Subsea Well Access And Blowout Preventer System Market Size 2024-2028

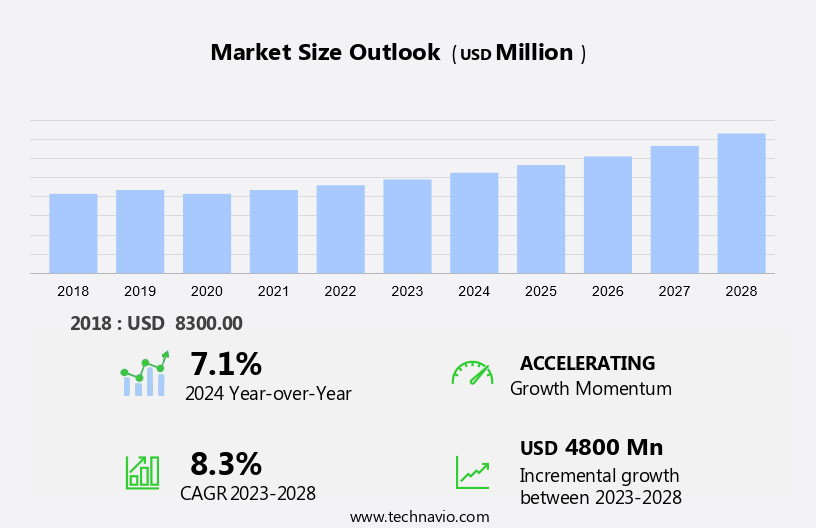

The subsea well access and blowout preventer system market size is forecast to increase by USD 4.8 billion, at a CAGR of 8.3% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing trend towards deepwater and ultra deepwater Exploration and Production (E and P) activities. The complexities involved in subsea oil and gas production necessitate advanced technologies and systems, such as subsea well access and blowout preventer systems, to ensure safe and efficient operations. Advances in subsea processing technologies have enabled the production of oil and gas from deeper and more remote locations, leading to a surge in demand for these systems. However, the implementation of these systems poses challenges, including the high cost of installation and maintenance, as well as the complexities of operating in harsh environmental conditions.

- Additionally, the need for stringent safety regulations and the risk of blowouts and other operational hazards necessitate the use of robust and reliable blowout preventer systems. Companies seeking to capitalize on the opportunities presented by the market must navigate these challenges effectively, focusing on innovation, cost optimization, and regulatory compliance to succeed.

What will be the Size of the Subsea Well Access And Blowout Preventer System Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by continuous evolution and integration of various technologies and services. Automated subsea systems streamline operations, enabling subsea survey and data acquisition with greater precision. Subsea robotics and sensors facilitate real-time monitoring, while subsea services ensure efficient subsea pipeline maintenance and pressure testing. Subsea production optimization relies on advanced subsea control systems, subsea hydraulics, and flow assurance. Subsea power systems and communication networks enable deepwater exploration and offshore operations, with safety regulations ensuring adherence to stringent safety standards. Subsea engineering and construction involve the installation of subsea trees, manifolds, and other infrastructure, requiring diverless intervention and hydrostatic testing for integrity management.

Subsea repair and maintenance are essential for extending the life of subsea equipment, with subsea handling and lifting techniques ensuring safe and efficient operations. Blowout preventer systems remain a critical component of subsea well access and production, with continuous advancements in subsea valves and emergency response technologies ensuring safety and reliability. The market's dynamism extends to subsea decommissioning, with innovative subsea solutions addressing the challenges of abandonment and environmental regulations. Subsea well access and production continue to evolve, with ongoing developments in subsea positioning, subsea drilling, and subsea actuators shaping the industry's future. The integration of subsea sensors, monitoring systems, and communication networks enables optimized subsea operations and enhanced safety.

How is this Subsea Well Access And Blowout Preventer System Industry segmented?

The subsea well access and blowout preventer system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Subsea BOP

- Subsea WAS

- Geography

- North America

- US

- Europe

- Norway

- UK

- South America

- Brazil

- Rest of World (ROW)

- North America

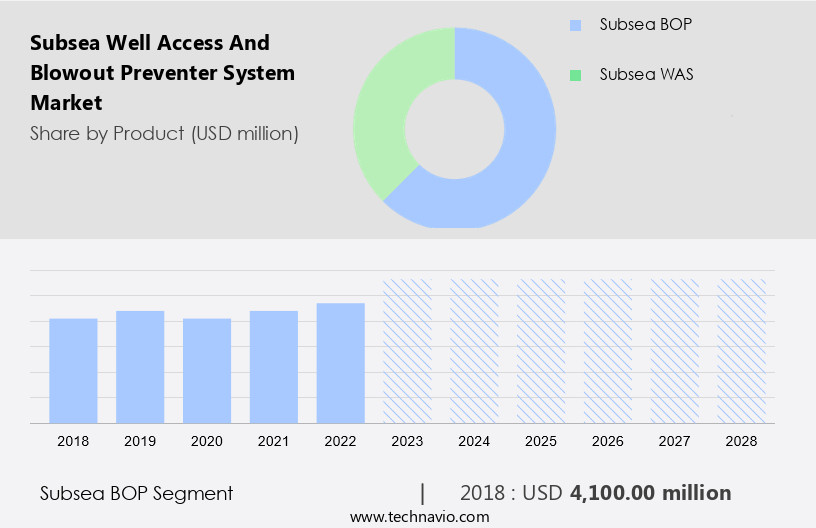

By Product Insights

The subsea bop segment is estimated to witness significant growth during the forecast period.

Subsea blowout preventers are essential pressure control equipment in the oil and gas industry, specifically in subsea wells. These systems prevent the uncontrolled release of oil and gas from wellheads, mitigating the risk of explosions and environmental damage. Equipped with shear rams, a safety valve that shears into the oil and gas conductor pipe, blowout preventers efficiently shut off the flow of oil and gas, averting potential disasters. Available in diverse pressure ratings and sizes, these preventers cater to various well requirements. Subsea robotics, automated subsea systems, and subsea data acquisition play a vital role in the installation, maintenance, and monitoring of these preventers.

Subsea services, including pressure testing, hydrostatic testing, and integrity management, ensure their optimal performance. Subsea pipeline, subsea production, and subsea power systems facilitate the transportation and processing of the extracted resources. Safety regulations mandate the implementation of these preventers to safeguard offshore operations and personnel. Subsea engineering, subsea production optimization, and subsea hydraulics contribute to the efficient operation of blowout preventers. Subsea tree, subsea control systems, drilling rig, and floating production systems are integral components of the subsea well infrastructure. Subsea communication systems enable real-time monitoring and emergency response, while safety equipment ensures the safety of personnel and the environment.

Subsea handling, subsea lifting, and subsea installation are crucial aspects of the subsea well access and wellhead equipment. Subsea decommissioning, subsea equipment, and subsea connectors facilitate the abandonment of wells. Environmental regulations govern the implementation and disposal of these systems to minimize environmental impact.

The Subsea BOP segment was valued at USD 4.1 billion in 2018 and showed a gradual increase during the forecast period.

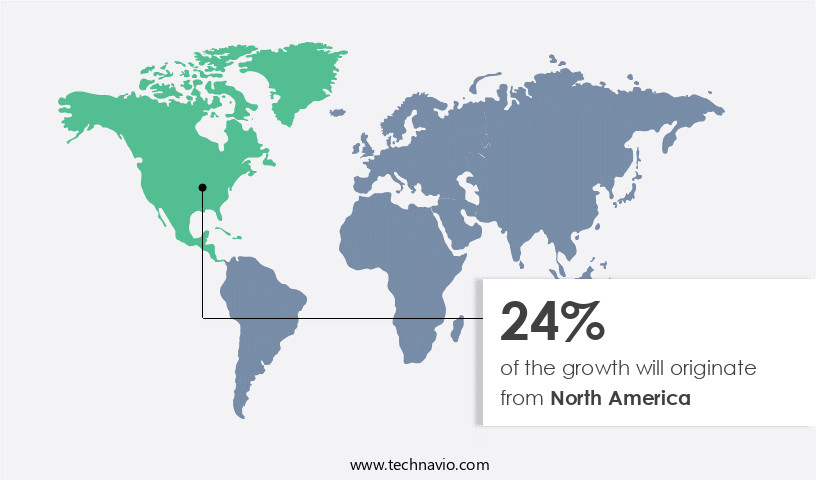

Regional Analysis

North America is estimated to contribute 24% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The subsea oil and gas industry in MEA is experiencing significant growth, driven primarily by the Middle East following the recent recovery of global crude oil prices. This price recovery is expected to lead to increased investments in offshore oil and gas fields. Africa is also emerging as a major production hub for natural gas due to significant discoveries on the continent, particularly in Mozambique, Kenya, South Africa, and Tanzania. These discoveries will spur the demand for new upstream projects, leading to a steady growth in the region during the forecast period. Subsea technology plays a crucial role in this growth, with automated subsea systems, subsea robotics, and subsea data acquisition enabling more efficient and cost-effective offshore operations.

Subsea services, including subsea pipeline installation and repair, subsea corrosion mitigation, and subsea maintenance, are also essential for ensuring the longevity and productivity of offshore infrastructure. Deepwater exploration and production are becoming increasingly important, requiring advanced subsea positioning and navigation systems, subsea handling and lifting equipment, and real-time monitoring capabilities. Subsea production optimization, subsea hydraulics, and flow assurance are also critical for maximizing the efficiency and profitability of offshore operations. Safety regulations and environmental considerations are also driving innovation in the subsea industry. Subsea communication systems, safety equipment, and emergency response capabilities are essential for ensuring the safety of offshore personnel and minimizing the environmental impact of subsea operations.

Subsea decommissioning and abandonment are also becoming increasingly important as offshore infrastructure reaches the end of its life cycle. Subsea engineering, including subsea tree installation, subsea valve automation, and subsea actuator and sensor technology, is a key area of focus for innovation in the industry. Subsea control systems, drilling rigs, and floating production platforms are also essential components of offshore infrastructure, requiring advanced subsea technology and engineering expertise. In conclusion, the subsea oil and gas industry in MEA is experiencing significant growth, driven by the Middle East and Africa's emerging natural gas production hubs. Subsea technology, including automated systems, robotics, data acquisition, and engineering innovations, are essential for maximizing the efficiency and profitability of offshore operations while ensuring safety and environmental sustainability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Subsea Well Access And Blowout Preventer System Industry?

- The increase in exploration and production (E&P) activities in deepwater and ultra-deepwater sectors is the primary market driver.

- Subsea well access and blowout preventer systems play a crucial role in the upstream oil and gas industry, enabling extraction from deepwater and ultra-deepwater environments. The shift from shallow water resources to these more complex drilling sites is driven by the significant untapped reserves in deeper waters. However, the high cost of production in subsea environments necessitates an average crude oil price above USD60/barrel for profitability. The production process in subsea environments is more intricate than conventional methods, involving subsea connectors, handling, lifting, and navigation systems. Real-time monitoring systems, such as blowout preventer systems, are essential for maintaining integrity and safety.

- Subsea technology encompasses various components, including manifolds, drilling fluids, Christmas trees, downhole tools, subsea umbilicals, and cables. Environmental regulations are increasingly stringent in the oil and gas sector, requiring companies to prioritize safety and minimize environmental impact. Subsea abandonment is a growing concern, with proper decommissioning and removal of infrastructure crucial for minimizing environmental risks. Subsea technology continues to evolve, with advancements in materials, design, and automation enhancing efficiency and reducing costs. These innovations contribute to the overall growth of the market.

What are the market trends shaping the Subsea Well Access And Blowout Preventer System Industry?

- Subsea processing is currently experiencing significant advances, representing the latest market trend in the oil and gas industry. This technological development enables the extraction and processing of resources underwater, increasing efficiency and reducing operational costs.

- Offshore oil and gas production involves significant investments for operations and infrastructure, making it essential for industry players to provide cost-effective solutions to remain competitive. Subsea processing systems are gaining popularity due to their benefits in both brownfield and greenfield developments. These systems offer design flexibility, increased recovery and production, extended field life, minimized physical intervention, reduced fluid flow issues, and optimized energy consumption. Subsea technology advancements include automated subsea systems, subsea robotics, and subsea data acquisition, which enable efficient subsea survey, subsea services, and subsea pipeline maintenance. Subsea power systems and subsea corrosion mitigation solutions further enhance the operational efficiency and lifespan of underwater infrastructure.

- Deepwater exploration and subsea intervention require advanced pressure testing and diverless intervention techniques. Offshore operations benefit from these advancements, reducing the need for physical intervention and improving overall safety and efficiency. Subsea production systems, including subsea well control and subsea production systems, are crucial components of offshore oil and gas production. These systems minimize the need for topside water treatment and processing, optimizing the energy consumed and reducing overall operational costs. In conclusion, the offshore oil and gas industry continues to evolve, with a focus on optimizing subsea operations through the adoption of advanced technologies and systems.

- These advancements contribute to increased efficiency, reduced costs, and improved safety in offshore operations.

What challenges does the Subsea Well Access And Blowout Preventer System Industry face during its growth?

- The intricacies of subsea oil and gas production pose a significant challenge to the industry's growth trajectory.

- Subsea drilling involves complex processes for oil and gas production below the seabed, requiring the use of oil rigs for crude oil extraction. Before drilling, operators must ensure minimal harm to marine environments and ecosystems. The equipment used in subsea drilling faces harsh operating conditions, necessitating robust and reliable solutions. Subsea well access is crucial for wellhead maintenance and completion, which involves subsea actuators, sensors, and monitoring systems. Hydrostatic testing and cementing operations are essential for safety regulations and subsea infrastructure repair. Subsea engineering, hydraulics, flow assurance, and production optimization are integral to the subsea drilling process. Subsea sensors and monitoring systems provide real-time data for efficient subsea operations, while safety regulations ensure the safety of personnel and the environment.

- Subsea infrastructure repair and maintenance are essential for prolonging the life cycle of subsea assets. Regular hydrostatic testing and cementing operations help maintain the structural integrity of subsea wells. Subsea engineering plays a significant role in optimizing subsea production and ensuring flow assurance. Subsea hydraulics are essential for subsea tree operations, and flow assurance ensures the smooth flow of oil and gas from the reservoir to the surface facilities. In conclusion, the subsea drilling industry requires advanced technologies and reliable equipment to address the unique challenges of subsea drilling and production.

Exclusive Customer Landscape

The subsea well access and blowout preventer system market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the subsea well access and blowout preventer system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, subsea well access and blowout preventer system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

4Subsea - The company specializes in providing subsea well access solutions and advanced blowout preventer systems. These systems effectively manage the flow of fluids, including gas and water, during drilling, production, and injection processes. By implementing cutting-edge technology, our offerings ensure optimal safety and efficiency for clients in the energy sector. Our solutions are designed to meet the evolving demands of the industry, enhancing operational excellence and reducing environmental impact.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 4Subsea

- Aker Solutions ASA

- Baker Hughes Co.

- Dril Quip Inc.

- Eaton Corp plc

- Halliburton Co.

- Helix Energy Solutions Group Inc.

- KOSO Kent Introl Ltd.

- NOV Inc.

- Oceaneering International Inc.

- Optime Subsea

- RMZ Oilfield Engineering Pte Ltd.

- Schlumberger Ltd.

- Subsea 7 SA

- TechnipFMC plc

- Total Marine Technology Pty Ltd.

- Trendsetter Engineering Inc.

- Weatherford International Plc

- Worldwide Oilfield Machine Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Subsea Well Access And Blowout Preventer System Market

- In January 2024, Schneider Electric, a leading energy management company, announced the launch of its new Subsea Power Grid solution, integrating subsea well access and Blowout Preventer (BOP) systems to optimize power distribution and improve operational efficiency in offshore oil and gas fields (Schneider Electric Press Release, 2024).

- In March 2024, Baker Hughes, a leading oilfield services company, entered into a strategic partnership with Subsea 7, a global subsea engineering, construction, and services contractor, to provide integrated well access and BOP solutions for deepwater projects (Baker Hughes Press Release, 2024).

- In May 2024, National Oilwell Varco, a leading manufacturer of equipment and components for the oil and gas industry, completed the acquisition of Wellhead Technologies, a provider of subsea wellhead systems and services, expanding its portfolio in the subsea well access market (National Oilwell Varco Press Release, 2024).

- In February 2025, the US Bureau of Safety and Environmental Enforcement (BSEE) approved the use of a new generation of BOP systems incorporating advanced sensors and digital technologies, enabling real-time monitoring and improved response to potential blowouts (BSEE Press Release, 2025).

Research Analyst Overview

- The subsea oil and gas industry continues to prioritize operational excellence and production optimization, driving significant market activity in subsea well access and blowout preventer (BOP) systems. Subsea power distribution, pipeline repair, and well tieback solutions are in high demand to enhance production efficiency and reduce operational costs. Subsea pressure relief systems, flowmeters, and corrosion protection technologies ensure pipeline integrity and safety. Remote control and data analytics enable real-time monitoring and intervention, while control modules and automation streamline operations. Digitalization and cybersecurity are essential components of modern subsea systems, safeguarding against potential threats. Subsea pipeline maintenance and installation tools are crucial for asset integrity, with multiplexers and chokes facilitating flow control.

- Wellhead protection and asset management systems ensure long-term reliability and performance. Subsea pipeline abandonment and decommissioning solutions are gaining traction as the industry focuses on reducing environmental impact. Subsea wellhead and BOP stack technologies continue to evolve, offering enhanced safety and efficiency. Market trends include the integration of advanced materials, sensors, and communication systems to optimize subsea production systems.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Subsea Well Access And Blowout Preventer System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.3% |

|

Market growth 2024-2028 |

USD 4800 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.1 |

|

Key countries |

Brazil, UK, Norway, US, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Subsea Well Access And Blowout Preventer System Market Research and Growth Report?

- CAGR of the Subsea Well Access And Blowout Preventer System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, APAC, Europe, North America, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the subsea well access and blowout preventer system market growth of industry companies

We can help! Our analysts can customize this subsea well access and blowout preventer system market research report to meet your requirements.