Rugged Equipment Market Size 2024-2028

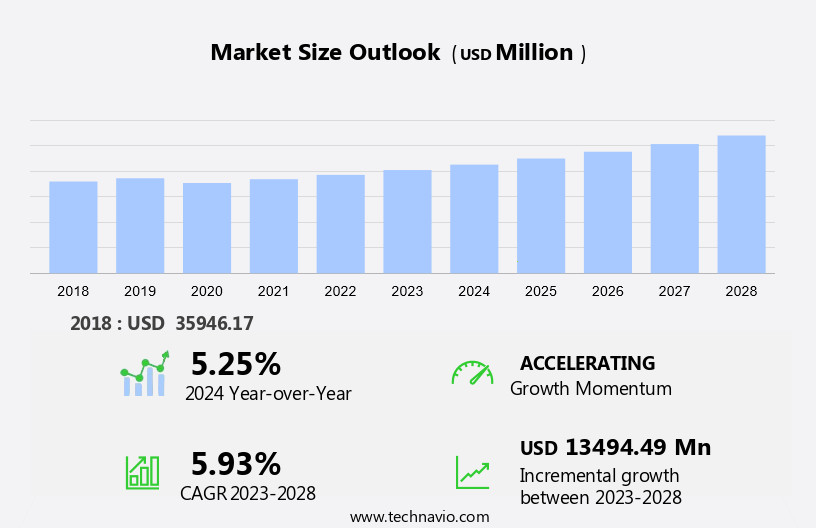

The rugged equipment market size is forecast to increase by USD 13.49 billion at a CAGR of 5.93% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand from industrial end-users. The integration of Internet of Things (IoT) technology in rugged devices is another key trend driving market growth. However, the high initial cost of procurement compared to non-rugged devices remains a challenge for market expansion. The market growth is attributed to the increasing need for reliable and durable equipment in harsh environments, particularly in industries such as oil and gas, mining, and construction. The adoption of IoT in rugged equipment enables real-time monitoring and data collection, leading to improved operational efficiency and productivity. Despite the challenges, the market is expected to continue growing due to the increasing demand for rugged devices in various industries and the benefits they offer over non-rugged alternatives.

What will be the Size of the Rugged Equipment Market During the Forecast Period?

- The market encompasses a diverse range of products engineered to withstand harsh environments and demanding industries. Key market dynamics include technological advancements and research and development In the areas of durability, designs, and innovative solutions. The market is driven by the need for overall efficiency and productivity in sectors such as defense, construction, and manufacturing. Manufacturing techniques have evolved to incorporate smart technologies, sustainable materials, and the Internet of Things (IoT), resulting in featuring connectivity, real-time monitoring, predictive maintenance, and data-driven insights. Rugged communication systems, rugged computers, rugged displays, and other equipment cater to the unique requirements of industries where reliability and durability are paramount.

- The defense and military sector continues to be a significant contributor to the market, with a focus on rugged equipment for real-time situational awareness and mission-critical applications. Smart sensors and connectivity features enable seamless integration and enable industries to optimize their operations, enhancing their competitive edge.

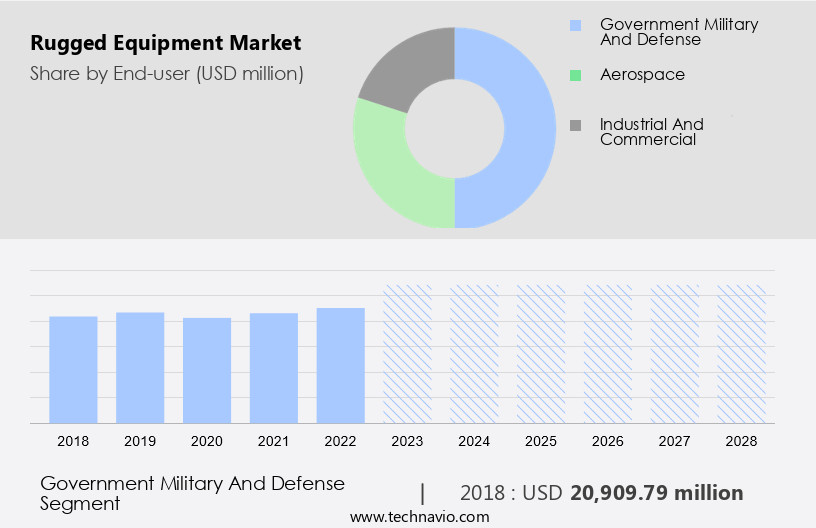

How is this Rugged Equipment Industry segmented and which is the largest segment?

