Saw Blades Market Size 2024-2028

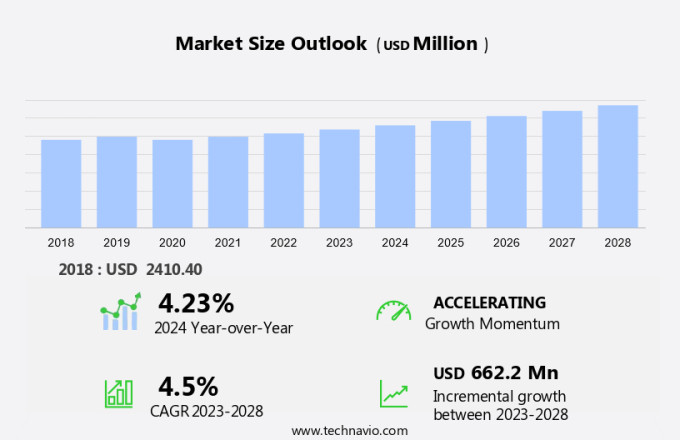

The saw blades market size is forecast to increase by USD 662.2 million at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for power tools such as reciprocating saws and miter saws in various industries. High-speed steel, diamond blades, and bi-metal blades continue to dominate the market, with circular saws leading the circular shape segment in the wood cutting division. Technological advancements, including automation and robotics, are driving innovation in tooth designs and sharpness, enhancing the efficiency and productivity of saw blades. However, fluctuations in raw material prices pose a challenge to market growth. To stay competitive, manufacturers must focus on optimizing production costs while maintaining the highest quality standards.

What will be the Size of the Market During the Forecast Period?

The saw blades market is driven by increasing demand across various applications, including energy consumption optimization in machining and DIY projects. Table saw blades, jigsaw saw blades, and reciprocating saw blades are essential tools for cutting through materials like polyvinyl chloride (PVC) pipes and laminate flooring. These saw blades are designed to rip teeth, providing clean, precise cuts for both professionals and DIY enthusiasts. As the market grows, the need for durable and efficient blades is amplified, especially in industries like construction and home improvement. The use of nails in projects also fuels the demand for specialized blades that can handle tougher materials, further expanding the saw blades market for a wide range of cutting tasks.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Stone cutting saw blades

- Circular saw blades

- Band saw blades

- Chain saw blades

- Others

- Geography

- Europe

- Germany

- UK

- APAC

- China

- Japan

- North America

- US

- Middle East and Africa

- South America

- Europe

By Product Insights

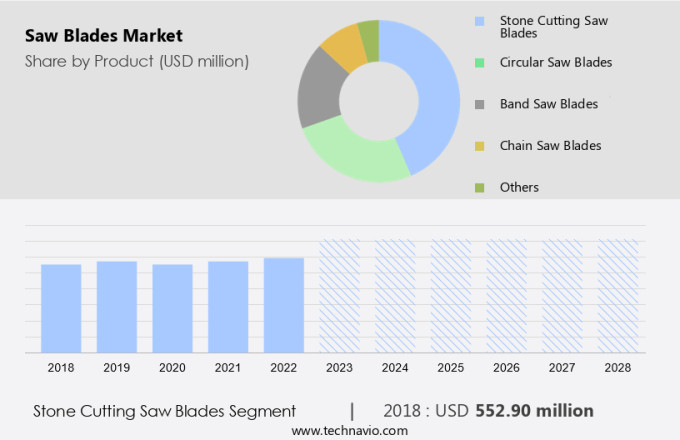

The stone cutting saw blades segment is estimated to witness significant growth during the forecast period. Stone-cutting saw blades are essential tools used for the precision cutting and shaping of thick materials such as lumber, concrete, granite, marble, sandstone, ceramic tiles, glass, and hard stone. These materials are extensively utilized in the construction sector. The escalating demand for commercial and residential construction projects in emerging economies like India and China is fueling the need for stone-cutting saw blades. In the US, a significant market for construction, the construction industry is projected to expand by low-digit percentages during the forecast period, resulting in increased demand for tools like saw blades for both residential and commercial building projects. Material technology advancements, including the use of alloy compositions and surface coatings, are also contributing to the growth of the stone-cutting market. Additionally, the integration of the Internet of Things (IoT) in material science and woodworking processes is enhancing the productivity and efficiency of saw blade usage.

Get a glance at the market share of various segments Request Free Sample

The stone cutting saw blades segment was valued at USD 552.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

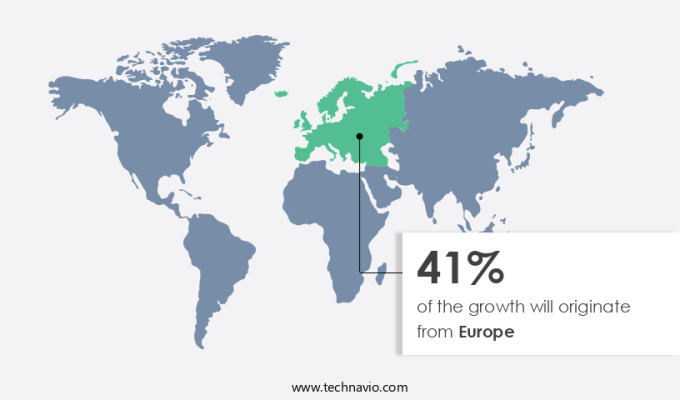

Europe is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European market is experiencing significant growth due to the wave in construction activities across the region. With approximately 80% of Europe's population projected to reside in urban areas by 2050, there is a pressing need for residential and commercial developments to accommodate this growing population. Major cities such as London, Barcelona, Amsterdam, and Paris are under increasing pressure to expand, leading to a rise in construction spending in countries like France and Germany. This trend is further fueled by the increasing number of hotel and restaurant construction projects in Europe. For instance, Europe's hotel construction pipeline, as reported by Lodging Econometrics (LE), stood at 1,705 projects and 253,777 rooms as of the first quarter of 2024. The use of diamond particles in saw blades enhances their durability and efficiency, making them an essential component in the construction industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased demand for automobiles is the key driver of the market. Saw blades play a crucial role in the manufacturing process of automobiles, particularly in shaping metals and rubber to specific dimensions for vehicle components such as door beams, seat frames, side sills, and suspension arms. With growing consumer preferences for fuel-efficient and technologically advanced cars, the demand for new vehicles equipped with enhanced safety features is on the rise in the US market. Environmental concerns and safety regulations are increasingly influencing blade manufacturers to adopt sustainable materials and energy-efficient production methods. Consumers are also turning to portable, battery-powered saws for their convenience and mobility. The e-commerce sector is thriving, with online sales channels and e-commerce platforms offering a wide range of saw blades to cater to this demand.

As the US leads the way in next-generation vehicle technologies, including electric cars, the demand for advanced saw blades is expected to continue. Manufacturers must prioritize safety regulations and environmental concerns while delivering high-quality, efficient, and cost-effective solutions to meet consumer demands.

Market Trends

Technological advancement in saw blades is the upcoming trend in the market. Saw blade technology has witnessed significant advancements in recent years, with manufacturers investing in innovative solutions to enhance blade performance and longevity. Three-dimensional coarse diamonds, for instance, provide stable operations and minimal vibration at high speeds. Moreover, air filtration technology employs three filters to prevent dust particles from settling on saw blades, ensuring optimal performance. In 2020, Stanley Black and Decker, Inc.'s LENOX division introduced the Gen-Tech carbide tipped band saw blade. This technologically advanced product offers versatility, long blade life, and a low cost per cut, making it suitable for cutting a wide range of materials, shapes, and sizes.

In the market, reciprocating saws and miter saws dominate the circular saw segment within the wood cutting division. High-speed steel and diamond blades, as well as bi-metal blades, are popular choices due to their sharp teeth and tooth designs that facilitate efficient cutting. Automation and robotics have also made their way into the saw blades industry, streamlining production processes and improving overall productivity. These advancements underscore the industry's commitment to providing efficient and cost-effective solutions for various applications.

Market Challenge

Fluctuations in raw material prices is a key challenge affecting the market growth. Saw blade manufacturers face challenges with price instability in the raw materials used in their production processes. To mitigate this issue, many providers establish long-term contracts with suppliers to secure consistent pricing and minimize the impact of raw material price fluctuations on their businesses. Iron, steel, aluminum, magnesium, copper, and brass are among the major raw materials used in the metal fabrication industry, which have experienced significant price fluctuations over the years. An analysis of historical metal and mineral price trends from 1970 to 2019 indicates an overall increase of approximately 20% in metal prices, with a 0.32% rise observed in the last two years.

The COVID-19 pandemic in 2020 led to a sharp increase in metal and mineral prices, adding to the challenges for saw blade manufacturers. In the US market, the construction and infrastructure sector, manufacturing industries, and the DIY culture continue to drive demand for saw blades, particularly in applications such as woodwork and circular saws. Carbide-tipped and diamond-tipped blades remain popular choices for their durability and efficiency.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AKE Knebel GmbH and Co. KG - The company offers circular saw blades, panel sizing saw blades, mustang saw blades and more.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMADA Co. Ltd.

- DOALL SAWS

- DIMAR GROUP

- Freud America Inc.

- Illinois Tool Works Inc.

- Ingersoll Rand Inc.

- J.N. Eberle and Cie. GmbH

- Kinkelder BV

- Leitz GmbH and Co. KG

- LEUCO AG

- Makita USA Inc.

- Pilana Metal Sro

- ROTHENBERGER Werkzeuge GmbH

- Simonds International LLC

- Snap On Inc.

- Stanley Black and Decker Inc.

- Stark Spa

- The M. K. Morse Co.

- Tyrolit Schleifmittelwerke Swarovski KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products designed for various applications in the construction, infrastructure, manufacturing, and industrial sectors. Consumers in these industries seek saw blades that offer superior cutting performance, durability, and safety. With increasing environmental concerns, there is a growing demand for saw blades made from sustainable materials, which consume less energy and minimize waste. Manufacturers are responding to these demands by innovating with new materials, tooth designs, and automation technologies. For instance, carbide-tipped and diamond-tipped blades are popular choices for woodwork applications due to their sharp teeth and high durability. High-speed steel, bi-metal, and diamond blades are preferred for metal cutting applications, while ripple teeth and crosscut teeth designs are commonly used for wood cutting.

Further, portable battery-powered saws, such as circular saws, reciprocating saws, miter saws, and jigsaw saws, have gained popularity due to their mobility, convenience, and ease of use. Online sales channels and e-commerce platforms have made it easier for consumers to purchase saw blades from manufacturer websites, construction supply stores, and home improvement retailers. The circular saw segment holds a significant market share in the market due to its versatility and wide application in woodworking, furniture manufacturing, and construction projects. The wood cutting division dominates the market, followed by the metal cutting division. The use of advanced composite materials, material technology, and alloy compositions in saw blade manufacturing has led to increased production efficiency, precision, and consistency.

In conclusion, the market is driven by the need for superior cutting performance, durability, and safety, as well as the increasing adoption of automation technologies and sustainable materials. The market is diverse, with various types of saw blades catering to different applications in the construction, infrastructure, manufacturing, and industrial sectors. The circular saw segment leads the market, with the wood cutting division being the largest application area.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 662.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

Europe, APAC, North America, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 41% |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AKE Knebel GmbH and Co. KG, AMADA Co. Ltd., DOALL SAWS, DIMAR GROUP, Freud America Inc., Illinois Tool Works Inc., Ingersoll Rand Inc., J.N. Eberle and Cie. GmbH, Kinkelder BV, Leitz GmbH and Co. KG, LEUCO AG, Makita USA Inc., Pilana Metal Sro, ROTHENBERGER Werkzeuge GmbH, Simonds International LLC, Snap On Inc., Stanley Black and Decker Inc., Stark Spa, The M. K. Morse Co., and Tyrolit Schleifmittelwerke Swarovski KG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch