Colombia Seed Market Size and Trends

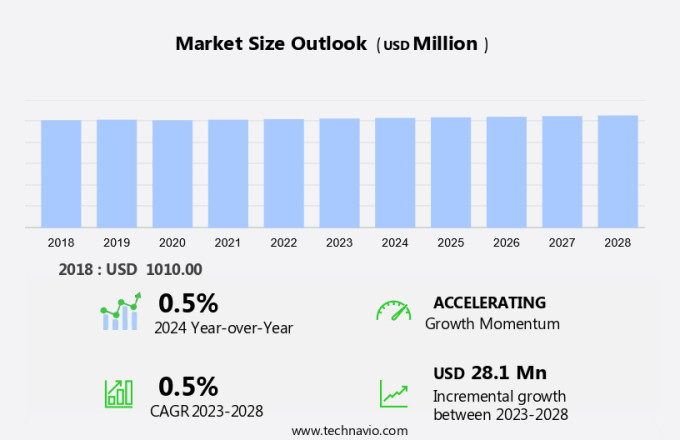

The Colombia seed market size is forecast to increase by USD 28.1 million. at a CAGR of 0.5% between 2023 and 2028. The seed market is experiencing significant growth due to several key factors. Investments in agricultural research and development are on the rise, leading to advancements in breeding technology such as molecular breeding and genetic engineering. Hybrid seeds, both transgenic and non-transgenic, are increasingly being adopted due to their higher yields and resistance to pests and diseases. However, challenges persist in the form of counterfeit seed products and the declining availability of arable land. Cereals and grains, as well as fruits and vegetables, are the primary focus of this market. The cultivation mechanism varies from open field to protected cultivation, depending on the crop type. The FAO estimates that hybrid derivatives will account for a significant portion of seed sales in the coming years. As the market continues to evolve, it is essential to stay informed about the latest trends and challenges to remain competitive.

The seed market plays a crucial role in the agricultural sector, supplying a diverse range of seeds to multinational corporations, small-scale seed producers, and public research institutions. This market encompasses various crop types, including row crops such as soybean, sunflower, cotton, and vegetable seeds. The cultivation mechanism for these crops can vary, with some grown in open field conditions and others under protected cultivation. Soybean, a primary focus in the seed market, is utilized extensively in the animal feed industry for producing oilseed meals like soybean meal. Similarly, sunflower, cottonseed, and other oilseeds contribute significantly to the production of oilseed meals.

Further, the modernization of agriculture has led to advancements in breeding technology, resulting in the development of hybrids, open-pollinated varieties, and hybrid derivatives. Breeding technology plays a pivotal role in enhancing crop productivity, yield, uniformity, color, and disease resistance. Seed companies invest heavily in research and development to create seeds with improved agro-climatic conditions adaptability and desirable traits. Crop productivity and yield are essential factors driving the growth of the seed market. The global seed industry's modernization has led to significant improvements in food production and biofuels. Seed companies have been instrumental in providing farmers with seeds that can withstand adverse weather conditions, pests, and diseases, ensuring consistent yields.

Additionally, the development of high-yielding seeds has led to an increase in food production, contributing to food security. In the context of the seed market, crop type is a significant factor influencing market growth. Row crops, such as soybean, sunflower, and cotton, dominate the market due to their extensive use in various industries. However, vegetables and other specialty crops are gaining popularity due to the increasing demand for healthy and organic food options. In conclusion, the seed market plays a vital role in modernizing agriculture and enhancing food production. With advancements in breeding technology, seed companies are able to provide farmers with seeds that can withstand adverse conditions and yield high-quality crops. The seed market's continued growth is expected to contribute significantly to food security and the biofuels industry.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Product

- GM seeds

- Conventional seeds

- Crop Type

- Grain and cereal seeds

- Oil seeds

- Fruits and vegetable

- Others

- Geography

- Colombia

By Product Insights

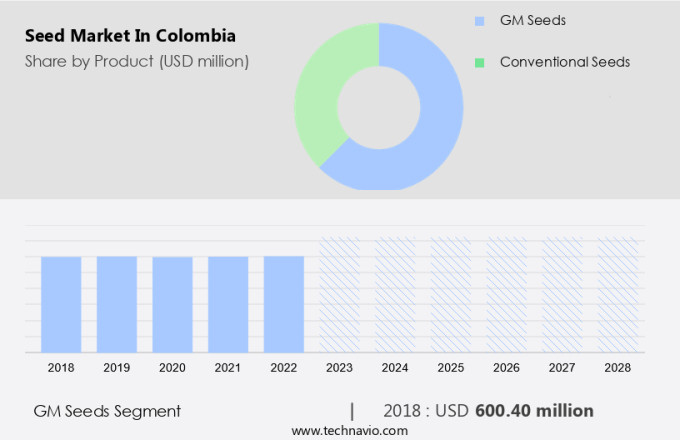

The GM seeds segment is estimated to witness significant growth during the forecast period. In the agricultural sector of Colombia, the utilization of genetically engineered seeds is experiencing significant growth, particularly in the cultivation of cotton and corn. The Colombian government aims to expand the production of genetically modified (GM) crops to decrease imports by half. Farmers are drawn to GM seeds due to their advantages, including simplified weed management, effective pest and disease control, improved nutritional content, and heightened productivity.

Get a glance at the market share of various segments Download the PDF Sample

The GM seeds segment accounted for USD 600.40 million in 2018 and showed a gradual increase during the forecast period. Herbicide-tolerant (HT) seeds, which can endure powerful herbicides like glyphosate, provide farmers with efficient weed management solutions. These advantages lead to greater economic gains and a superior return on investment (ROI) for GM seeds compared to traditional and organic seeds. Consequently, these factors will propel the expansion of the market in question through the GM seeds segment during the forecast period. Herbicide-tolerant (HT) seeds, which can endure powerful herbicides like glyphosate, provide farmers with efficient weed management solutions. These advantages lead to greater economic gains and a superior return on investment (ROI) for GM seeds compared to traditional and organic seeds. Consequently, these factors will propel the expansion of the market in question through the GM seeds segment during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing investments in agricultural research is notably driving market growth. In the agricultural landscape of Colombia, investments in research and development (R&D) have witnessed a steady rise, fueled by private firms' interest in innovations within the sector. The emergence of biotechnology and scientific advancements, coupled with the reinforcement of Intellectual Property Rights (IPR) for these innovations, have spurred significant investments in agricultural R&D. The agricultural inputs market in Colombia has also experienced expansion, amplifying these investments. The market for seed varieties, particularly genetically modified (GM) seeds, has experienced substantial growth due to the numerous advantages they provide to farmers.

Notably, seed treatment and seed trait improvements have become essential for farmers in emerging economies to maintain a reasonable seed replacement rate. Major international organizations, such as the Rockefeller Foundation, World Bank, and Ford Foundation, have played a pivotal role in providing financial and technical assistance to bolster agricultural R&D in Colombia. These initiatives have contributed to the adoption of advanced seed technologies and improved agricultural productivity. In summary, the agricultural sector in Colombia continues to attract substantial investments due to the need for seed innovations, population growth, and the expanding agricultural inputs market. The role of international organizations in providing financial and technical assistance has been instrumental in driving advancements in seed technology and agricultural productivity.ConclusionThus, such factors are driving the growth of the market during the forecast period.

Market Trends

Increasing adoption of hybrid seeds is the key trend in the market.In the agricultural sector, the seed market has experienced significant growth since 2016, driven by the increasing demand for high-yielding and disease-resistant seeds. Hybrid seeds, produced by crossing two distinct inbred strains, have gained popularity among farmers due to their uniform characteristics and improved productivity. These seeds, including Bt cotton hybrids, single-cross corn hybrids, and hybrid vegetables, offer farmers protection against pests and diseases, leading to increased yields and higher prices for their crops. Multinational corporations and public research institutions have played a crucial role in the advancement of seed technology, introducing gene-tagged markers and other innovative techniques to improve seed quality.

Further, plant-based protein companies are increasingly focusing on the production of alternative sources of protein, such as groundnut, rice, corn, wheat, rapeseed, mustard, safflower, and other crops. These companies are investing in research and development to create new and improved seed varieties, further expanding the seed market's reach. The adoption of hybrid seeds is a strategic move for farmers looking to maximize their yields and profits while minimizing risks. By utilizing the latest seed technology and partnering with reputable seed producers, farmers can stay competitive in the ever-evolving agricultural landscape.ConclusionThus, such trends will shape the growth of the market during the forecast period.

Market Challenge

The declining availability of arable land is the major challenge that affects the growth of the market. The seed market in Colombia has faced considerable challenges due to the decline in arable land over the past few decades. Industrialization, urbanization, and the increasing demand for energy have led to the conversion of agricultural land for non-agricultural purposes. Additionally, soil erosion and pollution have further reduced the quality and productivity of the remaining farmland. The Colombian government's efforts to protect natural resources and restore land have shown promising results. However, there are still obstacles to overcome, including limited access to financing and infrastructure for farmers.

In response, seed companies are developing seeds that are herbicide tolerant and insecticide resistant to help farmers mitigate the impact of pests and weeds. The demand for seeds that offer these traits is increasing as farmers seek to maximize yields and reduce their reliance on chemical inputs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Bayer AG: The company offers seeds that use plant biotechnology and modern plant breeding to develop high-performance seeds and enhance specific plant properties, increasing resistance to certain threats, improving quality, and increasing yields.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanta Seeds US

- Bejo Zaden B V

- Columbia Seeds LLC

- Corteva Inc.

- East West Seed Group

- Cultivos y Semillas el Aceituno

- Eurosemillas SA

- HarvestPlus

- Hazera Seeds Ltd.

- Land O lakes Inc.

- Amalgamated Hardware Merchants Ltd.

- Nongwoo Bio

- Pajonales

- Reimer Seeds Inc.

- Sakata Seed Corp.

- Semillas La palma

- SEMILLAS VALLE SA

- Syngenta Crop Protection AG

- Top Seeds International Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The seed market is a significant sector in the agriculture industry, serving various industries such as food production, animal feed, and biofuels. This market comprises multinational corporations, small-scale seed producers, and public research institutions. Soybean, sunflower, cottonseed, oilseed meal (soybean meal, sunflower meal, cottonseed meal), and grains (rice, corn, wheat, rapeseed, mustard, safflower) are among the major crops contributing to the seed market. The animal feed industry utilizes oilseed meals as a primary source of plant-based protein. Groundnut, a key oilseed crop, is also an essential component of the seed market. Cereals and grains, including rice, corn, and wheat, are widely used for food production and biofuels.

Further, breeding technology plays a crucial role in the seed market, with the use of gene-tagged markers, molecular breeding, and genetic engineering in developing hybrids, open pollinated varieties, hybrid derivatives, and transgenic hybrid seeds. The cultivation mechanism can be open field or protected, depending on the crop type, which includes row crops, vegetables, and forage crops like alfalfa and forage corn. The regulatory stance on seed technologies, such as herbicide-tolerant crops, and the availability of financial and technical assistance from organizations like the Rockefeller Foundation, World Bank, and Ford Foundation, contribute to the modernization of agriculture and the global seed industry's growth. Additionally, the seed market's importance in food production, population growth, and agricultural sector development cannot be overstated. Import and export, seed treatment, seed trait, and seed replacement rate are other essential aspects of this market. Emerging economies are significant players in the seed market due to their large agricultural sectors and growing demand for advanced seed technologies.

|

Industry Scope |

|

|

Report Coverage |

Details |

|

Page number |

132 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 0.5% |

|

Market growth 2024-2028 |

USD 28.1 million |

|

Market structure |

Fragmented |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Advanta Seeds US, Bayer AG, Bejo Zaden B V, Columbia Seeds LLC, Corteva Inc., East West Seed Group, Cultivos y Semillas el Aceituno, Eurosemillas SA, HarvestPlus, Hazera Seeds Ltd., Land O lakes Inc., Amalgamated Hardware Merchants Ltd., Nongwoo Bio, Pajonales, Reimer Seeds Inc., Sakata Seed Corp., Semillas La palma, SEMILLAS VALLE SA, Syngenta Crop Protection AG, and Top Seeds International Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Colombia

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch