Residential Roofing Market Size 2025-2029

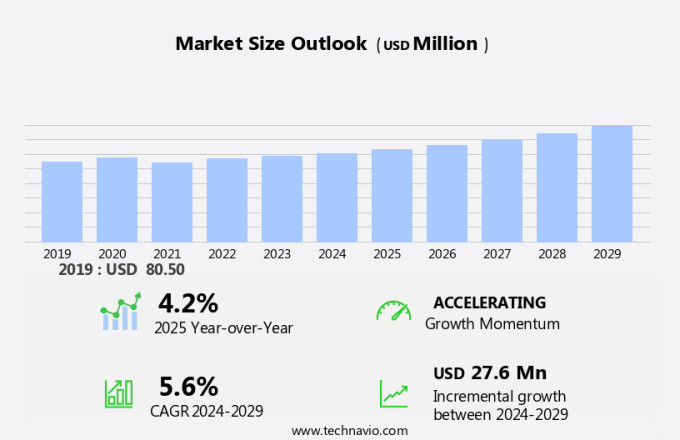

The residential roofing market size is forecast to increase by USD 27.6 million at a CAGR of 5.6% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for energy-efficient and sustainable solutions. Solar roofs and cool roofs, which utilize renewable energy and reflect sunlight to maintain lower temperatures, respectively, are gaining popularity. Weather-resistant, impact-resistant, and fire-resistant roofing materials are also in high demand as homeowners prioritize durability and safety. Smart technology integration, such as sensors and automated systems, is another trend, offering homeowners enhanced control and energy savings. Tiles and concrete remain preferred materials due to their durability and versatility. Strategic partnerships between roofing manufacturers and technology companies are driving innovation in the market. However, the high prices of raw materials pose a challenge, potentially increasing production costs for manufacturers and ultimately affecting consumer prices.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the demand for various roofing systems and materials used in the construction and maintenance of single-family housing units in the United States. This market caters to the needs of builders, contractors, and homeowners for providing adequate protection against environmental elements and enhancing the aesthetic appeal of their properties. Roofing materials play a significant role in the market. Asphalt shingles continue to dominate the market due to their affordability and ease of installation. However, there is a growing trend towards metal and composite roofing materials due to their durability, fire resistance, and energy efficiency. These materials are increasingly being adopted for their ability to withstand extreme weather conditions, UV radiation, and the effects of climate change. Building rehabilitation and remodeling projects also contribute to the market. Hard coating and smart roofing systems are gaining popularity for their ability to extend the life of existing roofs and improve their energy efficiency. These systems provide an effective solution for addressing roof leaks and reducing maintenance costs.

- Fire-resistant roofing materials are becoming increasingly important due to the increasing frequency of wildfires and other fire hazards. Metal roofing, in particular, is a popular choice due to its fire resistance and other benefits. Green construction is another trend driving the market. Solar tiles and other renewable energy solutions are being integrated into roofing systems to provide sustainable energy solutions for homes. The installation of roofing systems is a critical aspect of the market. Proper installation is essential to ensure the longevity and effectiveness of the roofing materials. Roofing contractors play a crucial role in this process, providing expertise and ensuring that the installation meets the required standards. The market is influenced by various factors, including climate conditions, building codes, and consumer preferences. New construction projects and reroofing projects also contribute significantly to the market demand.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Reroofing

- New construction

- Product

- Asphalt shingles

- Metal roofing

- Clay and concrete tiles

- Solar tile

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- North America

By Type Insights

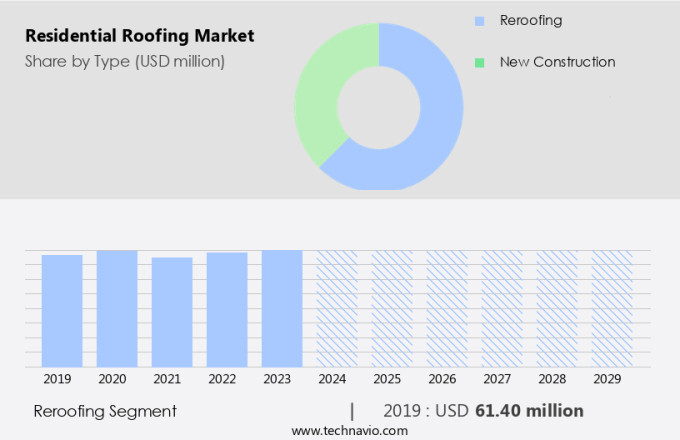

- The reroofing segment is estimated to witness significant growth during the forecast period.

