Sanitary Pumps Market Size 2025-2029

The sanitary pumps market size is forecast to increase by USD 566.6 million at a CAGR of 4.1% between 2024 and 2029.

What will be the Size of the Sanitary Pumps Market During the Forecast Period?

How is this Sanitary Pumps Industry segmented and which is the largest segment?

The sanitary pumps industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Kinetic sanitary pumps

- Positive displacement (PD) sanitary pumps

- End-user

- Food and beverage

- Pharmaceutical and biotechnology applications

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

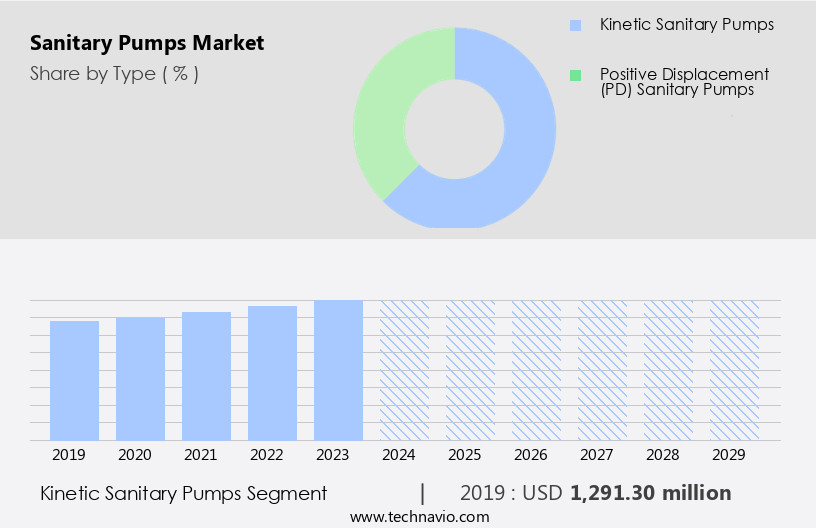

By Type Insights

- The kinetic sanitary pumps segment is estimated to witness significant growth during the forecast period.

Sanitary pumps, also known as dynamic or centrifugal pumps, are essential components in various industries, including food processing, beverage manufacturing, and biopharmaceuticals. These pumps function by introducing kinetic energy into fluids through an impeller, causing centrifugal force and generating pressure. The impeller's rotation accelerates the fluid, pushing it against the pump casing and propelling it through process lines. Centrifugal pumps are the most commonly used type, with applications ranging from low to high flow rates. They are widely adopted for transferring nonalcoholic beverages, processed food, and water treatment solutions. Incorporating automation, lean manufacturing, and IoT connectivity enhances fluid handling systems' efficiency and ensures adherence to hygiene standards.

Sanitary valves and sensors play a crucial role in contamination control and maintaining high-quality beverages. Stainless steel, Hastelloy, Titanium, Plastic, Ceramic, and customized solutions cater to diverse industry requirements. Energy-efficient, smart pumps, and remote monitoring systems enable real-time process optimization and eco-friendly operations. Single-use systems and clean-in-place systems are popular In the beverage industry, ensuring product safety and minimizing downtime. The biopharmaceutical industry relies on automated, sterilization-compatible pumps for fermentation, mixing, and spraying processes.

Get a glance at the Sanitary Pumps Industry report of share of various segments Request Free Sample

The Kinetic sanitary pumps segment was valued at USD 1291.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

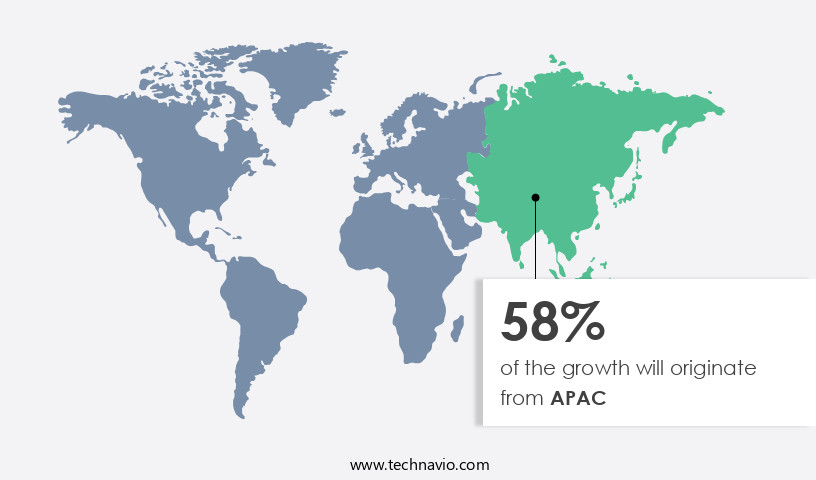

- APAC is estimated to contribute 58% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC experienced significant growth in 2024, driven primarily by the food and beverage, pharmaceutical, and semiconductor industries. The food and beverage sector, in particular, is a growing industry in APAC due to population growth. Many food and beverage businesses in APAC are small to medium enterprises that prioritize cost-effective solutions for their sanitary pump needs. However, in some countries, the food and beverage industry remains largely unorganized, with companies focusing less on hygiene and cleanliness. To address the unique challenges of the food and beverage industry, sanitary pump manufacturers offer automation, lean manufacturing, and fluid handling systems.

These solutions help ensure high-quality beverages, maintain hygiene standards, and facilitate clean-in-place systems. In addition, the use of sensors, IoT connectivity, and smart technologies enables remote monitoring and energy efficiency. The beverage industry includes both nonalcoholic and alcoholic beverages, with nonalcoholic beverages being a significant market for sanitary pumps due to their mass production and stringent cleanliness requirements. The market caters to various industries, including processed food, biotechnology, and biopharmaceuticals. Material options include stainless steel, Hastelloy, Titanium, plastic, ceramic, and customized solutions. Sanitary pumps come in various flow rates, including low, medium, and high, and are used for food processing, contamination control, water treatment, and more.

Types of sanitary pumps include centrifugal, positive displacement, diaphragm, peristaltic, and rotary pumps. Advanced technologies, such as automated pumps, eco-friendly pumps, and smart pumps, are also gaining popularity.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Sanitary Pumps Industry?

Rising demand for sanitary pumps In the food and beverage industry is the key driver of the market.

What are the market trends shaping the Sanitary Pumps Industry?

Rising demand for sanitary pumps incorporated with advanced technologies is the upcoming market trend.

What challenges does the Sanitary Pumps Industry face during its growth?

Volatility in raw material prices is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The sanitary pumps market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sanitary pumps market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sanitary pumps market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Alfa Laval AB - Sanitary pumps, including centrifugal models like LKH, cater to the hygiene-conscious industries. These pumps ensure the transfer of food, pharmaceutical, and other sensitive liquids while maintaining stringent cleanliness standards. Engineered to meet regulatory requirements, they offer reliable performance and efficient operation. With advanced features such as hygienic design, easy cleaning, and corrosion resistance, sanitary pumps contribute significantly to the production processes in various sectors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Laval AB

- Ampco Pumps Co.

- Axiflow Technologies Inc.

- Dover Corp.

- Erich NETZSCH BV and Co. Holding KG

- FRISTAM Pumpen KG GmbH and Co.

- GEA Group AG

- IDEX Corp.

- INOXPA INDIA Pvt. Ltd.

- ITT Inc.

- KSB SE and Co. KGaA

- LEWA GmbH

- Moyno Inc.

- Pentair Plc

- Q Pumps

- Spirax Sarco Engineering Plc

- SPX FLOW Inc.

- Sulzer Ltd.

- Verder Liquids BV

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of fluid handling solutions designed to meet the unique requirements of various industries. These pumps are engineered to ensure the highest level of hygiene and sanitation, making them indispensable in sectors such as food processing, beverage manufacturing, and biopharmaceuticals. Automation and lean manufacturing have significantly influenced the market. The integration of automation technologies has led to the development of smart pumps that offer remote monitoring capabilities, IoT connectivity, and sensors to optimize performance and enhance efficiency. This has enabled manufacturers to streamline their operations and reduce downtime, resulting in increased productivity and cost savings.

Fluid handling systems that incorporate sanitary pumps play a crucial role in maintaining health and sustainability in various industries. In the beverage industry, for instance, sanitary pumps ensure the production of high-quality nonalcoholic beverages by maintaining consistent flow rates and preventing contamination. Similarly, In the processed food sector, these pumps help maintain hygiene standards during the production process. Stainless steel, Hastelloy, titanium, plastic, ceramic, and other materials are commonly used In the manufacture of sanitary pumps due to their resistance to corrosion and ability to withstand harsh operating conditions. The choice of material depends on the specific application and the desired level of cleanliness.

Centrifugal pumps, positive displacement pumps, diaphragm pumps, peristaltic pumps, rotary pumps, and other types of sanitary pumps cater to various flow rate requirements. Low flow rate pumps are suitable for applications where a small volume of fluid needs to be transferred, while high flow rate pumps are used in large-scale production processes. The market is driven by the growing demand for clean-in-place systems and eco-friendly pumps. Clean-in-place systems enable the efficient cleaning of fluid handling systems without disassembly, reducing downtime and labor costs. Eco-friendly pumps, on the other hand, offer energy efficiency and reduced environmental impact, making them an attractive option for environmentally conscious manufacturers.

The biopharmaceutical industry relies heavily on sanitary pumps for the production of biotechnology products. These pumps are used in fermentation, mixing, and spraying processes to maintaIn the sterility of the production environment and ensure the highest level of product quality. In conclusion, the market is a dynamic and evolving industry that caters to the unique needs of various sectors. The integration of smart technologies, automation, and eco-friendly designs continues to drive innovation and growth in this market. With a focus on hygiene, efficiency, and sustainability, sanitary pumps play a vital role in maintaining the integrity and safety of fluid handling systems in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2025-2029 |

USD 566.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.0 |

|

Key countries |

US, China, Japan, Canada, India, South Korea, Germany, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sanitary Pumps Market Research and Growth Report?

- CAGR of the Sanitary Pumps industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sanitary pumps market growth of industry companies

We can help! Our analysts can customize this sanitary pumps market research report to meet your requirements.