US Sanitary Pumps Market Size 2024-2028

The US sanitary pumps market size is forecast to increase by USD 60.6 million, at a CAGR of 3.3% between 2023 and 2028.

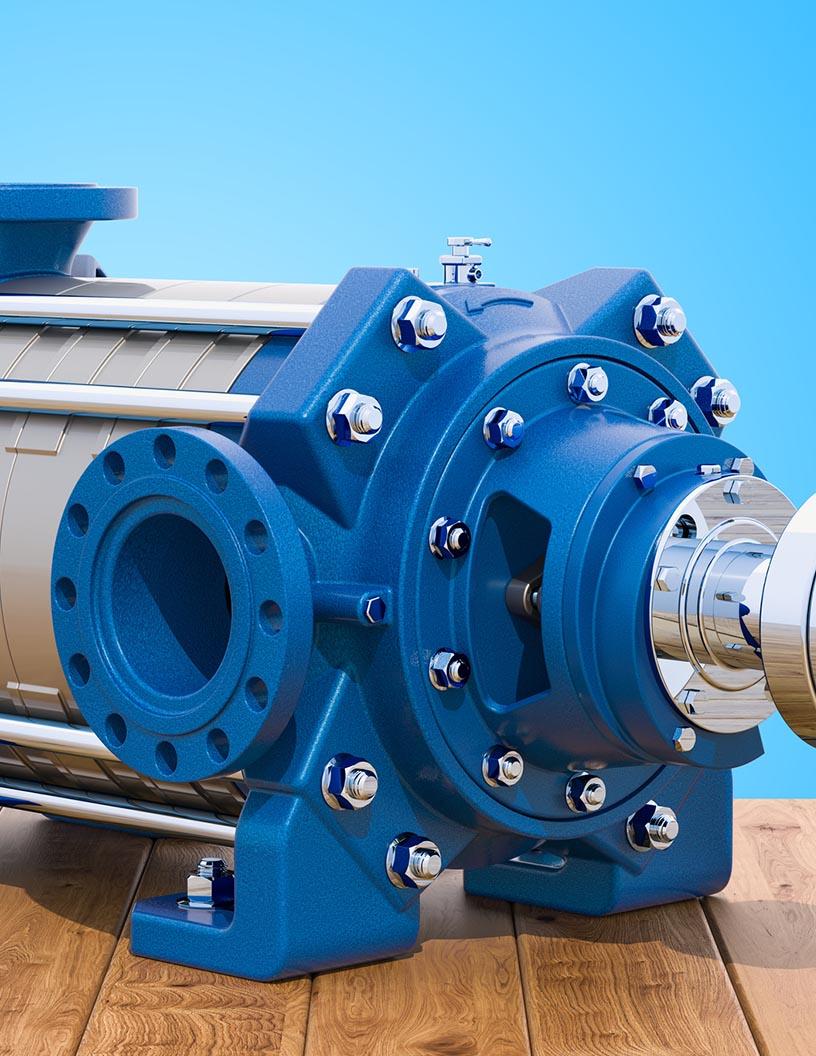

- The Sanitary Pumps Market in the US is driven by the increasing regulations in the food and beverage, as well as pharmaceutical industries. These industries demand high standards of hygiene and sanitation, leading to a growing preference for sanitary pumps that ensure efficient and reliable operation while maintaining stringent cleanliness requirements. Another key trend is the incorporation of advanced technologies into sanitary pumps, such as non-clogging designs, self-priming capabilities, and remote monitoring systems, which enhance their performance and versatility. However, the market faces challenges in the form of maintenance and operational complexity. Sanitary pumps require regular maintenance to ensure optimal performance and prevent potential contamination issues.

- Additionally, the integration of advanced technologies can increase the cost and complexity of maintenance, making it essential for companies to invest in skilled personnel and effective training programs. To capitalize on market opportunities and navigate these challenges effectively, companies should focus on developing user-friendly designs, offering comprehensive maintenance services, and collaborating with industry partners to provide integrated solutions that cater to the evolving needs of their customers.

What will be the size of the US Sanitary Pumps Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The sanitary pumps market in the US is characterized by the diverse application of various pump types in industrial processes and infrastructure development. Diaphragm pumps and progressive cavity pumps are popular choices for handling process water in industries like food and beverage, pharmaceuticals, and chemical processing. Hydraulic design and system optimization ensure efficient pumping in sewerage systems and fire suppression systems. Safety standards are paramount in the market, with non-clog pumps and screw pumps utilized in applications involving solids handling. Compliance with environmental regulations is a significant trend, with pumping efficiency and optimization essential for cooling water systems and water supply.

- Maintenance schedules and intervals are crucial in maintaining pumping networks, ensuring smooth operation in HVAC systems, pumping capacity enhancement, and pressure boosting. Wet pit pumps and dry pit pumps are integral to the market, with remote monitoring and pumping control systems enabling effective management of pumping networks. Chemical injection applications require adherence to compliance requirements, with the integration of safety features and pumping technology ensuring optimal performance. In the realm of industrial processes, pumping capacity and pressure boosting are essential for various applications, including fire suppression systems and water supply.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- PD sanitary pump

- Centrifugal sanitary pump

- End-user

- Food and beverages

- Pharmaceuticals

- Others

- Geography

- North America

- US

- North America

By Product Insights

The PD sanitary pump segment is estimated to witness significant growth during the forecast period.

In the US sanitary pumps market, Positive Displacement (PD) pumps held a significant market share in 2023. PD pumps are favored in sanitary applications due to their versatility in handling various fluids, catering to the demands of industries like pharmaceutical and food and beverage. The introduction of advanced PD pumps, such as twin-screw pumps, is propelling the market's growth. For example, Q Pumps' QTS Series Sanitary Pumps, a twin-screw PD pump, offers enhanced technology and functionality, leading to reduced production costs and time. Corrosion resistance is a crucial factor in pump selection, especially in industries dealing with harsh chemicals. Cast iron and ductile iron pumps, known for their corrosion resistance, are popular choices for chemical processing applications.

However, the increasing preference for energy efficiency and high flow rates has led to the growing popularity of vertical pumps in the market. Efficiency ratings, hydraulic losses, and life cycle costs are essential considerations in pumping systems. Automation systems, including control panels and variable speed drives, optimize pump performance and reduce operating costs. Vertical pumps, with their high head capacity and flow control capabilities, are ideal for water treatment plants and wastewater treatment applications. Sludge pumping and solids handling are essential in industrial wastewater treatment. Sanitary pumps are integral to stormwater management systems, ensuring efficient pumping and minimizing hydraulic performance issues.

Materials of construction, such as stainless steel, ensure abrasion resistance and longevity, reducing maintenance costs and downtime. Pump sizing and NPSH requirements are essential factors in pump performance. Centrifugal pumps, with their cavitation prevention capabilities, are widely used in municipal wastewater and sewage pumping applications. The integration of automation systems and energy efficiency features in pumping systems is a market trend, ensuring optimal system design and reducing pumping costs.

The PD sanitary pump segment was valued at USD 160.60 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the US Sanitary Pumps Market drivers leading to the rise in adoption of the Industry?

- The food and beverage and pharmaceutical industries are subject to progressively more stringent regulations, serving as the primary market driver.

- In the realm of industrial processes, sanitary pumps play a crucial role in maintaining hygiene and ensuring compliance with stringent regulations in the food and beverage and pharmaceutical industries. These pumps are subject to rigorous design standards and material specifications set by regulatory bodies such as the US Food and Drug Administration (FDA), 3-A Sanitary Standards Inc, USDA, NSF, EPA, USDA FSIS, and GMP Rules and Regulations. The demand for sanitary pumps is driven by the need for reliable and efficient pumping systems in various applications, including pharmaceutical manufacturing, industrial wastewater treatment, and sewage pumping. Key considerations in the selection of sanitary pumps include head capacity, materials of construction, and pump sizing.

- Stainless steel is a common material of choice due to its resistance to corrosion and ease of cleaning. Control panels and maintenance services are essential components of sanitary pump systems, ensuring optimal performance and reducing downtime. With increasing regulatory scrutiny and the potential for costly penalties and product recalls, the importance of maintaining high-performing and compliant sanitary pump systems cannot be overstated. The market for sanitary pumps is expected to grow as industries continue to prioritize hygiene and safety in their operations.

What are the US Sanitary Pumps Market trends shaping the Industry?

- Advanced technologies are increasingly being incorporated into sanitary pumps to meet the rising demand from the market. This trend signifies a significant shift towards more efficient, reliable, and sustainable pumping solutions.

- Sanitary pumps play a crucial role in various industries, particularly in wastewater treatment, where they are used in pumping stations to move municipal wastewater. Pumping efficiency is a significant concern in this context, as pumps consume substantial energy among industrial equipment. In response to increasing energy conservation regulations, pump manufacturers are prioritizing the development of more efficient pumps. Beyond design enhancements, manufacturers are also integrating advanced technologies, such as variable speed drives and sensor systems, into conventional pumps to create smart pumps. These technological upgrades enable real-time monitoring of operational parameters like vibration, voltage, current, temperature, pressure, and flow rate.

- By analyzing this data, manufacturers can optimize pump performance, ensuring maximum energy efficiency and preventing cavitation. Centrifugal pumps, including submersible pumps, are widely used in the sanitary pump market due to their high pumping efficiency and ability to handle large volumes of water. Manufacturers are focusing on meeting NPSH (Net Positive Suction Head) requirements to prevent cavitation, ensuring smooth and efficient pump operation. In conclusion, the integration of advanced technologies and a focus on energy efficiency are driving innovation in the sanitary pump market.

How does US Sanitary Pumps Market face challenges during its growth?

- The complexity of maintenance and operations poses a significant challenge to the industry's growth, requiring continuous attention and expertise from professionals.

- Sanitary pumps are essential components in industries with stringent hygiene standards, such as food processing and pharmaceuticals. However, their maintenance and operation can pose challenges for end-users due to the need for regular cleaning and thorough inspections. Motor control systems and automation are crucial for optimizing pump performance and reducing downtime. Corrosion resistance is another essential factor in pump selection, as these pumps often operate in harsh environments. Efficiency ratings and high flow rates are also vital considerations for maximizing productivity. In the context of sludge pumping, hydraulic losses can significantly impact the overall system performance. Installation services and expertise are essential for minimizing potential issues during the installation process.

- The life cycle costs of sanitary pumps, including maintenance, repair, and replacement, can be substantial. Materials such as cast iron and ductile iron are commonly used for their durability and resistance to wear and tear. In conclusion, while sanitary pumps play a vital role in various industries, their maintenance and operational complexities can pose challenges. By focusing on factors such as motor control, corrosion resistance, efficiency ratings, and expert installation services, end-users can mitigate potential issues and maximize the value of their investment.

Exclusive US Sanitary Pumps Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Laval AB

- Ampco Pumps Co.

- Axiflow Technologies Inc.

- Dover Corp.

- Flowserve Corp.

- GEA Group AG

- Graco Inc.

- IDEX Corp.

- Ingersoll Rand Inc.

- ITT Inc.

- KSB SE and Co. KGaA

- Moyno Inc.

- Pentair Plc

- Q Pumps

- Spirax Sarco Engineering Plc

- SPX FLOW Inc.

- Verder International BV

- Versamatic

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sanitary Pumps Market In US

- In March 2024, DAB Pumps, a leading manufacturer of sanitary and industrial pumps, introduced its new EcoSan S series of sanitary pumps. These pumps feature energy-efficient designs and advanced materials, making them an attractive option for the US market, which is increasingly focusing on sustainability and cost savings (DAB Pumps Press Release).

- In June 2024, Xylem, a global water technology company, announced a strategic partnership with 3E Company, a leading environmental, health, and safety consulting firm. The collaboration aims to integrate Xylem's water and wastewater treatment solutions with 3E's compliance and risk management software, creating a comprehensive offering for the US market (Xylem Press Release).

- In February 2025, the US Environmental Protection Agency (EPA) announced new regulations for the National Pollutant Discharge Elimination System (NPDES) program. The changes include stricter monitoring requirements for industrial wastewater discharge, driving demand for advanced sanitary pumps capable of handling and treating wastewater efficiently (US EPA Press Release).

Research Analyst Overview

The sanitary pumps market in the US continues to evolve, driven by the diverse requirements of various sectors. Pumping stations, wastewater treatment, and municipal wastewater are key applications, with a focus on enhancing pumping efficiency and addressing NPSH requirements. Sanitary pumps, including submersible pumps, play a crucial role in ensuring reliable and efficient operation. Centrifugal pumps, with their high flow rates and energy efficiency, are increasingly preferred in water treatment plants and chemical processing. Hydraulic losses and life cycle costs are critical considerations, leading to the adoption of materials like cast iron, ductile iron, and stainless steel. Automation systems and variable speed drives are essential for optimizing pump performance and reducing operating costs.

In the realm of sanitary pumps, applications such as sludge pumping, solids handling, and stormwater management necessitate abrasion resistance and high head capabilities. Pump sizing and system design are essential for ensuring optimal pumping efficiency and minimizing pumping costs. Pharmaceutical manufacturing and industrial wastewater treatment also require stringent standards for materials of construction and pumping systems. The ongoing pursuit of energy efficiency and flow control in pumping systems continues to shape market dynamics. High flow rates, head capacity, and cavitation prevention are essential for maintaining hydraulic performance and ensuring the seamless integration of pumping systems into complex industrial processes.

Maintenance services and installation services are also vital components of the market, ensuring the longevity and optimal performance of sanitary pumps.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sanitary Pumps Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2024-2028 |

USD 60.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch