Subsea Systems Market Size 2024-2028

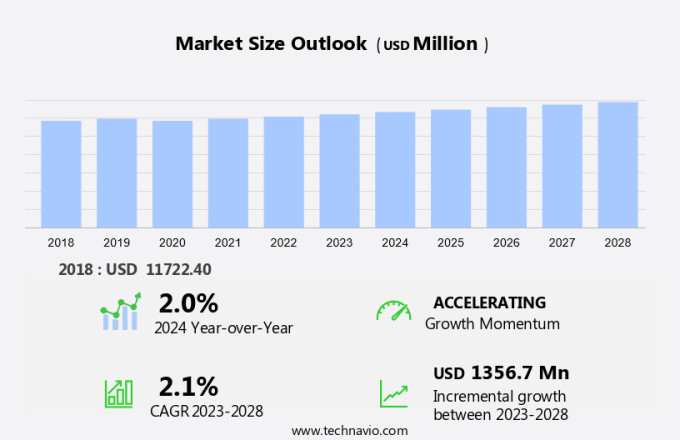

The subsea systems market size is forecast to increase by USD 1.36 billion at a CAGR of 2.1% between 2023 and 2028.

- The market is experiencing significant growth due to increasing investments in the offshore upstream sector and the adoption of advanced subsea technology for hydrocarbon recovery from offshore basins, particularly in ultra-deep-water regions. However, the high ownership costs associated with sub-sea production systems remain a challenge. To address this, there is a growing emphasis on cost-effective solutions, such as the implementation of smart subsea technologies, which can improve operational efficiency and reduce costs. These trends are expected to drive market growth in the coming years. The report provides a comprehensive analysis of the market trends, growth drivers, and challenges, offering valuable insights for stakeholders in the subsea technology industry.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing exploration and production activities in deepwater and ultra-deepwater offshore basins. With the depletion of onshore reserves, oil and gas companies are focusing on deepwater reserves to meet the rising energy demand. Deepwater and ultra-deepwater reserves offer numerous advantages such as large reserves, lower production costs, and extended field life. However, the high installation costs and offshore drilling risks associated with these reserves have led to the adoption of cost-effective subsea systems. Sub-sea technology plays a crucial role in deepwater and ultra-deepwater production.

- Similarly, subsea systems include various components such as subsea handling frameworks, subsea boosting, subsea separation, subsea injection, and subsea pressure gear. These systems enable the processing of hydrocarbons at the seabed, reducing the need for costly surface facilities. Deepwater and ultra-deepwater production involves offshore wells drilled in water depths exceeding 400 feet. The operational cost of these wells is significantly higher than onshore wells due to the complexities involved in drilling, installation, and maintenance. Subsea systems help to reduce these costs by enabling remote operations, reducing the need for manned vessels, and increasing oil recovery. The Permian Basin, located in West Texas and New Mexico, is the largest oil-producing basin in the US.

- However, the basin is primarily onshore, and the exploration and production activities are shifting towards deeper offshore areas. The adoption of subsea systems is expected to increase in the Permian Basin as companies explore deeper reserves. The investment in subsea production systems is expected to grow during the forecast period. The growth is driven by the increasing demand for cost-effective solutions for deepwater and ultra-deepwater production. Subsea systems offer several advantages such as reduced operational costs, increased oil recovery, and extended field life. Offshore basins around the world, including the Gulf of Mexico, the North Sea, and the Mediterranean Sea, are expected to witness significant growth in the market.

- In summary, the adoption of subsea systems is expected to increase as companies look for cost-effective solutions to extract resources from deepwater and ultra-deepwater reserves. The market is witnessing significant growth due to the increasing exploration and production activities in deepwater and ultra-deepwater offshore basins. Subsea systems offer several advantages such as reduced operational costs, increased oil recovery, and extended field life, making them an attractive solution for deepwater and ultra-deepwater production. The market is expected to grow at a robust rate during the forecast period.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Production systems

- Processing systems

- Geography

- Europe

- UK

- France

- Norway

- APAC

- China

- India

- North America

- Canada

- Mexico

- US

- Middle East and Africa

- South America

- Brazil

- Europe

By Type Insights

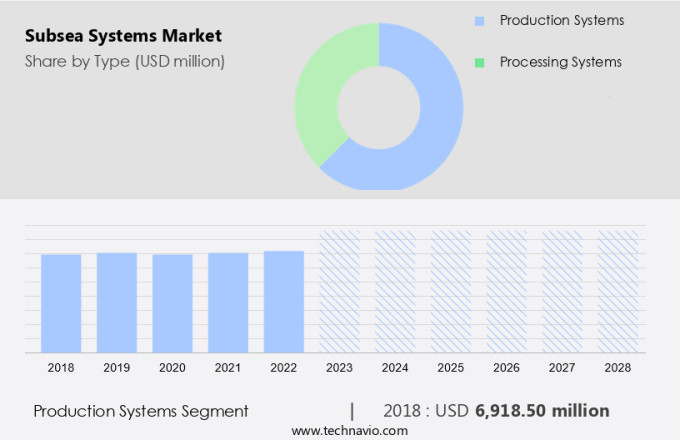

- The production systems segment is estimated to witness significant growth during the forecast period.

Subsea technology plays a crucial role in the exploration and production of hydrocarbons from offshore wells in ultra-deep-water environments. Sub-sea production systems, including umbilicals, risers, and flowlines (SURF), are essential components of offshore infrastructure. These systems enable the transfer of control, power, and fluid connections between surface facilities and submerged equipment. Umbilicals serve as the link between the seafloor and surface oil and gas equipment. They provide vital functions such as electric and fiber-optic signals, electrical power, and hydraulic and chemical injection fluids to the subsea unit. Flowlines, on the other hand, transport unprocessed fluids from the subsea well to the riser, which in turn transports the fluids to the surface processing system.

In some instances, flowlines are part of a production line or import line but remain distinct from the pipeline system. Investing in cost-effective sub-sea technology solutions is essential for oil recovery in offshore basins, particularly in ultra-deep-water environments. Sub-sea production systems, including subsea umbilicals, risers, and flow lines (SURF), are essential components of offshore infrastructure. The implementation of advanced sub-sea technology can significantly reduce operational costs and enhance the overall efficiency of offshore operations. Companies are continuously seeking innovative ways to optimize sub-sea production systems, ensuring a steady supply of hydrocarbons while minimizing expenses.

Get a glance at the market report of share of various segments Request Free Sample

The production systems segment was valued at USD 6.92 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

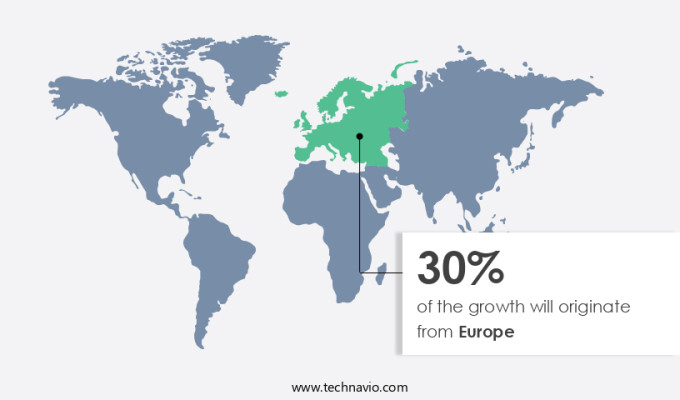

- Europe is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Subsea production systems, including Subsea Trees, Control Systems, Manifolds, Frameworks, Handling Frameworks, Boosting Systems, Separation Systems, and Injection Systems, are experiencing significant demand in Europe. Norway and the UK are leading markets due to increased offshore drilling activities and investments in the oil and gas industry. The European market for subsea production systems is anticipated to grow moderately during the forecast period. Factors fueling this growth include the exploration of new potential reserves in the North Sea and the Black Sea, as well as the rising demand for oil and gas in Europe due to economic recovery, industrial growth, and cold weather conditions. Companies specializing in subsea production systems stand to benefit from these trends.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Subsea Systems Market?

Increasing investments in the offshore upstream sector is the key driver of the market.

- In response to increasing energy demands and the depletion of traditional oil and gas reserves, many countries, including the US, are turning to deepwater and ultra-deepwater resources. To extract hydrocarbons from these challenging environments, subsea technology has emerged as a viable solution. Subsea systems, which include subsea pressure gear, single-stage boosting, and multi-stage boosting, are essential for hydrocarbon processing in offshore fields.

