Europe Rigid Bulk Packaging Market Size 2024-2028

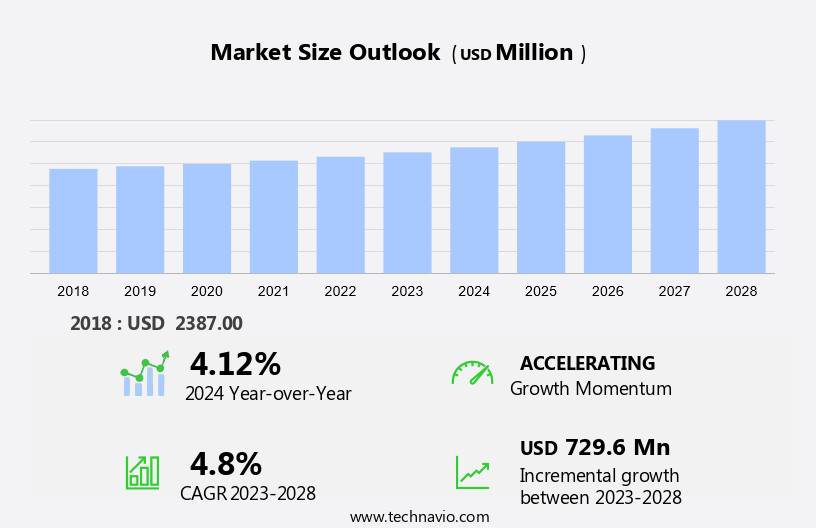

The Europe rigid bulk packaging market size is forecast to increase by USD 729.6 million at a CAGR of 4.8% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. Firstly, the increasing production and consumption of wine in Europe are driving market growth. Additionally, the rising number of free trade agreements within Europe is fostering market expansion. However, fluctuating raw material prices pose a challenge to market growth. With the ongoing urbanization and infrastructure development in Europe, there is a significant increase In the demand for construction materials, which require strong and reliable packaging solutions for transportation and storage. Producers must navigate these price fluctuations to maintain profitability. Overall, the European rigid bulk packaging market is poised for continued growth, with these trends shaping the market landscape.

What will be the size of the Europe Rigid Bulk Packaging Market during the forecast period?

- The market is experiencing significant growth due to increasing demand from various industries, including manufacturing, automotive, chemical, and petrochemical sectors. Sustainability is a key trend driving market expansion, with a focus on recycling packaging and reducing product wastage. Construction activity also contributes to the market's growth, as IBCs (Intermediate Bulk Containers) are commonly used for transporting fuel commodities and other heavy materials. Logistics costs are a critical consideration, with the supply chain becoming increasingly complex due to the need for an efficient bill of materials management and the importance of product safety. The European Union's emphasis on reusability and returnable bulk packaging is also influencing market dynamics.

- The market is concentrated, with key players serving the food, medical equipment, and petroleum products industries. The market's size is influenced by factors such as GDP, crude oil reserves, and export trends, as reported by the European Industrial Association (EIA). Overall, the market is expected to continue growing, driven by the need for cost-effective, safe, and sustainable packaging solutions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Plastic

- Metal

- Wood

- Others

- Product

- Pails

- Drums

- Others

- Geography

- Europe

- Europe

By Material Insights

- The plastic segment is estimated to witness significant growth during the forecast period.

In Europe, the rigid bulk packaging market encompasses a substantial segment utilizing plastic materials. Referred to as large containers or packaging options, rigid bulk packaging is employed for the transportation and storage of commodities in bulk. Plastic, with its strength, adaptability, and affordability, is a preferred material for such applications. It offers superior protection characteristics, high load-bearing capacity, and resistance to harsh conditions. Furthermore, plastic packaging provides exceptional resistance to UV rays, chemicals, and moisture. Major European industries, such as chemicals, food and beverage, pharmaceuticals, automotive, and construction, are significant consumers and growth drivers for rigid plastic bulk packaging.

Get a glance at the market share of various segments Request Free Sample

The plastic segment was valued at USD 951.00 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Europe Rigid Bulk Packaging Market?

Growing wine production and consumption in Europe is the key driver of the market.

- The market encompasses various types of packaging solutions, including steel pails, drums, and boxes. These packaging solutions cater to diverse industries such as food and beverages, chemicals, and pharmaceuticals. Steel pails, known for their durability and resistance to corrosion, are widely used in the storage and transportation of chemicals and other industrial products.

- Similarly, drums, available in various sizes and materials, are commonly used for storing and transporting liquids in industries like food and beverages and chemicals. Boxes, made of materials like wood, plastic, or corrugated cardboard, offer flexibility in size and shape and are used for packaging a wide range of products. The demand for these packaging solutions is driven by factors such as increasing industrial production and the need for safe and efficient transportation and storage solutions.

What are the market trends shaping the Europe Rigid Bulk Packaging Market?

The rising number of free trade agreements in Europe is the upcoming trend In the market.

- The market is primarily driven by the demand for steel pails, drums, and boxes in various industries such as chemicals, food and beverages, and pharmaceuticals. Steel pails and drums are widely used due to their durability and ability to withstand harsh conditions during transportation and storage. These packaging solutions offer advantages such as ease of handling, stackability, and protection against external factors.

- Additionally, rigid boxes are gaining popularity for their high-end appeal and ability to ensure product safety during transit. The market is expected to grow steadily due to the increasing demand for secure and efficient packaging solutions across various end-use sectors.

What challenges does Europe Rigid Bulk Packaging Market face during its growth?

Fluctuating raw material prices is a key challenge affecting the market growth.

The market encompasses various types of packaging solutions, including steel pails, drums, and boxes. Steel pails are widely used due to their durability and resistance to corrosion, making them suitable for storing and transporting chemicals and other heavy-duty products.

However, drums, another popular choice, offer a large capacity and are commonly used in the food, pharmaceutical, and industrial sectors. Boxes, on the other hand, provide flexibility in terms of size and shape and are utilized for a wide range of applications, from food and beverages to industrial goods. Overall, rigid bulk packaging plays a crucial role in ensuring product safety, security, and efficiency in the European market.

Exclusive Europe Rigid Bulk Packaging Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albea Services SAS

- Amcor Plc

- Berry Global Inc.

- Brambles Ltd.

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- Crown Holdings Inc.

- DS Smith Plc

- Greiner AG

- Huhtamaki Oyj

- KP Holding GmbH and Co. KG

- Nefab AB

- Plastipak Holdings Inc.

- Quadpack Industries SA

- Saccheria Piave Srl

- Sealed Air Corp.

- Smurfit Kappa Group

- Sonoco Products Co.

- Stora Enso Oyj

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Rigid bulk packaging plays a vital role in various industries across Europe, providing a reliable and efficient solution for transporting and storing a wide range of products. This market encompasses a diverse range of applications, including the chemicals sector, food and beverage industry, automotive sector, and medical equipment, among others. The demand for rigid bulk packaging is driven by several factors. The increasing focus on sustainability and reducing waste In the supply chain is one such factor. This has led to a rise In the use of reusable and returnable bulk packaging systems, such as Intermediate Bulk Containers (IBCs), which offer cost savings and environmental benefits.

Another factor driving the growth of the rigid bulk packaging market is the construction industry. Moreover, the food and beverage industry is a major consumer of rigid bulk packaging. The industry's focus on product safety and cost-effective packaging solutions has led to the adoption of high-strength packaging materials, such as high-density polyethylene (HDPE) and polypropylene (PP), for transporting and storing non-hazardous liquids. In the chemicals sector, the demand for rigid bulk packaging is driven by the need for corrosion-resistant containers for hazardous liquid applications.

Moreover, the sector's focus on product safety and regulatory compliance has led to the adoption of specialized packaging solutions that meet the unique requirements of the industry. The oil, lubricants, and fuel commodities sectors also contribute significantly to the rigid bulk packaging market. These sectors require packaging solutions that can withstand the harsh conditions of transportation and storage, making rigid bulk packaging an ideal choice. The pharmaceutical industry is another major consumer of rigid bulk packaging. The sector's focus on ensuring the safety and integrity of sensitive products during transportation and storage has led to the adoption of specialized packaging solutions, such as IBCs and drums, for transporting and storing pharmaceutical products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market Growth 2024-2028 |

USD 729.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.12 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch