Robotic Air Purifier Market Size 2024-2028

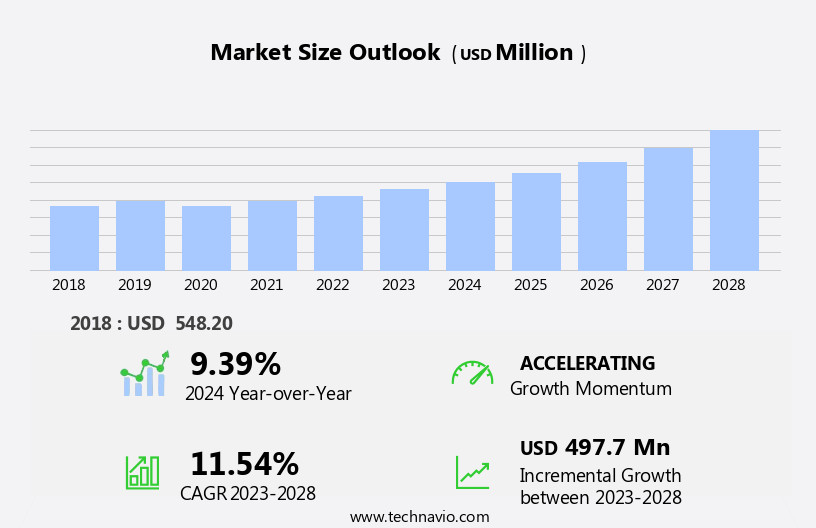

The robotic air purifier market size is forecast to increase by USD 497.7 million at a CAGR of 11.54% between 2023 and 2028.

- The market is experiencing significant growth, driven by the integration of advanced technologies such as robotic vacuum cleaners, smart sensors, and artificial intelligence. This fusion of functionalities offers consumers a more comprehensive solution for indoor air quality management, catering to the increasing demand for smart home devices. However, market expansion is not without challenges. Regulatory hurdles impact adoption due to stringent emission norms and safety standards. Furthermore, the high price point of robotic air purifiers may limit their accessibility to a broader consumer base.

- To capitalize on market opportunities, companies must focus on developing cost-effective solutions while adhering to regulatory requirements. Additionally, strategic partnerships and collaborations can help overcome supply chain inconsistencies and ensure a steady flow of components for manufacturing. By addressing these challenges and continuing to innovate, players in the market can expect robust growth and a strong competitive landscape.

What will be the Size of the Robotic Air Purifier Market during the forecast period?

- The market is experiencing significant advancements with the integration of smart technology and automation in air purification systems. Air purifier robots, powered by AI and sensor technology, are revolutionizing indoor environmental quality by providing autonomous air purification solutions. These robots utilize filtration technology and HVAC integration to ensure energy-efficient clean air technology. Intelligent air purification systems offer real-time air quality management, enabling businesses to maintain healthy home solutions and optimize energy usage.

- The adoption of connected air purifiers is increasing, allowing for seamless integration with existing HVAC systems and enhancing overall indoor environmental quality. Robotics technology plays a pivotal role in enhancing the functionality and efficiency of air purification solutions, making them an essential component of sustainable business operations.

How is this Robotic Air Purifier Industry segmented?

The robotic air purifier industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Residential

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

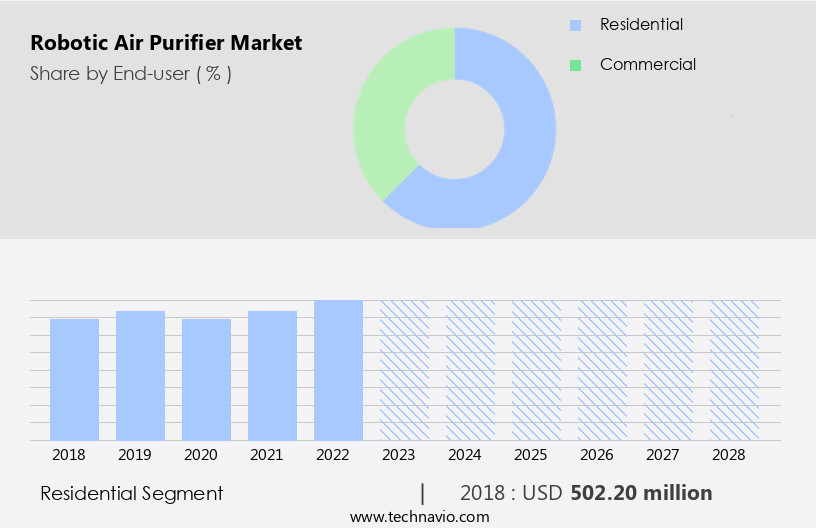

The residential segment is estimated to witness significant growth during the forecast period.

Robotic air purifiers, integrating vacuuming and air filtration capabilities, have gained popularity in the residential market. Over the past decade, robotic vacuum cleaners, known for their ease of use in daily household chores, have expanded their offerings to include air purification features. These devices, equipped with HEPA filters, can remove 99.95% of allergens, contributing significantly to improved indoor air quality. With growing awareness of the health implications of indoor air pollution, dedicated robotic air purifiers have emerged as a preferred choice for homeowners. Robotic air purifiers employ advanced technologies like obstacle avoidance, personalized settings, and real-time air quality monitoring.

They offer features such as UV sterilization, timer settings, and voice control for added convenience. Filtration capacities range from HEPA to activated carbon, catering to various air quality concerns. Additionally, smart home integration, data analytics, and IoT capabilities enable users to monitor and control their air purifiers remotely. These devices are energy efficient and operate quietly, making them an attractive option for those seeking healthier indoor environments. Airflow rates, mapping technology, and zoned cleaning ensure thorough coverage and efficient air purification performance. Maintenance intervals for filter replacement are conveniently scheduled, and air quality data is readily available through mobile apps and user interfaces.

Robotic air purifiers cater to various health concerns, including asthma relief, pet dander removal, and allergy relief. Advanced sensors detect and remove pollutants like mold, smoke, and VOCs. With autonomous cleaning, remote monitoring, and automatic operation, these devices offer a comprehensive solution for maintaining optimal indoor air quality.

The Residential segment was valued at USD 502.20 million in 2018 and showed a gradual increase during the forecast period.

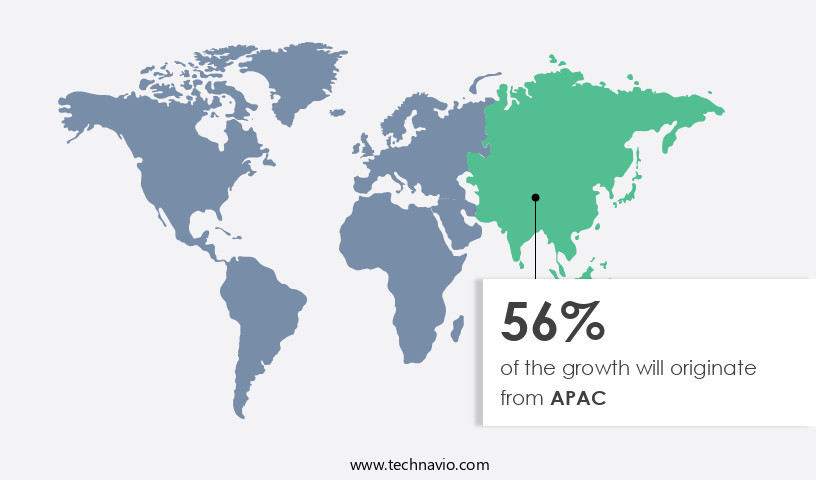

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In response to the growing concern over indoor and outdoor air pollution, the market for robotic air purifiers is experiencing significant growth. These advanced devices offer numerous features to improve indoor air quality, including filtration capacities that cater to large room coverage, obstacle avoidance for safe navigation, and personalized settings to address specific user needs. Robotic air purifiers effectively remove odors, allergens such as pet dander and pollen, mold, and volatile organic compounds (VOCs). UV sterilization technology and HEPA filtration ensure the elimination of bacteria and viruses, contributing to respiratory health benefits. Quiet operation and energy efficiency are essential factors for consumers, making robotic air purifiers an attractive choice.

Advanced air filtration systems, noise reduction technology, and filter replacement indicators enhance user experience. Voice control, cloud connectivity, and mobile apps enable users to monitor and control their air purifiers remotely. Additionally, air quality sensors, airflow rate, and mapping technology provide real-time data and insights for users. Smart home integration, data analytics, and IoT connectivity are key trends in the market, allowing for automation, scheduling, and remote monitoring. Robotic air purifiers cater to various user needs, including asthma relief, allergy relief, and zoned cleaning. Low power consumption and long-lasting filters contribute to the affordability and sustainability of these devices.

The market for robotic air purifiers is driven by the increasing awareness of indoor air quality and the need to mitigate the effects of pollutants on respiratory health. The demand for advanced features, such as personalized settings, energy efficiency, and smart home integration, is propelling the growth of this market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Robotic Air Purifier market drivers leading to the rise in the adoption of Industry?

- The integration of robotic air filters with robotic vacuum cleaners is a significant market trend, driving growth in the home automation industry by providing consumers with comprehensive solutions for indoor air purification and floor cleaning in a single, efficient package.

- Robotic air purifiers are gaining popularity due to their ability to provide asthma and allergy relief by removing pet dander, allergens, mold, and other pollutants from indoor air. Companies are focusing on developing advanced solutions, such as those with HEPA filters and VOC sensors, to enhance air quality data and filtration efficiency. These devices are increasingly being integrated into smart home ecosystems, allowing for remote monitoring and autonomous cleaning. The use of PM2.5 sensors ensures the removal of fine particulate matter, contributing to improved air purification performance.

- With the growing concern for indoor air quality, the demand for robotic air purifiers is expected to rise, offering significant opportunities for companies. These devices offer zoned cleaning capabilities, ensuring optimal air quality in specific areas of the home.

What are the Robotic Air Purifier market trends shaping the Industry?

- Smart sensors and artificial intelligence are becoming increasingly prevalent in today's market, representing a significant trend in various industries. These advanced technologies enable enhanced functionality, improved efficiency, and increased automation.

- Robotic air purifiers, integrating Internet of Things (IoT) technology, offer advanced air quality solutions for modern homes and offices. These devices, characterized by low power consumption, feature user-friendly interfaces and automatic operation. With particle filtration capabilities, they ensure cleaner air through scheduled cleaning cycles. Air purification systems with multi-room coverage and HEPA filtration provide comprehensive health benefits by monitoring and improving air quality in real-time.

- App connectivity and remote control enable users to manage their devices conveniently, while maintaining appropriate maintenance intervals. By leveraging AI technology, these robots can autonomously navigate and clean, providing a more efficient and effective solution for maintaining optimal indoor air quality.

How does Robotic Air Purifier market faces challenges face during its growth?

- The escalating cost of robotic air purifiers poses a significant challenge to the industry's growth trajectory.

- Robotic air purifiers offer extended benefits, such as room coverage, obstacle avoidance, filtration capacity, personalized settings, odor removal, and UV sterilization, through advanced robotic navigation. However, their adoption is limited due to their higher price point compared to traditional and automatic air purifiers. Robotic air purifiers with advanced technologies like AI, visual mapping, and real-time data collection can cost upwards of USD 2,000, which is approximately 40% more than other air purifiers. Similarly, robotic vacuum cleaners integrated with air filtration systems, such as HEPA, are more expensive than standalone vacuum cleaners.

- These features contribute to improved indoor air quality, essential for respiratory health. Additionally, these devices operate quietly and are energy efficient, making them a worthwhile investment for those prioritizing noise reduction and energy savings.

Exclusive Customer Landscape

The robotic air purifier market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the robotic air purifier market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, robotic air purifier market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Coway Co. Ltd. - This company introduces a technologically advanced robotic air purifier, featuring integrated temperature and humidity sensors, and intelligent frequency conversion.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Coway Co. Ltd.

- Diqee Intelligent Henan Corp. Ltd.

- Dongguan Future Electronic Technology Co. Ltd.

- Dyson Group Co.

- Ecovacs Robotics Co. Ltd.

- Fakir Elektrikli Ev Aletleri

- Fortune Electronic Technology Co. Ltd.

- ILIFE

- Irobot Corp.

- Milagrow Humantech

- Partnering Robotics

- Samsung Electronics Co. Ltd.

- Shenzhen Guanglei Electronic Co. Ltd.

- Shenzhen Mantru.e Commercial Equipment Manufacturing Co. Ltd.

- Unilever PLC

- Zigma.Home

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Robotic Air Purifier Market

- In February 2023, Blueair, a leading air purifier brand, introduced its new robotic air purifier model, the Blueair Balance 7170i, featuring advanced sensors and voice control capabilities (Blueair Press Release). This innovative product launch caters to the growing demand for smart home solutions and improved indoor air quality.

- In October 2024, Philips and IQAir, two major players in the air purification industry, announced a strategic partnership to develop and market robotic air purifiers with advanced air filtration technologies (Philips Press Release). This collaboration aims to strengthen their market presence and offer customers more comprehensive air purification solutions.

- In January 2025, Coway, a South Korean home appliance manufacturer, secured a significant investment of USD100 million in its robotic air purifier business from a leading private equity firm (Reuters). The funding will support the expansion of Coway's production capacity and global market entry, positioning the company as a key player in the rapidly growing the market.

- In March 2025, the European Union passed new regulations mandating the installation of robotic air purifiers in all new residential and commercial buildings to improve indoor air quality and comply with stringent emission standards (European Parliament Press Release). This regulatory approval represents a significant shift in the market, creating a massive demand for robotic air purifiers and driving growth within the industry.

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and increasing consumer demand for improved indoor air quality. Robotic air purifiers offer a range of features, including IoT integration, low power consumption, user-friendly interfaces, automatic operation, and particle filtration. These devices are designed to provide multi-room coverage, making them ideal for large homes or commercial spaces. Robotic air purifiers employ advanced filtration systems, such as HEPA and activated carbon, to remove allergens, odors, and pollutants from the air. Some models even feature UV sterilization and VOC sensors for added air quality monitoring. These devices also offer timer settings, voice control, and smart home integration, enabling users to customize their indoor environments to meet their specific needs.

Maintenance intervals are an essential consideration in the market. Many devices offer automated filter replacement notifications, ensuring optimal performance and longevity. Additionally, some models offer air quality data and real-time monitoring, allowing users to stay informed about their indoor air quality and take action when necessary. Robotic air purifiers offer numerous health benefits, particularly for individuals with respiratory conditions such as asthma or allergies. By removing allergens, pollutants, and other irritants from the air, these devices can help alleviate symptoms and improve overall respiratory health. As the market for robotic air purifiers continues to grow, we can expect to see further advancements in technology, such as autonomous cleaning, remote monitoring, and data analytics.

These innovations will enable users to enjoy cleaner, healthier indoor environments with greater convenience and efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Robotic Air Purifier Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.54% |

|

Market growth 2024-2028 |

USD 497.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.39 |

|

Key countries |

US, China, Germany, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Robotic Air Purifier Market Research and Growth Report?

- CAGR of the Robotic Air Purifier industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the robotic air purifier market growth of industry companies

We can help! Our analysts can customize this robotic air purifier market research report to meet your requirements.