Vietnam Hotel Market Size 2025-2029

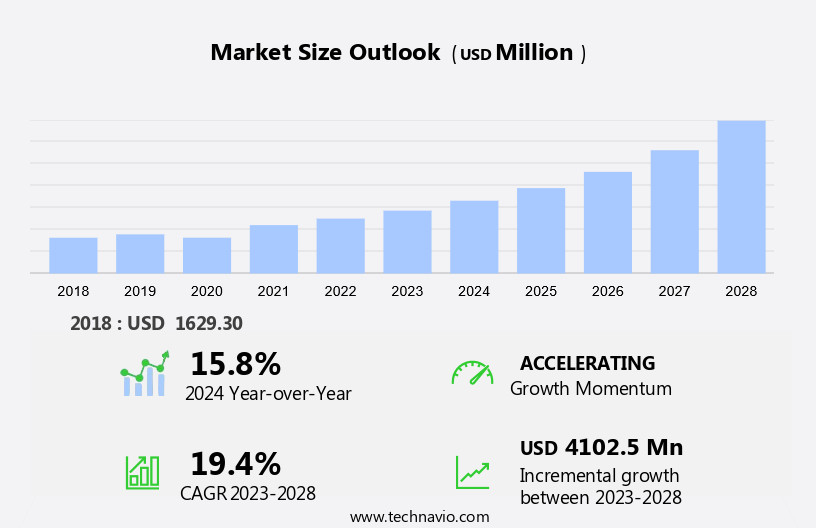

The Vietnam hotel market size is forecast to increase by USD 5.33 billion, at a CAGR of 21.1% between 2024 and 2029.

- The global hotel market is experiencing significant growth, driven by increasing affordability and rising disposable income levels among consumers. This trend is particularly evident in emerging economies, where the middle class is expanding and travel is becoming more accessible. Mobile check-in and hospitality technology enhance the guest experience, while big data analysis drives revenue optimization and cost control. Furthermore, the application of social media and internet penetration continues to transform the industry, enabling real-time bookings and customer engagement. However, the market faces challenges as well. Climate change and unexpected weather developments pose significant risks, leading to cancellations and operational disruptions.

- Hotel operators must adapt to these dynamics by investing in sustainable practices and implementing robust risk management strategies. To capitalize on market opportunities and navigate challenges effectively, companies must stay agile and responsive, leveraging technology and data analytics to optimize operations and enhance the customer experience.

What will be the size of the Vietnam Hotel Market during the forecast period?

- In the dynamic hotel market, service quality continues to be a top priority, with environmental sustainability gaining significant attention. Disaster preparedness and operational excellence are essential for ensuring guest safety. Social media marketing and email campaigns foster brand awareness and loyalty. Energy efficiency and corporate social responsibility are key components of brand image. Online reputation management, review monitoring, and automated services are crucial for maintaining a positive guest journey.

- Data analytics, customer relationship management, and digital transformation shape the industry's future. Cloud computing, voice assistants, and virtual concierge services streamline operations and improve guest personalization. Search engine optimization and paid advertising boost visibility, while security measures protect against cyber threats. Employee engagement and keyless entry systems contribute to operational efficiency and guest satisfaction.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Tourist accommodation

- Official business

- Type

- Chain hotels

- Independent hotels

- Service

- Service apartments

- Mid and upper mid-scale hotels

- Budget and economy hotels

- Luxury hotels

- Geography

- APAC

- Vietnam

- APAC

By Application Insights

- The tourist accommodation segment is estimated to witness significant growth during the forecast period. In the tourism industry, accommodation continues to dominate with a significant revenue share in 2024. The market is driven by both domestic and international travelers, with the latter holding a substantial impact. International tourism in Vietnam experienced a remarkable recovery, attracting approximately 17 million visitors in 2024, marking a 39.5% increase from the previous year. This increase contributed to a total revenue of 34,440 million USD. The government's initiatives to boost tourism activities have been instrumental in this growth. Customer experience is a crucial factor influencing travel decisions. Hoteliers focus on various aspects such as room types, customer segmentation, pricing strategies, and guest services to cater to diverse traveler needs.

- Property management systems and hotel management systems facilitate operational efficiency and revenue management. Independent and budget hotels cater to different market segments, while luxury hotels and hotel chains offer premium experiences. Technology plays a pivotal role in the hospitality sector. Mobile apps, social media, and online travel agencies provide convenience and personalized services to guests. Artificial intelligence and yield management systems help optimize pricing and inventory. Meeting rooms and fitness centers cater to business and family travelers, respectively. Competitor analysis and channel management are essential for maintaining a competitive edge. Loyalty programs and guest relationship management ensure repeat business and positive guest feedback. Staff training and operational efficiency are vital for delivering excellent guest satisfaction. Global distribution systems and digital marketing expand reach and visibility. Hoteliers adopt various strategies, from room types and pricing to technology and guest services, to cater to diverse traveler needs and preferences. The market continues to evolve, with a focus on operational efficiency, revenue management, and guest satisfaction.

Get a glance at the market share of various segments Request Free Sample

The Tourist accommodation segment was valued at USD 1155.10 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hotel in Vietnam Industry?

- The primary factors fueling market growth are the increasing affordability and disposable income of consumers. The market has experienced significant growth due to increasing per capita disposable income and the growing participation of women in the workforce. As of 2023, Vietnam's Gross National Income (GNI) per capita reached USD4,110, enabling more individuals to afford leisure travel and improve their customer experience during their stays. Furthermore, women comprise approximately 48.6% of Vietnam's labor force, leading to increased household income and higher consumer spending on hotel accommodations. These economic trends collectively contribute to a more balanced economic environment and a growing demand for various room types, from budget to luxury options.

- Hotel management systems and property management systems have become essential tools for independent hotels to optimize revenue management and cater to diverse customer segments through effective customer segmentation. The market dynamics include a growing demand for enhanced customer experiences, the adoption of advanced technology solutions, and the increasing competition among hotel providers. As the hotel industry continues to evolve, hotel management systems and property management systems will play a crucial role in optimizing operations, enhancing customer satisfaction, and maintaining a competitive edge.

What are the market trends shaping the Hotel in Vietnam Industry?

- The increasing utilization of social media and the expansion of internet access represent a significant market trend. This development is driven by the growing reliance on digital platforms for communication, information sharing, and commerce. The market is leveraging social media as a pricing strategy to reach a wider audience and attract various travel segments. With over 55 million Facebook users, this platform is a preferred choice for information sourcing among Vietnamese consumers planning ground travel. Hotels can showcase their facilities and services through visually appealing content, engaging potential guests and influencers. Yield management is optimized by targeting specific demographics and offering personalized deals. Mobile apps and online travel agencies are also crucial channels for booking and managing reservations.

- Competitor analysis and channel management ensure hotels maintain a competitive edge. Guest services are enhanced through technology, such as mobile check-in and contactless payment. Interior design plays a significant role in creating a deep guest experience. Overall, the market is adapting to technological advancements and consumer preferences, ensuring a memorable and efficient hospitality experience.

What challenges does the Hotel in Vietnam Industry face during its growth?

- Unforeseen weather developments and climate change pose a significant challenge to industry growth, necessitating adaptation and mitigation strategies to minimize potential disruptions. The global hotel market is experiencing significant changes driven by technology adoption and innovative trends. Artificial intelligence is increasingly being used for guest relationship management, staff training, and optimizing distribution channels. Hotel chains are focusing on green initiatives to attract eco-conscious travelers, while luxury hotels prioritize deep experiences. Meeting rooms are becoming more technologically advanced to cater to corporate clients. Boutique hotels are gaining popularity for their unique offerings and personalized services. Families continue to be a major market segment, with hotels offering family-friendly amenities and packages. Environmental sustainability is a key concern, as natural disasters can significantly impact the revenue of the hotel industry.

- Recovery from such calamities can take anywhere from 20 to 27 months, depending on the severity of the disaster and political unrest. Hoteliers must stay informed of these trends and adapt to meet the changing needs of travelers.

Exclusive Customer Landscape

The hotel market in Vietnam forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hotel market in Vietnam report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hotel market in Vietnam forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accor S.A. - The company specializes in providing a diverse range of internationally recognized hotel brands, including Sofitel, Novotel, and ibis.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accor S.A.

- Aman Group S.a.r.l.

- Central Plaza Hotel Public Co. Ltd.

- Four Seasons Hotels Ltd.

- Furama Resort Danang

- Hilton Worldwide Holdings Inc.

- Hotel Nikko Saigon

- Hyatt Hotels Corp.

- InterContinental Hotels Group Plc

- La Siesta Premium Hang Be

- Marriott International Inc.

- Melia Hotels International S.A.

- Minor International Public Co. Ltd.

- Muong Thanh Hospitality

- Oakwood

- SALA DANANG BEACH HOTEL

- Sofitel Legend Metropole Hanoi

- Victoria Hotels and Resorts

- Vinpearl

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hotel Market In Vietnam

- In February 2023, Marriott International announced the launch of its newest luxury brand, EDITION Hotels, in Miami, Florida. This expansion marks the brand's entry into the North American market, following its successful debut in Europe and the Middle East (Marriott International, 2023).

- In May 2024, Hilton Worldwide and Marriott International signed a strategic partnership with Microsoft to implement Microsoft's cloud and AI technologies across their properties. This collaboration aims to enhance guest experiences through personalized services and improved operational efficiency (Microsoft, 2024).

- In October 2024, AccorHotels completed the acquisition of Mövenpick Hotels & Resorts, significantly expanding its presence in Europe and Africa. This acquisition added over 85 hotels and 16,000 rooms to AccorHotels' portfolio (AccorHotels, 2024).

Research Analyst Overview

The hotel market continues to evolve, with dynamic market dynamics shaping various sectors. Technology adoption, such as property management systems and mobile apps, transforms operational efficiency and guest experience. Artificial intelligence and machine learning enhance customer segmentation, pricing strategies, and revenue management. Hotel chains expand their reach, while independent and boutique hotels cater to niche markets, including luxury travelers and families. Green initiatives and sustainable practices gain prominence, influencing hotel design and guest services. Meeting rooms adapt to digital trends, offering virtual and hybrid meeting solutions. Guest relationship management and staff training are prioritized for enhancing guest satisfaction and loyalty.

The Hotel Market in Vietnam is growing rapidly, fueled by rising tourism and evolving accommodation preferences. Hotels are upgrading point of sale systems to streamline transactions and improve guest experience. Modern fitness centers are becoming standard amenities, catering to health-conscious travelers. The demand for business travel accommodations remains strong, with premium services tailored for corporate guests. Likewise, family travel is on the rise, leading to an increase in family-friendly resorts and hotels with kid-friendly facilities. The average daily rate continues to fluctuate based on seasonal trends and occupancy rates, impacting revenue generation.

Distribution channels, including online travel agencies and global distribution systems, evolve to cater to diverse customer segments. Digital marketing and social media platforms play a crucial role in reaching and engaging potential guests. Competitor analysis and channel management are essential for maintaining a competitive edge. Industry standards, including average daily rates, occupancy rates, and yield management, continue to shape pricing strategies. Labor costs and operational efficiency are critical factors in maintaining profitability. Loyalty programs and guest feedback are valuable tools for retaining customers and improving overall performance. In this ever-changing landscape, hotels must remain agile and adapt to evolving trends to stay competitive and meet the evolving needs of their customers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hotel Market in Vietnam insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.1% |

|

Market growth 2025-2029 |

USD 5.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.2 |

|

Key countries |

Vietnam |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, Industry Risks, |

What are the Key Data Covered in this Hotel Market in Vietnam Research and Growth Report?

- CAGR of the Hotel in Vietnam industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Vietnam

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hotel market in Vietnam growth of industry companies

We can help! Our analysts can customize this hotel market in Vietnam research report to meet your requirements.