Robotic Lawn Mower Market Size 2025-2029

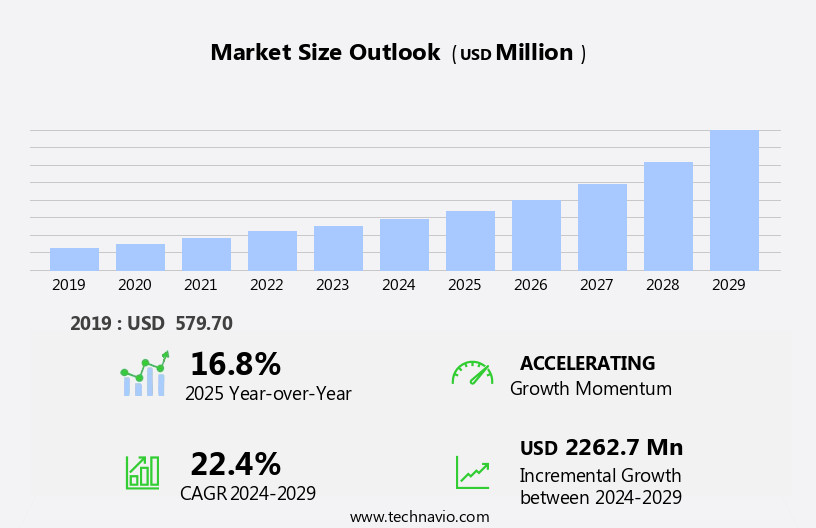

The robotic lawn mower market size is forecast to increase by USD 2.26 billion at a CAGR of 22.4% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The increasing demand from the commercial segment, driven by the need for efficient and cost-effective lawn maintenance solutions, is a major growth factor. Novel technologies, such as artificial intelligence and Bluetooth, enable these devices to map lawns for precision mowing and operate autonomously. Additionally, the development of smart cities is leading to the adoption of advanced technologies, including robotic lawn mowers, for landscaping and maintenance. Furthermore, the availability of alternatives to traditional lawn mowers, such as electric and cordless models, is also contributing to the market's growth. These trends are expected to continue driving market growth In the coming years. However, challenges such as high upfront costs and the need for regular maintenance and charging may hinder market expansion. Overall, the market is poised for steady growth, driven by technological advancements and changing consumer preferences.

What will be the Size of the Market During the Forecast Period?

- The market encompasses innovative technologies that automate lawn maintenance, aligning with the growing trend towards home gardening and smart tools. Robotic lawn mowers offer several advantages over traditional mowing methods, including labor cost savings, reduced noise pollution, and the ability to navigate uneven terrains. The market's expansion is driven by urbanization and the development of smart cities, which prioritize green spaces and visual appeal. Robotic lawn mowers' integration with smartphone applications and remote-controlled capabilities further enhance their appeal. Organic gardening enthusiasts also benefit from these devices, as they can be programmed to maintain lawns with minimal disruption to local ecosystems.

- As novel technologies continue to advance, the market is expected to grow significantly. The integration of AI and machine learning algorithms will enable these devices to adapt to various lawn conditions and optimize mowing schedules. Additionally, the increasing popularity of riding lawn mowers and zero-turn mowers will create opportunities for robotic lawn mowers to cater to diverse lawn maintenance needs. Overall, the market's growth is fueled by a combination of consumer demand for labor savings, environmental sustainability, and the desire for visually appealing green spaces.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Residential

- Commercial

- Distribution Channel

- Retail store/offline

- Online

- Battery Type

- Up to 20V

- 20V to 30V

- Product Type

- Fully autonomous

- Semi-autonomous

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Sweden

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- Europe

By End-user Insights

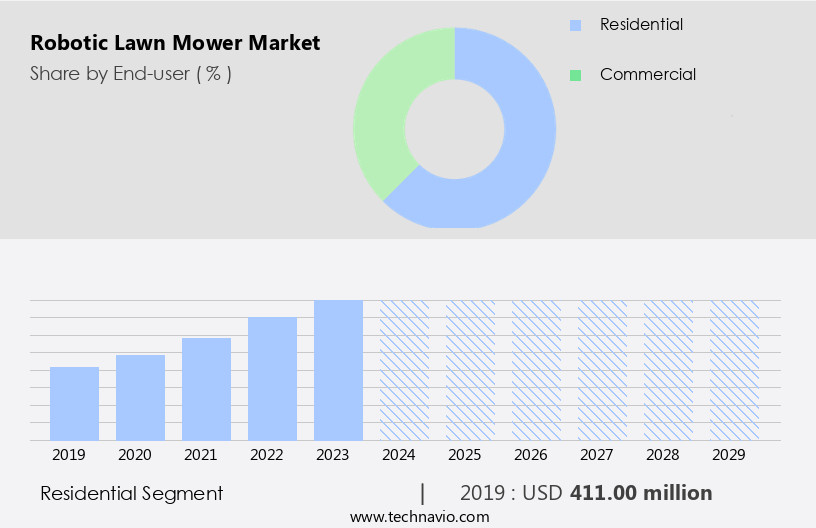

- The residential segment is estimated to witness significant growth during the forecast period. The residential market for robotic lawn mowers caters to homeowners seeking to maintain their grass lawns more efficiently. These lawns enhance the visual appeal of homes and contribute to the circulation of fresh air In the surroundings. Companies specializing in gardening tools are expanding their product offerings in this segment, catering to homeowners with large properties. Robotic lawn mowers offer an alternative to traditional mechanical grass-cutting equipment and professional lawn care services, potentially reducing dependence and costs. Market growth may be driven by companies' efforts to broaden their residential product offerings.

Get a glance at the market report of share of various segments Request Free Sample

The residential segment was valued at USD 411.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

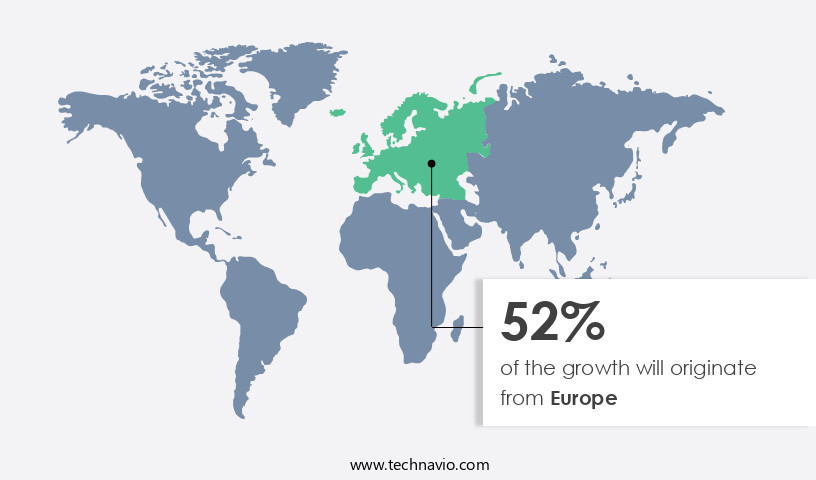

- Europe is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In Europe, urban gardening is experiencing growth, particularly in countries like Germany and the UK. The focus on urban and community gardening by food and nutrition councils in Germany is expanding garden spaces, thereby fueling the demand for robotic lawn mowers. Stringent emission laws and the rising number of large-scale landscape restoration projects are additional driving factors.

For more insights on the market size of various regions, Request Free Sample

The European market is further driven by the need to comply with emission standards set by agencies like the Environmental Protection Agency (EPA), which aim to control exhaust and evaporative emissions from traditional lawn mowers. Homeowners and households seek eco-friendly alternatives, leading to the preference for robotic lawn mowers that consume electricity instead of gasoline and emit no harmful pollutants.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Robotic Lawn Mower Industry?

- Increasing demand from commercial segment is the key driver of the market. Robotic lawn mowers have gained significant traction In the residential sector for lawn maintenance, with their ability to automate gardening activities. However, their adoption in commercial spaces was previously limited due to concerns over productivity, battery life, and maintenance requirements. Recent advancements in technology have addressed these challenges, making robotic lawn mowers an attractive option for large commercial gardens with uneven terrains. These machines' cordless design allows for easy maneuverability around garden landscapes. Novel technologies such as artificial intelligence and smartphone applications enable precise mowing and lawn mapping, reducing labor costs. Moreover, the integration of smart home systems and Bluetooth technologies facilitates remote control and GPS equipped features.

- The commercial sector's increasing focus on backyard beautification, landscaping, and the growth of smart cities have further boosted the demand for these advanced gardening tools. Robotic lawn mowers' environmental benefits, such as the use of organic products and the reduction of emissions from traditional mowers, are also appealing to consumers and the tourism industry. While the initial cost may be higher than that of traditional mowers, the long-term savings on maintenance and electricity make them a cost-effective investment for households and businesses alike. The e-commerce sector's growth and increased consumer confidence in smart tools have also contributed to the market's expansion.

What are the market trends shaping the Robotic Lawn Mower Industry?

- Development of smart cities is the upcoming market trend. In the realm of lawn maintenance and home gardening, novel technologies continue to revolutionize gardening activities. Smart tools, such as robotic lawn mowers, are gaining popularity due to their automation and integration with AI, smartphone applications, and other advanced features. These devices offer precision mowing capabilities, making lawn health a priority. Robotic lawn mowers are particularly useful for managing uneven terrains, providing an alternative to traditional riding lawn mowers and zero-turn mowers. Urbanization and the development of smart cities have increased the demand for these smart gardening tools. The tourism industry, garden parties, and backyard cookouts are just a few sectors that benefit from well-manicured green spaces.

- However, the initial cost of these devices may deter some households. Robotic lawn mowers are equipped with GPS, Bluetooth technologies, and remote control functionality, allowing for efficient lawn mapping and labor cost savings. They also integrate with smart home ecosystems, enhancing the visual appeal of your garden and contributing to backyard beautification and landscaping. Battery capacity is a crucial factor In the performance of these devices, with e-commerce platforms offering various options for consumers to compare and purchase based on their specific needs. Consumers can also monitor their lawn mower's status through smartphone apps, ensuring optimal lawn health and reducing the need for fertilizers and pesticides.

What challenges does the Robotic Lawn Mower Industry face during its growth?

- Availability of alternatives is a key challenge affecting the industry growth. The market for robotic lawn mowers faces competition from traditional lawn mowing equipment, which is more affordable for many households. Gardening activities, including lawn maintenance, remain a significant part of home life and urbanization. Novel technologies, such as automation and artificial intelligence, are transforming gardening tools, with robotic lawn mowers being a prime example. These smart tools often come with features like smartphone applications, GPS-equipped, and remote-controlled capabilities. However, their initial cost is higher than that of conventional mowers, including riding lawn mowers and zero-turn mowers. Companies offering robotic lawn mowers also provide conventional gardening equipment, generating most of their revenue from these sales.

- To remain competitive, they focus on enhancing the features of these products, such as battery capacity and efficiency. The tourism industry, with its emphasis on backyard beautification, landscaping, garden parties, and backyard cookouts, also benefits from the advancements in gardening tools. Consumers' growing confidence in smart home integration and smart home ecosystems further drives the demand for robotic lawn mowers. Bluetooth technologies and AI are enabling precision mowing and lawn mapping, reducing labor costs and improving lawn health. E-commerce platforms facilitate the purchase of these advanced gardening tools, making them increasingly accessible to households.

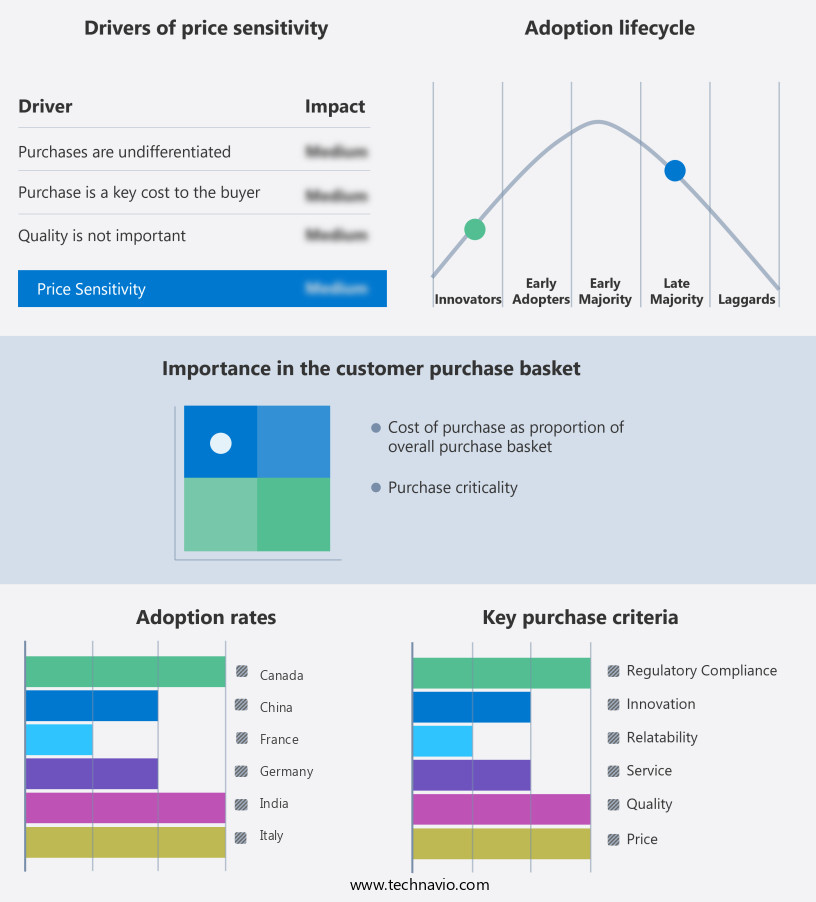

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AL KO SE - The company offers robotic lawn mowers such as solo by Robolindo 450W, 700W, and 2000W.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ANDREAS STIHL AG and Co. KG

- Globgro AB

- Hangzhou Favor Robot Tech Co. Ltd.

- Honda Motor Co. Ltd.

- Husqvarna AB

- Irobot Corp.

- LG Corp.

- LINEA TIELLE srl

- Mamibot Manufacturing USA Inc.

- Mowbot

- MTD Products Inc.

- Ningbo Ngp Industry Co.

- Robert Bosch GmbH

- STIGA S.p.A.

- The Kobi Co.

- The Toro Co.

- YAMABIKO CORP.

- Zucchetti Centro Sistemi Spa

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market represents a significant segment withIn the broader landscape of home gardening and lawn maintenance. This market is driven by the increasing adoption of automation and artificial intelligence (AI) technologies in various aspects of daily life, including gardening activities. Novel technologies, such as smart tools and smartphone applications, are transforming the way homeowners manage their lawns and gardens. Robotic lawn mowers offer several advantages over traditional mowing methods. They are designed to operate autonomously, allowing for more efficient use of time and resources. These devices can navigate uneven terrains, ensuring an evenly trimmed lawn without the need for manual intervention.

Moreover, they can be integrated into smart home ecosystems, enabling remote control and automation via Bluetooth technologies and GPS-equipped systems. The trend towards urbanization and the development of smart cities has further fueled the demand for robotic lawn mowers. In urban environments, green spaces play a crucial role in enhancing the visual appeal of residential areas and contributing to overall backyard beautification. Robotic lawn mowers offer a convenient and eco-friendly solution for maintaining these spaces, reducing the need for labor-intensive methods such as riding lawn mowers or zero-turn mowers. The adoption of robotic lawn mowers is not limited to residential applications.

In addition, they are also gaining popularity in commercial landscaping and tourism sectors, where maintaining large, expansive lawns and gardens is a significant undertaking. Robotic lawn mowers offer cost savings through reduced labor requirements and increased efficiency. Despite their advantages, the initial cost of robotic lawn mowers may be a barrier for some households. However, as the technology continues to evolve, prices are expected to decrease, making these devices more accessible to a broader consumer base. Additionally, the integration of AI and smartphone apps has led to improvements in battery capacity and lawn mapping capabilities, enhancing the overall value proposition of robotic lawn mowers.

Furthermore, the e-commerce sector has played a significant role in driving the growth of the market. Consumers can easily purchase these devices online, allowing for greater convenience and accessibility. Furthermore, consumer confidence In the technology has increased as more households adopt robotic lawn mowers, leading to a positive feedback loop of continued growth. Driven by the adoption of automation and AI technologies, these devices offer numerous advantages over traditional mowing methods. Their integration into smart home ecosystems and growing popularity in commercial landscaping applications further underscores their potential for long-term growth. Despite the initial investment, the benefits of robotic lawn mowers, including increased efficiency, reduced labor costs, and improved environmental sustainability, make them an attractive option for homeowners and businesses alike.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 22.4% |

|

Market growth 2025-2029 |

USD 2.26 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.8 |

|

Key countries |

US, Sweden, Germany, UK, France, Canada, China, Japan, Italy, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Robotic Lawn Mower industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.