Residential Faucets Market Size 2024-2028

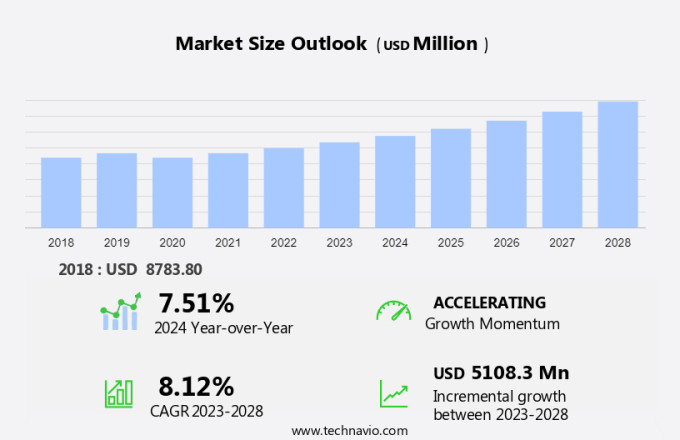

The residential faucets market size is forecast to increase by USD 5.11 billion, at a CAGR of 8.12% between 2023 and 2028. The market is experiencing significant growth, driven by product premiumization through innovation and an extensive product assortment. This trend is fueled by consumers' increasing preference for high-quality, aesthetically pleasing, and functional faucets.

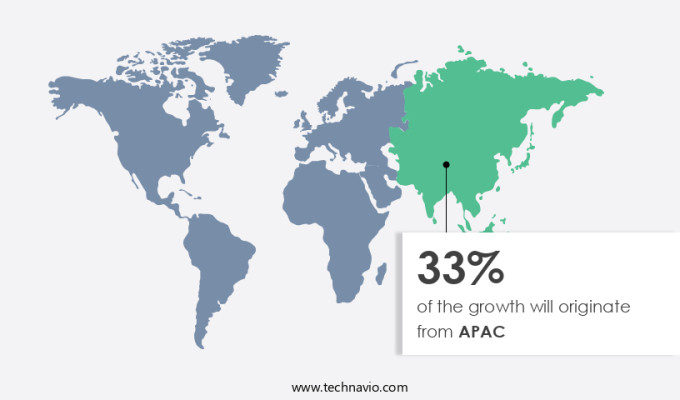

Rising demand from emerging markets, especially in Asia Pacific, is fueling growth, but rising costs for materials and labor challenge profitability. To stay competitive, manufacturers are innovating with cost-effective methods and alternative materials, driving steady market expansion shaped by evolving consumer preferences.

The residential faucet market is experiencing significant growth due to the increasing focus on water conservation and the construction sector's continued expansion. Touchless faucets and sensor-based controls are becoming increasingly popular, as they offer both environmental benefits and financial savings. These water-saving technologies are particularly relevant in urban areas, where water scarcity is a growing concern. Smart functionalities, such as voice-activated technology and advanced motion sensors, are also gaining traction in the market. These features offer added convenience and hygiene benefits, making them attractive to consumers. Industry applications include kitchens, bathrooms, and outdoor spaces. Materials used in the production of residential faucets include brass, steel, and die-cast zinc.

Components such as cartridges, spouts, mixing chambers, aerators, and intake sources are essential to the functionality and design of these products. Metal handles and touchless technology are popular choices for their durability and ease of use. Aesthetics also play a role in the market, with consumers seeking sleek designs and modern finishes. Overall, the residential faucet market is poised for continued growth as water conservation and smart technologies become increasingly important.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- Bathroom faucets

- Kitchen faucets

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Argentina

- Brazil

- North America

By Application Insights

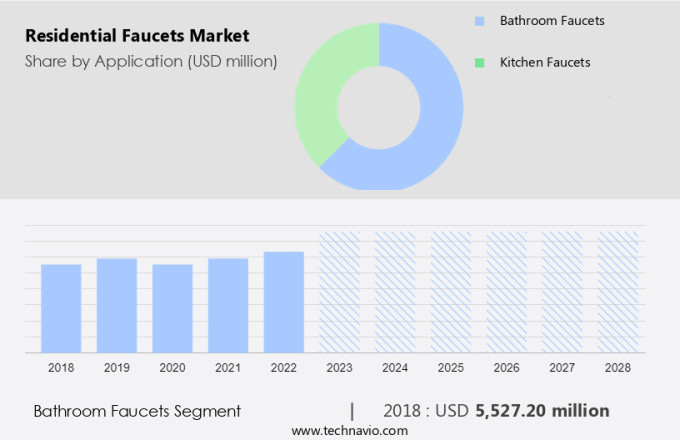

The bathroom faucets segment is estimated to witness significant growth during the forecast period. Residential faucets, encompassing both kitchen and bathroom models, deliver financial benefits through water savings and reduced maintenance costs. Hygiene is a significant consideration, leading to the emergence of touchless technology and voice-activated options. Advanced motion sensors ensure hands-free operation, enhancing user experience. Aesthetics play a crucial role, with finishes like chrome, brushed nickel, and matte black offering visual appeal. Bathroom faucets, available in various forms, include sink faucets, tub faucets, and shower faucets. Companies provide collections in modern, traditional, and transitional styles, catering to diverse home decor. Metals like brass, copper, titanium, and platinum are popular choices for their durability.

Operational configurations range from single handle, knobs, cross handles, to motion sensors. Certified by the US Environmental Protection Agency (EPA), these faucets meet stringent performance criteria. Homeowners seek higher-quality options to avoid issues like leaks, malfunction, weak finish, and corrosion. Budget-conscious consumers can opt for basic functionalities, while others may prefer pull-down, pull-out, hands-free, bar, pot, side spray, single-control cartridge, or dual-control cartridge faucets. Materials include metal options like brass, steel, and die-cast zinc, as well as chrome-plated plastic. Kitchen faucets often feature a spout for easy maneuverability, a cartridge for smooth operation, and an aerator for water flow control.

Intake sources can be ceramic disc or ball, while the mixer can be ceramic or metal.

Get a glance at the market share of various segments Request Free Sample

The bathroom faucets segment was valued at USD 5.53 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing significant growth due to the increasing focus on water conservation and the construction sector's adoption of touchless faucets and sensor-based controls. Smart functionalities, such as temperature control settings, water usage data, and home automation systems, are becoming increasingly popular in industry applications. Geographical trends indicate a rise in expenditure capacities and construction activities, leading to the installation of plumbing fixtures and water supply systems in both urban and rural areas. Hygiene standards are driving the demand for water-saving fixtures, sensor-based faucets, and easy-to-clean designs in healthcare facilities. Antimicrobial coatings and filtration systems are essential features in faucets to prevent the spread of viruses and bacteria, reducing cross-contamination risks.

Eco-friendly faucets, including metal and plastic designs, are gaining popularity due to their water-saving mechanisms and environmental benefits. Distribution channels, including online retail and offline retail, cater to diverse customer preferences. Water-saving technologies and smart faucets with advanced functionalities continue to shape the market landscape.

Our residential faucets market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Residential Faucets Market Driver

Product premiumization through product innovation and wide product assortment is the key driver of the market. The market is witnessing an increase in innovation and product diversity as retailers strive to meet the demands of homeowners for advanced functionalities and aesthetics. Financial benefits, such as water conservation and reduced maintenance, are driving the adoption of touchless technology and voice-activated faucets. These faucets come with features like advanced motion sensors and user-friendly designs, enhancing hygiene and user experience. Kitchen and bathroom faucets are available in various finishes, including Metal (Brass, Steel, Die-cast zinc), Chrome-plated plastic, and Pull-down/Pull-out designs. Reputable brands offer higher-quality options with stronger finishes, resistant to corrosion and leaks, ensuring durability. Basic functionalities like Single-control cartridge and Dual-control cartridge are standard, while some models offer additional features like Bar, Pot, Side spray, and Hands-free options.

Companies like Masco, with brands such as AXOR, Delta Faucet, Ginger, and others, cater to budget-conscious consumers with a wide product assortment. These brands offer a range of faucets, from basic to high-end, ensuring there is a product for every consumer need. The improved assortment allows traders to implement an integrated pricing strategy, providing financial benefits to both the sellers and consumers.

Residential Faucets Market Trends

The rising demand from emerging economies is the upcoming trend in the market. The market has experienced significant growth due to the increasing disposable income and urbanization in countries like India, Vietnam, Malaysia, China, and Qatar. With rising incomes, homeowners have been investing more in residential and non-residential infrastructure, leading to an increase in demand for high-quality faucets. These faucets offer financial benefits through water savings and reduced maintenance costs. Hygiene concerns have also driven the market, with touchless technology and voice-activated faucets gaining popularity. Aesthetics play a crucial role in the decision-making process, with consumers preferring finishes that offer visual appeal and a superior user experience. Advanced motion sensors and hands-free options have become essential features in both kitchens and bathrooms.

Reputable brands offer higher-quality options with materials like Metal, Handle, Cartridge, Spout, Mixing chamber, Aerator, Intake source, Brass, Steel, and Die-cast zinc, ensuring durability and resistance to leaks and malfunction. Budget-conscious consumers can opt for basic functionalities, while those seeking a premium experience can invest in pull-down, pull-out, bar, pot, side spray, single-control cartridge, and dual-control cartridge faucets. The market is expected to continue growing, driven by consumer preferences for advanced technology and higher-quality options.

Residential Faucets Market Challenge

The market experiences significant challenges in maintaining financial benefits due to the rising costs of raw materials and manufacturing. Metals such as aluminum, iron, copper, and brass are essential for producing high-quality faucets, but their increasing prices negatively impact profit margins for manufacturers and retailers. To remain competitive, they must produce and sell a sufficient quantity of units to maintain profitability. However, customer preferences, product trends, and market innovations pose challenges in sustaining profit margins, managing inventory, and achieving volume sales. Premium residential faucets with advanced features like touchless technology, voice-activated technology, and motion sensors, are increasingly popular among homeowners.

These faucets offer improved hygiene, user experience, and aesthetics in kitchens and bathrooms. Finishes like chrome-plated plastic, brass, and steel add visual appeal, but they can be costly. Budget-conscious consumers may opt for lower-quality options, which may result in leaks, malfunctions, and weak finishes, leading to customer dissatisfaction and potential damage to reputable brands. Manufacturers offer various faucet designs, including pull-down, pull-out, hands-free, bar, pot, side spray, single-control cartridge, and dual-control cartridge models. The faucet's components, such as the handle, cartridge, spout, mixing chamber, aerator, and intake source, are crucial to its functionality and durability. Despite the challenges, the market for residential faucets continues to grow, driven by consumer demand for advanced functionalities and improved user experiences.

Exclusive Customer Landscape

The residential faucets market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

CERA Sanitaryware Ltd.: The company caters to various types of faucet needs for homeowners with extensive product range includes kitchen faucets, bar faucets, and beverage faucets.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Delta Faucet Co

- Fortune Brands Innovations Inc.

- Kingston Brass Inc

- Kohler Co.

- Kraus USA Inc.

- LIXIL Corp.

- LIXIL Water Technology Americas

- Lowes Co. Inc.

- Masco Corp.

- Moen Inc.

- Oras Ltd.

- Spectrum Brands Holdings Inc.

- Jaquar India

- Toto Ltd.

- Ultra Faucets

- VIGO INDUSTRIES LLC

- Zurn Elkay Water Solutions Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing focus on water conservation and the construction sector's ongoing activities. Touchless faucets and sensor-based controls are becoming increasingly popular industry applications, offering smart functionalities that cater to both water-saving and hygiene standards. Geographical trends indicate a rise in expenditure capacities, leading to the demand for customized faucet designs and eco-friendly fixtures. Water-saving mechanisms, such as sensor-based faucets and water-saving technologies, are gaining traction in various industry applications, including healthcare facilities, where hand hygiene is crucial. The growing concern over viruses and bacteria and the need to prevent cross-contamination have led to the adoption of easy-to-clean faucet designs and antimicrobial coatings.

Smart faucets with temperature control settings, water usage data, and integration with home automation systems and filtration systems are also gaining popularity. The market is witnessing the emergence of faucets with smartphone control and water-saving mechanisms. Faucet materials, such as metal and plastic, are being used to cater to various consumer preferences and distribution channels, including online retail and offline retail. The urbanization process and the increasing focus on environmental benefits are further driving the growth of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.12% |

|

Market Growth 2024-2028 |

USD 5.11 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.51 |

|

Regional analysis |

North America, APAC, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 33% |

|

Key countries |

US, China, Russia, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

CERA Sanitaryware Ltd., Delta Faucet Co, Fortune Brands Innovations Inc., Kingston Brass Inc, Kohler Co., Kraus USA Inc., LIXIL Corp., LIXIL Water Technology Americas, Lowes Co. Inc., Masco Corp., Moen Inc., Oras Ltd., Spectrum Brands Holdings Inc., Jaquar India, Toto Ltd., Ultra Faucets, VIGO INDUSTRIES LLC, and Zurn Elkay Water Solutions Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch