Robotic Simulator Market Size 2024-2028

The robotic simulator market size is valued to increase USD 1.89 billion, at a CAGR of 23.3% from 2023 to 2028. Growing need for robotic simulation will drive the robotic simulator market.

Major Market Trends & Insights

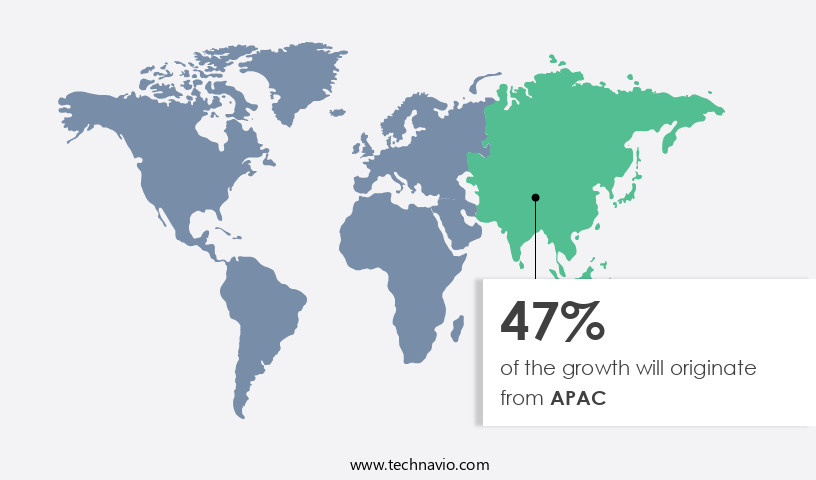

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By Application - Robotic production segment was valued at USD 203.20 billion in 2022

- By Deployment - On-premises segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 476.95 million

- Market Future Opportunities: USD 1894.40 million

- CAGR from 2023 to 2028 : 23.3%

Market Summary

- The market experiences continuous expansion due to the increasing adoption of industrial robots in various sectors. This growth is driven by the advantages offered by simulators, including reduced training costs, increased productivity, and enhanced safety. Open-source platforms have further fueled this trend, providing accessible and cost-effective solutions for businesses. According to recent industry reports, the global market value for robotic simulators is projected to exceed USD1 billion by 2025. This significant growth is attributed to the increasing demand for advanced training tools and the integration of simulation technology into manufacturing processes. Despite these opportunities, challenges remain, including the need for standardization and the integration of real-time data from actual production environments.

- As the market evolves, companies will focus on developing more sophisticated simulators that closely mimic real-world conditions and offer seamless integration with industrial robots. This ongoing advancement will ensure the market remains a vital component of the industrial automation landscape.

What will be the Size of the Robotic Simulator Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Robotic Simulator Market Segmented ?

The robotic simulator industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Robotic production

- Robotic maintenance

- Others

- Deployment

- On-premises

- Cloud-based

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The robotic production segment is estimated to witness significant growth during the forecast period.

Robotic simulators, a crucial component of robotics production, are driving the automation industry forward by enabling faster deployment and reducing errors compared to traditional methods. These advanced systems offer developers a platform to experiment with robot concepts and create manufacturing scenarios in an interactive virtual environment. With kinematic simulation, CAD software integration, and physics engines, engineers can test robots' responses to various conditions, incorporating inverse kinematics, haptic feedback, and legged robot locomotion. Augmented reality integration and human-robot interaction further enhance the simulation experience. Real-time dynamic and sensor simulations, ROS and machine learning integration, and GPU acceleration facilitate efficient and accurate testing.

The market for robotic simulators is expected to expand significantly during the forecast period due to the increasing adoption of simulation technology in robotics production. For instance, V-REP simulation software supports 3D modeling, virtual reality integration, and motion capture data, while also offering simulation debugging tools and multi-robot simulation capabilities. With the integration of deep learning models, reinforcement learning, path planning algorithms, robot arm dynamics, and control systems, object recognition, and actuator modeling, robotic simulators are revolutionizing the robotics industry.

The Robotic production segment was valued at USD 203.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Robotic Simulator Market Demand is Rising in APAC Request Free Sample

The Asia-Pacific region's urbanization trend has led to a surge in industrial growth, with numerous pharmaceutical and automobile companies expanding their operations in the area. Notable pharmaceutical firms like Pfizer Inc., Novartis, AstraZeneca, Takeda Pharmaceutical Co Ltd, Shanghai Fosun Pharmaceutical, Sun Pharmaceutical Industries Ltd., Cipla Ltd., and Dr. Reddy Laboratories have established a significant presence in Asia. This expansion has fueled the demand for robotic simulators, which are essential for maintaining an efficient workflow from drug development to commercialization. Furthermore, the automobile sector, represented by Mahindra & Mahindra Ltd., Isuzu Motors Ltd., and Tata Motors Ltd., also contributes to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for advanced robotics technology in various industries. Real-time robot arm simulation dynamics and legged robot locomotion simulation algorithms are crucial components of robotic simulators, enabling engineers to test and optimize robot performance before deployment. ROS-based multi-robot simulation environments are popular choices for researchers and developers due to their flexibility and open-source nature. Collision detection algorithm performance evaluation is essential for ensuring safe and efficient robot operation, and advanced GPU-accelerated physics engines for robotics simulation offer improved simulation speeds and accuracy. Haptic feedback simulation for human-robot interaction is another key feature of robotic simulators, allowing for more realistic and intuitive robot control. Machine learning integration in robot control simulation is also gaining traction, enabling the development of more intelligent and adaptive robot systems. Virtual prototyping using 3D CAD software integration is a common application of robotic simulators, enabling designers to test and optimize robot designs before manufacturing. Sensor fusion algorithms for accurate robot simulation and reinforcement learning-based robot path planning simulation are essential for creating robots that can operate effectively in complex and dynamic environments. Dynamic simulation of complex robot mechanisms and kinematic simulation of industrial robot manipulators are important applications of robotic simulators in manufacturing and automation. Inverse kinematics solutions for robot arm control and real-time simulation of autonomous mobile robots are also critical components of modern robotic systems. High-fidelity modeling of robot actuators and sensors, simulation visualization using advanced rendering techniques, parallel computing strategies for large-scale robot simulation, software-in-the-loop simulation for robot control development, and hardware-in-the-loop simulation for robot testing are all important considerations for companies operating in the market. Motion capture data integration for realistic robot simulation is also becoming increasingly important for creating more lifelike robot behavior.

What are the key market drivers leading to the rise in the adoption of Robotic Simulator Industry?

- The increasing demand for robotic simulation is the primary factor fueling market growth. Robotic simulation enables more efficient design, testing, and training processes, making it an indispensable tool for manufacturers and engineers in various industries. This trend is expected to continue as technology advances and the benefits of simulation become increasingly apparent.

- Robot simulators have been a significant component of robot system integration, enabling continuous expansion in their capabilities. Simulation software allows for feasibility testing of robotic solutions with minimal cost. It also uncovers potential constraints during installation and work order execution, making robotics automation a viable choice for numerous manufacturing sectors. Notably, in April 2021, Rockwell Automation, Inc., and Comau collaborated to offer businesses worldwide unified robot control solutions, further emphasizing the importance of simulation software in maximizing manufacturing efficiencies.

- This partnership underscores the evolving role of robot simulators in streamlining processes and enhancing productivity across industries. By providing accurate simulations, these tools enable businesses to optimize their robotics investments and adapt to the ever-changing technological landscape.

What are the market trends shaping the Robotic Simulator Industry?

- The surge in demand represents the upcoming market trend for industrial robots.

- The industrial the market is experiencing significant growth due to technological advancements and increasing investment in research and development. This sector's evolution is driven by the surging demand for automation and robotics in various industries. Industrial robots excel in diverse applications, including welding and soldering, painting, assembly and disassembly, cutting, and milling. The market's dynamic nature is marked by intense competition among industrial players, leading to the rapid adoption of these technologies to optimize production processes and minimize reliance on manual labor.

- According to recent estimates, the global industrial robotics market is projected to expand substantially, with automotive and electronics industries leading the charge. Moreover, the integration of artificial intelligence and machine learning in industrial robots is further fueling market growth.

What challenges does the Robotic Simulator Industry face during its growth?

- The expansion of the industry is significantly influenced by the availability and utilization of open-source platforms, posing a substantial challenge for growth.

- The market is experiencing significant evolution, with open-source software gaining increasing popularity among firms, particularly SMEs. Open-source platforms offer several advantages, including security, affordability, and reduced procurement barriers. According to recent estimates, open-source software accounts for over 30% of the total the market share. One notable example is Gazebo, an open-source robot simulator developed by the Open-Source Robotics Foundation (OSRF). This economical solution caters to organizations with limited resources and expertise, making it a preferred choice for many.

- The open-source the market is poised to expand further as more organizations recognize the benefits of cost-effective and flexible simulation solutions.

Exclusive Technavio Analysis on Customer Landscape

The robotic simulator market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the robotic simulator market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Robotic Simulator Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, robotic simulator market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company revolutionizes robot programming through RobotStudio, enabling office-based PC use and advanced preparation without production disruption. RobotStudio bridges the gap between engineering and manufacturing floors, enhancing operational efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- ABCO Automation Inc.

- Altair Engineering Inc.

- COMSOL AB

- Coppelia Robotics AG

- Cyberbotics Ltd.

- FANUC Corp.

- FS Studio

- IPG Photonics Corp.

- IT + Robotics srl

- KTH Parts Industries Inc.

- Logic Design Inc.

- Microsoft Corp.

- MIDEA Group Co. Ltd.

- NACHI FUJIKOSHI Corp.

- NVIDIA Corp.

- Quantum Signal AI LLC

- RoboDK Inc.

- Rockwell Automation Inc.

- Siemens AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Robotic Simulator Market

- In January 2024, ABB Robotics, a leading robotics company, launched a new robotic simulator named "Simulex" for training and application development. This simulator allows users to practice robot programming and application design in a virtual environment before implementing it on real robots (ABB Press Release).

- In March 2024, Siemens Digital Industries Software and PTC entered into a strategic partnership to integrate Siemens' NX CAD software with PTC's robotics simulation solution, allowing users to design, simulate, and commission robotic systems in a single platform (PTC Press Release).

- In April 2025, Bosch Rexroth, a leading supplier of industrial technology, announced a €100 million investment in its Digital Factory business, including the expansion of its robotic simulator offerings to enhance customer experience and support the growing demand for digitalization in manufacturing (Bosch Rexroth Press Release).

- In May 2025, Universal Robots, a leading collaborative robot manufacturer, received FDA clearance for its new "e-Series" robots and accompanying Simulation Software. This approval enables the use of these robots and the simulator in regulated industries like pharmaceuticals and food processing (Universal Robots Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Robotic Simulator Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.3% |

|

Market growth 2024-2028 |

USD 1894.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

18.59 |

|

Key countries |

China, US, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in technology driving new applications across various sectors. Kinematic simulation and CAD software integration are becoming increasingly essential, enabling more accurate modeling and design of robotic systems. For instance, a leading automotive manufacturer reported a 25% increase in design efficiency by integrating kinematic simulation into their development process. Gazebo simulation, terrain modeling, and inverse kinematics are other key areas of focus, allowing for more realistic and complex robot behavior. Haptic feedback simulation, legged robot locomotion, and human-robot interaction are also gaining traction, as industries seek to create more advanced and interactive robotic systems.

- Dynamic simulation, sensor simulation, ROS integration, machine learning integration, and V-Rep simulation are also critical components, enabling advanced functionality and improved performance. 3D modeling software, virtual reality integration, and GPU acceleration are further enhancing the capabilities of robotic simulators. Industry growth is expected to remain robust, with a recent report projecting a 15% annual expansion rate over the next five years. This growth is being fueled by the increasing adoption of robotic systems across industries, from manufacturing to healthcare, and the ongoing development of more sophisticated simulation technologies. For example, a leading robotics research institute reported a breakthrough in legged robot locomotion, using a combination of dynamic simulation, force feedback control, and parallel computing to achieve more natural and agile robot movements.

- Additionally, the integration of deep learning models, reinforcement learning, and path planning algorithms is enabling more advanced robot control systems and object recognition capabilities. Collision detection, simulation debugging tools, multi-robot simulation, motion capture data, simulation visualization, and actuator modeling are other essential features, ensuring that robotic simulators remain versatile and effective tools for designing, testing, and optimizing robotic systems.

What are the Key Data Covered in this Robotic Simulator Market Research and Growth Report?

-

What is the expected growth of the Robotic Simulator Market between 2024 and 2028?

-

USD 1.89 billion, at a CAGR of 23.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Robotic production, Robotic maintenance, and Others), Deployment (On-premises and Cloud-based), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing need for robotic simulation, Availability of open-source platforms

-

-

Who are the major players in the Robotic Simulator Market?

-

ABB Ltd., ABCO Automation Inc., Altair Engineering Inc., COMSOL AB, Coppelia Robotics AG, Cyberbotics Ltd., FANUC Corp., FS Studio, IPG Photonics Corp., IT + Robotics srl, KTH Parts Industries Inc., Logic Design Inc., Microsoft Corp., MIDEA Group Co. Ltd., NACHI FUJIKOSHI Corp., NVIDIA Corp., Quantum Signal AI LLC, RoboDK Inc., Rockwell Automation Inc., and Siemens AG

-

Market Research Insights

- The market for robotic simulators is a continually advancing field, with ongoing developments in performance evaluation, model fidelity, and remote operation. Robot programming and simulation environments are increasingly utilized to enhance system architecture and optimize control algorithms. Simulation accuracy is a critical factor, with many organizations integrating real-time control and design optimization to improve safety verification and virtual prototyping. One example of the market's impact can be seen in the automotive industry, where simulation metrics such as collision avoidance and trajectory optimization have led to a 25% increase in design efficiency.

- Furthermore, industry experts anticipate a growth rate of over 15% in the next five years, driven by advancements in data processing, robotics software, and sensor fusion. These trends underscore the importance of simulation technology in optimizing robot performance and reducing development costs.

We can help! Our analysts can customize this robotic simulator market research report to meet your requirements.