high cost of healthcare remains a significant challenge for the market. The escalating costs of providing quality care, coupled with regulatory requirements and reimbursement pressures, put pressure on hospice providers to optimize their operations and manage costs effectively.

- To navigate these challenges, hospice providers must explore innovative care models, leverage technology to improve efficiency, and collaborate with healthcare partners to share resources and reduce costs. By addressing these challenges, hospice providers can capitalize on the market's growth potential and deliver high-quality, person-centered care to their patients.

What will be the Size of the Hospice Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its landscape. Medication management, a crucial aspect, is increasingly integrated into hospice care through advanced technologies and specialized services. Wound care and home infusion therapy are also gaining prominence, providing comfort and symptom relief for patients. Hospice chaplains offer spiritual care, while home health aides and social workers ensure patient needs are met beyond medical care. Palliative care and grief counseling are essential components of holistic care, addressing the emotional and psychological aspects of end-of-life care. Referral pathways streamline the transition between various care settings, ensuring seamless continuity. Hospice volunteer coordinators play a vital role in supporting patients and families, while hospice physicians and administrators oversee the delivery of quality care.

Quality indicators, discharge planning, and spiritual assessment are key focus areas for enhancing patient satisfaction and improving overall care. Community resources, financial assistance, and durable medical equipment are essential for ensuring accessibility and affordability. Caregiver training and volunteer services are integral to supporting families and enhancing the patient experience. Symptom management, pain control, and nutritional support are ongoing priorities for hospice care. The market's continuous evolution reflects the diverse needs of patients and families, requiring a comprehensive approach to care that integrates medical, emotional, and spiritual support.

How is this Hospice Industry segmented?

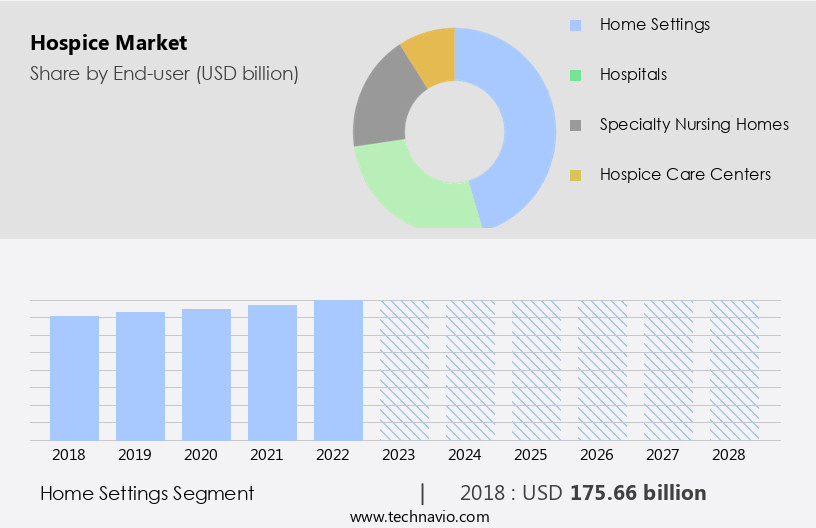

The hospice industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Home settings

- Hospitals

- Specialty nursing homes

- Hospice care centers

- Type

- Nursing services

- Medical supply services

- Physician services

- Other services

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By End-user Insights

The home settings segment is estimated to witness significant growth during the forecast period.

In the realm of healthcare, hospice care has emerged as a significant solution for individuals with chronic illnesses or those recovering from acute hospitalization. Hospice services encompass a range of social and medical offerings tailored to patients' needs. Registered and licensed nurses, therapists, dieticians, case managers, and nutritionists are among the professionals providing care. Home health aides, personal caregivers, and daily chores assistance are also included. These services extend to essential products, devices, and solutions for home settings. Hospice care goes beyond medical care, encompassing spiritual assessment, family support groups, and bereavement services. Outpatient hospice and inpatient hospice cater to varying patient requirements.

Quality indicators, discharge planning, and symptom management are integral components of hospice care. Caregiver training, volunteer services, and physician services ensure comprehensive patient care. Financial assistance, durable medical equipment, medication management, wound care, home infusion therapy, and hospice chaplain services further enhance the offerings. Palliative care and hospice volunteer coordinators facilitate seamless referral pathways. Patient satisfaction and community resources are essential elements of hospice care, with accreditation standards ensuring cost containment and maintaining high-quality care. Certified nursing assistants and registered nurses provide essential symptom management and hospice admission criteria assessment. The widespread awareness of hospice care has led to substantial savings compared to traditional nursing homes, making it a cost-effective alternative for end-of-life care.

Hospice care's comprehensive, holistic approach emphasizes the importance of spiritual care, patient satisfaction, and community resources in ensuring optimal care for patients and their families.

The Home settings segment was valued at USD 175.66 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

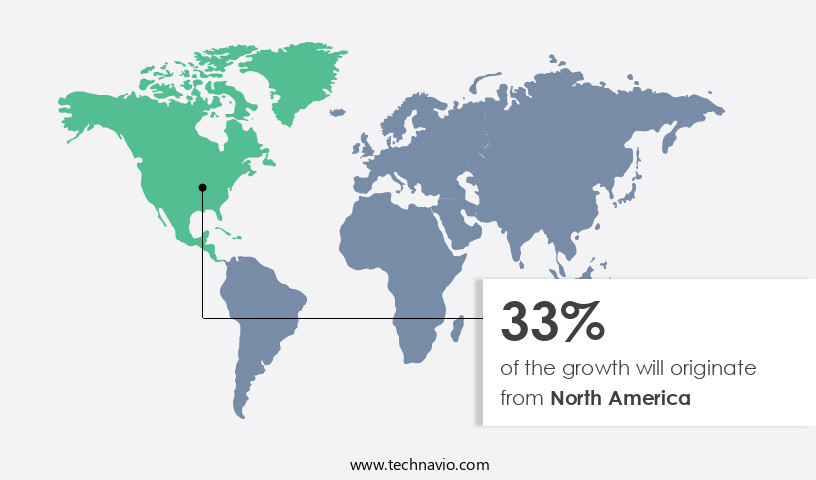

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the market is significantly large due to robust government support in the US and Canada. This has led to an increase in the number of private and government-aided organizations providing hospice care services. The US, in particular, has a high volume of patients with cancer, end-stage renal diseases, respiratory failure, and chronic kidney disease, driving market growth. Hospice care expenses in the US are primarily covered by Medicare, Medicaid, and VA benefits, ensuring affordability for patients. Hospice care encompasses various aspects, including respite care, advance care planning, nursing care, medical social workers, outpatient hospice, and spiritual assessment.

Quality indicators, discharge planning, and patient satisfaction are essential components of hospice care, ensuring a harmonious end-of-life experience. Hospice care also offers family support groups, bereavement support, and grief counseling. Hospice teams consist of professionals such as hospice nurses, social workers, chaplains, home health aides, and palliative care physicians. Volunteer services and caregiver training are crucial for enhancing the quality of care. Durable medical equipment, medication management, wound care, and home infusion therapy are essential services offered by hospice care. Inpatient hospice care and symptom management are critical aspects of hospice care, ensuring effective pain management and symptom relief.

Hospice admission criteria, certified nursing assistants, and registered nurses play a significant role in providing comprehensive care. Accreditation standards and cost containment are essential considerations for hospice care organizations. Community resources, referral pathways, and spiritual care are also integral components of hospice care, ensuring a holistic approach to end-of-life care. Hospice administrators and physicians oversee the operations and care delivery, ensuring adherence to accreditation standards and quality indicators. The market is expected to continue evolving, with a focus on improving patient care and experiences.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the compassionate realm of healthcare and telehealth , the market plays a pivotal role, offering comfort and care for individuals facing life-limiting illnesses. This market encompasses specialized medical services, palliative care, and emotional support for patients and their families. Hospice care focuses on enhancing quality of life, providing symptom management, and addressing spiritual and emotional needs. Hospice services include skilled nursing, home health aides, medical equipment, and medications. Additionally, hospice teams offer counseling, volunteer support, and bereavement care. The market prioritizes patient-centered care, ensuring dignity and respect for every individual. It's a collaborative approach involving physicians, nurses, social workers, chaplains, and volunteers. This holistic care model aims to improve patient experiences, allowing them to live their final days with peace, comfort, and dignity.

What are the key market drivers leading to the rise in the adoption of Hospice Industry?

- The geriatric population's continuous growth serves as the primary market driver. The market is experiencing significant growth due to the rising prevalence of chronic diseases among the aging population. According to recent research, Eastern and South-Eastern Asia, with its large elderly population of over 260 million, is a major contributor to this market's expansion. Europe and North America, with approximately 200 million people aged 65 and above, also represent substantial markets. In the US and Canada, the elderly population is projected to increase to over 20% by 2030, from the current 17%. Hospice care offers essential services such as respite care, advance care planning, nursing care, medical social workers, outpatient hospice, and discharge planning.

- These services focus on improving quality of life for patients and their families, addressing spiritual assessment, telemedicine and providing nutritional support. The hospice model of care emphasizes a harmonious and immersive approach, focusing on the physical, emotional, and spiritual needs of patients. Key market dynamics include the increasing demand for quality indicators in hospice care, the growing importance of respite facilities, and the need for effective discharge planning. As the global population ages, the market is expected to continue its growth trajectory, providing vital services to those in need.

What are the market trends shaping the Hospice Industry?

- Person-centered care is becoming increasingly prioritized in hospice settings, marking a significant market trend. This approach focuses on meeting the unique physical, emotional, and spiritual needs of each patient, ensuring they receive compassionate and individualized care.

- The market is experiencing significant growth due to the increasing emphasis on person-centered care. In this approach, hospice providers prioritize the unique needs, preferences, and values of each patient, resulting in customized care plans. Patients and their families are encouraged to actively participate in decision-making processes regarding their care and end-of-life preferences. Person-centered care fosters empowerment, dignity, and trust, leading to improved patient satisfaction and overall care quality. Additionally, hospice services encompass various aspects of care, including pain management, family support groups, bereavement support, hospice nurse and social worker services, caregiver training, volunteer services, physician services, financial assistance, and durable medical equipment.

- These comprehensive offerings cater to the multifaceted needs of patients and their families during the end-of-life journey. Hospice providers play a crucial role in addressing the emotional, spiritual, and social aspects of care, in addition to managing physical symptoms. This holistic approach enhances the overall quality of life for patients and their loved ones. As the population ages and the demand for compassionate, high-quality end-of-life care continues to grow, the market is poised for continued expansion.

What challenges does the Hospice Industry face during its growth?

- The escalating costs of healthcare represent a significant challenge that can hinder industry growth. In order to address this issue and maintain professionalism, it is crucial for organizations to implement cost-effective solutions and strategies within the healthcare sector.

- The market in developed countries, including the US, faces challenges due to high healthcare costs. Despite the US having one of the most expensive healthcare systems globally, hospice care expenses are primarily covered by Medicare. To qualify for Medicare's hospice benefit, a patient must have a life expectancy of six months or less, as certified by two physicians. This requirement can limit the number of patients who can access hospice services. Medication management, wound care, home infusion therapy, spiritual care, and palliative care are essential components of hospice services. Home health aides, hospice chaplains, and volunteer coordinators play crucial roles in ensuring patient satisfaction and providing emotional support.

- Grief counseling is also an integral part of hospice care. The market's dynamics are influenced by various factors, including referral pathways and the availability of skilled professionals. Ensuring an immersive and harmonious care experience is essential to preserve patient satisfaction and promote positive word-of-mouth referrals. The focus on patient-centered care and the importance of spiritual care in end-of-life care are key trends driving market growth.

Exclusive Customer Landscape

The hospice market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hospice market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hospice market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abode Hospice and Home Health - Expertly navigating the end-of-life journey, our hospice services prioritize patient comfort and symptom management, ensuring dignity and peace during this critical time.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abode Hospice and Home Health

- AccentCare Inc.

- Amedisys Inc.

- BRISTOL HOSPICE LLC

- Brookdale Senior Living Inc.

- Caring Hospice Services

- Chemed Corp.

- Compassus

- Covenant Care

- Crossroads Hospice

- Four Seasons

- Hospice of the Valley

- Liberty HomeCare and Hospice Services

- LifePoint Health Inc.

- PeaceHealth

- Providence

- Seasons Hospice

- Silverado

- Suncrest Hospice

- UnitedHealth Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hospice Market

- In January 2024, Hospice of the Valley, a leading non-profit hospice organization in the United States, announced the launch of its innovative telehealth program, "Connections," to expand access to hospice care services in rural areas (Hospice of the Valley Press Release, 2024).

- In March 2024, Kindred at Home, a prominent provider of hospice care services, entered into a strategic partnership with Cerner Corporation, a health care technology company, to integrate their electronic health records systems, enhancing care coordination and patient outcomes (Kindred at Home Press Release, 2024).

- In May 2024, Gentiva Health Services, a significant player in the market, completed the acquisition of CuraHealth, a California-based hospice and palliative care provider, expanding its presence in the Western United States (Gentiva Health Services Press Release, 2024).

- In February 2025, the Centers for Medicare & Medicaid Services (CMS) approved a new payment model for hospice care, allowing for increased reimbursement for care provided in the patient's home, further encouraging the growth of home-based hospice services (CMS Press Release, 2025).

Research Analyst Overview

- In the market, navigating legal issues related to end-of-life decision-making and advance directives is crucial. Hospices employ patient assessment tools to ensure appropriate care for their patients, while grants management is essential for securing essential funds. Ethical considerations, including spiritual well-being, are integral to hospice care. Continuing education and staff training are ongoing priorities to maintain high-quality care. Performance metrics and caregiver burden are significant concerns, with data analytics used to optimize care delivery and reduce caregiver stress. Hospices focus on symptom control, offering palliative sedation and comfort care when necessary. Public relations and community outreach efforts help build trust and increase awareness.

- Diversity and inclusion, cultural competency, and emotional support are essential components of hospice care. Hospices prioritize quality improvement, implementing outcome measurement and family dynamics strategies. Clinical documentation and medication reconciliation are critical for maintaining accurate records and ensuring effective care. Staff training in ethical decision-making, symptom control, and cultural competency is ongoing. Hospices also invest in volunteer recruitment and training to support their mission. Hospice care encompasses a holistic approach, addressing the physical, emotional, and spiritual needs of patients and their families.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hospice Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.88% |

|

Market growth 2024-2028 |

USD 111.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.86 |

|

Key countries |

US, Canada, China, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hospice Market Research and Growth Report?

- CAGR of the Hospice industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hospice market growth of industry companies

We can help! Our analysts can customize this hospice market research report to meet your requirements.