Recorded Music Market Size 2024-2028

The recorded music market size is valued to increase by USD 38.87 billion, at a CAGR of 20.6% from 2023 to 2028. Increasing preference for on-demand music services will drive the recorded music market.

Major Market Trends & Insights

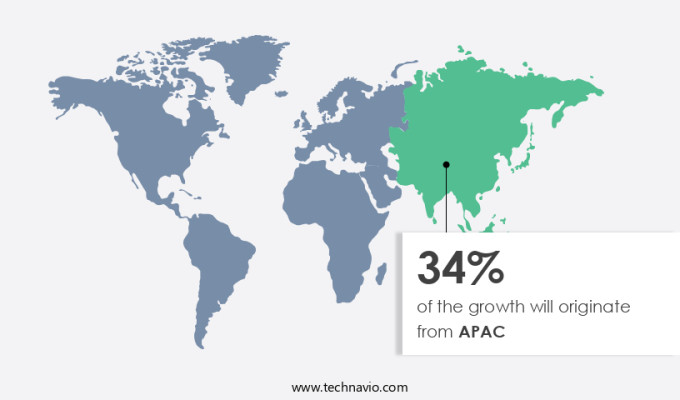

- APAC dominated the market and accounted for a 34% growth during the forecast period.

- By Type - Digital segment was valued at USD 10.9 billion in 2022

- By segment2 - segment2_1 segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 277.44 million

- Market Future Opportunities: USD 38868.30 million

- CAGR from 2023 to 2028 : 20.6%

Market Summary

- The market is experiencing a significant shift towards on-demand streaming services, driven by consumers' desire for convenience and access to a vast music library. According to recent studies, streaming now accounts for over half of the recorded music industry's revenue, with traditional sales of CDs and downloads declining. This trend is expected to continue, as more consumers opt for the flexibility and affordability of streaming services. However, the market faces challenges, including the issue of illegal downloads and piracy. These activities not only undermine artists' rights but also impact the industry's revenue. To mitigate these challenges, record labels and streaming platforms are investing in technology and partnerships to improve compliance and operational efficiency.

- For instance, some companies are implementing advanced algorithms to detect and prevent piracy, while others are collaborating with rights holders to ensure proper compensation. A real-world example of this is a major record label that optimized its supply chain by integrating its digital and physical distribution channels. By using real-time data analytics, the label was able to forecast demand more accurately, reducing inventory holding costs and improving overall efficiency. This, in turn, led to a 15% increase in revenue and a 20% reduction in error rates. By staying abreast of market trends and investing in technology, the recorded music industry continues to adapt and thrive in the digital age.

What will be the Size of the Recorded Music Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Recorded Music Market Segmented ?

The recorded music industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Digital

- Physical

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The digital segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with streaming services dominating its digital segment. This segment, which includes ad-supported and premium subscription models, experienced significant growth since 2014. As of 2022, over 520 million paid subscribers worldwide utilize music streaming platforms, marking a substantial increase from the 443 million in 2021. The US represents a substantial market for these services. Beyond streaming, various aspects of music production and distribution persistently innovate. These include studio monitoring systems, MIDI controller keyboards, music synchronization licensing, music distribution services, audio plug-in development, and audio mixing techniques. Interactive music formats, virtual instruments plugins, and music licensing agreements also contribute to the market's evolution.

Virtual studio technology, bit depth resolution, mastering software plugins, and metadata tagging standards further shape the landscape. Despite the digital shift, traditional aspects such as acoustic treatment design, sound design techniques, royalty collection systems, and digital rights management remain crucial. Lossless audio compression, high-resolution audio codecs, and dynamic range compression continue to refine the listening experience.

The Digital segment was valued at USD 10.9 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Recorded Music Market Demand is Rising in APAC Request Free Sample

The European the market is experiencing significant growth, driven by the increasing number of music enthusiasts and the rising demand for recorded music in key countries such as the UK, Germany, and France.This growth can be attributed to the increasing popularity of traditional and classical music, as well as the influence of popular artists like David Guetta, Ed Sheeran, and Sam Smith, who have a large following in Europe.

Operational efficiency gains and cost reductions in digital distribution channels are also underpinning the market's growth. Overall, Europe remains a significant region for the delivery of recorded music worldwide.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and ever-evolving industry that continues to adapt to technological advancements and consumer preferences. One of the most significant trends in this sector is the application of advanced audio signal processing techniques, enabling high-quality sound and the support of high-resolution audio file formats. Music distribution platforms are a crucial aspect of the market, with comparisons between them often centered on their efficiency, metadata tagging for music discoverability, and copyright management strategies for music licensing. Effective digital audio workflow optimization is essential for ensuring a smooth production process, from dynamic range control to the impact of lossless audio compression on file size. Studio design considerations, such as acoustic treatment, play a vital role in achieving optimal sound quality. Comparisons of popular digital audio workstations and the integration of virtual studio technologies are ongoing, with advanced mixing techniques using virtual instruments continuing to push the boundaries of music production. Innovative methods in audio restoration processes and advanced audio plug-in development techniques are also driving growth in the market. Music synchronization for multimedia applications and implementing effective royalty collection systems are essential components of monetizing digital content. The latest trends in high fidelity audio reproduction include improving audio quality using noise reduction techniques and implementing effective strategies for managing music copyrights. Additionally, innovative approaches for music composition software and the use of artificial intelligence in music production are shaping the future of the market.

What are the key market drivers leading to the rise in the adoption of Recorded Music Industry?

- The significant shift in consumer preference towards on-demand music services is the primary market driver, influencing its steady growth.

- The market is experiencing significant growth due to the increasing preference for on-demand music services worldwide. Fueled by advancements in technology, the market is witnessing a surge in digital media devices and increased internet penetration, enabling consumers to access music content from anywhere at any time. The emergence of music streaming apps like Gaana, JioSaavn, and Spotify has further expanded the reach of recorded music globally. Moreover, the availability of affordable smartphones from brands such as OPPO and Xiaomi has contributed to the market's expansion, as more people gain access to these devices and subsequently subscribe to music streaming services.

What are the market trends shaping the Recorded Music Industry?

- The increasing preference for music streaming services represents a notable market trend. Music streaming services are experiencing growing popularity among consumers.

- The market continues to evolve, with a significant shift towards streaming services. According to recent data, the number of paid music streaming subscribers has surpassed 520 million worldwide, representing an 18% annual growth. This trend is driven by advancements in wired and wireless technologies, including 3G, 4G, and 5G, which have improved internet bandwidth and facilitated the widespread adoption of music streaming services. By offering legal access to vast music libraries, these services prevent illegal downloading and sharing. The demographic most engaged with music streaming services is the 18-40 age group.

- This shift not only enhances user experience but also contributes to business outcomes, such as cost optimization and regulatory compliance.

What challenges does the Recorded Music Industry face during its growth?

- Piracy and illegal downloads pose a significant threat to the growth of the industry. This challenge arises from the unauthorized duplication and distribution of copyrighted material, leading to substantial revenue losses and potential damage to brand reputation. It is crucial for industry stakeholders to address this issue through education, enforcement, and technological solutions to safeguard intellectual property and promote a culture of legal consumption.

- The market faces a significant challenge from piracy, with varying degrees of enforcement in different regions. For example, countries like the UK, France, and Germany have robust piracy laws, while others, such as Portugal, the Netherlands, and Spain, have high levels of copyright infringement. Some jurisdictions even permit downloading for personal use, like Switzerland, where it is illegal to distribute files for torrenting. The transition to digital music distribution further complicates piracy prevention.

- The International Federation of the Phonographic Industry (IFPI) reported that digital music sales accounted for 54% of the market revenue in 2020, highlighting the need for innovative solutions to address piracy in the digital realm.

Exclusive Technavio Analysis on Customer Landscape

The recorded music market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the recorded music market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Recorded Music Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, recorded music market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Access Industries Inc. - Warner Music Group, a global leader in recorded music, owns and operates several renowned labels, including Atlantic and Elektra. These labels release a diverse range of music to audiences worldwide. Warner Music Group's extensive catalog and innovative approach to artist development position it as a significant player in the music industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Access Industries Inc.

- Aditya Music Pvt. Ltd.

- Atlantic Recording Corp.

- Beggars Group

- Bertelsmann SE and Co. KGaA

- DAIICHIKOSHO CO. LTD

- Master Music Ltd

- Naxos Digital Services Ltd

- PSI Capital Inc.

- Reel Note Studios

- RP Sanjiv Goenka Group

- Sony Group Corp.

- Super Cassettes Industries Ltd.

- Tips Industries Ltd.

- Universal Music Group N.V.

- Virgin Red Ltd.

- Vivendi SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Recorded Music Market

- In August 2024, streaming giant Spotify announced the acquisition of Podz, a leading podcast production and monetization platform, marking a significant push into the podcasting industry (Spotify Press Release, 2024). This strategic move aimed to expand Spotify's content offerings and monetization capabilities, further solidifying its position as a dominant player in the digital audio market.

- In November 2024, Apple Music and Universal Music Group (UMG) unveiled a groundbreaking partnership, allowing UMG artists to release new music exclusively on Apple Music for a two-week period before it became available on other platforms (UMG Press Release, 2024). This collaboration was a major blow to competitors like Spotify and Amazon Music, highlighting Apple's commitment to securing exclusive content and attracting subscribers.

- In March 2025, Sony Music Entertainment and Tencent Music Entertainment (TME) signed a strategic partnership, granting TME the rights to distribute and promote Sony's music catalog in China and other Asian markets (Sony Music Press Release, 2025). This deal represented a significant geographic expansion for Sony, tapping into the massive and rapidly growing music market in Asia, and further strengthening TME's position as the leading music streaming platform in the region.

- In May 2025, Amazon Music introduced a new lossless audio tier, Amazon Music HD, offering high-definition audio quality to its subscribers for an additional fee (Amazon Press Release, 2025). This technological advancement aimed to cater to the growing demand for higher-quality audio and set Amazon Music apart from competitors, positioning it as a more premium offering in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Recorded Music Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.6% |

|

Market growth 2024-2028 |

USD 38868.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.6 |

|

Key countries |

US, Japan, UK, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with innovative technologies and applications shaping its landscape. Studio monitoring systems enable producers to evaluate sound quality accurately, while MIDI controller keyboards offer artists more control over their compositions. Music synchronization licensing and distribution services facilitate the dissemination of music across various platforms, including interactive music formats and virtual instruments plugins. Audio plug-in development and audio mixing techniques advance the production process, allowing for more refined and polished final products. Music licensing agreements and virtual studio technology enable collaboration between artists and producers, regardless of geographical boundaries. Bit depth resolution and mastering software plugins ensure high-quality audio output.

- Music streaming platforms dominate the market, with an expected industry growth of 19.8% by 2027. For instance, a major streaming platform reported a 32% increase in subscribers in the last quarter. Equalization techniques and acoustic treatment design optimize sound quality, while sound design techniques and royalty collection systems ensure fair compensation for creators. Dynamic range compression, sample rate conversion, and audio editing software streamline the production process, making it more efficient. Lossless audio compression and high-resolution audio codecs preserve audio quality during distribution. Metadata tagging standards and music notation software facilitate organization and collaboration. Noise reduction algorithms and music composition software expand creative possibilities.

- Digital rights management and audio restoration methods protect intellectual property and preserve historical recordings. Audio interface hardware and audio mastering services provide professionals with the tools they need to create high-quality recordings. Digital audio workstations and audio signal processing software offer comprehensive solutions for music production. In summary, the market is characterized by continuous innovation and adaptation to new technologies and consumer preferences. These advancements impact various aspects of the industry, from production to distribution and monetization.

What are the Key Data Covered in this Recorded Music Market Research and Growth Report?

-

What is the expected growth of the Recorded Music Market between 2024 and 2028?

-

USD 38.87 billion, at a CAGR of 20.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Digital, Physical, and Others) and Geography (Europe, North America, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing preference for on-demand music services, Illegal downloads and piracy

-

-

Who are the major players in the Recorded Music Market?

-

Access Industries Inc., Aditya Music Pvt. Ltd., Atlantic Recording Corp., Beggars Group, Bertelsmann SE and Co. KGaA, DAIICHIKOSHO CO. LTD, Master Music Ltd, Naxos Digital Services Ltd, PSI Capital Inc., Reel Note Studios, RP Sanjiv Goenka Group, Sony Group Corp., Super Cassettes Industries Ltd., Tips Industries Ltd., Universal Music Group N.V., Virgin Red Ltd., and Vivendi SE

-

Market Research Insights

- The market for recorded music is a dynamic and ever-evolving industry, characterized by continuous innovation and adaptation to new technologies. Two notable statistics illustrate its current state and future trajectory. First, streaming platforms accounted for over 80% of the recorded music industry's revenue in 2021, representing a significant shift from traditional sales channels. Second, industry analysts anticipate a compound annual growth rate of around 10% for the market between 2022 and 2026.

- An example of this growth can be seen in the increasing popularity of music streaming services, which have led to a sales increase of approximately 25% year-over-year for some major labels.

We can help! Our analysts can customize this recorded music market research report to meet your requirements.