Rochelle Salt Market Size 2025-2029

The rochelle salt market size is forecast to increase by USD 122.1 million at a CAGR of 7.4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing use of electronic devices and advancements in manufacturing technologies. The proliferation of electronics, particularly in the consumer electronics and industrial sectors, has led to a surge in demand for Rochelle Salt, a critical component in various manufacturing processes. This trend is expected to continue as the global electronics industry continues to expand. Rochelle Salt as it is a crucial ingredient in various applications, including water softening, food processing, and pharmaceuticals. However, the market faces challenges in the form of fluctuations in the availability and pricing of raw materials. Rochelle Salt is derived from the mineral sylvinite, which is found in limited quantities. As a result, its availability and price can be volatile, posing a significant challenge for market participants.

- Companies seeking to capitalize on the market opportunities and navigate these challenges effectively must closely monitor raw material prices and secure reliable supply chains. Additionally, they must remain agile and adapt to market trends and technological advancements to maintain a competitive edge.

What will be the Size of the Rochelle Salt Market during the forecast period?

- The market continues to evolve, driven by advancements in biotechnological approaches and chemical reactions. Formulation technologies are revolutionizing various sectors, including the use of Rochelle salt as a leavening agent in food production. In the chemical industry, Rochelle salt functions as a vital reagent in the synthesis of industrial catalysts and crystal oscillators for electronic devices. Moreover, the healthcare sector leverages Rochelle salt's properties in the treatment of chronic diseases and pharmaceutical ingredients. The integration of smart technologies in manufacturing processes enhances the production efficiency and quality of Rochelle salt. Chelating Agents derived from Rochelle salt find applications in various industries, such as electroplating solutions and piezoelectric crystals for energy harvesting.

- Scientific advancements in food additives and lifestyle-related ailments further expand the market's potential. The ongoing research and development in quantitative research and formulation technologies ensure a continuous unfolding of market activities. The dynamic nature of the market reflects the evolving needs of various sectors, making it an exciting area for investment and innovation.

How is this Rochelle Salt Industry segmented?

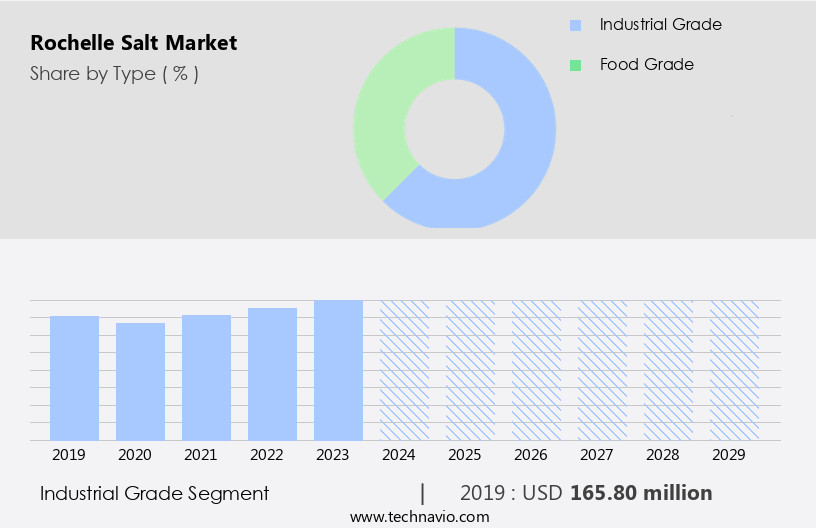

The rochelle salt industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Industrial grade

- Food grade

- Application

- F and B industry

- Electroplating

- Pharmaceuticals

- Others

- Product Type

- Powder

- Crystal

- Solution

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The industrial grade segment is estimated to witness significant growth during the forecast period.

The market experiences continuous expansion due to the industrial segment's significant contribution. This segment caters to various industries, including food and beverages, electronics, and pharmaceuticals, by providing high-purity, consistent-quality Rochelle salt. In the chemical industry, Rochelle salt plays a pivotal role as a reagent or a crucial component in numerous chemical reactions. Biotechnological approaches and formulation technologies integrate Rochelle salt in their processes, enhancing product efficiency and performance. Industrial catalysts benefit from Rochelle salt's unique properties, leading to increased demand. Smart technologies and electronic devices incorporate Rochelle salt in their manufacturing processes for specific applications. Chronic diseases and lifestyle-related ailments necessitate the use of Rochelle salt as a leavening agent and a chelating agent in food additives.

Pharmaceutical ingredients and electroplating solutions also utilize Rochelle salt's properties. Quantitative research in scientific advancements further explores the potential applications of Rochelle salt, such as in the production of crystal oscillators and piezoelectric crystals. Potassium sodium tartrate, a crucial component of Rochelle salt, is an essential ingredient in various industries, driving market growth.

The Industrial grade segment was valued at USD 165.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. China, as a key production center and the largest consumer in APAC, is driving the market's expansion. The increasing demand for Rochelle salt in applications such as food processing, pharmaceuticals, and electronics is fueling this growth. In the pharmaceutical industry, Rochelle salt is used as a leavening agent and a source of potassium and sodium ions in formulations. In electronics, it is utilized in the production of crystal oscillators and electroplating solutions. In food processing, it functions as a chelating agent and a flavor enhancer.

The APAC region's growing demand for convenience foods, chronic disease treatments, and advanced electronic devices is further propelling the market's expansion. The region's rapid scientific advancements in biotechnological approaches, chemical reactions, and formulation technologies are also contributing to the market's growth. The company selection methodology in the market is becoming increasingly sophisticated, with a focus on suppliers that can provide high-quality products and reliable delivery. The market's future trends include the development of smart technologies, such as piezoelectric crystals, and the integration of Rochelle salt into new applications, such as in the production of chemical reagents for research and laboratory use.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Rochelle Salt Industry?

- The escalating reliance on electronic devices serves as the primary catalyst for market growth.

- The global market for Rochelle salt has witnessed notable growth due to the escalating usage of electronic devices in diverse industries, including automotive and pharmaceuticals. The proliferation of electronic devices, such as smartphones, tablets, laptops, and wearables, has fueled the demand for Rochelle salt as a crucial ingredient in their production. The expanding use of electronic devices can be attributed to several factors, including technological innovations, evolving consumer preferences, and the mounting dependence on digital solutions. The smartphone sector, in particular, has experienced remarkable growth, transforming into an essential component of daily life. Smartphones serve multiple functions, acting as communication tools, personal organizers, and entertainment devices, among others.

- This increasing reliance on electronic devices has led to an escalating demand for Rochelle salt, which is used as a leavening agent and chemical reagent in various manufacturing processes. Additionally, Rochelle salt's application in the production of crystal oscillators, which are essential components in electronic devices, further bolsters its market potential.

What are the market trends shaping the Rochelle Salt Industry?

- The current market trend reflects significant advancements in manufacturing technologies. This sector continues to evolve, driving innovation and efficiency in production processes.

- The market experiences significant growth due to advancements in manufacturing technologies. Automation plays a pivotal role in enhancing production efficiency and reducing costs. By integrating robotics, computer-controlled machinery, and advanced sensors, manufacturers ensure consistent product quality and minimize errors. This innovation enables the industry to meet the escalating demand for Rochelle salt in diverse sectors while maintaining stringent quality standards. Chelating agents, a primary application of Rochelle salt, contribute to its market expansion. In the realm of food additives, Rochelle salt functions as a crucial ingredient in various food products, enhancing their taste and preserving their freshness.

- Furthermore, the utilization of Rochelle salt in the production of piezoelectric crystals, which are essential components in various industrial applications, fuels market growth. Quantitative research indicates a steady increase in demand for Rochelle salt, driven by its versatility and wide-ranging applications. The market's dynamic nature underscores the importance of adopting a rigorous company selection methodology to ensure the reliability and efficiency of suppliers. By partnering with reputable companies, businesses can mitigate risks and optimize their supply chain, ultimately driving their success in the competitive marketplace.

What challenges does the Rochelle Salt Industry face during its growth?

- The unpredictable fluctuations in the availability and pricing of raw materials pose a significant challenge to the industry's growth trajectory.

- Rochelle salt, a vital pharmaceutical ingredient and an essential component in various industries, including electroplating solutions and convenience foods, is subject to market dynamics influenced by raw material availability and pricing. The production of Rochelle salt relies on raw materials like tartaric acid and sodium carbonate, which undergo fluctuations due to market demand, sourcing challenges, and global economic conditions. Tartaric acid, a crucial component in Rochelle salt production, is sourced from natural sources such as grapes, tamarinds, and bananas.

- Weather conditions, crop yields, and harvest patterns significantly impact the availability of these sources, leading to price and supply variations in tartaric acid. As a result, the market experiences volatility, necessitating close monitoring of raw material markets for businesses relying on this essential compound.

Exclusive Customer Landscape

The rochelle salt market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rochelle salt market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rochelle salt market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Aesar

- BeanTown Chemical

- Central Drug House

- ChemPur

- EMD Millipore

- Fisher Scientific

- GFS Chemicals

- Hach Company

- Honeywell International

- J.T. Baker

- LabChem

- Merck KGaA

- Parchem

- Santa Cruz Biotechnology

- Sigma-Aldrich

- Spectrum Chemical

- Thermo Fisher Scientific

- TCI Chemicals

- Tosoh Corporation

- VWR International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Rochelle Salt Market

- In February 2024, DuPont announced the expansion of its Rochelle Salt production capacity by 30% at its site in Salisbury, Maryland. This strategic move aimed to cater to the increasing demand for Rochelle Salt in various industries, including food, pharmaceuticals, and water treatment (DuPont Press Release, 2024).

- In August 2024, Solvay and Lanxess entered into a joint venture to produce and market Rochelle Salt and related derivatives. This collaboration was expected to strengthen their market positions and enhance their product offerings (Solvay Press Release, 2024).

- In March 2025, the European Commission approved the use of Rochelle Salt as a food additive, expanding its application in the European food industry (European Commission Press Release, 2025).

- In October 2025, Merck KGaA invested â¬100 million in its Rochelle Salt production facility in Germany to increase production capacity and improve efficiency (Merck KGaA Press Release, 2025).

Research Analyst Overview

The market experiences dynamic growth in response to shifting consumer preferences towards functional foods and health and wellness. Processed foods increasingly incorporate this essential ingredient as part of experimental settings for ingredient innovation. The aging population's demand for nutritional enhancement drives this trend. Science research in processing technologies advances, ensuring quality control and adherence to food and safety regulations. digital health platforms facilitate easy access to information on the ingredient's benefits, further fueling market expansion.

Functional foods, a significant market segment, leverage Rochelle Salt's unique properties to cater to health-conscious consumers. Ingredient innovation continues to be a key driver, with ongoing research in the field of food science.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Rochelle Salt Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 122.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

6.7 |

|

Key countries |

US, China, UK, Germany, Japan, France, India, Canada, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rochelle Salt Market Research and Growth Report?

- CAGR of the Rochelle Salt industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rochelle salt market growth of industry companies

We can help! Our analysts can customize this rochelle salt market research report to meet your requirements.