- Additionally, these systems enable subsea water evacuation, allowing operators to maximize revenue from mature oil and gas fields. The market is witnessing significant growth due to increasing investments in the upstream oil and gas sector. This trend is expected to continue as countries seek energy security and look to extract hard-to-reach resources. Subsea technology offers a cost-effective and efficient solution for deepwater and ultra-deepwater hydrocarbon production.

What are the market trends shaping the Subsea Systems Market?

Adoption of smart subsea solutions is the upcoming trend in the market.

- Subsea systems play a crucial role in deepwater and ultra-deepwater oil and gas production, as energy demand continues to rise. The integration of advanced digital tools and automation in subsea equipment design can significantly reduce engineering hours by up to 70%. Intelligent subsea systems are gaining popularity due to their ability to address current and future needs in deepwater production.

- Moreover, by adopting an integrated approach to field design, these systems can be rapidly developed and configured to customer requirements, leading to a reduction in time to first production. The adoption of smart subsea solutions is expected to set a new standard for customer value in projects worldwide during the forecast period. This trend will drive the growth of the market, making it an essential component of deepwater reserves exploration and production.

What challenges does Subsea Systems Market face during the growth?

High ownership costs are key challenges affecting the market growth.

- Subsea systems play a crucial role in the extraction of natural resources from deep-water reservoirs. These systems consist of various components such as gas/fluid separation equipment, gas treatment systems, subsea trees, subsea control systems, and subsea manifolds. The installation and maintenance of these systems come with significant upfront costs, making the market a capital-intensive industry. Despite these challenges, the demand for subsea systems continues to grow due to the increasing focus on deepwater drilling and the exploitation of high-pressure, high-temperature (HPHT) fields. However, the high costs of subsea equipment and technologies can pose a restraint on market growth. The price of subsea gear, pipelines, steel, and other materials continues to rise, while oil prices remain relatively stagnant.

- Moreover, the importance of proper installation and regular maintenance cannot be overstated. A single failure in a subsea system can lead to catastrophic consequences. Geopolitical reasons may also influence the market dynamics, as some regions may offer more favorable regulatory environments or tax incentives for deepwater drilling and subsea systems development. In conclusion, the market faces considerable challenges due to the high costs associated with the installation, maintenance, and replacement of equipment. However, the growing demand for deepwater resources and the need for reliable and efficient subsea systems make it an essential industry for the energy sector. Proper planning, investment, and execution are key to overcoming these challenges and realizing the full potential of the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aker Solutions ASA

- Baker Hughes Co.

- BP Plc

- Dril Quip Inc.

- Equinor ASA

- Exxon Mobil Corp.

- General Electric Co.

- Halliburton Co.

- Kerui Petroleum and Gas

- Kongsberg Gruppen ASA

- McDermott International Ltd.

- NOV Inc.

- Oceaneering International Inc.

- Parker Hannifin Corp.

- Proserv UK Ltd.

- Saipem S.p.A.

- Schlumberger Ltd.

- Siemens AG

- Subsea 7 SA

- TechnipFMC plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing exploration and production activities in offshore basins, particularly in deepwater and ultra-deepwater regions. With the discovery of vast hydrocarbon reserves in these areas, the demand for cost-effective solutions for deepwater production and sub-sea processing is on the rise. The high installation cost and operational risks associated with offshore drilling in deepwater and ultra-deepwater reserves are being mitigated through the adoption of advanced sub-sea technology. Deepwater and ultra-deepwater exploration activities are driven by the growing energy demand and the need for economic recovery from petrochemical consumption.

In summary, the digital advancement in sub-sea technology has led to the development of subsea handling frameworks, subsea boosting systems, subsea separation, and subsea injection systems. These systems enable efficient hydrocarbon processing and subsea production, reducing the need for topsides facilities. The market is expected to grow at a CAGR of over 5% during the forecast period. The market growth is driven by factors such as the increasing demand for subsea production systems, the need for subsea processing systems, and the adoption of subsea control systems, subsea manifolds, and subsea trees. The market is also influenced by regional insights, geopolitical reasons, and ongoing deepwater drilling activities.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.1% |

|

Market growth 2024-2028 |

USD 1.36 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.0 |

|

Key countries |

US, China, Norway, India, UK, Brazil, Canada, Mexico, France, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch