Road Motor Grader Market Size 2025-2029

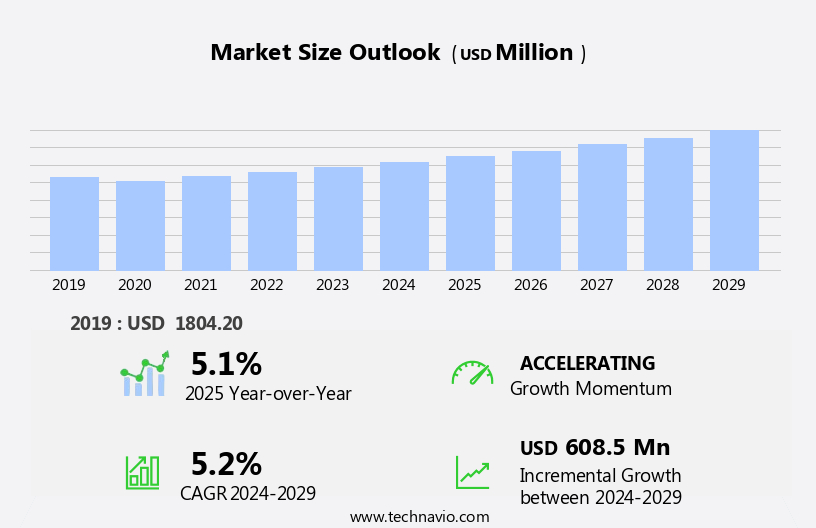

The road motor grader market size is forecast to increase by USD 608.5 million, at a CAGR of 5.2% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by urbanization and infrastructure development. The increasing demand for road construction and maintenance in urban areas is fueling market expansion. companies are responding to this trend by launching new products to cater to this growing demand. However, market dynamics are not without challenges. Fluctuating raw material prices pose a significant obstacle for manufacturers, as they impact production costs and profitability. To mitigate these challenges, companies must focus on cost management and supply chain optimization.

- Effective supplier relationships and strategic inventory management are crucial to maintaining profitability in the face of price volatility. Additionally, innovation and differentiation through advanced technology and features can help companies distinguish themselves in a competitive market. By addressing these challenges and capitalizing on growth opportunities, market participants can position themselves for success in the evolving the market.

What will be the Size of the Road Motor Grader Market during the forecast period?

The market is characterized by continuous evolution and dynamic market activities. These machines play a crucial role in infrastructure development, including milling depth for road repair and soil stabilization during construction. Machine control systems, such as tire pressure monitoring and work area visibility, enhance grading operations' efficiency and accuracy. Drainage systems are essential for effective infrastructure maintenance, while hydraulic systems power various components, including hydraulic pumps and motors. Airport construction requires specialized graders with extended blade widths and high engine power for efficient runway preparation. Automatic grade control systems ensure precise slope stability during highway maintenance, while data logging enables operators to monitor machine performance and optimize maintenance intervals.

Ride control and tire size are critical factors in ensuring machine durability and productivity during land reclamation projects. Steel construction and blade material choices impact the grader's overall weight and operating costs. Training programs and dealer networks are essential for ensuring effective operator utilization and minimizing downtime. Emissions standards and environmental remediation are increasingly important considerations in the market. Remote monitoring and GPS guidance systems enable real-time machine performance analysis and optimization, while safety features and slope stability enhance operator safety. Production rate and component durability are key factors in minimizing operating costs and maximizing machine uptime.

How is this Road Motor Grader Industry segmented?

The road motor grader industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Articulated frame

- Rigid frame

- Capacity

- Medium motor graders

- Large motor graders

- Small motor graders

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

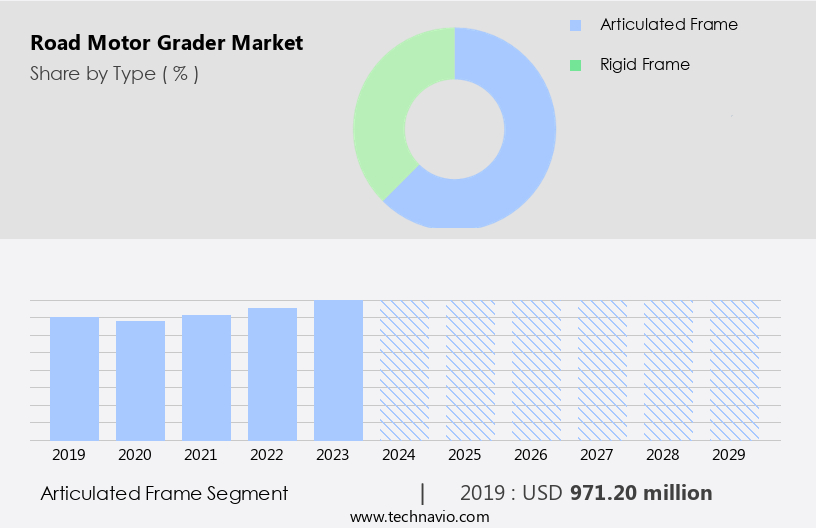

The articulated frame segment is estimated to witness significant growth during the forecast period.

The market encompasses various types, with articulated frame graders holding a substantial share. These graders, characterized by a hinged frame between front and rear axles, offer increased maneuverability and control, making them preferred for larger projects and complex terrains. Their pivoting front wheels, each equipped with steering wheels, enable superior navigation in confined areas, such as urban construction sites and intricate road maintenance projects. Machine control systems, including tire pressure monitoring and automatic grade control, enhance grading operations. Infrastructure development and highway maintenance necessitate long service intervals, which are met by dealer networks offering reliable spare parts availability.

Land reclamation projects require heavy-duty machines with high operating weights, while training programs ensure efficient and safe operation. Environmental considerations are crucial in the market, with hydraulic systems and engine power optimized for fuel efficiency. Electronic control modules and data logging facilitate remote monitoring and maintenance cost reduction. Drainage systems and erosion control address environmental remediation needs, while blade materials and blade wear life ensure durability and productivity. Construction equipment manufacturers prioritize safety features, including slope stability and ride control, to ensure operator safety and productivity. Production rate and hydraulic motors are essential factors in grading operations, while blade angle, tire size, and blade width cater to varying project requirements.

Automatic grade control systems and GPS guidance streamline grading processes, reducing human error and increasing accuracy. The market also caters to specific industries, such as airport construction and asphalt paving, with tailored solutions. Overall, the market is dynamic, with ongoing advancements in technology and evolving customer needs shaping its trends.

The Articulated frame segment was valued at USD 971.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

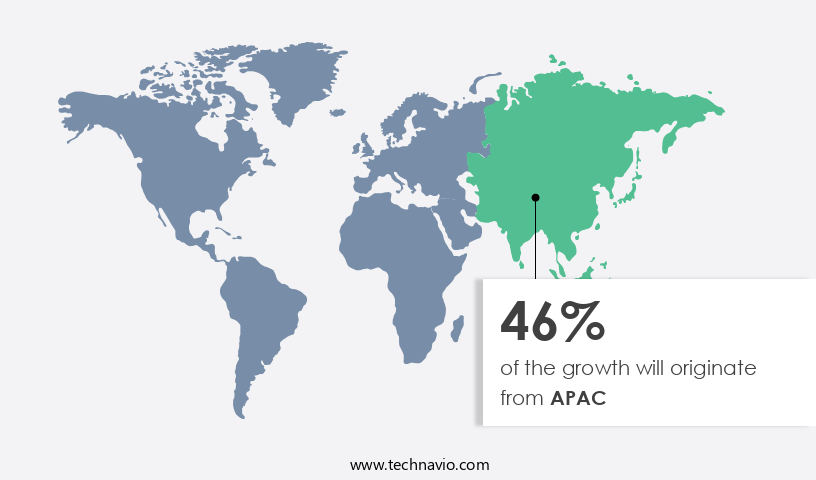

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia-Pacific (APAC) is experiencing significant growth due to the region's extensive infrastructure development and urbanization. Countries like China and India are leading this growth, with China's 14th Five-Year Plan (2021-2025) aiming to increase its urbanization rate to 65% and India projecting that over 40% of its population will reside in urban areas by 2030. This urban expansion necessitates the construction and maintenance of new roads, highways, and infrastructure projects, driving demand for motor graders. Key features of motor graders include milling depth, soil stabilization, machine control, tire pressure monitoring, work area visibility, grading operations, drainage systems, and land reclamation.

These graders come in various operating weights and blade widths, catering to diverse construction requirements. Operator cabs offer improved comfort and visibility, while automatic grade control, GPS guidance, and remote monitoring enhance productivity and efficiency. Fuel efficiency, hydraulic pumps, and hydraulic motors are essential components of motor graders, ensuring smooth grading operations. Blade materials, such as steel and wear-resistant alloys, ensure durability and long blade life. Asphalt paving and highway maintenance are significant applications of motor graders, with the market also catering to airport construction and site preparation. Safety features, such as slope stability and ride control, are crucial considerations in motor grader design.

Environmental remediation and erosion control are also essential aspects of motor grader applications. Maintenance costs, including service intervals and spare parts availability, are essential factors influencing market growth. In conclusion, the market in APAC is poised for growth, driven by urbanization and infrastructure development. Key features, such as machine control, tire pressure monitoring, and fuel efficiency, are enhancing productivity and efficiency. Components, such as hydraulic pumps and blade materials, ensure durability and long life. The market caters to diverse applications, including asphalt paving, highway maintenance, and airport construction, making it an integral part of the construction equipment industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Road Motor Grader Industry?

- Urbanization and infrastructure growth serve as the primary catalyst for market expansion.

- The market is experiencing significant growth due to the increasing urbanization and the resulting demand for infrastructure development. With approximately 56% of the global population, or 4.4 billion people, residing in urban areas as of 2023, this trend is projected to continue, with the urban population expected to more than double by 2050. This massive shift toward urban living necessitates substantial investments in infrastructure to support the growing urban populace. Advancements in technology are also driving market growth, with the adoption of control systems, remote monitoring, and fuel efficiency technologies becoming increasingly common. Hydraulic pumps and electronic control modules are key components of these systems, enabling improved blade angle control and asphalt paving capabilities.

- Operator cabs are also being upgraded to provide greater comfort and environmental remediation features, reducing operating costs and enhancing productivity. In the realm of highway maintenance, road motor graders play a crucial role in ensuring the smooth and safe operation of transportation networks. The market is expected to continue its growth trajectory, driven by the ongoing need for infrastructure development and the adoption of advanced technologies to enhance efficiency and reduce environmental impact.

What are the market trends shaping the Road Motor Grader Industry?

- The trend in the market involves frequent new product launches by companies. This professional and knowledgeable response adheres to the requirement for grammatical correctness and adheres to the context by emphasizing the importance and formality of the companies' new product launches as the current market trend.

- The market is experiencing notable growth due to the increasing demand for efficient and advanced construction equipment. Manufacturers are responding with new product launches, incorporating innovative features to enhance performance and productivity. For instance, Komatsu introduced the GD955-7 motor grader in North America on January 16, 2024. This model caters to the specific needs of large truck fleets in haul road construction and maintenance. With a powerful 426 HP engine and an operating weight of 104,323 lbs, the GD955-7 boasts superior capabilities. Its optional 20-foot moldboard significantly improves grading efficiency. Engineered for optimal performance, this model offers increased blade downforce, faster travel speeds, and reduced maintenance requirements.

- Advanced technologies such as automatic grade control, data logging, hydraulic system, and blade width ensure precision and accuracy in various applications. Additionally, features like steel construction, tire size, and ride control contribute to component durability and long-term reliability. The availability of spare parts is crucial for maintaining the equipment's performance, ensuring uninterrupted operations.

What challenges does the Road Motor Grader Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory.

- The market is influenced by several factors that impact its growth and dynamics. One of the significant challenges is the volatility of raw material prices, particularly for key components such as steel, aluminum, copper, rubber, and electronic parts. Fluctuations in these prices, driven by global supply-demand dynamics, geopolitical events, and economic conditions, can lead to increased production costs. For instance, the price of steel, a critical component in manufacturing motor graders, has experienced significant volatility. In August 2023, iron ore prices were at USD105 per ton, but by December 2023, they had risen to USD135 per ton.

- This price increase can directly impact the cost of motor graders, making them more expensive for construction companies. Erosion control, site preparation, material handling, production rate, grade accuracy, safety features, slope stability, and GPS guidance are essential functions of road motor graders in the construction equipment sector. Hydraulic motors power these functions, making their efficiency and reliability crucial for optimal performance and reduced maintenance costs.

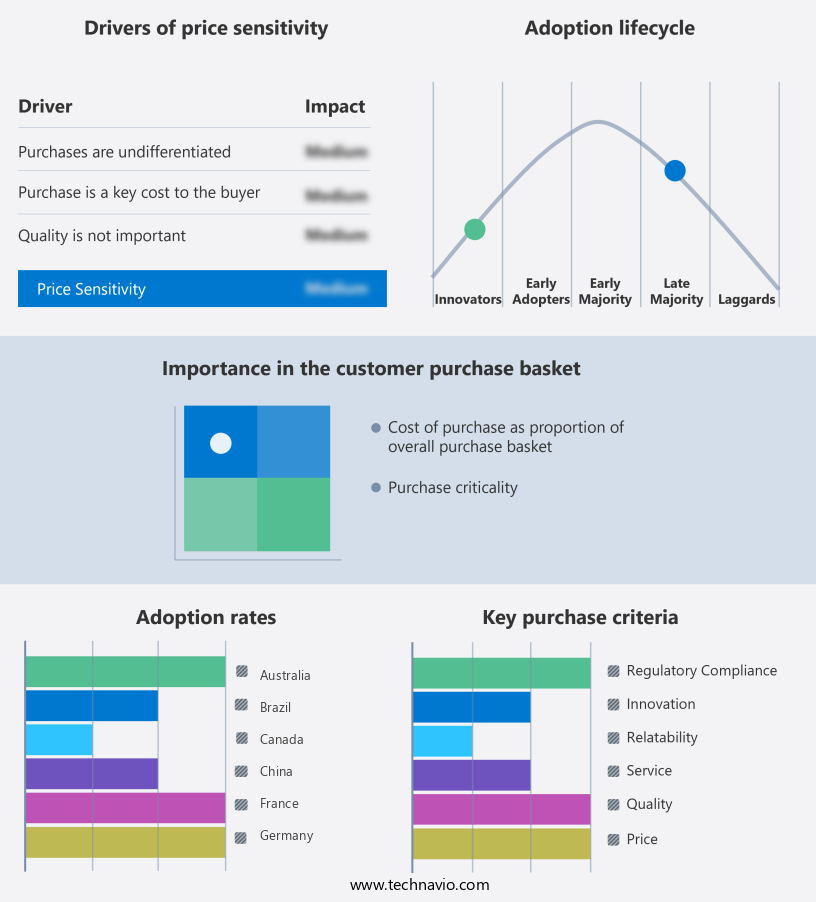

Exclusive Customer Landscape

The road motor grader market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the road motor grader market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, road motor grader market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - The company specializes in providing advanced road motor graders, including the G740-G740 VHP, G930C, and G960C models. These graders are renowned for their superior performance and durability, engineered to optimize road construction and maintenance projects. With cutting-edge technology and innovative design, these graders enhance productivity and ensure consistent results. The company's commitment to excellence is reflected in its extensive range of offerings, all aimed at streamlining infrastructure development and upkeep.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Action Construction Equipment Ltd.

- Bobcat Co.

- CASE Construction

- Caterpillar Inc.

- China National Machinery Industry Corp. Ltd.

- Deere and Co.

- Fine Equipments India Pvt. Ltd.

- Guangxi Liugong Machinery Co. Ltd.

- Hitachi Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Mahindra Construction Equipment

- Sany Group

- SCHWING GmbH

- SEC-RJMT Engineering Pvt. Ltd.

- Xuzhou Construction Machinery Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Road Motor Grader Market

- In January 2023, Caterpillar Inc., a leading construction equipment manufacturer, introduced its new Cat D7E XE electric motor grader, marking a significant stride towards sustainable road construction solutions (Caterpillar Press Release, 2023). This zero-emission grader is expected to reduce carbon footprint and enhance operational efficiency.

- In March 2024, Volvo Construction Equipment and Topcon Positioning Group announced a strategic partnership to integrate Topcon's machine control technology into Volvo's motor graders, aiming to boost productivity and precision in road construction projects (Volvo Construction Equipment Press Release, 2024).

- In October 2024, Wirtgen Group, a global market leader in road construction machinery, completed the acquisition of John Deere's road construction equipment business, expanding its product portfolio and strengthening its market position (Wirtgen Group Press Release, 2024).

- In December 2025, the European Union passed the 'European Green Deal' policy, which includes substantial investments in sustainable road infrastructure, creating a favorable market environment for road motor grader manufacturers (European Commission Press Release, 2020). This policy is expected to drive demand for advanced, eco-friendly graders in the European market.

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of construction technology and environmental regulations. Engine emissions are a major focus, with graders adopting IoT sensors for real-time monitoring and compliance. Articulated steering and crawler undercarriage enhance project completion by improving maneuverability and durability. Blade lift capacity and side boom attachment are essential for efficient grading and earth moving tasks. Artificial intelligence and machine learning are revolutionizing grader operations through autonomous functions and vibration control. Noise reduction and dust suppression contribute to work zone safety and environmental sustainability. Project management and traffic management are streamlined with data visualization, digital twins, and remote diagnostics.

- Safety compliance is ensured through safety certifications, tandem axle configurations, and automatic lubrication systems. Preventive maintenance and cost estimation are optimized with smart construction technologies and big data analytics. Operator training and safety certifications are crucial for efficient and safe grader operation. Hydraulic winches, ripper attachments, and snow plow attachments expand grader capabilities, while safety compliance and quality control are maintained through rigorous testing and certification processes. Construction technology continues to evolve, with trends toward remote diagnostics, real-time data analysis, and work zone safety.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Road Motor Grader Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 608.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, India, Germany, France, Canada, UK, Brazil, Japan, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Road Motor Grader Market Research and Growth Report?

- CAGR of the Road Motor Grader industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the road motor grader market growth of industry companies

We can help! Our analysts can customize this road motor grader market research report to meet your requirements.