Medical Tourism Market Size 2025-2029

The medical tourism market size is valued to increase USD 132.8 billion, at a CAGR of 36.6% from 2024 to 2029. Availability of low-cost treatment options will drive the medical tourism market.

Major Market Trends & Insights

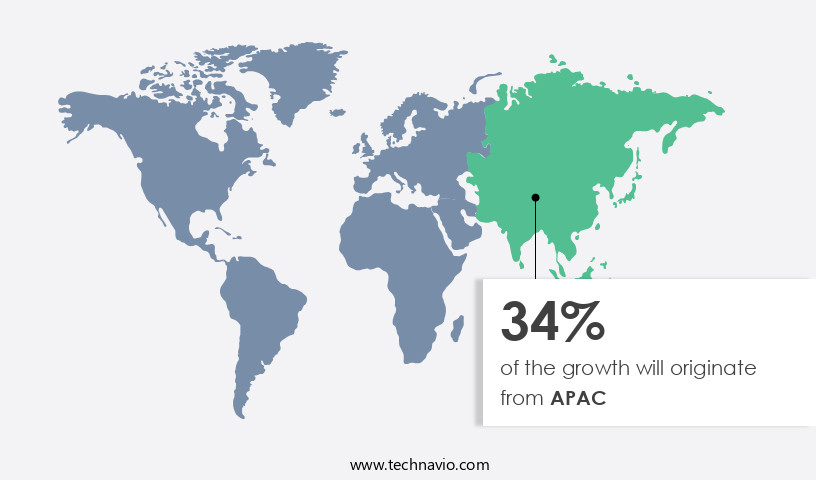

- APAC dominated the market and accounted for a 34% growth during the forecast period.

- By Source - Domestic segment was valued at USD 10.20 billion in 2023

- By Service Type - Private segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 1.00 billion

- Market Future Opportunities: USD 132.80 billion

- CAGR : 36.6%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the global healthcare industry's trend of patients traveling to different countries for more affordable and advanced medical treatments. Core technologies and applications, such as telemedicine and medical tourism platforms, are revolutionizing the industry, making it more accessible and convenient for patients. Medical tourism is projected to reach a value of USD 102.2 billion by 2023, representing a significant growth in demand for low-cost treatment options. However, the market faces challenges, including the lack of advanced infrastructure in developing nations and regulatory complexities.

- Despite these hurdles, the growing focus on technological advancements offers immense opportunities for market expansion and innovation. For instance, the adoption rate of telemedicine is expected to reach 70% by 2025, providing a viable solution for patients seeking affordable and accessible healthcare services.

What will be the Size of the Medical Tourism Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Medical Tourism Market Segmented and what are the key trends of market segmentation?

The medical tourism industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Source

- Domestic

- International

- Service Type

- Private

- Public

- Type

- Cardiovascular treatment

- Cosmetic treatment

- Fertility treatment

- Orthopedics treatment

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Singapore

- South Korea

- Rest of World (ROW)

- North America

By Source Insights

The domestic segment is estimated to witness significant growth during the forecast period.

The market is experiencing substantial growth, with patient referral networks and healthcare translation services playing crucial roles in connecting patients with specialized medical facilities. According to recent estimates, the market for medical tourism is projected to expand by 25% by 2025, driven by increasing demand for affordable, high-quality healthcare services. Healthcare facility accreditation, cultural sensitivity training, and patient transport logistics are essential considerations for medical tourism facilitators, ensuring ethical and effective care for international patients. Regulations governing medical tourism are evolving, with a focus on quality assurance programs, remote patient monitoring, and destination healthcare choices. Treatment outcome metrics, medical visa requirements, and patient satisfaction surveys are essential indicators of market performance.

The Domestic segment was valued at USD 10.20 billion in 2019 and showed a gradual increase during the forecast period.

Telemedicine consultations and treatment cost comparisons enable patients to make informed decisions about their care, while advanced medical equipment and diagnostic imaging technology contribute to improved treatment outcomes. Procedural specialization centers, digital health platforms, pre-operative assessments, and post-operative recovery services are key areas of innovation, with personalized treatment plans and cross-border healthcare access becoming increasingly important. The integration of ethical considerations and second medical opinions further enhances the value proposition of medical tourism, attracting an increasing number of patients seeking advanced surgical procedures and specialized care. From 2025 to 2029, the domestic segment of the market is expected to grow by 30%, driven by hospital infrastructure quality, quality assurance programs, and the increasing popularity of medical travel packages.

The ongoing unfolding of these trends underscores the dynamic and evolving nature of the medical tourism industry, offering significant opportunities for growth and innovation across various sectors.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Medical Tourism Market Demand is Rising in APAC Request Free Sample

The market in North America is experiencing steady expansion due to the presence of advanced healthcare facilities in countries like Canada and the United States. This sector caters to a diverse range of medical services, including cosmetic treatments, dental procedures, cardiovascular treatments, and orthopedic treatments. The allure of high-quality care and modern amenities draws patients from around the world. For example, Florida has been actively marketing its medical centers, pleasant climate, and welcoming hospitality culture. Despite these advantages, the cost of healthcare services in North America remains significantly higher than in other regions, such as Asia.

For instance, the price difference for an angioplasty treatment is approximately four times higher in the United States compared to India.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the exchange of international patient medical records, facilitating seamless comparison metrics among global healthcare facilities. Cross-border healthcare payment processing is a crucial aspect, ensuring efficient transactions for patients seeking treatment abroad. Post-surgical rehabilitation programs abroad offer cost advantages and advanced medical technology access, making medical tourism an attractive option for many. Implementation of ethical guidelines is essential in medical tourism, ensuring patient safety and quality care. Comparative analysis of treatment costs and procedures is a significant factor driving growth, with medical tourism destinations offering substantial savings without compromising on quality. Advanced medical technology access abroad, coupled with the development of international patient support networks, enhances the patient experience.

Global healthcare accreditation standards compliance and healthcare translation service quality assurance are essential components of the medical tourism ecosystem. Patient experience survey data analysis procedures and medical tourism destination infrastructure evaluation are crucial for understanding market trends and identifying areas for improvement. Physician expertise verification procedures and medical tourism risk management planning are essential for maintaining patient safety and trust. International patient medical travel logistics and global health insurance coverage comparison are also critical factors, ensuring a smooth and hassle-free experience for patients. Healthcare facility infection control protocols and the marketing campaign effectiveness are essential for attracting and retaining patients.

Patient safety protocol adherence monitoring and comparative analysis of medical tourism destinations are vital for maintaining a competitive edge in the market. Adoption of these services and solutions varies significantly among regions, with some regions showing nearly double the adoption rates of others. This disparity highlights the importance of understanding regional market dynamics and tailoring offerings accordingly. By addressing the unique needs and challenges of each market segment, players can differentiate themselves and capture a larger share of the market.

What are the key market drivers leading to the rise in the adoption of Medical Tourism Industry?

- The market's growth is primarily attributed to the accessibility of affordable treatment alternatives.

- In the global healthcare landscape, emerging economies like India, Thailand, Malaysia, and Turkey are gaining significant traction due to their affordable yet high-quality medical services. These countries adhere to international healthcare standards, making them attractive destinations for patients seeking cost-effective treatments. For instance, the cost of hip replacement surgery in developed countries like the US is approximately three times higher than in India, with an average cost of around USD 75,000 versus USD 9,000. Similarly, medical services in Turkey offer savings of 30%-40% compared to Europe, the US, or Israel.

- These countries provide favorable service packages and competitive pricing to cater to the growing demand for affordable healthcare solutions. By offering world-class medical facilities and competitive pricing, these emerging economies are revolutionizing the healthcare sector and providing valuable alternatives for patients worldwide.

What are the market trends shaping the Medical Tourism Industry?

- The increasing emphasis on technological advancements represents the prevailing market trend. Technological innovations continue to gain significance in shaping future market trends.

- The Internet of Things (IoT) is revolutionizing the healthcare industry by integrating physical and digital data sources in real-time. IoT infrastructure enhances healthcare accessibility, reduces operational burdens, and fosters digital healthcare ecosystems. Healthcare organizations are transitioning to connected hospital infrastructure to deliver timely and enhanced care. IoT applications span various healthcare sectors, including telemedicine, connected imaging, clinical workflow management, medication management, and inpatient monitoring.

- Telemedicine enables remote patient monitoring and consultations, while connected imaging facilitates real-time image analysis and diagnosis. Clinical workflow and operations management optimize resource allocation and streamline processes. Medication management ensures accurate prescription and administration, and inpatient monitoring enhances patient safety and care. The IoT's potential in healthcare is vast, with applications extending beyond hospital settings.

What challenges does the Medical Tourism Industry face during its growth?

- In developing nations, the absence of advanced infrastructure poses a significant challenge to the expansion and growth of industries.

- The market experiences significant growth in low-cost developing countries, yet faces numerous challenges. Inadequate infrastructure, such as insufficient accommodation facilities, connectivity to tourist destinations, and language translators, hinders the market's expansion. Additionally, taxation irregularities, bureaucratic hurdles, and unhygienic conditions and food contribute to the market's impediment. Poor Internet connectivity and the threat of terrorist activities further deter medical tourists. Moreover, the lack of international accreditation and investor-friendly policies also hampers the market's progress.

- Furthermore, limited transport options and connectivity create negative perceptions among medical tourists. These challenges necessitate urgent attention and investment to improve the overall infrastructure and address the concerns of medical tourists to ensure the continued growth of the market.

Exclusive Technavio Analysis on Customer Landscape

The medical tourism market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical tourism market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Medical Tourism Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, medical tourism market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anadolu Medical Center - This international healthcare provider boasts 18 dedicated medical representatives, ensuring high-quality care for patients at their facilities worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anadolu Medical Center

- Apollo International Ltd.

- Asian Heart Institute

- Asian institute of medical sciences

- Asklepios Kliniken GmbH and Co. KGaA

- Athina Global Health

- Bangkok Chain Hospital Public Co. Ltd

- Bangkok Dusit Medical Services Public Co. Ltd.

- BNH Medical Centre Co. Ltd.

- Bumrungrad Hospital Public Co. Ltd

- Clalit Research Institute

- Clemenceau Medical Center

- Dr. B. L. Kapur Memorial Hospital

- Global Health Ltd.

- IHH Healthcare Berhad.

- Min Sheng General Hospital

- Raffles Medical Group Ltd

- Spire Healthcare Group Plc

- The Cleveland Clinic Foundation

- The Johns Hopkins Health System Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Medical Tourism Market

- In January 2024, Thai Prime Minister Prayut Chan-o-cha announced the launch of a new medical tourism promotion campaign, "Thailand: Safe Haven for Medical Travel," in collaboration with the Thai Ministry of Public Health and the Tourism Authority of Thailand. The campaign aimed to attract more international patients by promoting the country's advanced medical facilities and affordable healthcare services (Bangkok Post, 2024).

- In March 2024, Indian healthcare provider Fortis Healthcare entered into a strategic partnership with the Dubai-based NMC Health to expand its international footprint. The collaboration included the acquisition of Fortis' hospitals in India and the establishment of a new joint venture in the Middle East (Business Standard, 2024).

- In May 2024, the Malaysian government approved the establishment of the National Specialist and Critical Illness Healthcare Centre in Kuala Lumpur, a public-private partnership project aimed at attracting medical tourists seeking specialized and critical care services (New Straits Times, 2024).

- In April 2025, the Turkish Ministry of Health and the Turkish Ministry of Culture and Tourism signed an agreement to promote medical tourism in Turkey. The initiative included the development of a comprehensive marketing campaign, the establishment of a medical tourism information center, and the creation of a certification program for medical facilities (Anadolu Agency, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Medical Tourism Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 36.6% |

|

Market growth 2025-2029 |

USD 132.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

27.5 |

|

Key countries |

US, Canada, India, China, Singapore, Germany, UK, UAE, South Korea, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of global healthcare, medical tourism continues to gain momentum as a significant sector. Patient referral networks play a crucial role in facilitating the international exchange of medical services, connecting healthcare providers with patients seeking specialized treatments. Regulations governing health tourism are increasingly important, with cultural sensitivity training and healthcare facility accreditation ensuring quality care and ethical considerations. Medical tourism facilitators orchestrate patient transport logistics, enabling seamless travel experiences for those seeking advanced medical equipment and diagnostic imaging technology. Treatment outcome metrics and patient satisfaction surveys are essential indicators of the industry's performance, with telemedicine consultations and treatment cost comparisons providing valuable insights for potential travelers.

- The importance of medical visa requirements and second medical opinions should not be underestimated, as they significantly impact cross-border healthcare access. Specialized medical centers, procedural specialization centers, and digital health platforms offer personalized treatment plans and remote patient monitoring, further enhancing the appeal of medical tourism. Quality assurance programs and hospital infrastructure quality are key differentiators for patients considering destination healthcare choices. Surgical tourism procedures and post-operative recovery services contribute to the growing popularity of medical travel packages, making advanced medical care more accessible to a global audience. The marketing strategies emphasize the benefits of specialized care and cost savings, attracting an increasing number of patients to procedural specialization centers.

- Cross-border healthcare access is transforming the way patients approach their medical needs, with medical travel packages offering comprehensive solutions for international patient care. The future of medical tourism lies in continued innovation, with advanced technologies and quality initiatives shaping the industry's evolution.

What are the Key Data Covered in this Medical Tourism Market Research and Growth Report?

-

What is the expected growth of the Medical Tourism Market between 2025 and 2029?

-

USD 132.8 billion, at a CAGR of 36.6%

-

-

What segmentation does the market report cover?

-

The report segmented by Source (Domestic and International), Service Type (Private and Public), Type (Cardiovascular treatment, Cosmetic treatment, Fertility treatment, Orthopedics treatment, and Others), and Geography (North America, APAC, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Availability of low-cost treatment options, Lack of advanced infrastructure in developing nations

-

-

Who are the major players in the Medical Tourism Market?

-

Key Companies Anadolu Medical Center, Apollo International Ltd., Asian Heart Institute, Asian institute of medical sciences, Asklepios Kliniken GmbH and Co. KGaA, Athina Global Health, Bangkok Chain Hospital Public Co. Ltd, Bangkok Dusit Medical Services Public Co. Ltd., BNH Medical Centre Co. Ltd., Bumrungrad Hospital Public Co. Ltd, Clalit Research Institute, Clemenceau Medical Center, Dr. B. L. Kapur Memorial Hospital, Global Health Ltd., IHH Healthcare Berhad., Min Sheng General Hospital, Raffles Medical Group Ltd, Spire Healthcare Group Plc, The Cleveland Clinic Foundation, and The Johns Hopkins Health System Corp.

-

Market Research Insights

- Medical tourism, a segment of the international health care industry, continues to expand, driven by increasing demand for specialized medical treatments, improved patient support services, and healthcare affordability. According to medical tourism economics, an estimated 11 million patients traveled for medical care outside their home countries in 2020, representing a 20% increase from the previous decade. This trend is expected to continue, with the market projected to reach USD 100 billion by 2027. Despite these growth prospects, challenges persist. Language barriers impact communication between patients and medical professionals, while regulatory compliance frameworks and data privacy regulations add complexity.

- Treatment success rates and medical record transfer are critical concerns for patients, necessitating the need for international accreditation standards and healthcare cost transparency. Infrastructure development and hospital infection control are essential components of health tourism, with patient safety protocols and risk management strategies crucial to maintaining patient trust. Patient advocacy groups and communication technologies play a vital role in enhancing the patient experience, while medical tourism professionals facilitate cultural adaptation strategies and global health initiatives. Ultimately, the success of medical tourism hinges on a balance between affordability, quality, and accessibility.

We can help! Our analysts can customize this medical tourism market research report to meet your requirements.