North America Road Freight Transportation Market Size 2025-2029

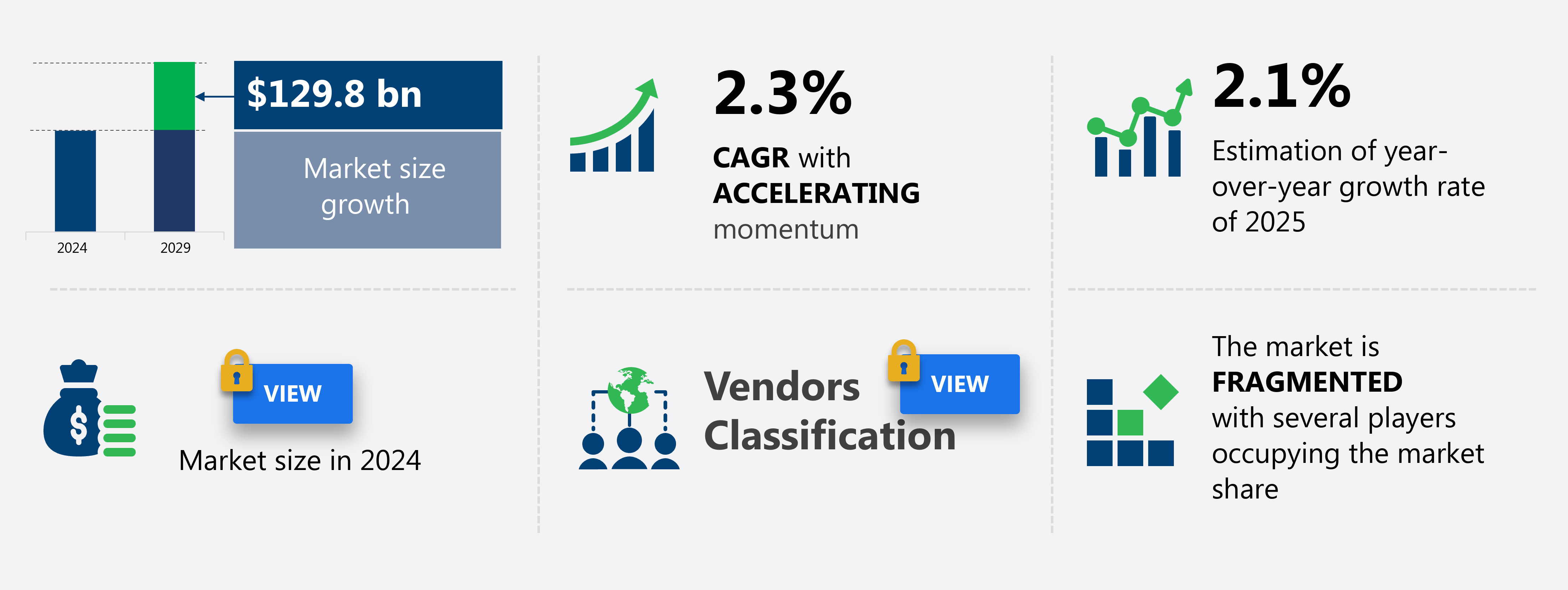

The north america road freight transportation market size is forecast to increase by USD 129.8 billion at a CAGR of 2.3% between 2024 and 2029.

- The North American road freight transportation market is experiencing significant growth, driven by the increasing demand for efficient and cost-effective logistics solutions. One key trend transforming the industry is the adoption of blockchain technology, which offers enhanced transparency, security, and traceability in the supply chain. This innovation is particularly relevant for companies seeking to increase operational efficiency and reduce costs. However, the market is not without challenges. New regulations, such as those related to emissions and hours of service, are negatively impacting operational costs and productivity.

- Compliance with these regulations requires significant investment in technology and training, adding to the financial burden for transportation providers. To navigate these challenges and capitalize on market opportunities, companies must stay informed of regulatory changes and invest in technology solutions that enable compliance and streamline operations. By doing so, they can differentiate themselves in a competitive market and maintain a strategic advantage.

What will be the size of the North America Road Freight Transportation Market during the forecast period?

- The road transportation industry in North America is undergoing significant changes as companies explore new ways to enhance operational efficiency and address environmental concerns. One such innovation is the adoption of blockchain technology to streamline logistics processes and enhance supply chain transparency. This comes as regulatory pressure mounts to reduce carbon dioxide (CO2) and nitrogen oxide emissions from road freight transportation. Environmental conservation is a growing priority, with many players in the industry turning to alternative fuels and self-driven trucks to minimize their carbon footprint. Less-than-truckload (LTL) and full truckload carriers are also exploring collaborations with rail freight to optimize their networks and reduce reliance on road transport.

- Cross-border trade remains a significant driver of growth in the road freight transportation market. However, the logistics industry faces challenges in managing complex regulatory frameworks and ensuring compliance with evolving environmental regulations. As the industry evolves, operational efficiency and environmental sustainability will be key differentiators for market success. Companies that can effectively navigate these trends and adapt to changing market dynamics will be well-positioned to thrive in the North American road freight transportation landscape.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Full truckload

- Less-than truckload

- Product Type

- Solid goods

- Liquid goods

- Vehicle Type

- Light commercial

- Heavy commercial

- Service Type

- Third-party logistics (3PL)

- Express and parcel services

- Freight forwarding

- Geography

- North America

- US

- Canada

- Mexico

- North America

By Type Insights

The full truckload segment is estimated to witness significant growth during the forecast period.

The North American road freight transportation market is characterized by the full truckload segment's continuous expansion. Full truckload carriers specialize in transporting bulk freight, ranging from food and perishable products to hazardous materials, requiring diverse equipment and insurance. Flatbed, dry van, and refrigerated trailers are commonly used for these shipments. The full truckload segment exhibits a highly fragmented landscape, with the leading carriers holding less than 1% of the market share. Concurrently, the industry concentration remains relatively low, with the top 25 full truckload carriers accounting for approximately 8% of the market in 2024. Operational efficiency and cost-effectiveness are critical factors driving the growth of the full truckload segment.

Value-added services, such as freight management and logistics, are increasingly being adopted to optimize supply chain performance. The use of digital mobile communications, electronic toll collection, and intermodal transportation facilitates streamlined operations. Environmental concerns are gaining significance in the road freight transportation sector. Harmful gases, including carbon dioxide and nitrogen oxides, contribute to air pollution. To mitigate these emissions, alternative fuels, such as biodiesel and natural gas, are being explored. Additionally, the use of big data analytics and synchronization among agencies enables more efficient traffic flow and reduces congestion. The rail freight and air freight transportation sectors also play a vital role in the North American freight market.

Rail freight offers a more cost-effective alternative for transporting large quantities of freight over long distances. Air freight transportation is essential for time-sensitive and high-value goods. However, it is more expensive compared to road and rail freight. Cross-border trade significantly influences the North American freight market, particularly between the United States and its neighboring countries. The logistics industry is continually evolving, with the adoption of innovative technologies, such as blockchain, self-driven trucks, and use of greenhouse gases to optimize operations and enhance sustainability.

Get a glance at the market report of share of various segments Request Free Sample

The Full truckload segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of North America Road Freight Transportation Market?

- Need to increase operational efficiency is the key driver of the market.

- The North American road freight transportation market is experiencing significant growth due to the increasing need for operational efficiency among logistics businesses. The rise in fleet operating costs, driven by increasing vehicle and fuel prices, has put pressure on companies to reduce expenses and improve their bottom line. Intermodal transportation, which involves the use of multiple modes of transport, such as trucks and rail, is gaining popularity for the shipment of automotive parts, consumer goods, and heavy vehicles. This mode of transportation offers several advantages, including cost savings, ease of tracking, and minimal idle periods.

- The shift towards intermodal transportation is driven by its ability to enhance efficiency, reduce costs, and minimize environmental impact. Companies are increasingly relying on intermodal transportation to optimize their supply chains and remain competitive in the market.

What are the market trends shaping the North America Road Freight Transportation Market?

- Use of blockchain in road transportation industry is the upcoming trend in the market.

- Blockchain technology, a decentralized and cryptographically secured digital ledger, is revolutionizing the transport industry by enhancing the transparency and traceability of operations. Each block in the chain stores encrypted information and a pointer to the previous block, ensuring the integrity of data and preventing unauthorized modifications. This technology offers stakeholders the ability to track products effectively across the logistics process, increasing visibility and accountability.

- The interconnected blocks record the involvement of all parties involved and the specific details of the products associated with each movement, creating a secure and efficient supply chain network. By leveraging blockchain technology, transportation companies can streamline their operations, reduce fraud, and improve customer satisfaction.

What challenges does North America Road Freight Transportation Market face during the growth?

- Negative operational impact of new regulations is a key challenge affecting the market growth.

- The North American road freight transportation market is shaped by various regulations that add to the operational costs. Compliance with security regulations, federal driver safety rules, carbon emission standards, state taxes on diesel fuel, and environmental standards increase the complexity of the supply chain process. These regulations necessitate significant administrative work and delay the transportation of goods and vehicles. Given the market's focus on cost reduction and profit generation, these stringent regulations pose a challenge. Moreover, the environmental impact of harmful emissions from trucks and heavyweight vehicles is a significant concern.

- The market's intricacy necessitates a professional and efficient approach to managing logistics and ensuring regulatory compliance. Adhering to these regulations while minimizing costs and maximizing profits requires a strategic and well-informed approach.

Exclusive North America Road Freight Transportation Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArcBest Corp.

- C H Robinson Worldwide Inc.

- CMA CGM Group

- Estes Express Lines

- FedEx Corp.

- Hub Group Inc.

- J B Hunt Transport Services Inc.

- Knight Swift Transportation Holdings Inc.

- Landstar System Inc.

- NFI Industries Inc.

- Old Dominion Freight Line Inc.

- Penske Corp.

- R L Carriers Inc.

- Ryder System Inc.

- Schneider National Inc.

- TransForce Inc.

- United Parcel Service Inc.

- Werner Enterprises Inc.

- XPO Inc.

- YRC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant changes as operational efficiency and cost management continue to be top priorities for businesses. The less-than-truckload (LTL) segment is witnessing notable growth due to its ability to optimize space utilization and reduce transportation costs. However, the rise of LTL does not signal the demise of full truckload (FTL) transportation. Instead, both modes are adapting to meet the evolving demands of the market. One of the key challenges facing the road freight transportation industry is the issue of harmful gases, particularly carbon dioxide (CO2) and nitrogen oxide emissions. To mitigate these environmental concerns, there is a growing emphasis on alternative fuels and green initiatives.

Value-added services, such as fleet management and logistics services, are also becoming increasingly important as businesses seek to streamline their supply chains and reduce their carbon footprint. Rail freight is another alternative that is gaining traction in the market. While it may not offer the same level of speed as road freight, it is an effective solution for transporting large volumes of freight over long distances. Digital mobile communications and electronic toll collection systems are also being adopted to improve synchronization among agencies and enhance operational efficiency. The use of self-driven trucks and the integration of big data analytics are also transforming the road freight transportation landscape.

Self-driven trucks offer the potential for increased operational efficiency and reduced labor costs, while big data analytics enable real-time monitoring of freight tonnage, CO2 emissions, and other key performance indicators. The air pollution generated by heavy-duty vehicles is a significant concern for environmental conservation efforts. The logistics industry is responding by exploring the use of alternative fuels and implementing green initiatives to reduce emissions. Traffic congestion is another challenge that is being addressed through the adoption of digital technologies and intermodal transportation solutions. Cross-border trade is a critical component of the North American freight transportation market. The use of blockchain technology is gaining popularity as a means of enhancing security and transparency in cross-border transactions.

Air freight transportation and maritime transport continue to play important roles in the market, with airline operations adopting digital technologies to optimize their operations and reduce costs. Medium-duty and light-duty vehicles are also impacting the road freight transportation market. The adoption of electric and hybrid vehicles is on the rise, and these vehicles offer the potential for reduced emissions and lower operating costs. However, the transition to alternative fuels and electric vehicles is not without its challenges, including the need for charging infrastructure and the cost of battery technology. In , the market is undergoing significant changes as businesses seek to optimize operational efficiency, reduce costs, and address environmental concerns.

The adoption of digital technologies, alternative fuels, and intermodal transportation solutions are key drivers of growth in the market. The use of self-driven trucks, big data analytics, and blockchain technology are also transforming the industry and enabling new business models and operational efficiencies. The road freight transportation market is a dynamic and evolving landscape, and businesses that can adapt to these changes will be well-positioned for success.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.3% |

|

Market growth 2025-2029 |

USD 129.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch