Corn Starch Market Size 2025-2029

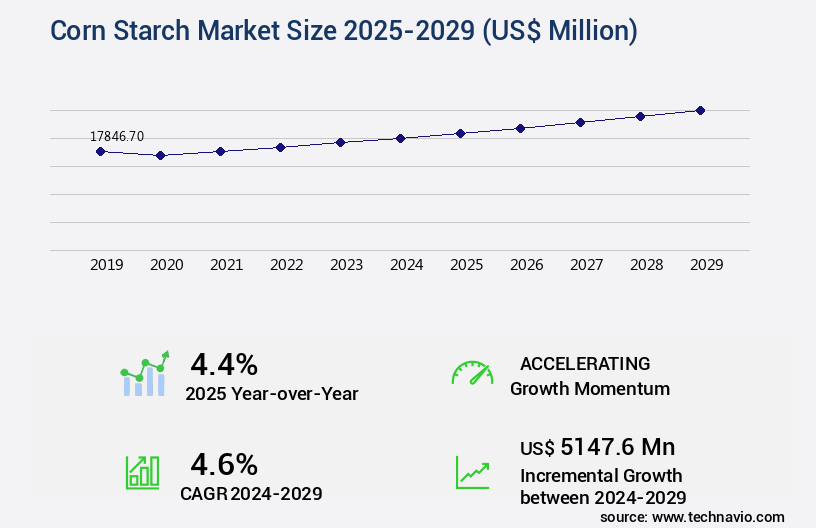

The corn starch market size is forecast to increase by USD 5.15 billion, at a CAGR of 4.6% between 2024 and 2029.

Major Market Trends & Insights

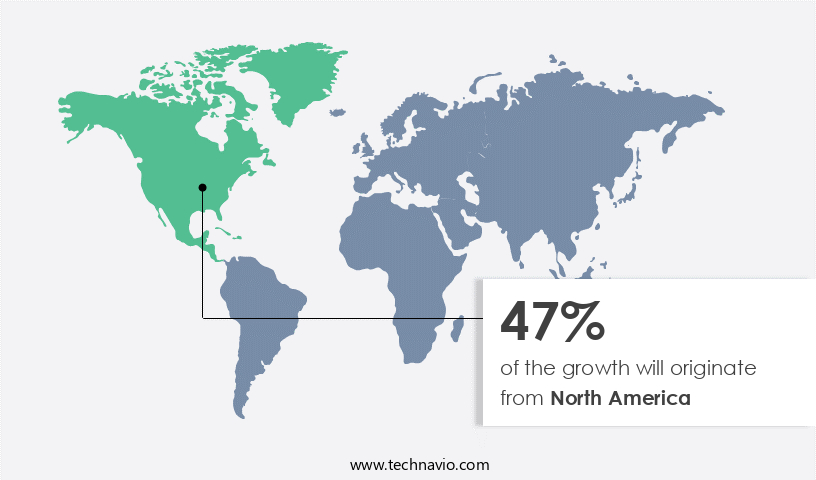

- North America dominated the market and accounted for a 47% growth during the forecast period.

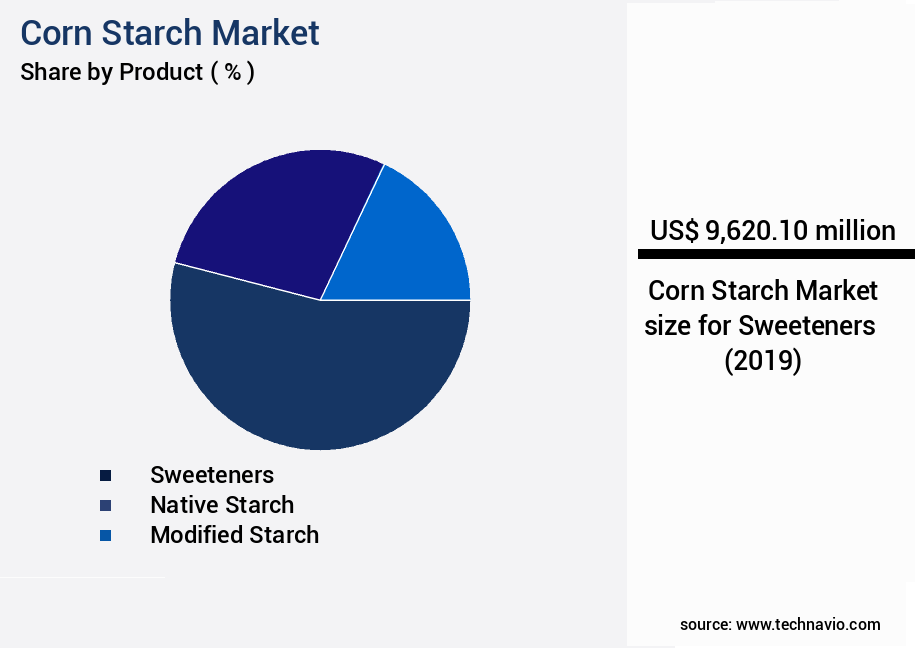

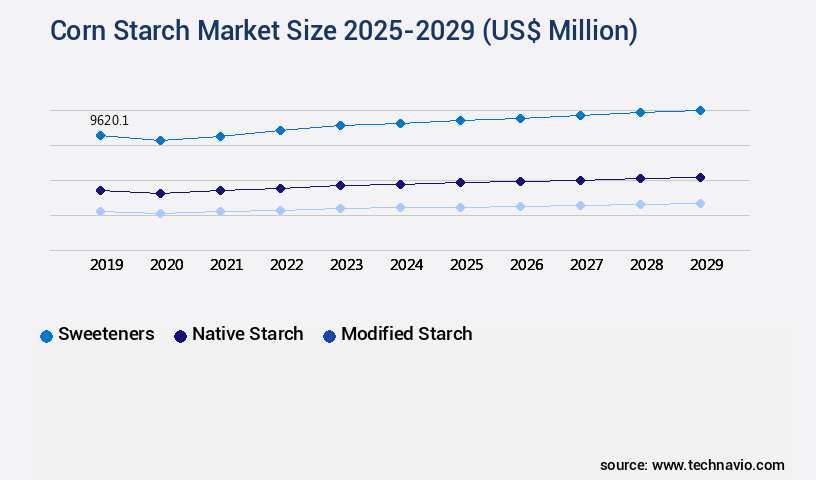

- By the Product - Sweeteners segment was valued at USD 9.62 billion in 2023

- By the End-user - Food processing segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 42.20 billion

- Market Future Opportunities: USD USD 5.15 billion

- CAGR : 4.6%

- North America: Largest market in 2023

Market Summary

- The market exhibits significant growth and diversity, with applications extending beyond traditional uses in the food industry. According to market research, The market is projected to reach a value of around USD12 billion by 2026, representing a substantial increase from its current size. This expansion is driven by the rising demand for corn starch in various sectors, including textiles, paper, and adhesives. In the food industry, the market is witnessing a shift towards the use of functional starches, which offer improved texture, stability, and thickening properties. The increasing popularity of plant-based foods and the growing awareness of healthier food alternatives are also fueling the demand for corn starch as a natural and cost-effective alternative to synthetic additives.

- Despite the positive outlook, competition from alternative thickeners and substitutes, such as cellulose gum and xanthan gum, presents a challenge to market growth. Nevertheless, the ongoing research and development efforts to enhance the functional properties of corn starch are expected to create new opportunities in the market.

What will be the Size of the Corn Starch Market during the forecast period?

Explore market size, adoption trends, and growth potential for corn starch market Request Free Sample

- The market encompasses a diverse range of applications, from food and beverage industries to industrial sectors. According to industry estimates, The market reached a value of USD12.5 billion in 2020, exhibiting a steady growth trajectory. Notably, the food industry remains the largest consumer of corn starch, accounting for approximately 65% of the total market share. In contrast, the industrial sector, which includes applications in adhesives, coatings, and biodegradable plastics, is projected to witness a compound annual growth rate of 5% through 2025. Advancements in starch technology continue to expand the market's scope. For instance, starch pasting properties and texture analysis have led to the development of improved starch-based films and coatings.

- Additionally, starch chemical modification techniques, such as esterification, etherification, and crosslinking, have enabled the production of high-performance starch-based materials. These innovations underscore the market's dynamic nature and its potential to address evolving consumer demands and industrial applications.

How is this Corn Starch Industry segmented?

The corn starch industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Sweeteners

- Native starch

- Modified starch

- End-user

- Food processing

- Paper

- Chemical

- Textile

- Cosmetics

- Source

- Yellow corn

- White corn

- Waxy corn

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The sweeteners segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth, with the sweeteners segment leading the way due to the increasing utilization of corn starch in the food and beverages industry. Approximately 40% of the market's current revenue can be attributed to this segment. Corn sweeteners, derived from corn starch, come in various grades and maltose contents, with corn syrup being the most common. This sweetener, also known as glucose syrup, is distinct from high-fructose corn syrup (HFCS), which undergoes extensive glucose conversion to fructose. Corn-based sweeteners play a crucial role in enhancing the taste, texture, and visual appeal of various food and beverage products.

The functional starch properties, such as swelling power, crystallinity analysis, viscosity profile, and degradation kinetics, are essential factors driving the market's expansion. Waxy maize starch, with its enhanced oxidative stability and modified applications, is another key contributor to the market's growth. The market's future growth is anticipated to reach new heights, with the modified starch applications segment projected to account for approximately 35% of the industry's expansion. This segment's growth can be attributed to the ongoing research and development efforts in starch modification processes, such as hydrolysis enzymes, gel strength, dextrose equivalent measurement, and extrusion cooking. These advancements lead to improved rheological properties, amylose content determination, molecular weight, coating properties, paste clarity, solubility index, and high amylose starch.

Additionally, the market's evolution is influenced by the continuous unfolding of starch adhesive properties, retrogradation rate, amylopectin branching pattern, granule morphology, gelatinization temperature, and film formation. These trends underscore the market's dynamic nature and the ongoing innovation in starch technology.

The Sweeteners segment was valued at USD 9.62 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Corn Starch Market Demand is Rising in North America Request Free Sample

The market is experiencing significant expansion in North America, driven by the increasing consumption of convenience food and the growing Hispanic population. This region is projected to dominate the global market due to the rising demand for corn-based products, particularly in the US. The food service industry is a significant contributor to this growth, with the large urban population leading to an increase in the number of food outlets. Tortillas, a staple food for the Hispanic community in the US, are a major driver of the corn flour market's growth. According to recent studies, the North American the market is expected to grow steadily at a rate of approximately 3% annually over the next five years.

Furthermore, the European market is anticipated to grow by around 2.5% during the same period due to the increasing demand for organic and functional food products. The Asia Pacific region is projected to witness the fastest growth, with a rate of approximately 4% per annum, driven by the rising demand for convenience food and the growing awareness of health and wellness. Overall, The market is poised for substantial growth, with increasing demand from various end-use industries, including food and beverages, pharmaceuticals, and paper and pulp.

Market Dynamics

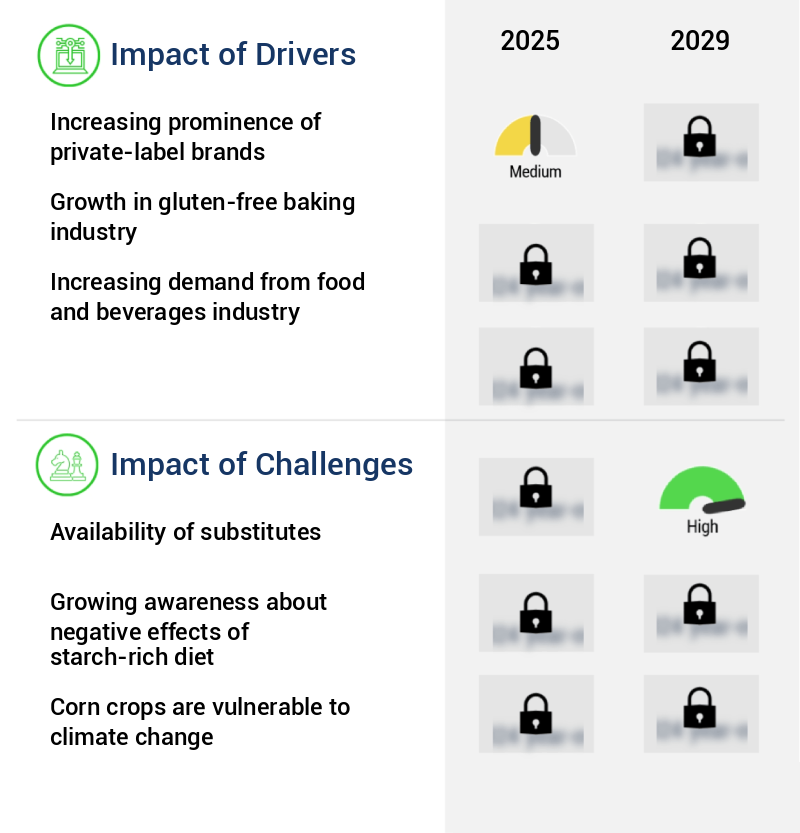

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Innovations and Performance Improvements in the US the market: A Focus on Gelatinization, Viscosity, and Film Properties The US the market continues to evolve, driven by advancements in technology and research. One key area of focus is the effect of amylose content on starch gelatinization. By manipulating the amylose-to-amylopectin ratio, starch manufacturers can optimize gelatinization temperatures and improve paste clarity and texture. Another critical aspect is the impact of starch granule size on viscosity. Smaller granules offer increased surface area for swelling, resulting in higher viscosity and improved flow properties. This is particularly relevant in the food industry, where precise control of texture is essential. Starch crystallinity and retrogradation also play a significant role in starch performance. Understanding these mechanisms and employing appropriate modification techniques can lead to improved film properties, such as enhanced tensile strength and flexibility. High amylose starch finds extensive applications in food systems, including baked goods, snacks, and beverages. The assessment of resistant starch content in these foods is crucial, as it impacts nutritional value and regulatory compliance. Starch processing optimization for specific applications, such as food, pharmaceuticals, and bioplastics, is a continuous focus. Characterization of starch molecular structure and determination of water holding capacity, freeze-thaw stability, and rheological properties are essential for achieving optimal results. Innovations in starch modification methods, such as acetylation, cross-linking, and enzymatic modification, offer significant improvements in film properties and processing efficiency. Comparative studies of these methods provide valuable insights for manufacturers seeking to enhance their product offerings. Starch-based bioplastics production processes are gaining traction due to their environmental benefits. The study of starch oxidation and its impact on properties is crucial for optimizing these processes and ensuring consistent product quality. In conclusion, the US the market is characterized by continuous innovation and performance improvements, driven by advancements in research and technology. From gelatinization and viscosity to film properties and bioplastics, the focus on enhancing functionality and optimizing processes is key to meeting the evolving needs of various industries.

What are the key market drivers leading to the rise in the adoption of Corn Starch Industry?

- The rising prevalence of private-label brands significantly contributes to the market's growth trajectory.

- Private-label corn starch has emerged as a significant focus for retailers worldwide, driving the expansion of the market. Retailers are capitalizing on the increasing consumer demand for corn starch by introducing their branded versions under various product categories. For example, Alibaba, a leading China-based retailer, offers a diverse range of corn starch, including organic and conventional types, under its private label. The growth of the private-label corn starch segment can be attributed to its numerous applications across various industries. Corn starch is extensively used in the food and beverage sector as a thickener, stabilizer, and texturizer.

- It also finds extensive use in the pharmaceutical industry as a binder and excipient. Moreover, it is increasingly used in the production of biodegradable plastics due to its eco-friendly nature. The market for corn starch has experienced significant growth in recent years. According to industry reports, The market is projected to reach a substantial value by 2026, growing at a steady pace. This growth can be attributed to the increasing demand for corn starch in various end-use industries, coupled with the rising trend of private labeling among retailers. Retailers are continually introducing new corn starch-based products to cater to the evolving consumer preferences and market trends.

- For instance, the demand for organic and natural food products has led to the launch of organic corn starch under private labels. Similarly, the growing trend of veganism and vegetarianism has led to the production of corn starch-based meat alternatives. In conclusion, The market is witnessing continuous growth due to the increasing demand for corn starch in various industries and the trend of private labeling among retailers. The market is expected to continue expanding as retailers introduce new product offerings and consumers continue to seek out eco-friendly and natural alternatives.

What are the market trends shaping the Corn Starch Industry?

- The rising awareness concerning gluten-free products represents a significant market trend. This trend reflects growing consumer interest in dietary restrictions and health-conscious choices.

- Corn starch, a gluten-free alternative to wheat-based starches, has gained significant traction in the food industry due to the increasing demand for non-gluten products. The rise in awareness about celiac disease and other gluten intolerances has driven this trend. Unlike wheat, barley, rye, and other grains that contain gluten, corn does not. When water is added to corn starch, it forms a thick, clear liquid, making it an excellent thickener and binding agent in various food applications. The food industry is not the only sector experiencing growth in corn starch demand. It is also used extensively in industrial applications, such as paper manufacturing, textiles, and pharmaceuticals.

- In the textile industry, corn starch is used as a size and finish agent, while in the pharmaceutical sector, it serves as a binder and excipient. The demand for corn starch is a continuous and evolving trend. Its versatility and wide range of applications make it a valuable commodity in numerous industries. The food industry's share of the market is substantial, but industrial applications are growing at a steady pace. The market's expansion is driven by the increasing demand for gluten-free products, the growing awareness of health and wellness, and the continuous development of new applications for corn starch in various industries.

- Compared to traditional starches, corn starch offers several advantages. It is renewable, biodegradable, and has a lower environmental impact. Additionally, it is non-GMO and can be produced organically, making it an attractive alternative for consumers and businesses seeking sustainable and eco-friendly solutions. In conclusion, the market is a dynamic and growing industry, driven by the increasing demand for gluten-free products and the expanding applications of corn starch in various industries. Its versatility, sustainability, and eco-friendliness make it a valuable commodity in today's market.

What challenges does the Corn Starch Industry face during its growth?

- The availability of substitutes poses a significant challenge to the industry's growth trajectory. In today's competitive business landscape, companies must continually innovate and differentiate themselves to maintain market share and outpace competitors. The emergence of viable substitutes can disrupt industry growth by reducing demand for traditional products and services, forcing companies to adapt or risk becoming obsolete. Therefore, staying abreast of market trends and consumer preferences, as well as investing in research and development, are essential strategies for mitigating the impact of substitutes and ensuring long-term industry growth.

- Corn starch, derived from corn kernels, is a versatile and widely used food ingredient for thickening and binding purposes. In various industries, corn starch serves as a crucial component in food manufacturing, pharmaceuticals, and paper production. However, it is essential to note that alternatives to corn starch exist, offering similar functionalities in different applications. Arrowroot starch, derived from the rhizomes of the Maranta arundinacea plant, is a popular substitute for cornstarch in the food industry. It is particularly effective in sauces with acidic ingredients due to its high pH tolerance. Arrowroot starch is also a suitable alternative for cornstarch in pie fillings.

- Another alternative to cornstarch is potato starch, which is derived from potatoes. Potato starch is a suitable replacement for cornstarch in thickening and baking applications. It delivers comparable results to cornstarch and is an all-around alternative, performing well in various industries. Potato starch is especially effective in baked goods like shortbread. The choice between corn starch and its alternatives depends on factors such as availability, cost, and specific application requirements. While corn starch remains a widely used ingredient, alternatives like arrowroot starch and potato starch offer comparable functionality and versatility. In terms of market dynamics, the global starch market size was valued at USD 44.8 billion in 2020 and is projected to expand at a steady pace due to the increasing demand for functional food and beverage products, growing population, and rising disposable income levels.

- The market is expected to remain competitive, with key players focusing on expanding their product portfolios and increasing their market presence through strategic collaborations and partnerships.

Exclusive Customer Landscape

The corn starch market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the corn starch market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Corn Starch Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, corn starch market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

5Brothers - The company specializes in the production and supply of corn starch, a versatile ingredient with applications in various industries. It is utilized in adhesives for binding purposes, enhances paper's texture and strength, improves textile fabric's absorbency, and is an essential component in food processing.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 5Brothers

- AGRANA Beteiligungs AG

- Angel Starch and Food Pvt. Ltd.

- Archer Daniels Midland Co.

- Associated British Foods Plc

- Cargill Inc.

- Everest Starch India Pvt. Ltd.

- HL Agro Products Pvt. Ltd.

- Ingredion Inc.

- Kent Corp.

- Manitoba Starch Products

- Roquette Freres SA

- Sanstar Bio Polymers Ltd.

- Shubham Starch Chem Pvt. Ltd.

- SMS Corp. Co. Ltd.

- Tate and Lyle PLC

- Tereos Participations

- Vijaya Enterprises

- Zhaoqing Huanfa Biotechnology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Corn Starch Market

- In January 2024, DuPont Nutrition & Biosciences, a leading global biotech company, announced the launch of its new corn starch product line, Danisco® DECAS™ 650, designed for improved texture and stability in food applications (DuPont press release).

- In March 2024, Archer Daniels Midland Company (ADM) and Cargill, two major players in the corn processing industry, joined forces to expand their corn starch joint venture, ADM Cargill Corn Milling, aiming to enhance their market presence and boost production capacity (ADM press release).

- In May 2024, Ingredion Incorporated, a leading global ingredient solutions provider, received regulatory approval from the European Commission for its acquisition of Penford Corporation, a US-based specialty corn milling and food ingredient company, further expanding Ingredion's corn starch product portfolio (Ingredion press release).

- In April 2025, Tate & Lyle PLC, a global provider of food and beverage ingredients, unveiled its new corn starch-based sweetener, Sucralose Pro, which offers improved taste and functionality in sugar reduction applications, marking a significant technological advancement in the market (Tate & Lyle press release).

Research Analyst Overview

- The market encompasses a diverse range of applications, driven by the unique properties of this versatile carbohydrate. One crucial aspect of corn starch is its amylose content determination, which significantly influences its molecular weight and subsequent coating properties. For instance, high amylose starch, with a higher amylose content, exhibits superior film-forming capabilities due to its lower molecular weight and higher crystallinity. Starch paste clarity and solubility index are essential parameters for various industries, including food and pharmaceuticals. Modifications to native starch properties, such as starch modification processes, can enhance these characteristics, enabling better performance in various applications. Starch syneresis, the separation of starch suspension into two phases, is a critical issue that affects the functionality of starch in several industries.

- Understanding the underlying mechanisms and developing strategies to mitigate syneresis is a continuous area of research. The market for starch-based products is expected to grow at a steady pace, with industry analysts estimating a growth rate of approximately 4% per year. This growth is fueled by the evolving demand for functional starch properties, such as improved freeze-thaw stability, enhanced gel strength, and increased resistance to degradation. Starch molecular weight plays a significant role in determining its functional properties. For example, waxy maize starch, with its low molecular weight and high amylose content, is widely used in the food industry for its superior thickening and gelling properties.

- Similarly, starch hydrolysis enzymes, such as amylases and glucoamylases, are employed to modify starch molecular weight for various applications. Starch modification processes, including starch extrusion cooking, oxidative stability enhancement, and starch film formation, are essential to create value-added products. These processes can significantly impact starch's rheological properties, amylose content, and crystallinity, making them indispensable for industries relying on starch for their products' functionality.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Corn Starch Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 5147.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Canada, Germany, China, UK, India, France, Italy, Japan, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Corn Starch Market Research and Growth Report?

- CAGR of the Corn Starch industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the corn starch market growth of industry companies

We can help! Our analysts can customize this corn starch market research report to meet your requirements.