The report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Government military and defense

- Aerospace

- Industrial and commercial

- Product

- Communication equipment

- Computer system

- Display

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By End-user Insights

- The government military and defense segment is estimated to witness significant growth during the forecast period.

The market experiences steady growth due to increasing demand from defense, construction, and manufacturing industries. Technological advancements and research & development in durability designs, innovative solutions, and overall efficiency are key driving factors. Manufacturing techniques employing smart technologies, sustainable materials, and productivity enhancements contribute to the market's expansion. The Internet of Things, smart sensors, connectivity features, real-time monitoring radio, predictive maintenance, and data-driven insights are integral to rugged communication solutions. In military applications, rugged computers, displays, and communication equipment are essential for demanding environments, ensuring tactical durability, longevity assurance, and extreme condition performance. Infrastructure development and military modernization initiatives fuel market adoption, while budgetary constraints and regional insights may impact growth. Advanced technologies, such as ruggedization techniques, outdoor durability, and design, continue to shape the market landscape.

Get a glance at the market report of share of various segments Request Free Sample

The Government military and defense segment was valued at USD 20.91 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market In the US is experiencing significant growth due to increased defense spending, driven primarily by the country's military modernization efforts. In 2022, the US military budget accounted for approximately 40% of global military expenditures, amounting to a substantial investment. This growth is influenced by the demand for durable solutions in military applications, as well as infrastructure development projects In the defense sector. In South America, geopolitical tensions in countries like Uruguay, Brazil, and Nicaragua due to the presence of armed groups have also contributed to the demand in the region. Technological advancements, such as smart technologies, sustainable materials, and the Internet of Things, are driving innovation in designs, providing overall efficiency and productivity improvements.

Manufacturing techniques, including ruggedization and military-grade specifications, ensure tactical durability and longevity assurance. Key factors include extreme conditions, real-time monitoring, predictive maintenance, and data-driven insights. The market is expected to continue growing, with trends toward rugged communication, smart sensors, connectivity features, and smart technologies shaping the future of solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Rugged Equipment Industry?

Growth of industrial end-users is the key driver of the market.

- The market is experiencing significant growth due to its increasing adoption in demanding industries such as defense, construction, and manufacturing. Technological advancements, research and development, and innovative solutions are driving the market, with a focus on durability, designs, and overall efficiency. companies are implementing manufacturing techniques that incorporate smart technologies, sustainable materials, and connectivity features to enhance productivity. In the defense sector, the need in military applications is increasing due to military modernization and infrastructure development. Rugged communication, smart sensors, real-time monitoring, predictive maintenance, and data-driven insights are essential features in military and defense applications.

- In the construction and development industry, rugged equipment is essential for outdoor durability and design. Impact-resistant appliances, waterproof devices, vibration-resistant tools, and heavy-duty electronics are critical for construction sites and outdoor adventures. The market's growth is, however, restrained by budgetary constraints and the high cost of rugged equipment. Despite these challenges, the market is expected to grow steadily during the forecast period, with a focus on ruggedization techniques and extreme conditions. The market is witnessing significant growth due to its increasing adoption in various industries. The market's growth is driven by technological advancements, research and development, and the need for rugged equipment in harsh environments.

- Despite the challenges, the market is expected to grow steadily during the forecast period, with a focus on innovation and cost reduction.

What are the market trends shaping the Rugged Equipment Industry?

Incorporation of internet of things in rugged equipment is the upcoming market trend.

- Rugged equipment, utilized extensively in defense, construction, and manufacturing industries, is witnessing significant technological advancements due to the integration of the Internet of Things (IoT) and smart technologies. The forecast period for this market is marked by the adoption of innovative solutions that enhance overall efficiency, durability, and productivity. Rugged equipment, engineered to withstand extreme conditions, is designed with military-grade specifications, ensuring tactical durability and longevity assurance. IoT plays a pivotal role in this market, enabling real-time monitoring, predictive maintenance, and data-driven insights. Smart sensors and connectivity features are integral to rugged communication systems, enabling seamless interaction between humans and machines.

- These technological advancements are driving factors for the market, particularly in defense and emergency services, military applications, and infrastructure development. However, budgetary constraints and regional insights may act as restraining factors. Manufacturing techniques continue to evolve, with a focus on sustainable materials and ruggedization techniques, ensuring outdoor durability and design. The market is further fueled by the increasing preference for rugged solutions in demanding industries, including military and defense, construction and development, and outdoor adventures. Smart technologies, such as impact-resistant appliances, waterproof devices, and vibration-resistant tools, are essential for heavy-duty electronics used In these industries. The integration of these technologies is transforming the market, enabling improved operational environments and productivity in harsh conditions.

What challenges does the Rugged Equipment Industry face during its growth?

High initial cost of procurement compared with non-rugged devices is a key challenge affecting the industry growth.

- Rugged equipment engineered to withstand harsh environments and demanding industries is a significant investment for enterprises and businesses. Although the initial procurement cost is higher than commercial equipment, the total cost of ownership (TCO) is often lower. In contrast, consumer-grade products may appear more attractive due to their lower upfront cost. However, the TCO analysis reveals that rugged equipment, with its durability, designs, and innovative solutions, offers overall efficiency and productivity gains. Technological advancements, such as smart technologies, the Internet of Things, smart sensors, connectivity features, real-time monitoring, predictive maintenance, and data-driven insights, contribute to the lower TCO. Rugged communication solutions, including rugged computers, displays, and military-grade specifications, ensure tactical durability and longevity assurance in extreme conditions.

- The defense sector, infrastructure development, military modernization, and construction and development industries are key driving factors for the market. Budgetary constraints and regional insights may act as restraining factors. Regardless, the adoption of rugged solutions is on the rise due to their ability to perform optimally in harsh operational environments, making them essential for industries requiring ruggedization techniques, such as military applications, outdoor adventures, and heavy-duty electronics.

Exclusive Customer Landscape

The rugged equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rugged equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rugged equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMETEK Inc.

- Curtiss Wright Corp.

- Dell Technologies Inc.

- Ecrin Systems

- Extreme Engineering Solutions Inc.

- General Dynamics Corp.

- Getac Technology Corp.

- Honeywell International Inc.

- Kontron AG

- L3Harris Technologies Inc.

- Leonardo DRS Inc.

- Panasonic Holdings Corp.

- Raytheon Technologies Corp.

- Siemens AG

- Trimble Inc.

- Zebra Technologies Corp.

- MilDef Group AB

- Sparton Rugged Electronics

- Systel Inc.

- Winmate Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of products engineered to withstand demanding environments and operational conditions. These solutions cater to various industries, including defense, construction, and manufacturing, where durability and overall efficiency are paramount. Technological advancements have significantly influenced the rugged equipment landscape, leading to the development of innovative designs and smart technologies. Manufacturers have embraced manufacturing techniques that ensure tactical durability and longevity assurance. Rugged communication equipment, for instance, is designed to operate in extreme conditions, providing real-time monitoring, predictive maintenance, and data-driven insights. The integration of the Internet of Things (IoT), smart sensors, and connectivity features has enabled these devices to deliver valuable information in real-time, enhancing productivity and operational efficiency.

Rugged displays, computers, and other heavy-duty electronics are essential components of rugged equipment. Military-grade specifications and advanced technologies are employed to create impact-resistant appliances and waterproof devices. Vibration-resistant tools are also a crucial part of the market, catering to industries where equipment is subjected to harsh conditions. The adoption of rugged solutions is driven by several factors. In the defense sector, military applications require equipment that can withstand the rigors of military modernization and the demands of operational environments. Infrastructure development projects also necessitate rugged equipment to ensure the longevity of structures and installations. However, budgetary constraints and regional insights can act as restraining factors In the market.

Defense sectors and military applications often face significant budgetary pressures, which may limit the adoption of advanced technologies and rugged equipment. Regional differences in infrastructure development and industrial requirements can also impact the demand for rugged equipment. The market is characterized by a continuous quest for innovation and durability. Manufacturers are investing in research and development to create rugged solutions that cater to the needs of various industries, from defense and military to construction and development. The integration of smart technologies, sustainable materials, and ruggedization techniques is transforming the rugged equipment landscape, ensuring that these solutions remain essential tools for businesses operating in demanding environments.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.93% |

|

Market growth 2024-2028 |

USD 13.49 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.25 |

|

Key countries |

US, Canada, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rugged Equipment Market Research and Growth Report?

- CAGR of the Rugged Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rugged equipment market growth of industry companies

We can help! Our analysts can customize this rugged equipment market research report to meet your requirements.