The market encompasses a substantial sector dedicated to reroofing projects, which entails the replacement or enhancement of existing roofs. This segment exhibits a large market size, considerable fragmentation, and stability during economic fluctuations, making it a crucial aspect of the broader roofing industry. In January 2024, Bertram Capital made a strategic investment in Ridgeline Roofing and Restoration, LLC, a prominent player in the US residential reroofing and restoration sector. Operating in key states like Alabama, Georgia, Tennessee, and Florida, Ridgeline specializes in delivering top-notch services to single-family housing units. This investment aims to fuel Ridgeline's expansion across the Southeast and replicate its successful business model in new markets.

Additionally, the focus on reroofing is significant due to the importance of maintaining the aesthetic appeal and functionality of housing infrastructure. Homeowners prioritize the upkeep of their properties, leading to a steady demand for roofing solutions. In addition, the construction of new units continues to drive growth in the market. Green construction trends, such as the adoption of asphalt shingles, solar tiles, and clay tiles, are also contributing to the expansion of the market. This market is expected to continue its growth trajectory, offering opportunities for both established players and new entrants.

Get a glance at the market report of share of various segments Request Free Sample

The reroofing segment was valued at USD 61.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Another region contributing to the market growth is North America. The North American market is a significant sector in the global industry, fueled by ongoing construction projects and strategic collaborations. One notable partnership is between BILT Exteriors and Absolute Construction, announced in November 2024. This alliance brings together two industry leaders, with BILT Exteriors specializing in storm restoration and exterior services, and Absolute Construction excelling in roofing services. This partnership expands BILT Exteriors' reach into key markets in Kansas, Missouri, and Texas, bolstering its presence in the Central United States and enhancing its residential roofing services. Companies are making strategic moves to broaden their market scope and enhance offerings in response to the increasing demand for innovative roofing solutions in these regions.

Additionally, by combining their expertise and resources, BILT Exteriors and Absolute Construction can better cater to the diverse roofing needs of homeowners, including New Construction Roofing, Roofing Patterns (such as Flat Roofs and Slope Roofs), Green Roofing Solutions, and the use of reflective materials for Climate Control. This partnership showcases the architectural versatility and unique aesthetics that are increasingly popular in the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Residential Roofing Market ?

Increasing residential construction is the key driver of the market.

- The market in the US and globally is witnessing notable expansion due to the increasing number of building construction projects, remodeling, and renovation activities. In the US, the residential construction sector has experienced significant growth, with over 1.4 million new residential permits issued and an equivalent number of new constructions initiated by October 2024. Moreover, the completion rate of residential housing units reached a seasonally adjusted annual rate of 1.6 million, representing a substantial 13% increase compared to the previous year.

- This trend is not limited to the US; the residential construction market in India has also been thriving, with approximately 500,000 primary homes built in 2023. Aesthetic considerations and energy efficiency are key factors driving the demand for residential roofing. Green building certifications and energy conservation are increasingly important in new construction and renovation projects, making energy-efficient roofing solutions a popular choice.

What are the market trends shaping the Residential Roofing Market?

Strategic partnerships is the upcoming trend in the market.

- In the market, there is a growing trend toward strategic partnerships to expand services and enhance offerings. A notable instance of this is the collaboration between River Sea Network and Pearl Street Capital Partners, two US-based private equity firms specializing in the services sector. In March 2024, they announced the formation of Aligned Exteriors Group (AEG), a new platform dedicated to residential roofing and other exterior services. AEG's strategy centers around forming alliances with leading roofing companies and business owners who align with its core values of honesty, integrity, accountability, social responsibility, and strong work ethic. This approach aims to establish AEG as the preferred partner for founders and management teams within the broader exterior industry.

What challenges does Residential Roofing Market face during the growth?

High prices of raw materials is a key challenge affecting the market growth.

- The market in the United States is currently confronted with escalating material costs, particularly in the areas of solar and renewable energy roofing solutions. In May 2024, industrial metals experienced unprecedented price hikes, with copper reaching an all-time high of over USD11,000 per ton on the London Metal Exchange. This price wave is a reflection of broader trends impacting the cost of essential materials, including solar panels and roofing tiles made of metals.

- The petroleum jelly industry in North America, Europe, and Asia underwent considerable price fluctuations in the latter half of 2023. These price swings were largely driven by volatility in crude oil prices, exacerbated by OPEC export restrictions and the halt of Russian oil imports, leading to a substantial increase in asphalt prices. As a result, the adoption of advanced roofing technologies, such as cool, weather-resistant, impact-resistant, fire-resistant, and smart roofing systems, is becoming increasingly important for homeowners seeking energy efficiency and durability.

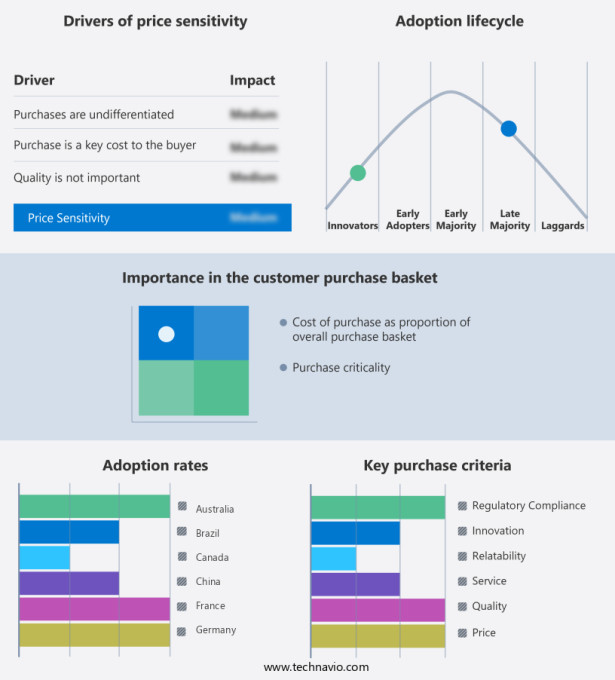

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecasts, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atlas Roofing Corp.

- BEACON ROOFING SUPPLY INC.

- BMI Group Holdings UK Ltd.

- Boral Ltd.

- Carlisle Companies Inc.

- Compagnie de Saint-Gobain SA

- Duro Last Inc.

- Etex NV

- GAF Materials LLC

- IKO Industries Ltd.

- Kingspan Group

- Owens Corning

- Sika AG

- SOPREMA SAS

- TAMKO Building Products LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of roofing solutions designed for single-family housing units. Roofing materials vary from fire-resistant options like metal and composite shingles to aesthetically appealing choices such as clay, concrete, and solar tiles. Climate change and adverse weather events have increased the demand for durable and weather-resistant roofing systems. Building rehabilitation projects often involve reroofing with hard-coating, reflective materials, and smart roofing systems to improve climate control and energy efficiency. New construction roofing projects incorporate architectural versatility and unique aesthetics through various roofing patterns, including flat and slope roofs. Green building certifications, energy conservation, and renewable energy are essential considerations in today's market.

Further, asphalt shingles, metal roofing, and solar tiles are popular choices for their energy efficiency and eco-friendly properties. Adverse weather events necessitate the use of impact-resistant and fire-resistant materials. Roof maintenance is crucial to ensure the longevity and performance of residential roofing systems. Regular inspections can help prevent roof leaks and ensure the roofing materials remain in good condition. Building construction projects, remodeling, and renovation projects often involve roofing upgrades for improved aesthetics and energy efficiency. In conclusion, the market offers a diverse range of roofing solutions catering to various needs, including energy efficiency, climate control, aesthetics, and durability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2025-2029 |

USD 27.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Germany, UK, India, Canada, France, Japan, Brazil, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch